The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

Loan Restructuring Options After Default: Can You Renegotiate?

Understanding your options after a personal loan default is crucial. If you’ve fallen behind on your title loan payments, you might feel overwhelmed. But don’t worry! There are loan restructuring options after default that can help you regain control of your finances and avoid further complications.

What is Loan Restructuring?

Loan restructuring involves modifying the terms of your loan to make it more manageable. This could mean extending the repayment period, lowering the interest rate, or even reducing the total amount owed. By renegotiating your loan, you can create a payment plan that fits your current financial situation.

Steps to Consider

- Communicate with Your Lender: Reach out to discuss your situation. Many lenders are willing to work with you.

- Explore Options: Ask about different restructuring options available.

- Document Everything: Keep records of all communications and agreements.

- Stay Informed: Understand the implications of any changes to your loan.

By taking these steps, you can navigate your personal loan default and recovery more effectively. Remember, you’re not alone in this process!

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

What Happens When You Default on a Title Loan?

When you default on a title loan, it can feel overwhelming. Understanding your options is crucial. Title loan restructuring options after default can help you regain control of your finances. But what does it mean to default, and can you renegotiate your loan? Let’s explore this together.

When you miss a payment, the lender may start the repossession process. This means they can take your vehicle. However, there are ways to avoid this. Here are some loan restructuring options after default:

Possible Options:

- Renegotiate Terms: Talk to your lender about adjusting your payment plan. They might offer a lower interest rate or extended repayment period.

- Payment Plans: Some lenders allow you to create a new payment plan that fits your budget better.

- Loan Modification: This involves changing the loan’s terms to make it more manageable. It can help you avoid defaulting again.

Remember, communication is key. If you’re facing personal loan default and recovery, reach out to your lender as soon as possible. They may be more willing to work with you than you think.

Can You Renegotiate Your Title Loan Terms?

When life throws unexpected challenges your way, managing a title loan can feel overwhelming, especially after a default. Understanding your Loan Restructuring Options After Default is crucial. It’s not just about facing the consequences; it’s about finding a way to recover and regain control of your finances.

Understanding Your Options

Yes, you can often renegotiate your title loan terms! Many lenders are willing to work with you, especially if you communicate your situation. Here are some options to consider:

- Lower Interest Rates: Ask if they can reduce your interest rate to make payments more manageable.

- Extended Payment Terms: Request a longer repayment period to lower your monthly payments.

- Payment Plans: Some lenders may offer flexible payment plans that fit your budget better.

The Importance of Communication

Always keep the lines of communication open with your lender. They may have specific Personal Loan Default and Recovery programs designed to help borrowers like you. Remember, it’s better to ask for help than to ignore the problem!

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

Exploring the Benefits of Loan Restructuring After Default

When life throws unexpected challenges your way, it can be tough to keep up with loan payments. If you find yourself in a situation of personal loan default, don’t lose hope! Exploring Title Loan Restructuring Options After Default can open doors to new possibilities and help you regain control of your finances.

Understanding Loan Restructuring

Loan restructuring is like hitting the reset button on your loan. It allows you to renegotiate the terms of your loan, making it easier to manage. This can mean lower monthly payments or extended repayment periods, which can be a lifesaver during tough times.

Key Benefits of Restructuring Your Loan

- Lower Payments: You might be able to reduce your monthly payment, easing your financial burden.

- Extended Terms: A longer repayment period can give you more time to pay off the loan.

- Improved Credit Score: Successfully managing a restructured loan can help improve your credit score over time.

In short, taking advantage of loan restructuring options after default can be a smart move. It not only helps you recover but also sets you on a path to financial stability.

Also Read: Personal Loan Default and Recovery: What You Should Know

Key Factors to Consider Before Renegotiating Your Loan

When facing a personal loan default, it’s crucial to understand your options. Title loan restructuring can be a lifeline, allowing you to renegotiate terms and regain control. But before diving in, consider several key factors that can influence your decision and outcome.

Understand Your Current Situation

Before you approach your lender, assess your financial health. Are you able to make higher payments? Knowing your budget will help you negotiate effectively. Also, consider the reasons behind your personal loan default; understanding these can guide your conversation with the lender.

Communicate Openly with Your Lender

Don’t hesitate to reach out to your lender. They may offer various loan restructuring options after default, such as extended repayment terms or lower interest rates. Being honest about your situation can foster goodwill and lead to better solutions. Remember, lenders prefer to work with you rather than lose their investment.

How to Approach Your Lender for Loan Restructuring

When you find yourself in a tough spot after a personal loan default, knowing your TitleLoan restructuring options can be a game changer. Renegotiating your loan can help ease financial stress and put you back on track. But how do you approach your lender?

Be Prepared

Before you reach out, gather all your loan documents. Understanding your current terms will help you explain your situation clearly. This preparation shows your lender that you are serious about finding a solution.

Open the Conversation

Start by contacting your lender and expressing your desire to discuss loan restructuring options after default. Be honest about your financial situation. Lenders appreciate transparency and may be more willing to work with you if they see you’re committed to recovery.

Suggest Solutions

When you talk to your lender, suggest specific restructuring options. This could include extending the loan term, lowering interest rates, or even temporarily pausing payments. Having these ideas ready can make the conversation smoother and more productive.

The Role of Credit Counseling in Title Loan Restructuring

When facing a title loan default, understanding your options can feel overwhelming. However, exploring Loan Restructuring Options After Default is crucial. One effective path to recovery is through credit counseling, which can help you renegotiate your loan terms and regain control of your finances.

The Benefits of Credit Counseling

Credit counseling offers several advantages for those in a tough spot:

- Expert Guidance: Counselors can provide tailored advice based on your financial situation.

- Negotiation Skills: They often have established relationships with lenders, making it easier to negotiate better terms.

- Budgeting Help: Counselors can assist in creating a budget that prioritizes loan repayment, helping you avoid future defaults.

Steps to Take

If you’re considering credit counseling, here are some steps to follow:

- Research: Look for reputable credit counseling agencies.

- Consultation: Schedule a meeting to discuss your situation.

- Action Plan: Work with your counselor to develop a plan that includes your Personal Loan Default and Recovery options.

By taking these steps, you can effectively navigate the complexities of title loan restructuring and work towards a more stable financial future.

Real-Life Success Stories: Renegotiating Title Loans

When facing a personal loan default, many borrowers feel trapped and unsure of their options. However, understanding Title Loan Restructuring Options After Default can open doors to recovery. Renegotiating your title loan may seem daunting, but it’s often possible and can lead to a brighter financial future.

Many borrowers have successfully renegotiated their title loans. For instance, Sarah, a single mother, found herself struggling after losing her job. She reached out to her lender and explained her situation. To her surprise, they offered her a lower interest rate and extended her repayment period, making her monthly payments more manageable.

Key Insights from Successful Renegotiations

- Open Communication: Always talk to your lender about your situation. They may have options available.

- Be Honest: Share your financial struggles. Lenders appreciate transparency and may be willing to help.

- Explore Alternatives: Sometimes, lenders can offer different restructuring options, like a payment plan or loan modification.

How ExpressCash.com Can Help You Navigate Loan Restructuring Options

When you find yourself in a tough spot after a personal loan default, understanding your options is crucial. Title loan restructuring can provide a lifeline, allowing you to renegotiate terms and regain control of your finances. But how do you navigate these waters? That’s where ExpressCash.com comes in.

At ExpressCash.com, we specialize in guiding you through the complexities of loan restructuring options after default. Our team understands the stress that comes with personal loan default and recovery, and we’re here to help you explore your choices.

Key Steps We Offer:

- Assessment of Your Situation: We’ll review your current loan terms and financial status.

- Negotiation Support: Our experts can assist in renegotiating your loan terms with lenders.

- Customized Solutions: We tailor strategies that fit your unique needs, ensuring you have a clear path forward.

With our support, you can feel empowered to tackle your financial challenges and work towards a brighter future. Remember, you’re not alone in this journey!

FAQs

🔄 What is loan restructuring after default?

Loan restructuring is when a lender modifies your loan terms after a default to help you repay. This could include extending the loan term, reducing interest rates, or converting unpaid dues into a new loan.

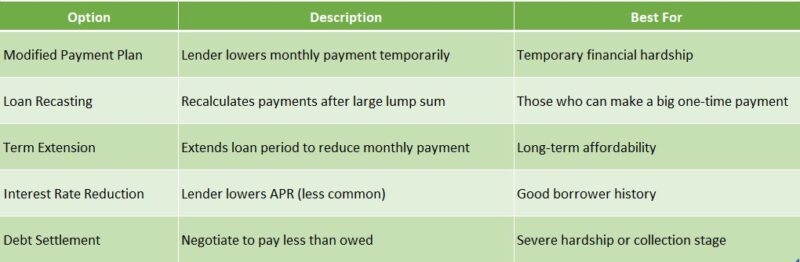

🧩 What are common loan restructuring options?

Lenders may offer:

-

Extension of tenure to reduce EMI

-

Temporary payment pause (moratorium)

-

Switch to a lower interest rate

-

Settlement plans for partial repayment

📞 How do I request loan restructuring?

Contact your lender and submit a written request. You’ll likely need to provide:

-

Proof of financial hardship

-

Updated income documents

-

A revised repayment plan proposal

⚖️ Will loan restructuring hurt my credit score?

Yes, it can. While it’s better than continued default, restructuring is often marked on your credit report as a “restructured loan,” which can negatively affect your creditworthiness.

💡 Is loan restructuring better than defaulting completely?

Absolutely. Restructuring shows you’re trying to honor your debt and may protect you from legal action, asset seizure, or wage garnishment, depending on the loan type.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.