The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

Personal Loan Repayment Schedule Generator: Track Your EMIs

When you take out a personal loan, understanding how to manage your repayments is crucial. This is where a Personal Loan Repayment Schedule Generator comes into play. It helps you track your EMIs (Equated Monthly Installments) effectively, ensuring you never miss a payment. This tool can make your financial journey smoother and less stressful.

Why Use a Personal Loan Repayment Schedule?

A repayment schedule is like a roadmap for your loan. It shows you:

- How much you owe each month

- When your payments are due

- The total interest you’ll pay over time

By using a Personal Loan EMI Calculator, you can easily estimate your monthly payments and plan your budget accordingly. This way, you can avoid surprises and stay on top of your finances.

Benefits of Tracking Your EMIs

Keeping track of your EMIs has several advantages:

- Stay Organized: Knowing your payment dates helps you avoid late fees.

- Financial Awareness: You’ll understand how much you’re paying in interest.

- Better Planning: You can adjust your spending habits based on your repayment schedule.

Using a repayment schedule generator not only simplifies your loan management but also empowers you to take control of your financial future.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

How Does a Personal Loan Repayment Schedule Generator Work?

Managing a personal loan can feel overwhelming, especially when it comes to keeping track of your monthly payments. That’s where a Personal Loan Repayment Schedule Generator comes in handy! This tool helps you visualize your repayment plan, making it easier to stay on top of your EMIs (Equated Monthly Installments).

Using a Personal Loan EMI Calculator is simple and straightforward. Here’s how it works:

- Input Your Loan Details: Start by entering the loan amount, interest rate, and tenure. This information is crucial for generating an accurate schedule.

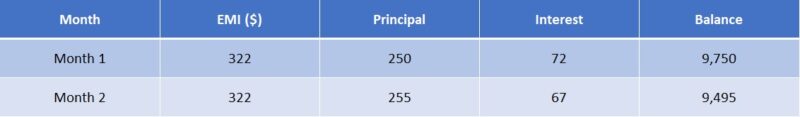

- Generate Your Schedule: Once you input the details, the generator calculates your monthly payments and creates a repayment schedule. You’ll see how much you owe each month and how much interest you’ll pay over time.

- Track Your Payments: With your schedule in hand, you can easily track your EMIs. This helps you plan your budget and ensures you never miss a payment, keeping your credit score healthy!

In summary, a Personal Loan Repayment Schedule Generator is a valuable tool that simplifies loan management. By using it, you can stay organized and make informed financial decisions, ensuring a smooth repayment journey.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

Key Features to Look for in a Personal Loan Repayment Schedule Generator

Managing your finances can feel like a daunting task, especially when it comes to repaying personal loans. That’s where a Personal Loan Repayment Schedule Generator comes in handy. This tool helps you track your EMIs (Equated Monthly Installments) effortlessly, ensuring you stay on top of your payments and avoid any late fees.

When choosing a Personal Loan Repayment Schedule Generator, there are several key features to consider. These features can make your experience smoother and more efficient. Here are some essential aspects to look for:

User-Friendly Interface

- A simple, intuitive design helps you navigate the tool easily.

- Clear instructions ensure you can input your loan details without confusion.

Accurate Calculations

- The generator should provide precise calculations for your EMIs.

- Look for a Personal Loan EMI Calculator that factors in interest rates and loan tenure accurately.

Customization Options

- The ability to adjust loan amounts and terms allows for personalized repayment plans.

- Some generators even let you simulate different scenarios to see how changes affect your payments.

Progress Tracking

- A good generator will help you track your repayment progress over time.

- Visual aids, like graphs, can make it easier to see how much you’ve paid and what’s left.

Also Read: Personal Loan EMI Calculator: Find Your Monthly Installments

Why You Should Track Your EMIs Regularly

Tracking your EMIs is essential for managing a personal loan effectively. A Personal Loan Repayment Schedule Generator helps you stay organized and ensures you never miss a payment. This tool allows you to visualize your repayment plan, making it easier to manage your finances.

Regularly monitoring your EMIs is vital for understanding your financial health. Here’s why it matters:

- Stay on top of payments: Knowing due dates helps avoid late fees.

- Budgeting made easy: A clear repayment schedule aids in effective monthly budgeting.

- Avoid surprises: Tracking EMIs allows you to anticipate changes in your finances and adjust spending accordingly.

Using a Personal Loan EMI Calculator alongside your repayment schedule offers additional insights, showing how different interest rates or loan amounts impact your monthly payments. This knowledge empowers you to make informed financial decisions.

Benefits of Using a Personal Loan Repayment Schedule Generator

- Visualize your payments: See your repayment journey clearly.

- Track progress: Celebrate milestones as you pay off your loan.

- Plan for the future: Adjust your budget based on your repayment timeline.

Tips for Effective EMI Tracking

- Set reminders: Use your phone or calendar for due dates.

- Review regularly: Check your repayment schedule monthly.

- Adjust as needed: Revisit your EMI plan if your financial situation changes.

Conclusion

Using a Personal Loan Repayment Schedule Generator is crucial for financial peace of mind. Staying organized and informed helps you navigate your loan repayment journey confidently.

Tips for Managing Your Personal Loan Repayment Effectively

Managing a personal loan can be daunting, especially when tracking monthly payments. A Personal Loan Repayment Schedule Generator is a valuable tool that helps you visualize your repayment plan, making it easier to stay on top of your EMIs and avoid late fees.

Understand Your Loan Terms

Before repayment, it’s essential to understand your loan terms, including your interest rate, loan tenure, and total borrowed amount. This knowledge allows you to use a Personal Loan EMI Calculator effectively, helping you estimate monthly payments and plan your budget accordingly.

Set Up Reminders

To avoid missing payments, set reminders on your phone or calendar. This simple step can save you from late fees and stress. A Personal Loan Repayment Schedule Generator can also help you visualize payment due dates, keeping you organized.

Create a Budget

Creating a budget is crucial for managing repayments. List your monthly expenses and identify areas to cut back, allowing you to allocate more funds towards your EMIs. A well-planned budget ensures you stay on track with payments.

Make Extra Payments When Possible

If you have extra cash, consider making additional payments towards your loan. This can reduce your principal and lower total interest paid over time. A Personal Loan Repayment Schedule Generator can illustrate how extra payments impact your loan duration.

Stay Informed About Your Loan

Maintain communication with your lender to stay updated on any changes to your loan terms. If you encounter difficulties, inquire about options like loan restructuring. Being proactive can help you manage repayments effectively and avoid financial issues.

How ExpressCash Can Simplify Your Loan Repayment Process

Managing a personal loan can be daunting, especially when tracking monthly payments. A Personal Loan Repayment Schedule Generator simplifies this process, allowing you to visualize your repayment plan and stay on top of your EMIs without surprises.

Easy Tracking of Your EMIs

Our Personal Loan Repayment Schedule Generator makes it easy to track your EMIs. Simply enter your loan amount, interest rate, and tenure, and the generator will create a clear repayment schedule, ensuring you know when your next payment is due!

Benefits of Using Our Tools

- Visual Clarity: View your repayment timeline at a glance.

- Budgeting Made Simple: Plan your finances with clear payment dates.

- Avoid Late Fees: Stay informed and never miss a payment.

Our Personal Loan EMI Calculator complements the generator, helping you estimate monthly payments before taking out a loan. This allows for informed decisions when choosing a loan that fits your budget.

User-Friendly Interface

Designed with you in mind, our website features an easy-to-use Personal Loan Repayment Schedule Generator, perfect for everyone, even those who aren’t tech-savvy. Just a few clicks, and you’re on your way to mastering your loan repayments!

Real-Time Updates

As your financial situation changes, so can your repayment plan. Adjust your inputs and see how it affects your EMIs instantly, helping you stay proactive about your finances.

Peace of Mind

Knowing when and how much to pay each month reduces stress, allowing you to focus on other important aspects of your life, confident that your loan is under control.

Frequently Asked Questions About Personal Loan Repayment Schedules

What is a Personal Loan Repayment Schedule Generator?

This tool outlines your loan repayment plan, detailing how much you need to pay each month, including both interest and principal. It aids in budgeting and helps avoid surprises!

How does a Personal Loan EMI Calculator help?

A Personal Loan EMI Calculator is a useful tool that estimates your monthly payments based on the loan amount, interest rate, and tenure. Knowing your EMIs in advance allows you to make informed financial decisions and choose a suitable loan.

Why is tracking your EMIs important?

Tracking your EMIs is essential for effective financial management. Missing payments can lead to penalties and damage your credit score. A repayment schedule generator keeps you organized and ensures timely payments, safeguarding your financial health.

Can I customize my repayment schedule?

Yes! Many generators allow customization of your repayment plan. You can adjust the loan amount, interest rate, and tenure to see how these changes impact your monthly payments, helping you find the best plan for your needs.

What if I want to pay off my loan early?

If you wish to pay off your loan early, check your lender’s policies, as some may impose prepayment penalties. A repayment schedule generator can help you calculate potential interest savings from early repayment.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.