The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

Financial Planning to Prevent Loan Default: Tips That Help

Financial planning is like having a map for your money. It helps you navigate through life’s financial challenges, especially when it comes to loans. Understanding the importance of financial planning to prevent loan default is crucial. When you plan well, you can avoid the stress of personal loan default and recovery later on.

Why Financial Planning Matters

When you take out a loan, you promise to pay it back. But life can throw unexpected expenses your way. That’s where financial planning comes in. It helps you set aside money for emergencies, ensuring you can meet your loan payments even when times get tough.

Tips for Effective Financial Planning

- Create a Budget: Track your income and expenses. This way, you know where your money goes.

- Build an Emergency Fund: Save at least three to six months’ worth of expenses. This fund acts as a safety net.

- Prioritize Loan Payments: Treat your loan payments like a bill that must be paid every month.

- Seek Professional Help: If you’re unsure, consider talking to a financial advisor. They can guide you in making smart choices.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

What Are the Key Steps in Effective Financial Planning?

Financial planning is like having a roadmap for your money. It helps you avoid pitfalls, especially when it comes to loans. By understanding Financial Planning to Prevent Loan Default, you can keep your finances on track and avoid the stress of personal loan default and recovery. Let’s explore the key steps to effective financial planning.

Assess Your Financial Situation

Start by taking a good look at your income, expenses, and debts. Knowing where you stand financially is crucial. Ask yourself:

- What are my monthly expenses?

- How much do I earn?

- What debts do I have?

This assessment will help you create a solid foundation for your financial plan.

Create a Budget

Next, create a budget that reflects your financial goals. A budget helps you allocate your money wisely. Consider these tips:

- Track your spending.

- Set limits for different categories.

- Save for emergencies.

By sticking to your budget, you can prevent overspending and ensure you have enough to cover your loan payments.

Build an Emergency Fund

Finally, set aside some money for unexpected expenses. An emergency fund can be a lifesaver if something goes wrong. Aim for at least three to six months’ worth of living expenses. This way, if you face a financial setback, you won’t risk defaulting on your loans.

How to Create a Realistic Budget That Supports Loan Repayment

Creating a realistic budget is essential for anyone looking to manage their finances effectively. When it comes to loan repayment, having a solid financial plan can prevent loan default and help you recover if you ever find yourself in a tough spot. Let’s explore how to craft a budget that supports your loan repayment goals.

Understand Your Income and Expenses

Start by listing all your sources of income. This includes your salary, side gigs, or any other earnings. Next, track your monthly expenses. Categorize them into fixed (like rent) and variable (like groceries). This will give you a clear picture of where your money goes each month.

Set Priorities

Once you know your income and expenses, prioritize your spending. Make sure to allocate funds for your loan repayments first. Consider using the 50/30/20 rule: 50% for needs, 30% for wants, and 20% for savings and debt repayment. This way, you can ensure you’re on track to avoid personal loan default.

Adjust as Needed

Finally, be flexible. If you notice you’re overspending in one area, adjust your budget accordingly. Regularly review your financial plan to ensure it aligns with your goals. Remember, effective financial planning to prevent loan default is about making informed choices and staying committed to your repayment journey.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

The Role of Emergency Funds in Preventing Loan Default

When it comes to managing loans, financial planning is crucial. One of the best strategies to prevent loan default is having an emergency fund. This fund acts as a safety net, ensuring you can cover unexpected expenses without falling behind on your payments. Let’s explore how emergency funds play a vital role in your financial planning to prevent loan default.

Why Emergency Funds Matter

Emergency funds are essential because they provide peace of mind. Imagine facing a sudden car repair or medical bill. Without savings, you might struggle to pay your loan, leading to personal loan default and recovery challenges. Having that cushion can keep you afloat during tough times.

Key Benefits of an Emergency Fund

- Reduces Stress: Knowing you have money set aside can ease anxiety about unexpected costs.

- Prevents Loan Default: With an emergency fund, you’re less likely to miss payments, protecting your credit score.

- Promotes Financial Stability: It encourages better budgeting and spending habits, making you more resilient financially.

In summary, building an emergency fund is a smart step in your financial planning to prevent loan default. It not only safeguards your loans but also empowers you to handle life’s surprises with confidence.

Also Read: Personal Loan Default and Recovery: What You Should Know

Are You Making These Common Financial Mistakes?

Financial planning is crucial for anyone looking to avoid the pitfalls of loan default. When you take out a personal loan, it’s easy to get overwhelmed by monthly payments and unexpected expenses. However, with the right strategies, you can safeguard your financial future and ensure you stay on track. Let’s explore some common financial mistakes that can lead to personal loan default and how to avoid them.

- Ignoring Your Budget: Without a clear budget, it’s easy to overspend. Track your income and expenses to see where your money goes each month. This helps you allocate funds for loan payments and avoid default.

- Underestimating Expenses: Life is full of surprises! Always plan for unexpected costs, like car repairs or medical bills. Having an emergency fund can help you stay afloat during tough times.

- Taking on Too Much Debt: It’s tempting to borrow more than you need, but this can lead to financial strain. Stick to what you can afford to repay comfortably.

Remember, financial planning to prevent loan default starts with responsible borrowing.

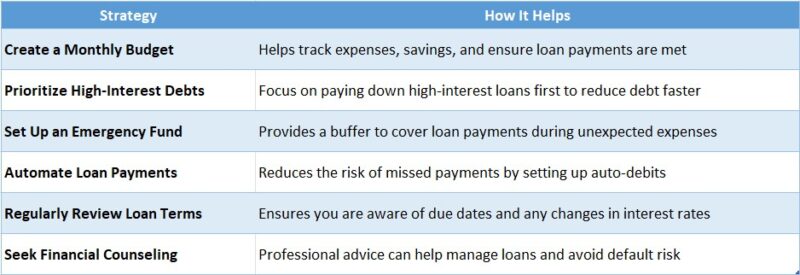

How Can Debt Management Strategies Help You Stay Afloat?

Financial planning is crucial for anyone looking to avoid the pitfalls of loan default. When you take out a personal loan, you commit to repaying it, but life can throw unexpected challenges your way. That’s why understanding how to manage your debt effectively can keep you afloat during tough times.

Create a Budget

Start by creating a budget that tracks your income and expenses. This helps you see where your money goes and identify areas to cut back. A clear budget is a powerful tool in your financial planning to prevent loan default.

Prioritize Your Debts

Not all debts are created equal. Focus on high-interest loans first, as they cost you more over time. By prioritizing, you can reduce your overall debt burden and improve your chances of recovery from any potential personal loan default.

Build an Emergency Fund

Having a safety net can be a lifesaver. Aim to save at least three to six months’ worth of expenses. This fund can help you manage unexpected costs without falling behind on your loan payments.

Exploring Resources: How ExpressCash Can Support Your Financial Journey

Financial planning is crucial for anyone looking to avoid the pitfalls of loan default. When you take out a personal loan, it’s easy to feel overwhelmed by the responsibilities that come with it. However, with the right strategies in place, you can navigate your financial journey successfully and prevent loan default. Let’s explore how ExpressCash can support you in this endeavor.

Understanding Your Financial Landscape

At ExpressCash, we believe that knowledge is power. Start by assessing your current financial situation. Knowing your income, expenses, and debts can help you create a solid financial plan to prevent loan default.

Tips for Effective Financial Planning

- Create a Budget: Track your spending to identify areas where you can save.

- Build an Emergency Fund: Aim for at least three to six months of living expenses.

- Communicate with Lenders: If you’re struggling, reach out to your lender early to discuss options.

By following these steps, you can significantly reduce the risk of personal loan default and set yourself on a path to recovery. Remember, planning today can lead to a more secure financial future tomorrow!

Long-Term Financial Health: Building a Strategy to Avoid Future Defaults

Financial planning is crucial for anyone who wants to avoid the stress of loan defaults. When you take out a loan, you’re making a promise to pay it back. However, life can throw unexpected challenges your way. That’s why having a solid financial plan can help you stay on track and prevent personal loan default.

Create a Budget

Start by creating a budget that tracks your income and expenses. This helps you see where your money goes and where you can cut back. Remember, every dollar saved can go towards your loan payments!

Build an Emergency Fund

An emergency fund acts like a safety net. Aim to save at least three to six months’ worth of expenses. This way, if something unexpected happens, like a job loss, you won’t have to worry about missing loan payments.

Stay Informed

Keep yourself educated about your loans. Understand the terms and conditions, and know what to do if you’re struggling. This knowledge can empower you to make better financial decisions and avoid personal loan default and recovery situations.

FAQs

-

How can financial planning help me avoid loan default?

Good financial planning helps you budget your income, prioritize essential expenses, and ensure you have enough to make loan payments on time, reducing the risk of default. -

What should I include in my budget to stay on top of loan payments?

Include all fixed costs (like rent, loans, utilities), variable expenses (like groceries, fuel), and set aside a portion for emergency savings and debt payments. -

Should I consolidate debt to make loan payments more manageable?

Yes, debt consolidation can combine multiple loans into one with a lower monthly payment or interest rate, helping you stay organized and avoid missed payments. -

How much emergency savings should I have to prevent default?

Aim to save at least 3 to 6 months’ worth of essential expenses, which can cover loan payments during unexpected income loss or emergencies. -

Can financial counseling help me prevent a loan default?

Absolutely. A certified financial counselor can help you create a realistic repayment plan, improve money management, and negotiate with lenders if needed.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.