The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

Loan Default FAQs for Borrowers: Get Your Answers

Understanding Loan Default is crucial for every borrower. When you take out a loan, you promise to pay it back. But what happens if you can’t? This section on Loan Default FAQs for Borrowers: Get Your Answers will help you navigate these tricky waters and understand your options.

What is Loan Default?

Loan default occurs when a borrower fails to make the required payments on their loan. This can happen with any type of loan, including personal loans. If you miss payments, your lender may consider you in default, which can lead to serious consequences.

Consequences of Default

- Credit Score Impact: Your credit score can drop significantly.

- Legal Action: Lenders may take legal steps to recover their money.

- Loss of Assets: If your loan is secured, you could lose your collateral, like a car or home.

Understanding these outcomes can help you avoid them and find ways to recover if you’re already in trouble.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

What Causes Loan Default? Key Factors Explained

Understanding loan default is crucial for borrowers. It helps you navigate the tricky waters of borrowing money and ensures you stay informed. In this section, we’ll explore the key factors that lead to loan default, answering your Loan Default FAQs for Borrowers in a simple way.

Financial Hardship

One of the main reasons for personal loan default is financial hardship. This can happen due to unexpected events like job loss, medical emergencies, or other expenses that strain your budget. When money gets tight, paying back loans can become challenging.

Poor Financial Planning

Another factor is poor financial planning. Sometimes, borrowers take on more debt than they can handle without a solid plan. This can lead to missed payments and, eventually, default. It’s essential to budget wisely and understand your financial limits.

Lack of Communication

Lastly, a lack of communication with lenders can contribute to loan default. If you’re struggling to make payments, reaching out to your lender can help. They may offer options to avoid default, such as payment plans or deferments. Remember, it’s always better to ask for help than to ignore the problem.

How Does Loan Default Affect Your Credit Score?

Understanding how loan default affects your credit score is crucial for borrowers. When you miss payments on a personal loan, it can lead to serious consequences. This section of Loan Default FAQs for Borrowers aims to clarify these impacts, helping you navigate your financial journey with confidence.

When you default on a loan, your credit score can take a significant hit. Here’s how it works:

- Payment History: This is the most important factor in your credit score. Missing payments can drop your score by 100 points or more!

- Credit Utilization: If you default, lenders may see you as a higher risk, which can affect your ability to borrow in the future.

- Public Records: Defaults can lead to collections or even bankruptcy, which stay on your report for years.

This can make it harder to get loans or credit cards later on. Recovering from a personal loan default is possible. Focus on rebuilding your credit by making timely payments on any new loans or credit cards. Over time, your score can improve, showing lenders that you’re responsible.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

Can You Recover from a Loan Default? Steps to Take

Understanding how to recover from a loan default is crucial for borrowers. Loan Default FAQs for Borrowers: Get Your Answers is designed to guide you through this challenging situation. Knowing your options can help you regain control of your finances and rebuild your credit.

Assess Your Situation

First, take a deep breath and evaluate your financial situation. Are you able to make payments now? Understanding your current ability to pay is the first step toward recovery.

Communicate with Your Lender

Next, reach out to your lender. They may offer options like loan modification or a repayment plan. Open communication can lead to solutions that work for both parties, making it easier to navigate your personal loan default and recovery.

Create a Budget

Finally, create a budget to manage your expenses. Prioritize paying off debts and consider seeking financial advice. By taking these steps, you can start your journey toward recovery and regain your financial footing.

Also Read: Personal Loan Default and Recovery: What You Should Know

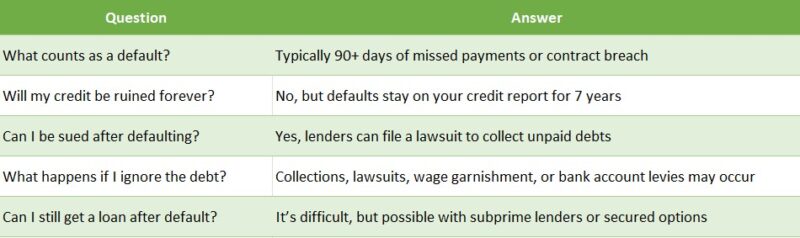

Loan Default FAQs for Borrowers: Common Questions Answered

Understanding loan defaults can be confusing, especially if you’re facing financial challenges. That’s why our Loan Default FAQs for Borrowers: Common Questions Answered section is here to help. We aim to provide clear, straightforward answers to your pressing questions about personal loan default and recovery.

What Happens When You Default on a Loan?

When you default on a loan, it means you’ve failed to make payments as agreed. This can lead to serious consequences, including damage to your credit score and potential legal action. It’s crucial to understand these risks to make informed decisions.

How Can I Recover from a Loan Default?

Recovery is possible! Here are some steps you can take:

- Communicate with your lender: They may offer options like loan modification.

- Consider credit counseling: Professionals can help you manage your debts.

- Create a budget: This helps you prioritize your payments and regain control.

Taking action early can make a big difference in your recovery journey.

What Are the Consequences of Defaulting on a Loan?

Understanding the consequences of defaulting on a loan is crucial for every borrower. Loan Default FAQs for Borrowers: Get Your Answers provides clarity on what happens when you miss payments. Knowing these outcomes can help you make informed decisions and avoid pitfalls.

When you default on a loan, several things can happen. Here are some key consequences to consider:

Impact on Credit Score

- Your credit score will drop significantly, making it harder to get loans in the future.

- A lower score can lead to higher interest rates on any future borrowing.

Legal Actions

- Lenders may take legal action to recover the money you owe.

- This can lead to wage garnishment or bank account levies, which can be stressful.

Recovery Options

- If you find yourself in a personal loan default situation, recovery is possible. You can negotiate with lenders or seek financial counseling to explore your options. Remember, it’s essential to act quickly to minimize damage.

How Can You Prevent Loan Default? Tips for Borrowers

Preventing loan default is essential for borrowers, and understanding the steps involved can alleviate financial stress while protecting your credit score. Here are some tips to help you avoid defaulting on your loans.

Stay Informed About Your Loan

- Read the fine print: Know your loan terms and conditions.

- Know your payment schedule: Track due dates to avoid missed payments.

Create a Budget

- Track your income and expenses: Understand your financial flow.

- Set aside funds for loan payments: Prioritize these payments in your budget.

Communicate with Your Lender

- Don’t ignore problems: Contact your lender if you’re struggling; they may offer solutions.

- Ask about deferment options: Some lenders allow you to pause payments during tough times.

Build an Emergency Fund

- Save for unexpected expenses: A financial cushion can help prevent default.

- Aim for three months’ worth of expenses: This provides stability and peace of mind.

Consider Automatic Payments

- Set up auto-debit: Ensure timely payments to reduce default risk.

- Check your account regularly: Make sure you have sufficient funds for these withdrawals.

Seeking Help: How ExpressCash Can Assist You with Loan Default

Understanding loan defaults can be overwhelming, especially when you’re facing financial difficulties. That’s why our Loan Default FAQs for Borrowers is here to help you navigate this challenging situation. We aim to provide clear answers and support, making the recovery process less daunting.

What is a Loan Default?

A loan default occurs when a borrower fails to make the required payments on time. This can lead to serious consequences, including damage to your credit score. Knowing the facts can empower you to take action.

How Can ExpressCash Help?

- Personal Loan Default Guidance: We offer resources that explain your options if you’re struggling with personal loan payments.

- Recovery Strategies: Learn about steps you can take to recover from a default, including negotiating with lenders and exploring debt relief options.

- Supportive Community: Join our forums to connect with others who are facing similar challenges. Sharing experiences can provide comfort and insight.

What Are Your Rights as a Borrower in Default?

Understanding your rights as a borrower in default is essential. When financial difficulties arise, knowing your options can significantly reduce stress. This section on Loan Default FAQs for Borrowers: Get Your Answers provides vital information about your rights and choices.

What Are Your Rights as a Borrower?

Even in default, you have several rights:

- Fair Treatment: Lenders must treat you fairly and cannot engage in harassment.

- Clear Communication: You have the right to clear information regarding your loan status and lender actions.

- Negotiation: You can negotiate repayment plans or loan modifications with your lender.

- Legal Protections: Familiarize yourself with local laws that protect you from unfair practices.

Steps to Take if You Default

If you are in a personal loan default situation, consider these steps:

- Contact Your Lender: Communicate openly about your situation.

- Explore Options: Inquire about deferment or restructuring your loan.

- Seek Help: Consult a financial advisor or credit counselor for assistance.

- Know Your Rights: Always be aware of your rights to ensure fair treatment.

By understanding your rights and options, you can navigate the recovery process more effectively.

FAQs

-

What does it mean to default on a loan?

A loan default happens when you fail to make scheduled payments for an extended period, typically 90 days or more, depending on the lender’s terms. -

What are the consequences of defaulting on a loan?

Default can lead to credit score damage, debt collection efforts, legal action, wage garnishment, and asset seizure in some cases. -

Can I fix a loan default?

Yes, you can often rehabilitate the loan by making payments, negotiate a settlement, or request a repayment plan to regain good standing. -

How long does a default stay on my credit report?

A loan default typically stays on your credit report for up to 7 years, even if you repay or settle the debt. -

What should I do immediately after defaulting?

Contact your lender or a credit counselor to explore settlement options, repayment agreements, or debt relief programs before legal action is taken.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.