The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

How to Calculate Loan Tenure for EMI Accurately

Understanding how to calculate loan tenure for EMI accurately is crucial for anyone considering a personal loan. It helps you plan your finances better and avoid surprises down the road. A clear understanding of your loan tenure can lead to more manageable monthly payments and less stress overall.

When you take out a personal loan, the loan tenure is the period over which you agree to repay the loan. Knowing how to calculate loan tenure for EMI can help you choose the right loan amount and repayment plan. Here’s how you can do it:

Steps to Calculate Loan Tenure

- Determine Your Loan Amount: Know how much you want to borrow.

- Interest Rate: Check the interest rate offered by your lender.

- Monthly EMI: Decide how much you can afford to pay each month.

- Use a Personal Loan EMI Calculator: This tool can help you find the exact tenure based on your inputs.

By following these steps, you can easily figure out the loan tenure that suits your financial situation. Remember, a shorter tenure means higher EMIs but less interest paid overall!

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

How to Calculate Loan Tenure for EMI: A Step-by-Step Guide

Calculating loan tenure for EMI accurately is essential for anyone borrowing money. It helps in effective financial planning and avoids unexpected surprises. Knowing your loan tenure also aids in selecting the right personal loan EMI calculator for the best deal.

Step 1: Gather Your Information

Start by collecting key details: loan amount, interest rate, and desired EMI. This information is vital for accurate calculations.

Step 2: Use the Formula

The formula to calculate EMI is:

EMI = [P * r * (1 + r)^n] / [(1 + r)^n – 1]

Where:

- P = Principal loan amount

- r = Monthly interest rate (annual rate/12)

- n = Number of monthly installments (loan tenure)

Step 3: Rearranging the Formula

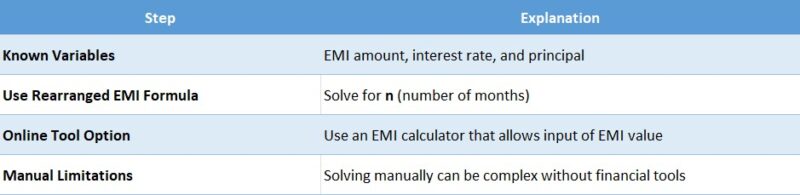

To find the tenure (n), rearranging the formula is necessary. This can be complex, but a personal loan EMI calculator can simplify it. Just input your details, and it will do the calculations for you!

Step 4: Review Your Results

After determining your tenure, assess if it’s manageable. If it isn’t, consider adjusting your loan amount or EMI to find a suitable balance. Understanding how to calculate loan tenure for EMI leads to better financial decisions!

Why Accurate Loan Tenure Calculation Matters

Calculating your loan tenure accurately is crucial when it comes to managing your finances. If you know how to calculate loan tenure for EMI accurately, you can avoid surprises and make informed decisions. This knowledge helps you understand how much you’ll pay each month and how long you’ll be in debt.

Understanding Your Financial Commitment

When you take a personal loan, knowing the exact tenure helps you plan your budget. A longer tenure means lower EMIs but more interest paid overall. Conversely, a shorter tenure means higher EMIs but less interest. It’s all about finding the right balance!

Benefits of Using a Personal Loan EMI Calculator

- Quick Calculations: A personal loan EMI calculator allows you to see how different tenures affect your monthly payments.

- Better Planning: You can adjust the tenure to fit your budget, ensuring you don’t stretch your finances too thin.

- Informed Decisions: With accurate calculations, you can choose the best loan option for your needs, avoiding any financial pitfalls.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

Common Mistakes in Calculating Loan Tenure for EMI

Calculating loan tenure for your EMI is crucial because it directly affects your monthly payments and overall loan cost. Many borrowers make mistakes that can lead to confusion and financial strain. Understanding how to calculate loan tenure for EMI accurately can save you from these pitfalls and help you manage your finances better.

Ignoring the Interest Rate

One common mistake is not factoring in the interest rate. A higher interest rate can significantly increase your EMI. Always use a Personal Loan EMI Calculator to see how different rates affect your tenure and payments.

Misunderstanding the Loan Amount

Another mistake is miscalculating the loan amount. If you underestimate how much you need, you might end up with a longer tenure than necessary. Make sure to assess your financial needs accurately before applying for a loan.

Not Using Available Tools

Lastly, many people forget to use tools like the Personal Loan EMI Calculator. This handy tool can simplify your calculations and provide clarity on how different tenures impact your EMI. Don’t skip this step!

Also Read: Personal Loan EMI Calculator: Find Your Monthly Installments

What Factors Influence Your Loan Tenure?

Understanding how to calculate loan tenure for EMI accurately is crucial for anyone looking to borrow money. It helps you plan your finances better and ensures you don’t end up with overwhelming monthly payments. So, what factors influence your loan tenure? Let’s dive in!

Interest Rate

The interest rate on your loan significantly affects your tenure. A higher rate means higher EMIs, which might push you to choose a longer tenure to keep payments manageable. Conversely, a lower rate can allow you to opt for a shorter tenure, saving you money in the long run.

Loan Amount

The total amount you borrow also plays a role. If you take out a larger personal loan, you might need a longer tenure to keep your EMIs affordable. On the other hand, a smaller loan can often be repaid faster, allowing for a shorter tenure.

Personal Loan EMI Calculator

Using a personal loan EMI calculator can help you visualize how different factors affect your tenure. By adjusting the loan amount, interest rate, and tenure, you can find the perfect balance that suits your financial situation.

Using Online Calculators: Are They Reliable?

Calculating the loan tenure for your EMI is crucial because it helps you understand how long you’ll be paying off your loan and how much interest you’ll end up paying. Knowing how to calculate loan tenure for EMI accurately can save you money and help you plan your finances better. But with so many tools available, how do you know which ones are reliable?

When it comes to calculating your EMI, online calculators can be a lifesaver. They are quick and easy to use, allowing you to input your loan amount, interest rate, and tenure to get instant results. However, it’s essential to ensure that you’re using a trustworthy Personal Loan EMI Calculator. Here are some tips:

- Check the Source: Use calculators from reputable banks or financial websites.

- Understand the Inputs: Make sure you know what each input means to avoid errors.

- Cross-Verify: It’s a good idea to double-check the results with a manual calculation or another calculator.

By following these steps, you can confidently use online calculators to determine your loan tenure and make informed financial decisions.

How to Adjust Your Loan Tenure for Better EMI Management

Calculating loan tenure for EMI accurately is essential for effective financial management. A well-structured loan tenure helps you maintain your monthly budget while minimizing interest payments. Let’s explore how to adjust your loan tenure for better EMI management.

Know Your Options

When applying for a personal loan, you can choose your loan tenure, which can range from a few months to several years. A longer tenure results in lower EMIs but higher overall interest, while a shorter tenure leads to higher EMIs but less interest paid.

Use a Personal Loan EMI Calculator

Using a personal loan EMI calculator can help you find the right balance. By entering the loan amount, interest rate, and tenure, you can see how your EMI changes. This tool allows you to visualize your options and make informed choices.

Adjusting your loan tenure can greatly affect your financial health. By accurately calculating your EMI, you can select a tenure that suits your lifestyle. Remember, it’s not just about the monthly payment; it’s about how it fits into your overall budget. Explore your options wisely!

Real-Life Examples of Loan Tenure Calculations

Understanding how to calculate loan tenure for EMI accurately is crucial for anyone considering a personal loan. It helps you plan your finances better and avoid surprises when the monthly payments start rolling in. Let’s explore some real-life examples to make this concept clearer!

Example 1: Short-Term Loan

Imagine you take a personal loan of $10,000 at an interest rate of 10% for 2 years. Using a personal loan EMI calculator, you find that your monthly EMI would be around $500. This means you’ll pay off the loan in just 24 months, making it easier to budget your expenses!

Example 2: Long-Term Loan

Now, consider a different scenario. You borrow $20,000 at the same interest rate but for 5 years. The personal loan EMI calculator shows your monthly payment is about $425. While the tenure is longer, your monthly payments are lower, giving you more flexibility in your budget.

In both examples, knowing how to calculate loan tenure for EMI helps you choose the best option for your financial situation.

How ExpressCash Can Help You Calculate Your Loan Tenure Accurately

Calculating your loan tenure accurately is crucial for managing your finances effectively. It helps you understand how long you’ll be paying your loan and what your monthly payments will look like. Knowing how to calculate loan tenure for EMI can save you from unexpected surprises down the road.

At ExpressCash, we offer a user-friendly Personal Loan EMI Calculator that simplifies the process. With just a few clicks, you can input your loan amount, interest rate, and desired tenure. Our calculator will instantly show you the EMI amount, helping you make informed decisions.

Benefits of Using Our Calculator

- Quick and Easy: No complicated formulas needed! Just enter your details.

- Accurate Results: Get precise calculations to plan your budget better.

- Flexible Options: Experiment with different loan amounts and tenures to see what works best for you.

Using our tools, you can confidently choose a loan tenure that fits your financial goals.

FAQs

-

What is loan tenure in EMI calculations?

Loan tenure refers to the total repayment period, usually in months, over which you pay your EMIs. -

How can I calculate the tenure if I know my EMI, interest rate, and loan amount?

You can use a reverse EMI calculator or solve the EMI formula for N (number of months), which involves logarithmic functions. -

What’s the formula to calculate loan tenure from EMI?

Tenure (N) can be calculated using:

N=log(EMIEMI−P×R)log(1+R)N = \frac{\log(\frac{EMI}{EMI – P × R})}{\log(1 + R)}

where P = loan amount and R = monthly interest rate. -

Does increasing tenure reduce my EMI?

Yes, longer tenure lowers the monthly EMI but increases the total interest paid over the loan’s life. -

Is there a tool to calculate loan tenure easily?

Yes, you can use loan tenure calculators online—just enter your loan amount, EMI, and interest rate to get the duration.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.