The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

Loan Recovery Process Explained: How Lenders Take Action

Understanding the Loan Recovery Process Explained is crucial for anyone who has taken out a loan. When borrowers default on personal loans, lenders must take action to recover their money. This process can seem daunting, but knowing what to expect can ease your worries.

The Steps in the Loan Recovery Process

Initial Contact

When a borrower misses a payment, the lender usually reaches out first. They may call or send a letter to remind you about the missed payment. This is often a friendly nudge to help you get back on track.

Payment Plans

If you’re struggling, lenders might offer a payment plan. This can help you manage your debt without overwhelming you. It’s important to communicate with your lender during this time. They want to work with you, not against you!

Legal Action

If payments continue to be missed, lenders may escalate the situation. This could involve legal action, which is the last resort. It’s essential to understand that this step is taken only after all other options have been exhausted. Knowing the Loan Recovery Process Explained can help you avoid this stress.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

What Triggers the Loan Recovery Process?

Understanding the Loan Recovery Process Explained is crucial for anyone who has taken out a loan. When borrowers default on their personal loans, lenders must take action to recover their funds. This process can be daunting, but knowing what triggers it can help you navigate the situation better.

Several factors can trigger the loan recovery process. Here are some key reasons:

- Missed Payments: If you miss one or more payments, lenders may start the recovery process. They typically reach out to remind you of your obligations.

- Default Status: After a certain period of missed payments, your loan may be classified as in default. This is a serious status that prompts lenders to take action.

- Communication Breakdown: If you stop communicating with your lender, they may assume you’re unable to pay, leading to recovery efforts.

- Legal Action: In extreme cases, lenders may resort to legal action to recover the owed amount. This can include garnishing wages or seizing assets.

Understanding these triggers can help you avoid falling into the loan recovery process. Always communicate with your lender if you’re facing difficulties.

The Initial Steps Lenders Take in Loan Recovery

When a borrower misses payments, the Loan Recovery Process Explained becomes crucial for lenders. Understanding how lenders take action can help borrowers navigate the situation better. It’s not just about money; it’s about relationships and trust.

1. Communication

The first step is often a friendly reminder. Lenders usually reach out to borrowers through calls or emails. They want to understand the reason behind the missed payment. This initial contact can help clear up misunderstandings.

2. Payment Plans

If the borrower is struggling, lenders may offer flexible payment plans. This shows that they care about helping the borrower rather than just collecting money. It’s a win-win situation, as it can prevent further issues down the line.

3. Formal Notices

If payments continue to be missed, lenders will send formal notices. These documents outline the amount owed and the consequences of not paying. It’s a serious step, but it’s part of the Personal Loan Default and Recovery process. Borrowers should take these notices seriously to avoid further action.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

How Do Lenders Communicate with Borrowers During Recovery?

Understanding the Loan Recovery Process Explained is crucial for both lenders and borrowers. When a borrower defaults on a personal loan, it can lead to a series of actions by the lender. Knowing how lenders communicate during recovery can help borrowers navigate this challenging time with more clarity and less stress.

Lenders typically start by reaching out through friendly reminders. They may send emails or make phone calls to discuss missed payments. This initial contact is often more about understanding the borrower’s situation than demanding immediate payment.

Key Communication Steps:

- Friendly Reminders: Lenders often send notices to remind borrowers of missed payments. This can be a gentle nudge to help them get back on track.

- Payment Plans: If a borrower is struggling, lenders may offer flexible payment plans. This shows that they are willing to work with the borrower rather than just focusing on recovery.

- Formal Notices: If payments continue to be missed, lenders will send formal notices. These documents outline the consequences of default and the next steps in the recovery process.

Also Read: Personal Loan Default and Recovery: What You Should Know

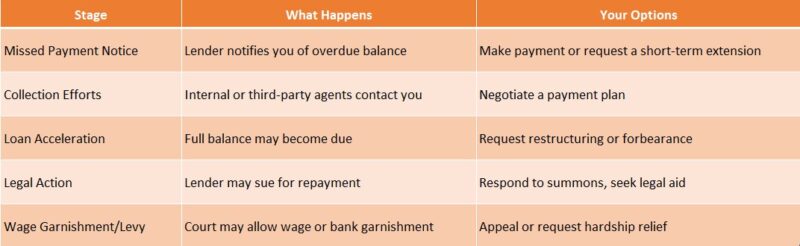

Legal Actions in the Loan Recovery Process: What to Expect

Understanding the Loan Recovery Process Explained is crucial for anyone who has taken out a loan. When borrowers default on personal loans, lenders must take action to recover their money. Knowing what to expect can help ease anxiety and prepare you for the next steps.

Initial Communication

When a borrower misses payments, lenders typically start with friendly reminders. They may call or send letters to discuss the situation. This is often the first step in the loan recovery process, aiming to resolve issues without escalating matters.

Escalation to Legal Action

If payments continue to be missed, lenders may escalate the situation. They might send a formal demand letter, which is a serious warning. If the borrower still doesn’t respond, legal actions can follow, including:

- Filing a lawsuit: This is when lenders take borrowers to court.

- Judgment: If the court rules in favor of the lender, they can collect the debt through wage garnishment or bank levies.

Understanding these steps in the personal loan default and recovery process can help borrowers navigate their options and responsibilities.

The Role of Credit Reporting in Loan Recovery

Understanding the Loan Recovery Process Explained is crucial for both lenders and borrowers. When a borrower defaults on a personal loan, it can lead to serious consequences. Lenders must take action to recover their funds, and credit reporting plays a significant role in this process.

How Credit Reporting Works

Credit reporting involves tracking a borrower’s credit history. When a personal loan default occurs, lenders report this to credit bureaus. This negative mark can affect the borrower’s credit score, making it harder to secure future loans.

Consequences of Default

- Lower Credit Score: A default can drop your score significantly.

- Difficulty in Future Loans: Lenders may hesitate to lend to someone with a poor credit history.

- Increased Interest Rates: If you do get approved, expect higher rates due to perceived risk.

In summary, the Loan Recovery Process Explained highlights how credit reporting is a powerful tool for lenders. It not only helps them recover funds but also serves as a warning to borrowers about the importance of timely payments. Understanding this can help borrowers avoid the pitfalls of personal loan default and recovery.

How Can ExpressCash.com Assist You in Navigating Loan Recovery?

Understanding the Loan Recovery Process Explained is crucial for anyone who has taken out a personal loan. When borrowers default, lenders must take action to recover their funds. This process can be daunting, but knowing how it works can empower you to navigate it more effectively. That’s where ExpressCash.com comes in!

Expert Guidance

At ExpressCash.com, we provide expert insights into the loan recovery process. Our resources help you understand what happens when a personal loan default occurs and what steps lenders typically take to recover their money. This knowledge can help you prepare and respond appropriately.

Personalized Support

We offer personalized support tailored to your situation. Whether you’re facing potential default or already in recovery, our team can guide you through your options. We aim to make the process less intimidating and more manageable, ensuring you feel supported every step of the way.

Key Insights

- Know Your Rights: Understanding your rights during the recovery process is essential.

- Explore Options: We help you explore various options to avoid default.

- Stay Informed: Our articles keep you updated on the latest trends in loan recovery.

With ExpressCash.com, you’re not alone in navigating the complexities of loan recovery.

Tips for Borrowers: Navigating the Loan Recovery Process Successfully

Understanding the Loan Recovery Process Explained is essential for borrowers. When taking out a personal loan, the obligation to repay is serious. If repayment becomes difficult, knowing how lenders act can help borrowers navigate these challenges and avoid further complications.

Stay Informed

Maintain open communication with your lender. If you foresee trouble making payments, reach out. Lenders value honesty and may provide solutions to prevent personal loan default and recovery actions.

Explore Options

Before situations worsen, consider alternatives like:

- Loan restructuring: Changing payment terms.

- Payment plans: Smaller, manageable payments.

- Debt counseling: Professional guidance can help you through tough times.

Know Your Rights

Understand your rights as a borrower. Lenders must adhere to specific rules during the loan recovery process. Knowing these rights can empower you to negotiate better terms and protect against unfair practices.

Keep Records

Document all communications with your lender, including emails and calls. A clear record can be invaluable if disputes arise during the loan recovery process.

Seek Help Early

Don’t hesitate to reach out for help. A financial advisor can offer insights and strategies to manage your debt effectively. Stay positive and proactive; understanding the loan recovery process can help you regain control over your financial future.

FAQs

📩 What happens when I miss a loan payment?

When you miss a loan payment, your lender will usually contact you first to remind you and offer solutions like payment extensions or loan restructuring.

📜 What is a loan recovery notice?

A loan recovery notice is a formal letter from your lender asking you to repay the pending dues within a set period. It often comes before legal or recovery action.

🧾 Can banks take legal action for unpaid loans?

Yes. If repayment isn’t made after reminders and notices, banks may approach the Debt Recovery Tribunal (DRT) or use laws like the SARFAESI Act to seize assets (in case of secured loans).

🔊 Do I have any rights during the recovery process?

Absolutely. As a borrower, you have the right to be treated fairly and respectfully. Recovery agents must follow RBI guidelines and cannot use threats or harassment.

📞 What should I do if I’m struggling to repay my loan?

Contact your lender immediately. Many lenders are willing to work out solutions like EMI rescheduling, temporary relief, or a settlement plan to avoid legal recovery steps.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.