The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

What to Do in Nevada When Rent Is Due and Your Paycheck Is Delayed

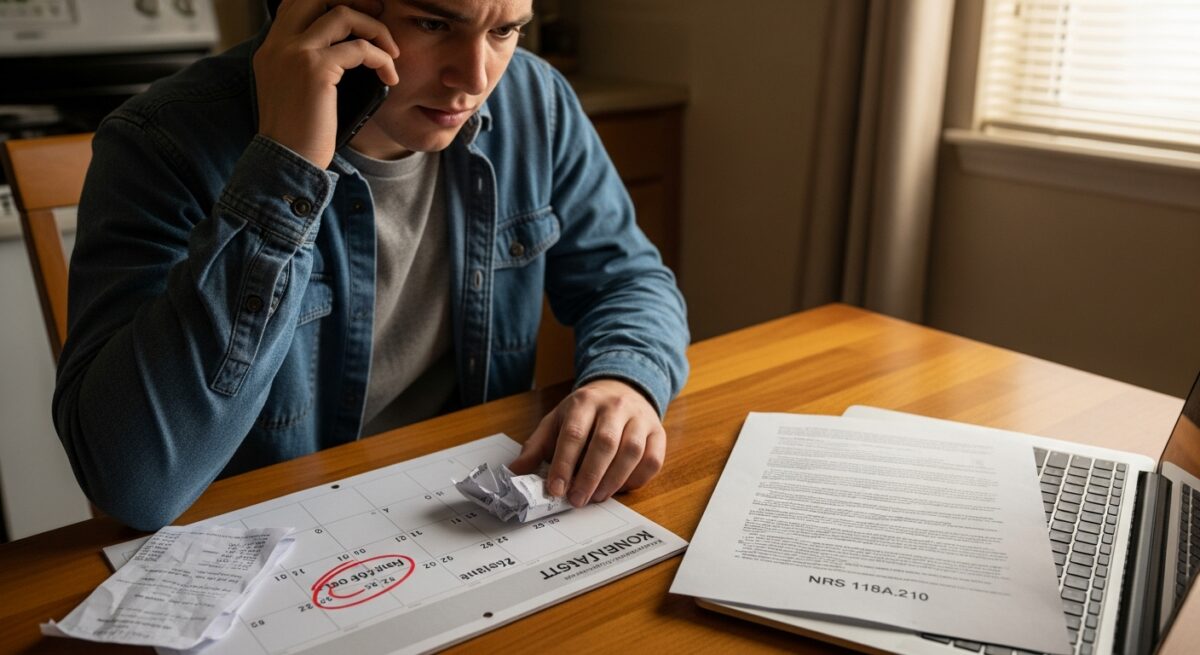

You budgeted carefully, you planned it all out, but then life throws a wrench in the works. Your paycheck is delayed, but your Nevada landlord’s due date is still staring you down from the calendar. That sinking feeling is all too real. The good news is you’re not without options. With calm, immediate action and a clear understanding of Nevada-specific resources and rules, you can navigate this stressful situation and protect your housing and your finances.

Protect your housing and credit today—call 📞833-856-0496 or visit Get Rent Help to secure a fast, professional solution for your delayed rent.

Key Things To Know About Rent Due Dates and Delayed Pay in Nevada

First, take a deep breath. A delayed paycheck is a cash flow problem, not necessarily a personal failure. In Nevada, like most states, rent is typically due on the date specified in your lease agreement. There is usually no formal grace period unless your lease explicitly states one. This means late fees can be assessed the day after the due date.

However, Nevada law (NRS 118A.210) requires landlords to provide at least 5 days’ written notice before they can start the eviction process for non-payment of rent. This “5-Day Notice to Pay or Quit” is your critical window. It’s not extra time to relax; it’s the official period you have to either pay the rent in full or come to another agreement with your landlord before they can file for eviction in court.

The Importance of Immediate Communication

Your very first step should always be to contact your landlord or property manager. Proactive, honest communication is your most powerful tool. Explain the situation calmly, provide proof of the payroll delay if you have it (like an email from your employer), and state when you expect to have the funds.

Why It Matters for Homeowners and Renters Alike

For anyone calling Nevada home, protecting your rental history and credit score is crucial. An eviction filing, even if you eventually pay, can stay on your record for years, making it incredibly difficult to rent a decent place in the future. Late payments reported to credit bureaus can drag down your credit score, affecting your ability to get loans, credit cards, and even some jobs.

Beyond the long-term record, the immediate stress of potential homelessness is overwhelming. Taking structured, informed steps isn’t just about money; it’s about preserving your stability and peace of mind. Knowing your rights and options turns panic into a manageable action plan.

If you need a fast, professional solution to bridge this temporary gap, covering your rent on time with ExpressCash fast loan solutions can provide the immediate funds you need to avoid late fees and landlord disputes while you wait for your paycheck.

Common Issues and Their Causes

The root cause is simple: a timing mismatch between your income and your obligations. But the reasons behind that mismatch vary. Understanding them can help you plan better or explain the situation clearly.

- Payroll Processing Errors: A glitch at your company’s HR or payroll department.

- Bank Delays: Direct deposits can be held up by weekends, holidays, or ACH processing times.

- Freelance or Gig Payment Delays: Clients paying late or platforms having extended payout periods.

- Unexpected Holds: Your bank placing a hold on a check you deposited.

- Company Cash Flow Problems: Your employer themselves may be delaying payroll, which is a major red flag.

Regardless of the cause, the effect is the same: your essential bills are due before your money arrives.

How to Professionally Address the Shortfall

Think of this as a financial triage. A professional approach involves multiple lines of defense, starting with the least costly option.

- Contact Your Landlord: As mentioned, do this immediately. Some may offer a brief, informal extension without fees if you have a good history.

- Explore Nevada Assistance Programs: Check with the Nevada 211 service or the Department of Health and Human Services for possible one-time rental assistance.

- Request a Salary Advance: Ask your employer if they can provide an advance on your delayed wages.

- Use a Responsible Short-Term Loan: For a predictable, fast solution, a reputable short-term loan can cover the gap. It’s essential to understand how to use short-term loans responsibly to ensure this tool helps rather than harms your finances.

- Pay with a Credit Card (with caution): Some landlords accept credit card payments, but beware of high transaction fees and even higher APRs if you can’t pay the card off quickly.

When time is of the essence and other options aren’t viable, a dedicated service can provide a straightforward path. Explore effective quick cash solutions for rent and bills designed to alleviate financial stress quickly and securely.

Signs You Should Not Ignore

While a single delayed paycheck is a crisis, certain patterns or reactions from your landlord are serious red flags that require escalated attention.

Protect your housing and credit today—call 📞833-856-0496 or visit Get Rent Help to secure a fast, professional solution for your delayed rent.

If your landlord refuses to communicate, slaps on excessive late fees not outlined in your lease, or threatens to immediately change the locks or remove your belongings, these are illegal actions in Nevada. The eviction process must go through the courts. Most critically, do not ignore any formal written notice taped to your door or sent by certified mail.

- The “5-Day Notice to Pay or Quit” from your landlord.

- Threats of immediate lock-out or utility shut-off.

- A pattern of your own pay being consistently late.

- Landlord refusing partial payment you can offer.

- Feeling pressured into a high-risk loan with unclear terms.

Cost Factors and What Affects Pricing

The “cost” of this situation isn’t just the rent amount. It’s the total financial impact of your chosen solution. Late fees are the most immediate added cost, often a flat fee (e.g., $50) or a percentage of the rent. If you borrow money, the cost includes interest rates and any origination fees. These vary widely based on the lender, your credit profile, and the loan amount and term.

Always calculate the Annual Percentage Rate (APR) to understand the true annual cost of a loan. For more on this, our EMI interest rate calculation guide can help you understand your cost. The highest cost of all, however, is an eviction filing, which can lead to court costs, legal fees, and long-term housing insecurity.

Choosing the right financial partner is key to managing these costs. Before you commit, learn what to expect when applying for a short-term loan so you can make a confident, informed decision with clear terms.

How To Choose the Right Financial Service

If you decide a loan is your best option, selecting a trustworthy provider is critical. Look for transparency in all fees and interest rates upfront. A legitimate lender will clearly state the APR and repayment schedule. They should be licensed to operate in Nevada. Check online reviews and the Better Business Bureau for complaints. Avoid any service that pressures you to act immediately, guarantees approval without checking anything, or asks for unusual upfront fees.

Long-Term Benefits for Your Financial Home

Successfully navigating this challenge does more than just keep a roof over your head this month. It builds your financial resilience. You learn the value of emergency communication, you become aware of local resources, and you understand the real cost of various options. Establishing a small emergency fund, even just a few hundred dollars, becomes a tangible goal. This experience, as stressful as it is, reinforces the importance of having a backup plan, ensuring you’re better prepared for any of life’s unexpected financial repairs in the future.

Frequently Asked Questions (FAQs)

Can my landlord evict me immediately for late rent in Nevada?

No. Nevada law requires landlords to give you a written 5-Day Notice to Pay or Quit before they can file an eviction lawsuit in court. You have those five days to pay the rent in full or move out.

What if I can only pay part of the rent before the due date?

Pay that partial amount and immediately communicate with your landlord. Provide proof of your delayed paycheck and a firm date for the remainder. Some landlords may accept this with a small fee, while others may not. It’s always better to pay something and show good faith.

Are payday loans a good option for late rent?

They are one option, but they come with very high costs and short repayment terms. It’s vital to understand how payday loans affect your credit score and have a solid plan for repayment to avoid a cycle of debt.

Where can I find rental assistance in Nevada?

Start by calling 211 or visiting the Nevada 211 website. You can also contact the Nevada Department of Health and Human Services or local non-profits like Catholic Charities or Salvation Army chapters for potential emergency assistance programs.

Will a late rent payment affect my credit score?

Only if your landlord reports it to the credit bureaus. Many smaller landlords do not. However, if the debt is sent to a collection agency or an eviction is filed and you receive a judgment, those will severely damage your credit report.

What should I do if I know my paycheck will be late again next month?

This indicates a recurring problem. You need to either address the income issue with your employer, adjust your budget to create a one-month buffer, or discuss a permanent change to your rent due date with your landlord based on your new pay schedule.

Facing a delayed paycheck with rent due is a high-pressure situation, but it’s a solvable one. By acting quickly, communicating openly, and using reliable resources, you can navigate this temporary setback. The goal is to secure your housing today while building smarter financial habits for a more stable tomorrow.

Protect your housing and credit today—call 📞833-856-0496 or visit Get Rent Help to secure a fast, professional solution for your delayed rent.