The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

Loan Default Penalty Fees: What You’ll Be Charged

When you take out a loan, you expect to pay it back on time. But sometimes, life gets in the way, and you might miss a payment. This is where Loan Default Penalty Fees come into play. Understanding these fees is crucial because they can add up quickly and make your financial situation even tougher.

What Are Loan Default Penalty Fees?

Loan Default Penalty Fees are charges that lenders impose when you fail to make your loan payments on time. These fees can vary widely depending on the lender and the type of loan. They are designed to encourage borrowers to stay on track with their payments, but they can also lead to more debt if you’re not careful.

How Do They Affect You?

- Increased Debt: Missing payments can lead to higher overall debt due to these fees.

- Credit Score Impact: Defaulting can hurt your credit score, making future loans harder to get.

- Recovery Options: If you find yourself in a Personal Loan Default situation, explore recovery options like loan restructuring or speaking with your lender.

Understanding these aspects can help you avoid the pitfalls of loan default and keep your finances on track.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

How Are Loan Default Penalty Fees Calculated?

When you take out a loan, it’s important to understand the potential costs involved, especially if you fall behind on payments. Loan Default Penalty Fees can add up quickly, making your financial situation even more challenging. Knowing how these fees are calculated can help you avoid unnecessary stress and keep your finances in check.

Loan Default Penalty Fees are typically calculated based on the amount you owe and how long you’ve been in default. Here’s a simple breakdown:

- Percentage of the Loan: Many lenders charge a percentage of your outstanding balance as a penalty. This can range from 1% to 5% depending on the lender’s policies.

- Flat Fees: Some lenders may impose a flat fee for each missed payment. This fee can vary widely, so it’s crucial to read your loan agreement carefully.

- Interest Accumulation: If you default, interest may continue to accrue on your unpaid balance, increasing the total amount you owe. This can lead to a cycle of debt that’s hard to escape.

Understanding these factors can help you manage your personal loan default and recovery more effectively. By staying informed, you can take proactive steps to avoid these fees and maintain your financial health.

The Impact of Loan Default Penalty Fees on Your Finances

Loan Default Penalty Fees can feel like a heavy weight on your shoulders. When you take out a personal loan, you expect to manage your payments smoothly. However, if you miss a payment, the penalties can pile up quickly, impacting your finances in ways you might not expect.

What Are Loan Default Penalty Fees?

These fees are charges imposed by lenders when you fail to make your loan payments on time. They can vary widely, but they often add significant costs to your overall debt. Understanding these fees is crucial to avoid financial pitfalls.

How Do They Affect You?

- Increased Debt: Missing payments leads to higher amounts owed.

- Credit Score Damage: Defaults can hurt your credit score, making future loans harder to obtain.

- Stress and Anxiety: The pressure of unpaid loans can take a toll on your mental health.

In the long run, personal loan default and recovery can be challenging. It’s essential to stay informed and proactive about your payments to avoid these fees and protect your financial future.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

What Happens When You Default on a Loan?

When you take out a loan, you agree to pay it back on time. But what happens if you can’t? Understanding Loan Default Penalty Fees is crucial because these fees can add up quickly, making your financial situation even tougher. Let’s explore what you might face if you default on a loan.

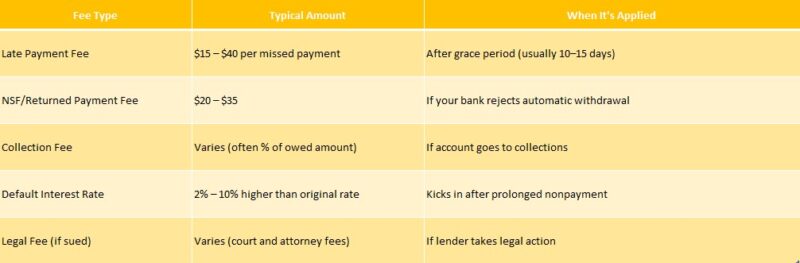

When you miss payments, your lender may charge you Loan Default Penalty Fees. These fees can vary, but they often include:

- Late fees: Charged for each missed payment.

- Increased interest rates: Your loan may become more expensive.

- Collection fees: If the lender sends your account to collections, additional fees can apply.

Defaulting on a personal loan can also hurt your credit score. A lower score means it’s harder to borrow money in the future. But don’t lose hope! There are ways to recover from a default. You can negotiate with your lender or consider debt counseling to get back on track. Remember, understanding these fees and consequences can help you make better financial choices in the future.

Also Read: Personal Loan Default and Recovery: What You Should Know

Can You Negotiate Loan Default Penalty Fees?

When you take out a loan, understanding the potential costs is crucial. Loan Default Penalty Fees can add up quickly if you miss payments, making your financial situation even tougher. But what if you could negotiate these fees? Let’s explore that possibility!

Negotiating Loan Default Penalty Fees is not only possible, but it’s also worth trying. Here are some steps to consider:

- Communicate Early: If you know you might miss a payment, reach out to your lender as soon as possible. They may be more willing to help if you contact them before defaulting.

- Explain Your Situation: Share your story. Lenders often appreciate honesty and may offer options to reduce or waive fees if they understand your circumstances.

- Offer a Payment Plan: Suggest a plan to catch up on missed payments. This shows your commitment to repaying the loan, which can encourage lenders to negotiate fees.

Remember, while personal loan default and recovery can be challenging, open communication can lead to better outcomes. Don’t hesitate to ask for help!

Common Myths About Loan Default Penalty Fees Debunked

When it comes to loans, many people worry about the dreaded Loan Default Penalty Fees. Understanding what these fees are and how they work is crucial. If you miss a payment, you might think the worst is over, but the reality can be much more complicated. Let’s clear up some common myths surrounding these fees.

Myth 1: All Loans Have the Same Penalty Fees

Not all lenders charge the same Loan Default Penalty Fees. In fact, fees can vary widely based on the type of loan and the lender’s policies. Always read the fine print before signing any loan agreement to know what you might face if you default.

Myth 2: You’ll Always Be Charged a Fee Immediately

Many believe that a penalty fee is charged the moment you miss a payment. However, most lenders provide a grace period. This means you might have a few days to make your payment without incurring any fees. It’s essential to understand your lender’s specific terms.

Myth 3: Defaulting Means You Lose Everything

While a Personal Loan Default can lead to serious consequences, it doesn’t mean you lose everything right away. Lenders often prefer to work with borrowers to recover their money, so communication is key. If you find yourself in trouble, reach out to your lender for options.

How ExpressCash.com Can Help You Navigate Loan Default Penalty Fees

Understanding Loan Default Penalty Fees is crucial for anyone considering a personal loan. When you miss payments, lenders can impose hefty fees, making your financial situation even tougher. Knowing what to expect can help you avoid surprises and manage your finances better.

Expert Guidance

At ExpressCash.com, we provide clear information about Loan Default Penalty Fees. Our resources help you understand how these fees work and what they can mean for your personal loan default and recovery journey.

Personalized Support

We offer personalized support to help you navigate your options. Whether you’re facing default or looking to recover, our team is here to guide you through the process.

Key Insights

- Stay Informed: Learn about the specific fees associated with your loan.

- Plan Ahead: Understand how to avoid default and the penalties that come with it.

- Recovery Options: Explore ways to recover from a default situation effectively.

With our help, you can take control of your financial future and minimize the impact of loan default penalty fees.

Tips to Avoid Loan Default and Its Associated Fees

Loan Default Penalty Fees can significantly impact your finances, making it essential to understand how to avoid them. When you take out a personal loan, timely repayment is crucial. However, unexpected situations can lead to missed payments and costly fees. Here are some tips to help you steer clear of these penalties and maintain financial health.

Stay Organized with Payments

Keeping track of payment dates is vital. Use reminders on your phone or a calendar to avoid late payments and the dreaded Loan Default Penalty Fees. A little organization can go a long way!

Communicate with Your Lender

If you’re having trouble, reach out to your lender. They may provide options like payment plans or deferments. Open communication can prevent personal loan default and recovery issues later on.

Create a Budget

A solid budget helps manage your finances effectively. By tracking income and expenses, you can allocate funds for loan payments, reducing the risk of falling behind.

Build an Emergency Fund

Life is unpredictable, so having an emergency fund can cover unexpected expenses. Aim for at least three months’ worth of expenses to ensure timely loan payments.

Consider Automatic Payments

Setting up automatic payments can help you avoid missing deadlines and incurring Loan Default Penalty Fees. It’s a simple yet effective solution!

Review Your Loan Terms

Understanding your loan terms, including interest rates and penalties, is crucial. Being informed helps you make better financial decisions and avoid personal loan default situations.

FAQs

⚖️ What are loan default penalty fees?

Loan default penalty fees are extra charges lenders apply when you miss a loan payment or fail to repay on time. These are meant to discourage late payments and compensate the lender for the risk.

📊 How are penalty fees calculated?

Penalty fees vary by lender but are usually a percentage of the overdue amount. For example, a lender might charge 1%–5% per month on the unpaid EMI until it’s cleared.

🛑 Can lenders charge interest on penalty fees?

No. According to the RBI guidelines (2024), lenders can’t charge interest on penal charges. The penalty is a one-time fee and should not be capitalized or added to the principal.

💳 What happens if I keep missing payments?

Continued defaults can lead to:

-

A lower credit score

-

Higher cumulative penalty fees

-

Legal action after 90 days of non-payment (loan marked as NPA)

🔍 How can I avoid loan default penalties?

Make payments on time, set up auto-debit, and if you’re struggling financially, contact your lender early. They might offer options like loan restructuring or temporary relief.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.