The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

How to Rebuild Credit After a Loan Default

Understanding how to rebuild credit after a loan default is vital for regaining financial stability. While a loan default can feel overwhelming, it doesn’t have to dictate your financial future. Recognizing its impact on your credit score is the first step toward recovery.

Defaulting on a personal loan can significantly lower your credit score, as lenders view you as a higher risk. Here are the key effects of a loan default:

Key Effects of Loan Default:

- Credit Score Drop: Your score may decrease by 100 points or more.

- Negative Mark: A default remains on your credit report for up to seven years.

- Higher Interest Rates: Future loans may come with increased rates due to perceived risk.

Despite these setbacks, recovery is achievable. By learning how to rebuild credit after a loan default, you can improve your score and regain lender trust. Start by checking your credit report for errors and disputing inaccuracies. Additionally, create a budget to better manage your finances. Making on-time payments on new credit accounts will also aid in rebuilding your score. Remember, recovery takes time, but with patience and effort, you can turn your financial situation around.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

What Steps Should You Take Immediately After Defaulting?

When you default on a personal loan, it can feel like a heavy weight on your shoulders. But don’t worry! Learning how to rebuild credit after a loan default is possible. Taking the right steps can help you recover and regain control of your financial future.

Assess Your Situation

First, take a deep breath and assess your situation. Understand why you defaulted. Was it due to unexpected expenses or loss of income? Knowing the cause can help you avoid similar issues in the future.

Communicate with Your Lender

Next, reach out to your lender. They may offer options like a payment plan or loan modification. Open communication can sometimes lead to a more manageable solution, which is crucial for your recovery.

Create a Budget

Finally, create a budget. Track your income and expenses to see where you can cut back. This will help you save money and make timely payments on any new credit, which is essential for rebuilding your credit score.

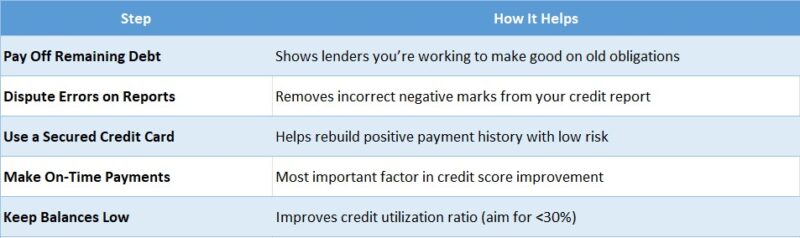

How to Rebuild Credit After a Loan Default: A Step-by-Step Guide

Rebuilding your credit after a loan default can feel overwhelming, but it’s essential for your financial future. Understanding how to rebuild credit after a loan default is crucial because a good credit score can open doors to better loan terms and lower interest rates. Let’s dive into a step-by-step guide to help you on your recovery journey.

1. Assess Your Credit Situation

Start by checking your credit report. Look for any errors and understand how the default has impacted your score. Knowing where you stand is the first step in your recovery.

2. Create a Budget

Develop a budget that prioritizes paying off existing debts. This will help you manage your finances better and ensure you don’t miss future payments. Stick to it diligently!

3. Make Payments on Time

Timely payments on any new loans or credit cards are vital. This shows lenders you’re responsible and can help improve your credit score over time. Remember, consistency is key!

4. Consider a Secured Credit Card

A secured credit card can be a great tool for rebuilding credit. It requires a cash deposit, which acts as your credit limit. Use it wisely and pay off the balance each month to boost your score.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

Can You Negotiate with Creditors to Improve Your Situation?

Rebuilding your credit after a loan default can feel overwhelming, but it’s essential for your financial future. Understanding how to negotiate with creditors is a crucial step in this recovery process. When you take the initiative to communicate with your creditors, you may find they are more willing to work with you than you think.

Start the Conversation

First, reach out to your creditors. Explain your situation honestly. Many creditors prefer to negotiate rather than risk losing their money altogether. This can lead to options like lower payments or even settling for less than you owe.

Benefits of Negotiation

- Lower Payments: You might secure a more manageable payment plan.

- Settlements: Sometimes, creditors will accept a lump sum that’s less than your total debt.

- Improved Credit Score: Successfully negotiating can help improve your credit score over time.

Remember, negotiating isn’t just about reducing debt; it’s also about rebuilding trust. By showing your willingness to pay, you can start to mend your financial reputation. This is a vital part of learning how to rebuild credit after a loan default.

Also Read: Personal Loan Default and Recovery: What You Should Know

The Importance of Monitoring Your Credit Report Regularly

Rebuilding credit after a loan default is crucial for your financial future. When you face a personal loan default, it can feel overwhelming. However, understanding how to rebuild credit after a loan default can open doors to better financial opportunities and help you regain control over your finances.

Stay Informed

Regularly checking your credit report is essential. It helps you understand where you stand and what areas need improvement. You can spot errors or fraudulent activities that could harm your credit score.

Track Your Progress

Monitoring your credit report allows you to see the impact of your recovery efforts. As you make positive changes, you’ll notice improvements in your score, which can motivate you to keep going.

Know Your Rights

You have the right to dispute any inaccuracies on your credit report. If you find mistakes related to your personal loan default, take action! Correcting these errors can significantly boost your credit score. By keeping an eye on your credit report, you empower yourself. It’s not just about knowing your score; it’s about taking charge of your financial health. Remember, recovery takes time, but with diligence and the right strategies, you can rebuild your credit and achieve your financial goals.

Building Positive Credit Habits: Tips for Long-Term Success

Rebuilding credit after a loan default is crucial for your financial future. When you face a personal loan default, it can feel overwhelming. However, with the right strategies, you can recover and build positive credit habits that last a lifetime. Let’s explore how to rebuild credit after a loan default and set yourself up for success.

Start with a Budget

Creating a budget is your first step. Track your income and expenses to see where your money goes. This helps you avoid overspending and ensures you can make timely payments on any new credit accounts.

Make Payments on Time

Timely payments are vital. Set reminders or automate payments to ensure you never miss a due date. This habit not only helps you recover from a personal loan default but also boosts your credit score over time.

Use Credit Responsibly

Consider using a secured credit card. This allows you to rebuild credit while managing your spending. Keep your balance low and pay it off each month to demonstrate responsible credit use.

How Can ‘ExpressCash’ Help You Rebuild Your Credit?

Rebuilding your credit after a loan default can feel overwhelming, but it’s essential for your financial future. Understanding how to rebuild credit after a loan default is the first step towards regaining control. At ‘ExpressCash’, we’re here to guide you through this journey with practical tips and support.

Personalized Guidance

We offer tailored advice based on your unique situation. Our experts can help you understand the impact of your personal loan default and recovery strategies that work best for you.

Actionable Steps to Improve Your Credit

- Check Your Credit Report: Start by reviewing your credit report for errors. Correcting mistakes can boost your score.

- Make Timely Payments: Consistently pay your bills on time to show lenders you’re responsible.

- Consider a Secured Credit Card: This can help rebuild your credit if used wisely.

Ongoing Support

At ‘ExpressCash’, we provide ongoing support and resources to help you stay on track. With our help, you can turn your financial situation around and build a brighter future.

Frequently Asked Questions About Rebuilding Credit After Default

What should I do first?

Begin by checking your credit report. Understanding your current situation is vital. Look for errors and dispute them if needed to get a clearer picture of your credit status.

How long does recovery take?

Recovery from a personal loan default can take several months to a few years. Patience and consistent effort are crucial during this journey.

Can I still get credit after a default?

Yes, you can still obtain credit post-default, but it may be more challenging. Lenders may view you as a higher risk. Be cautious and read terms carefully before accepting new loans.

What are some effective strategies?

To rebuild your credit, consider these strategies:

- Pay bills on time: This demonstrates responsibility.

- Use a secured credit card: This can help improve your credit with responsible use.

- Limit new credit applications: Too many inquiries can negatively impact your score.

- Keep old accounts open: A longer credit history is beneficial!

How can I track my progress?

Regularly monitor your credit score using free services. This allows you to see the results of your efforts and adjust your strategies as necessary.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.