The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

Debt Settlement for Personal Loans: Is It a Good Idea?

Debt can feel like a heavy weight on your shoulders, especially when it comes to personal loans. If you’re struggling to keep up with payments, you might wonder: is debt settlement for personal loans a good idea? Understanding this option can help you regain control of your finances and find a path to recovery.

Debt settlement for personal loans involves negotiating with your lender to pay less than what you owe. This can be a viable option if you’re facing personal loan default. However, it’s essential to weigh the pros and cons before making a decision. Here are some key points to consider:

Benefits of Debt Settlement:

- Reduced Payments: You might pay less than your total debt, easing your financial burden.

- Avoiding Bankruptcy: It can be a way to avoid the long-term consequences of bankruptcy.

- Faster Recovery: Settling your debt can lead to quicker recovery and a fresh start. While debt settlement can be beneficial, it’s not without risks.

It can impact your credit score negatively and may lead to tax implications. Therefore, it’s crucial to consult with a financial advisor to explore all your options before proceeding. Remember, understanding your choices is the first step toward financial freedom.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

Is Debt Settlement for Personal Loans Right for You?

When you’re struggling with personal loans, the idea of debt settlement can seem appealing. But is it really a good idea? Understanding the ins and outs of debt settlement for personal loans is crucial. It can help you decide if this path is right for you, especially if you’re facing personal loan default and recovery challenges.

Debt settlement for personal loans involves negotiating with your lender to pay less than what you owe. Here are some key points to consider:

- Potential Savings: You might pay less than your total debt, which can provide immediate relief.

- Credit Impact: While it can help you avoid default, it may hurt your credit score in the short term.

- Negotiation Skills: Success often depends on your ability to negotiate effectively with lenders. Before deciding, think about your financial situation. Ask yourself:

- Can I afford to settle my debt now?

- Will this affect my credit score significantly?

- Am I prepared for the negotiation process?

If you answer yes to these questions, debt settlement might be a viable option. However, always weigh the pros and cons carefully before taking the plunge.

The Pros and Cons of Debt Settlement for Personal Loans

Debt settlement for personal loans can feel like a lifeline when you’re drowning in debt. But is it really a good idea? Understanding the pros and cons can help you make an informed decision. Let’s dive into what debt settlement means and how it affects personal loan default and recovery.

The Pros of Debt Settlement for Personal Loans

- Lower Payments: Debt settlement can reduce the total amount you owe, making it easier to pay off your loans.

- Avoiding Bankruptcy: It can be a way to avoid the long-term consequences of bankruptcy, which can impact your credit for years.

- Negotiation Power: You might be able to negotiate a payment plan that fits your budget better than your current loan terms.

The Cons of Debt Settlement for Personal Loans

- Credit Score Impact: Settling a debt can hurt your credit score, especially if you are already in default.

- Fees and Costs: Some companies charge fees for their services, which can add to your financial burden.

- Tax Implications: The IRS may consider forgiven debt as taxable income, leading to unexpected tax bills later.

In conclusion, while debt settlement for personal loans can offer relief, it’s essential to weigh these pros and cons carefully. Consider your financial situation and consult with a professional to find the best path forward.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

How Debt Settlement Affects Your Credit Score

When considering Debt Settlement for Personal Loans, it’s crucial to understand how it can impact your credit score. Many people wonder if settling their debts is a good idea, especially when facing financial difficulties. Knowing the effects on your credit can help you make an informed decision.

Debt settlement can lead to a significant drop in your credit score. Here’s why:

- Default Status: When you settle a debt, it often gets marked as ‘settled’ or ‘paid for less than owed.’ This can signal to lenders that you were unable to meet your obligations, which is similar to a Personal Loan Default.

- Long-Term Impact: A lower credit score can affect your ability to borrow in the future. It may take years to recover fully, depending on your overall credit history and how you manage your finances afterward. However, there are some benefits to consider:

- Reduced Debt: Settling can lower the total amount you owe, making it easier to manage your finances.

- Fresh Start: Once settled, you can focus on rebuilding your credit and improving your financial situation.

Also Read: Personal Loan Default and Recovery: What You Should Know

Steps to Successfully Navigate Debt Settlement for Personal Loans

Debt can feel like a heavy weight on your shoulders, especially when it comes to personal loans. If you’re struggling to keep up with payments, you might wonder, “Is debt settlement for personal loans a good idea?” Understanding the steps to navigate this process can help you regain control of your finances and find a path to recovery.

Understand Your Situation

Before diving into debt settlement, assess your financial situation. Are you facing personal loan default? Knowing your total debt and monthly expenses is crucial. This clarity will guide your decisions and help you communicate effectively with creditors.

Research Your Options

Not all debt settlement options are created equal. Look into various companies that specialize in debt settlement for personal loans. Read reviews and check their success rates. This research can save you time and money, ensuring you choose a reputable partner for your recovery journey.

Negotiate Wisely

Once you’ve selected a debt settlement company, it’s time to negotiate. Be honest about your financial struggles. Many lenders are willing to settle for less than the full amount owed. Remember, the goal is to reach a mutually beneficial agreement that allows you to pay off your debt and move forward.

Alternatives to Debt Settlement: What Are Your Options?

When facing financial struggles, many people wonder about their options. Debt Settlement for Personal Loans may seem like a quick fix, but is it the best choice? Understanding your alternatives is crucial for making informed decisions that lead to a brighter financial future.

1. Debt Management Plans

A debt management plan (DMP) involves working with a credit counseling agency to consolidate your debts. You make one monthly payment, and the agency pays your creditors, helping you avoid Personal Loan Default and Recovery issues.

2. Negotiating with Lenders

You can also negotiate directly with your lenders for lower interest rates or extended payment terms. This approach can help you manage payments without the negative impacts of debt settlement.

3. Bankruptcy

If your situation is dire, bankruptcy might be an option. While it has long-term consequences, it can provide a fresh start. Consult a financial advisor to understand the implications fully.

4. Personal Loans from Family or Friends

Turning to family or friends for a personal loan can be viable. They may offer better terms than traditional lenders, helping you avoid debt settlement altogether. Clear communication is key to avoiding misunderstandings.

5. Side Jobs or Freelancing

Consider side jobs or freelancing to increase your income. This extra money can help pay off loans faster, reducing the need for debt settlement while building new skills.

6. Financial Education

Investing time in financial education empowers you to make better choices, preventing future financial issues and avoiding personal loan defaults.

How ExpressCash Can Help You with Debt Settlement for Personal Loans

Debt can feel like a heavy weight on your shoulders, especially when it comes to personal loans. Many people wonder, “Is debt settlement for personal loans a good idea?” Understanding your options is crucial, and that’s where we come in. At ExpressCash, we’re here to guide you through the maze of debt settlement and help you make informed decisions.

When you’re facing personal loan default, it’s easy to feel overwhelmed. But don’t worry! Here’s how we can assist you:

Expert Guidance

- Personalized Advice: Our team offers tailored strategies based on your unique financial situation.

- Negotiation Skills: We have experience negotiating with lenders to potentially lower your total debt.

Resources and Tools

- Debt Management Plans: We provide tools to help you create a budget and manage your payments effectively.

- Educational Materials: Learn about the debt settlement process and what to expect, so you’re never in the dark.

Choosing debt settlement for personal loans can be a smart move if done correctly. It can help you recover from financial setbacks and regain control over your finances. With ExpressCash by your side, you’ll have the support you need to navigate personal loan recovery successfully. Remember, you’re not alone in this journey!

FAQs

-

What is debt settlement for a personal loan?

Debt settlement is when you negotiate with your lender to pay a lump sum that’s less than the total amount owed, in exchange for resolving the debt. -

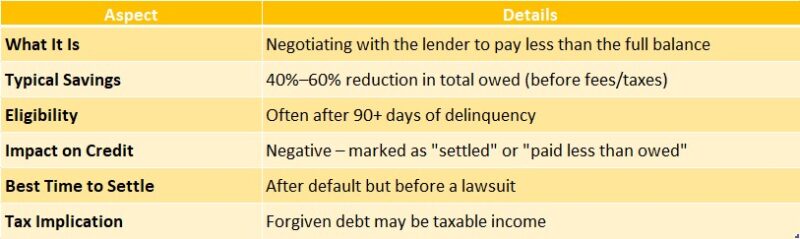

How much can I save through debt settlement?

Depending on your financial situation and negotiation, you may settle the debt for 40%–60% of the original balance. However, results vary and are not guaranteed. -

Does debt settlement hurt my credit score?

Yes, settling a loan for less than owed typically has a negative impact on your credit, though it’s usually less damaging than a default or bankruptcy. -

Can I negotiate debt settlement on my own?

Yes, you can contact your lender directly and request a settlement offer. Alternatively, you can hire a debt settlement company to negotiate on your behalf (usually for a fee). -

Is debt settlement a good option for me?

Debt settlement may be a good option if you’re struggling to make payments, have multiple debts, and want to avoid bankruptcy, but it’s important to weigh the credit and legal risks.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.