The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

Credit Score Impact of Loan Defaults: How Bad Is It?

Understanding the Credit Score Impact of Loan Defaults is essential for anyone borrowing money. A loan default can feel overwhelming, but it’s important to know what it means for your credit score. Let’s simplify it.

What Happens When You Default?

Defaulting on a personal loan means you haven’t made payments as agreed. This can lead to serious consequences, such as:

- A significant drop in your credit score

- Difficulty obtaining new loans or credit

- Higher interest rates in the future

The Long-Term Effects

The Credit Score Impact of Loan Defaults is not just a short-term issue. A default can remain on your credit report for up to seven years, making recovery difficult. However, there are ways to improve your situation.

Personal Loan Default and Recovery

If you’ve defaulted, don’t despair—recovery is possible! Here are some tips to help you get back on track:

- Make payments on time moving forward

- Consider credit counseling

- Monitor your credit report regularly

By understanding the effects of loan defaults and taking proactive steps, you can work towards a healthier credit score and a brighter financial future.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

What Happens to Your Credit Score After a Default?

When you take out a loan, you might think it’s just a simple agreement. But what happens if you can’t pay it back? Understanding the Credit Score Impact of Loan Defaults is crucial because it can affect your financial future for years. Let’s dive into what happens to your credit score after a default.

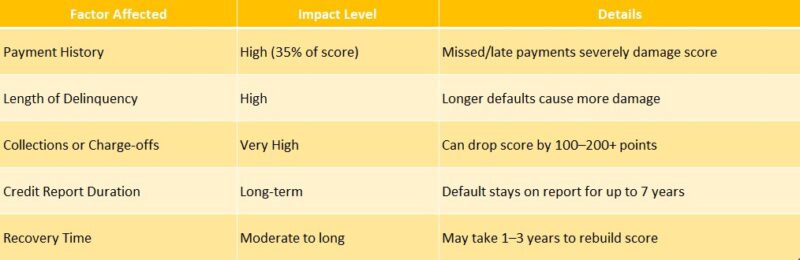

When you default on a personal loan, your credit score can take a significant hit. Here’s how it works:

- Immediate Drop: Your score can drop by 100 points or more, depending on your previous score.

- Long-Term Effects: A default can stay on your credit report for up to seven years, making it harder to get new loans or credit cards.

- Higher Interest Rates: If you do qualify for credit in the future, expect higher interest rates due to your damaged score. Recovering from a personal loan default isn’t impossible, but it requires time and effort. You can rebuild your credit by making timely payments on new loans, keeping credit card balances low, and regularly checking your credit report for errors. Remember, every step counts towards your recovery!

The Long-Term Effects of Loan Defaults on Your Financial Health

When you take out a loan, you might think it’s just a simple agreement. But what happens if you can’t pay it back? Understanding the Credit Score Impact of Loan Defaults is crucial because it can affect your financial health for years. Let’s dive into how a personal loan default can change your life.

The Ripple Effect of Loan Defaults

A loan default doesn’t just mean losing money; it can lead to a significant drop in your credit score. This score is like your financial report card, and a low score can make it hard to get future loans, rent an apartment, or even land a job.

Key Consequences of a Low Credit Score

- Higher Interest Rates: If you do get approved for a loan, expect to pay higher interest rates.

- Limited Options: Many lenders may refuse to work with you altogether.

- Long Recovery Time: It can take years to rebuild your credit score after a default, making it essential to manage your loans wisely. In conclusion, the Credit Score Impact of Loan Defaults is serious. A personal loan default can lead to long-term financial struggles.

However, understanding this impact can help you make better choices today, ensuring a brighter financial future tomorrow.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

How Loan Defaults Can Affect Your Future Borrowing Opportunities

When it comes to borrowing money, understanding the Credit Score Impact of Loan Defaults is crucial. Imagine wanting to buy your dream car or a cozy home, but your past loan defaults hold you back. This section explores how loan defaults can affect your future borrowing opportunities and why it matters.

The Ripple Effect of Defaults

When you default on a personal loan, it doesn’t just disappear. Instead, it creates a ripple effect on your credit score. A lower score can mean higher interest rates or even denial of loans. This can make it tough to secure future financing, whether for a car, home, or even a credit card.

Recovery is Possible

Don’t lose hope! Recovery from a personal loan default and recovery is possible. Here are some steps to consider:

- Check Your Credit Report: Understand where you stand.

- Make Payments on Time: Consistency can help rebuild your score.

- Consider Secured Credit: This can be a stepping stone to better credit. In conclusion, knowing the Credit Score Impact of Loan Defaults helps you make informed decisions.

By understanding the consequences and taking steps to recover, you can pave the way for a brighter financial future.

Also Read: Personal Loan Default and Recovery: What You Should Know

Can You Recover from a Loan Default? Steps to Rebuild Your Credit

When you default on a loan, it can feel like a dark cloud hanging over your financial future. Understanding the Credit Score Impact of Loan Defaults is crucial because it can affect your ability to borrow money in the future. But don’t worry! There are steps you can take to recover and rebuild your credit after a personal loan default.

Understand the Damage

First, it’s important to know how much a loan default can hurt your credit score. Typically, your score can drop by 100 points or more! This can make it harder to get loans or even rent an apartment. But don’t lose hope; recovery is possible!

Take Action

Here are some steps to help you bounce back:

- Check Your Credit Report: Look for errors and dispute them if necessary.

- Make Payments on Time: Start paying your bills on time to show lenders you’re responsible.

- Consider a Secured Credit Card: This can help you rebuild your credit history.

- Seek Professional Help: A credit counselor can guide you through the recovery process.

By following these steps, you can improve your credit score over time and regain financial stability. Remember, recovery from a personal loan default is not just possible; it’s within your reach!

The Role of Credit Reporting Agencies in Loan Defaults

Understanding the Credit Score Impact of Loan Defaults is essential for making informed financial decisions. A loan default can feel overwhelming, but knowing how credit reporting agencies operate can help clarify the situation.

Credit reporting agencies are key players in determining how loan defaults affect your credit score. When you miss payments or default on a personal loan, these agencies update your credit report, which lenders review when you apply for new credit.

Key Points to Remember:

- Credit Score Drop: A default can decrease your score by 100 points or more.

- Long-lasting Effects: Defaults may remain on your report for up to seven years.

- Recovery is Possible: With time and responsible financial habits, you can improve your score after a default.

A loan default signals to lenders that you may be a risky borrower, potentially leading to higher interest rates or loan denials in the future.

How Defaults Affect Your Future

- Loan Applications: A low credit score can hinder your chances of loan approval.

- Higher Costs: If approved, you may face elevated interest rates, increasing your overall costs.

Steps to Recovery

- Check Your Credit Report: Regularly review for errors.

- Make Payments on Time: Consistent payments can help improve your score.

- Consider Credit Counseling: Professionals can assist in creating a recovery plan.

How ExpressCash.com Can Help You Navigate Loan Defaults

When it comes to loans, understanding the Credit Score Impact of Loan Defaults is crucial. A loan default can feel like a dark cloud hovering over your financial future. But don’t worry! At ExpressCash.com, we’re here to help you navigate these tricky waters and find your way back to financial health.

Understanding the Consequences

When you default on a personal loan, it can drop your credit score significantly. This drop can affect your ability to secure future loans, rent an apartment, or even get a job. But knowing this is the first step toward recovery!

Steps to Recovery

- Assess Your Situation: Understand how much you owe and to whom.

- Communicate with Lenders: They may offer options to help you avoid default.

- Create a Budget: This will help you manage your finances better.

At ExpressCash.com, we provide resources and guidance to help you recover from a personal loan default. With the right tools and support, you can rebuild your credit score and regain control of your financial future.

Preventing Loan Defaults: Tips for Maintaining a Healthy Credit Score

Understanding the Credit Score Impact of Loan Defaults is crucial for anyone looking to borrow money. When you default on a personal loan, it can feel like a dark cloud hanging over your financial future. But don’t worry! There are ways to prevent defaults and keep your credit score healthy.

Stay Informed About Your Finances

Keep track of your income and expenses. Knowing where your money goes helps you avoid surprises that could lead to a personal loan default.

Create a Budget

A budget is like a roadmap for your money. It helps you plan for bills and saves you from overspending, which can lead to missed payments.

Communicate with Lenders

If you’re struggling, reach out to your lender. They might offer options to help you avoid a default. Remember, it’s better to ask for help than to ignore the problem!

Build an Emergency Fund

Having savings set aside can be a lifesaver. An emergency fund can help you cover unexpected expenses without falling behind on your loans.

By following these tips, you can protect your credit score and avoid the negative effects of loan defaults. Remember, a healthy credit score opens doors to better financial opportunities!

FAQs

📉 How does a loan default affect my credit score?

A loan default can severely lower your credit score, often by 100 points or more. The exact impact depends on your current credit status and the loan type, but defaults signal high risk to future lenders.

📆 When is a missed loan payment reported to credit bureaus?

Lenders typically report missed payments once they are 30 days past due. The longer the delay (60, 90, 120+ days), the more damage it does to your credit report.

🛠️ Can I fix my credit score after a default?

Yes, but it takes time. You can start by:

-

Paying off the defaulted loan

-

Negotiating a settlement

-

Making on-time payments on current credit

Defaults generally stay on your report for 7 years, but your score can gradually improve with good habits.

⚠️ Will one missed payment ruin my credit?

One late payment can cause a noticeable dip, especially if you previously had good credit. However, quick repayment and no further missed payments can help you recover faster.

🔍 Do payday loan defaults affect credit scores too?

It depends. Many payday lenders don’t report to credit bureaus, but if the loan is sent to collections, that will appear on your report and hurt your score.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.