The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

Loan Repayment Agreement After Default: How to Set It Up

Understanding a Loan Repayment Agreement After Default is crucial for anyone who has fallen behind on their payments. When you default on a personal loan, it can feel overwhelming. However, setting up a repayment agreement can help you regain control and avoid further financial trouble.

What is a Loan Repayment Agreement?

A Loan Repayment Agreement After Default is a plan between you and your lender. It outlines how you will repay your debt after missing payments. This agreement can help you avoid serious consequences like legal action or damage to your credit score.

Steps to Set Up Your Agreement

- Contact Your Lender: Reach out as soon as you realize you’re in trouble.

- Discuss Your Situation: Be honest about your financial struggles.

- Propose a New Payment Plan: Suggest a realistic amount you can afford.

- Get Everything in Writing: Ensure you have a formal agreement to avoid misunderstandings.

By following these steps, you can create a manageable plan to recover from personal loan default. Remember, communication is key! Your lender may be more willing to help than you think.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

What Are the Key Components of a Loan Repayment Agreement?

If you find yourself struggling after a personal loan default, a Loan Repayment Agreement After Default can be a crucial tool. This agreement helps you and your lender establish a clear plan for repayment, making it easier to regain financial stability.

Key Components of a Loan Repayment Agreement

To ensure clarity and fairness, a solid Loan Repayment Agreement should include several key components:

- Loan Amount: Clearly state the total amount owed, including interest and fees.

- Payment Schedule: Outline when payments are due and the amount for each, helping both parties know what to expect.

- Interest Rate: Specify whether the interest rate will change or remain fixed during repayment.

- Consequences of Non-Payment: Detail the repercussions of missed payments, such as late fees or further actions from the lender.

Including these components creates a roadmap for recovery, simplifying the management of finances after a personal loan default.

Benefits of a Clear Agreement

A clear Loan Repayment Agreement After Default provides several advantages:

- Reduces Stress: Knowing what you owe and when to pay alleviates financial anxiety.

- Improves Communication: A written agreement enhances communication between you and your lender.

- Encourages Accountability: Both parties are held accountable, leading to a more successful repayment process.

How to Negotiate Terms in Your Loan Repayment Agreement

When you find yourself in a tough spot after a personal loan default, setting up a Loan Repayment Agreement After Default can be a lifesaver. This agreement helps you regain control over your finances and avoid further penalties. But how do you negotiate terms that work for you?

Understand Your Situation

Before diving into negotiations, take a moment to assess your financial situation. Know how much you owe and what you can realistically afford to pay. This understanding will empower you during discussions with your lender.

Communicate Openly

Reach out to your lender and explain your situation honestly. Most lenders prefer to work with you rather than escalate the issue. Be clear about your financial struggles and express your willingness to repay the loan. This openness can lead to more favorable terms.

Propose a Plan

Once you’ve established communication, propose a repayment plan that suits your budget. Consider options like lower monthly payments or extended repayment periods. Be flexible and ready to discuss alternatives. Remember, the goal is to find a solution that benefits both you and your lender.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

Common Mistakes to Avoid When Setting Up a Loan Repayment Agreement

Setting up a Loan Repayment Agreement After Default is crucial for both borrowers and lenders. It helps in recovering funds while providing borrowers a chance to get back on track. However, many people make mistakes during this process that can complicate matters further. Let’s explore some common pitfalls to avoid.

Lack of Clear Communication

One of the biggest mistakes is not communicating clearly. Both parties should discuss terms openly. If you’re a borrower, ask questions about the repayment plan. If you’re a lender, be transparent about expectations. Clear communication can prevent misunderstandings and build trust.

Ignoring Legal Requirements

Another mistake is overlooking legal requirements. A Loan Repayment Agreement After Default should comply with local laws. Failing to do so can lead to complications later. Always consider consulting a legal expert to ensure your agreement is valid and enforceable.

Setting Unrealistic Terms

Lastly, avoid setting unrealistic repayment terms. Borrowers should assess their financial situation honestly. Lenders should be flexible but firm. Creating a plan that is achievable for both parties increases the chances of successful recovery from a personal loan default.

Also Read: Personal Loan Default and Recovery: What You Should Know

Can You Modify Your Loan Repayment Agreement After Default?

When you find yourself in a tough spot after a personal loan default, it can feel overwhelming. But don’t worry! A Loan Repayment Agreement After Default can help you get back on track. Understanding how to set this up is crucial for your financial recovery.

Absolutely! Modifying your loan repayment agreement is not only possible, but it’s often necessary. Here’s how you can approach it:

Steps to Modify Your Agreement:

- Communicate with Your Lender: Reach out to your lender as soon as possible. They may offer options to help you.

- Review Your Financial Situation: Assess your income and expenses. This will help you propose a realistic repayment plan.

- Negotiate Terms: Don’t hesitate to ask for lower payments or extended terms. Lenders often prefer to work with you rather than lose their investment.

- Get Everything in Writing: Once you reach an agreement, ensure it’s documented. This protects both you and the lender.

By taking these steps, you can create a manageable Loan Repayment Agreement After Default, paving the way for your financial recovery. Remember, it’s all about communication and finding a solution that works for both parties.

The Role of Creditors in Loan Repayment Agreements

When a borrower falls behind on payments, the situation can feel overwhelming. However, understanding the role of creditors in a Loan Repayment Agreement After Default is crucial. Creditors can help guide borrowers through the recovery process, making it easier to regain financial stability.

Understanding the Creditor’s Role

Creditors are the lenders who provide the loan. After a personal loan default, they have a vested interest in recovering the money. They often prefer to negotiate rather than pursue legal action. This can lead to a more manageable repayment plan for the borrower.

Key Responsibilities of Creditors

- Communication: Creditors will reach out to discuss the default and possible solutions.

- Flexibility: They may offer different repayment options tailored to the borrower’s financial situation.

- Documentation: Creditors will provide necessary paperwork to formalize the Loan Repayment Agreement After Default, ensuring both parties understand the terms.

By working together, borrowers and creditors can create a plan that benefits everyone involved, paving the way for recovery and financial health.

How ExpressCash Can Help You Navigate Loan Repayment Agreements

When you find yourself in a tough spot after a personal loan default, setting up a Loan Repayment Agreement After Default can feel overwhelming. But don’t worry! Understanding how to navigate this process is crucial for regaining your financial footing. Here’s where ExpressCash comes in to help you every step of the way.

Understanding Your Options

At ExpressCash, we believe in empowering you with knowledge. A Loan Repayment Agreement After Default allows you to negotiate new terms with your lender. This can include lower monthly payments or extended repayment periods. Here’s how we can assist you:

- Personalized Guidance: We provide tailored advice based on your unique situation.

- Negotiation Support: Our experts can help you communicate effectively with your lender.

Steps to Set Up Your Agreement

Setting up a Loan Repayment Agreement After Default doesn’t have to be complicated. Follow these simple steps:

- Assess Your Finances: Understand what you can afford to pay.

- Contact Your Lender: Reach out to discuss your situation.

- Draft the Agreement: Work with us to create a clear repayment plan.

With ExpressCash by your side, you can turn your personal loan default into a recovery story. Let’s work together to get you back on track!

Steps to Take After Signing a Loan Repayment Agreement

After facing a personal loan default, setting up a Loan Repayment Agreement After Default is crucial. This agreement helps you regain control over your finances and rebuild your credit. Understanding the steps involved can make this process smoother and less stressful.

- Review the Agreement: Make sure you understand all the terms. This includes the repayment schedule, interest rates, and any penalties for late payments.

- Create a Budget: Adjust your monthly budget to accommodate the new payment plan. This will help you avoid future defaults and keep your finances on track.

- Communicate with Your Lender: Stay in touch with your lender. If you face any difficulties, let them know immediately. Open communication can lead to more flexible solutions.

- Make Payments on Time: Consistently making your payments on time is essential. This not only helps you recover from the default but also improves your credit score over time.

- Seek Financial Advice: If you’re unsure about your financial situation, consider consulting a financial advisor. They can provide tailored advice to help you navigate your recovery effectively. By following these steps, you can successfully manage your Loan Repayment Agreement After Default. Remember, recovery takes time, but with commitment and the right approach, you can regain your financial footing.

FAQs

-

Can I set up a new repayment plan after defaulting on a loan?

Yes, many lenders are willing to negotiate a repayment agreement after default to help you avoid legal action and recover your loan standing. -

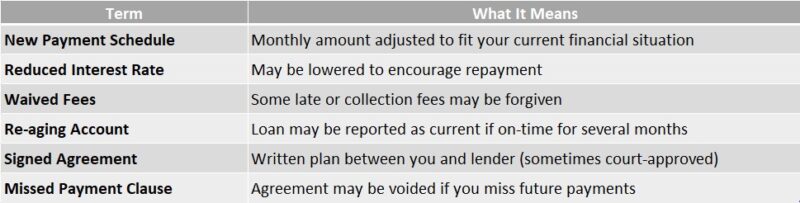

What should a repayment agreement after default include?

It should clearly outline the total amount owed, monthly payment amount, payment schedule, any waived fees or interest, and the consequences of missing payments again. -

Will a repayment agreement stop collections?

Yes, in most cases, once you sign a formal agreement and start making consistent payments, the lender will pause or stop collection efforts and may even withdraw legal action if it was initiated. -

Can a repayment agreement improve my credit?

While the default will still appear on your credit report, successfully following a repayment plan can limit further damage and may help rebuild your credit over time. -

Should I get legal advice before signing a repayment agreement?

Yes, it’s a good idea to consult a legal or financial advisor to ensure the terms are fair and you fully understand your rights and responsibilities.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.