The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

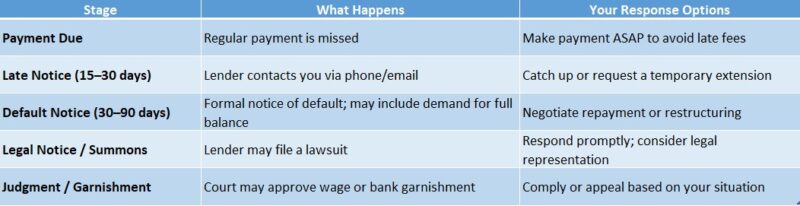

Default Notices and Legal Actions: What Borrowers Should Know

Understanding Default Notices is crucial for borrowers. When you take out a personal loan, you agree to repay it on time. But what happens if you miss a payment? This is where Default Notices and Legal Actions come into play, and knowing what they mean can help you avoid serious consequences.

What is a Default Notice?

A Default Notice is a formal letter from your lender. It informs you that you have fallen behind on your payments. This notice is not just a warning; it’s a signal that your lender may take legal action if you don’t respond. Ignoring it can lead to more significant problems, like losing your property or facing legal fees.

Key Points to Remember:

- Act Quickly: If you receive a Default Notice, don’t panic. Reach out to your lender to discuss your options.

- Understand Your Rights: Familiarize yourself with your rights as a borrower. You may have time to recover before legal actions begin.

- Consider Recovery Options: Look into ways to get back on track, such as payment plans or loan modifications. Taking action early can prevent further complications.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

The Legal Actions That Follow Default Notices: A Comprehensive Overview

When borrowers receive a default notice, it can feel overwhelming. Understanding the implications of Default Notices and Legal Actions is crucial for anyone who has taken out a personal loan. Knowing what comes next can help you navigate this challenging situation with confidence.

What Happens After a Default Notice?

Once a default notice is issued, several legal actions may follow. Here’s what you should know:

- Debt Collection: Lenders often turn to collection agencies to recover the owed amount. This can lead to persistent calls and letters.

- Legal Proceedings: If the debt remains unpaid, lenders may file a lawsuit against you. This can result in court appearances and additional fees.

- Credit Impact: A default can severely affect your credit score, making it harder to secure loans in the future.

Steps to Take After Receiving a Default Notice

If you find yourself in this situation, consider these steps:

- Review the Notice: Understand the terms and the amount owed.

- Communicate with Your Lender: Reach out to discuss possible repayment options or settlements.

- Seek Legal Advice: Consulting with a legal expert can provide clarity on your rights and obligations.

How Default Notices Impact Your Credit Score: Key Insights

When you take out a loan, you promise to pay it back. But what happens if you can’t? Understanding Default Notices and Legal Actions: What Borrowers Should Know is crucial. These notices can affect your credit score and future borrowing options, so let’s break it down.

What is a Default Notice?

A default notice is a formal warning from your lender. It means you’ve missed payments and they’re serious about getting their money back. Ignoring it can lead to legal actions, which can be even worse for your credit score.

The Credit Score Connection

When you receive a default notice, your credit score can drop significantly. This happens because lenders see you as a higher risk. Here are some key points to remember:

- Immediate Impact: Your score may drop by 100 points or more.

- Long-Term Effects: A default can stay on your credit report for up to seven years.

- Future Borrowing: It may be harder to get loans or credit cards after a default.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

What Should You Do Upon Receiving a Default Notice?

Receiving a Default Notice can be a stressful experience for any borrower. It’s essential to understand what this notice means and the potential legal actions that may follow. Knowing your rights and options can help you navigate this challenging situation and avoid further complications.

First, take a deep breath. It’s crucial to stay calm and assess the situation. Here are some steps you can take:

Review the Notice

- Understand the Details: Read the notice carefully. It should outline the amount owed and the reason for the default. This information is vital for your next steps.

- Check Your Records: Look at your payment history. Did you miss payments? If so, how many? This will help you determine your options moving forward.

Respond Promptly

- Contact Your Lender: Reach out to your lender as soon as possible. Discuss your situation and see if there are options for repayment or restructuring your loan.

- Seek Professional Help: If you feel overwhelmed, consider consulting a financial advisor or a legal expert. They can provide guidance on Personal Loan Default and Recovery strategies.

By taking these steps, you can better manage the situation and work towards a resolution that suits your needs. Remember, being proactive is key!

Also Read: Personal Loan Default and Recovery: What You Should Know

Navigating the Legal Process: Steps After a Default Notice

When you receive a default notice, it can feel overwhelming. Understanding Default Notices and Legal Actions is crucial for borrowers. Knowing what steps to take can help you regain control and avoid further complications. Let’s break it down together!

Understand the Default Notice

A default notice is a formal alert from your lender. It means you’ve missed payments on your personal loan. This notice is the first step in the legal process, so take it seriously!

Respond Promptly

Ignoring the notice won’t make it go away. Instead, respond quickly. Contact your lender to discuss your situation. They may offer options for recovery, like a payment plan or loan modification. This can prevent further legal actions.

Know Your Rights

As a borrower, you have rights. Familiarize yourself with them! You can request documentation and seek legal advice. Understanding your rights can empower you during this challenging time. Remember, you’re not alone in this process!

Common Misconceptions About Default Notices and Legal Actions

Understanding Default Notices and Legal Actions is crucial for borrowers. Many people think these terms only apply to those who are in serious trouble with their loans. However, knowing the facts can help you avoid common pitfalls and make informed decisions about your personal finances.

Misconception 1: Default Notices Mean Immediate Legal Action

Many borrowers believe that receiving a Default Notice automatically leads to legal actions. In reality, a Default Notice is just a warning. It gives you a chance to catch up on missed payments before any serious steps are taken.

Misconception 2: All Loans Are Treated the Same

Not all loans have the same rules regarding Default Notices and Legal Actions. For instance, personal loan default and recovery processes can vary widely between lenders. Understanding your specific loan agreement is essential to know what to expect.

Misconception 3: Ignoring the Notice Will Make It Go Away

Some borrowers think that if they ignore a Default Notice, it will disappear. Unfortunately, this is not true. Ignoring the notice can lead to more severe consequences, including legal actions. It’s always best to address the issue head-on.

How ExpressCash Can Help You Manage Default Notices Effectively

Managing debt can be overwhelming, especially when you receive Default Notices and Legal Actions regarding your personal loans. Understanding what these notices mean and how they can impact your financial future is crucial. At ExpressCash, we’re here to guide you through this challenging time, ensuring you know your rights and options.

Understanding Default Notices

When you miss a payment, lenders may send you a Default Notice. This is a formal warning that you are behind on your loan. Ignoring it can lead to serious consequences, including legal actions. Knowing how to respond is essential for your recovery.

Steps to Take After Receiving a Default Notice

- Read the Notice Carefully: Understand what it says and the actions required.

- Contact Your Lender: Open a dialogue to discuss your situation. They may offer solutions.

- Explore Recovery Options: Look into debt management programs or refinancing to avoid further issues.

At ExpressCash, we provide resources and support to help you navigate these notices. Our team can assist you in understanding your options, ensuring you take the right steps toward financial recovery. Remember, you’re not alone in this journey!

Preparing for Potential Legal Actions: Tips for Borrowers

When it comes to borrowing money, understanding Default Notices and Legal Actions is crucial. If you miss payments on a personal loan, you might receive a default notice. This can lead to serious consequences, including legal actions. Knowing what to expect can help you prepare and respond effectively.

Stay Informed

First, always read your loan agreement. It outlines what happens if you default. Knowing the terms can help you avoid surprises. If you receive a default notice, don’t panic! It’s a signal to take action before things escalate.

Communicate with Your Lender

Next, reach out to your lender. They may offer options like payment plans or deferments. Open communication can prevent further legal actions. Remember, lenders prefer to work with you rather than go through the hassle of recovery processes.

Seek Professional Help

Lastly, consider consulting a financial advisor or attorney. They can guide you through the complexities of personal loan default and recovery. Having expert advice can empower you to make informed decisions and protect your rights.

FAQs

-

What is a default notice?

A default notice is a formal letter from your lender stating that you’ve missed payments and are at risk of legal action if the debt isn’t repaid within a specified period (usually 14–30 days). -

What happens if I ignore a default notice?

Ignoring a default notice can lead to legal action, such as a court judgment, wage garnishment, or damage to your credit score. It may also result in debt collection efforts. -

Can I stop legal action after receiving a default notice?

Yes, if you repay the overdue amount, negotiate a new payment plan, or contact the lender quickly, you may be able to stop legal action and avoid further consequences. -

Will defaulting on a loan affect my credit?

Yes, loan default will negatively affect your credit score, making it harder to get approved for future loans or credit cards. The default can remain on your credit report for up to 7 years. -

Can a lender take me to court for unpaid loans?

Yes, if the debt remains unpaid, lenders can file a lawsuit to recover the amount owed. If the court rules in their favor, they may garnish wages, place a lien on assets, or freeze bank accounts.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.