The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

What Happens When You Default on a Loan?

Understanding what happens when you default on a loan is crucial for anyone who borrows money. Defaulting can lead to serious consequences, affecting your financial health and credit score. So, let’s break it down and see why it matters!

When you miss payments on a personal loan, you enter a phase called default. This usually happens after 90 days of missed payments. Here’s what you can expect:

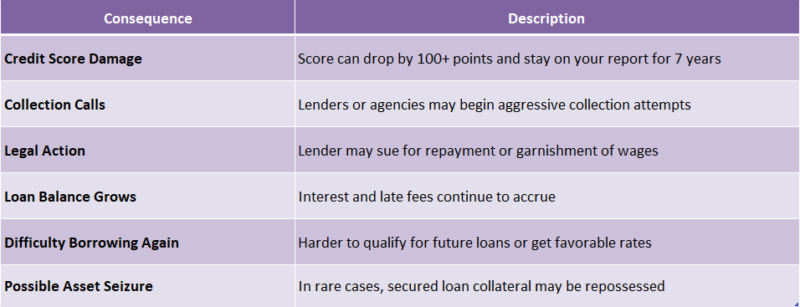

Consequences of Default:

- Credit Score Drop: Your credit score can drop significantly, making it harder to borrow in the future.

- Collection Calls: Lenders may start calling you to collect the debt, which can be stressful.

- Legal Action: In some cases, lenders might take legal action to recover the money owed.

Recovery Options:

If you find yourself in this situation, don’t panic! There are ways to recover from a personal loan default:

- Communicate with Your Lender: They may offer a repayment plan or deferment options.

- Consider Debt Counseling: Professionals can help you manage your debts effectively.

- Explore Loan Consolidation: This can simplify your payments and potentially lower your interest rate.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

The Immediate Consequences of Loan Default: What to Expect

When you take out a loan, you expect to pay it back on time. But what happens when you default on a loan? Understanding the immediate consequences is crucial, as it can impact your financial future significantly. Let’s explore what you can expect if you find yourself in this situation.

Damage to Your Credit Score

One of the first things that happens is a drop in your credit score. This can make it harder to borrow money in the future. A lower score means higher interest rates or even denial of loans.

Collection Efforts Begin

After defaulting, your lender may start contacting you for payment. They might send letters or call you frequently. If you ignore them, they could even hire a collection agency to recover the debt, which can be stressful.

Legal Action

In some cases, lenders may take legal action against you. This could lead to wage garnishment or bank account levies, making it even harder to recover financially. Understanding personal loan default and recovery is essential to avoid these drastic measures.

How Defaulting on a Loan Affects Your Credit Score

When you take out a loan, you might think about how it can help you achieve your goals. But what happens when you default on a loan? Understanding this is crucial because it can have serious consequences for your financial future, especially your credit score.

Defaulting on a loan can feel overwhelming, but knowing the impact on your credit score can help you make better decisions. Here’s what you need to know:

Immediate Impact

- Credit Score Drop: Your credit score can drop significantly, often by 100 points or more.

- Negative Mark: A default stays on your credit report for up to seven years, affecting your ability to get future loans.

Long-Term Consequences

- Higher Interest Rates: If you try to borrow again, lenders may charge you higher interest rates.

- Difficulty in Approval: You might find it harder to get approved for credit cards or mortgages, limiting your financial options.

In summary, defaulting on a personal loan can lead to a downward spiral in your credit health. Understanding personal loan default and recovery is essential to avoid these pitfalls and regain control of your finances.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

Legal Ramifications: What Happens When You Default on a Loan?

When you take out a loan, you agree to pay it back on time. But what happens when you default on a loan? Understanding this can save you from a lot of stress. Defaulting can lead to serious consequences that affect your finances and credit score.

Immediate Consequences

- Credit Score Drop: Your credit score can plummet, making it harder to borrow in the future.

- Collection Efforts: Lenders may start calling or sending letters to collect the debt.

- Legal Action: In some cases, lenders can sue you to recover the money owed.

Long-Term Effects

Defaulting on a personal loan can haunt you for years. It may lead to:

- Difficulty Getting Loans: Future lenders might see you as a high-risk borrower.

- Higher Interest Rates: If you do get approved, expect to pay higher rates.

- Wage Garnishment: If a court rules against you, they can take money directly from your paycheck.

Understanding these legal ramifications can help you avoid default and explore recovery options.

Also Read: Personal Loan Default and Recovery: What You Should Know

Can You Recover from Defaulting on a Loan?

When you take out a loan, you expect to pay it back. But what happens when you default on a loan? This situation can feel overwhelming, but understanding the recovery process is crucial. Defaulting on a personal loan can impact your credit score and financial future, but there are steps you can take to bounce back.

Recovering from a loan default is possible, and it often starts with acknowledging the situation. Here are some key steps to consider:

- Communicate with Your Lender: Reach out to discuss your options. They may offer a repayment plan or other solutions.

- Create a Budget: Assess your finances and prioritize your expenses to ensure you can meet your obligations moving forward.

- Consider Credit Counseling: Professional help can guide you through the recovery process and improve your financial habits.

Remember, while defaulting on a personal loan can be daunting, taking proactive steps can lead you back to financial stability.

Exploring Options: What Happens When You Default on a Loan?

When you take out a loan, you expect to pay it back on time. But what happens when you default on a loan? Understanding this can save you from future financial troubles. Defaulting can lead to serious consequences, and knowing your options is crucial for recovery.

Immediate Consequences

When you default on a personal loan, the lender may take immediate action. This can include:

- Late Fees: You might face additional charges for missed payments.

- Credit Score Impact: Your credit score can drop significantly, making future borrowing harder.

- Collections: The lender may send your debt to a collection agency, leading to more stress.

Recovery Steps

If you find yourself in this situation, don’t panic! Here are steps to consider for recovery:

- Communicate with Your Lender: They may offer options like a payment plan or deferment.

- Seek Financial Counseling: Professionals can help you create a budget and manage your debts.

- Consider Debt Consolidation: This can simplify payments and potentially lower interest rates.

The Role of Debt Collectors: What Happens When You Default on a Loan?

Taking out a loan means promising to pay it back, but what happens when you default? This situation can significantly impact your financial future, often leading to the involvement of debt collectors. Let’s explore their role and what you can expect.

The Role of Debt Collectors

Debt collectors are hired by lenders to recover owed money. If you default on a personal loan, your lender may sell your debt to a collector, believing they won’t recover the money directly from you. Here’s what usually happens:

- Contact Attempts: Collectors will reach out via phone, mail, or email.

- Negotiation: They may propose payment plans or settlements to help you settle the debt.

- Credit Impact: Expect your credit score to drop, making future loans more difficult to secure.

Personal Loan Default and Recovery

Recovering from a personal loan default is challenging but achievable. Here are some steps to consider:

- Communicate: Engage with your lender or collector for potential solutions.

- Budgeting: Develop a budget to better manage your finances.

- Seek Help: Consult a financial advisor for additional guidance.

Understanding the consequences of defaulting on a loan can empower you to take steps towards recovery and financial stability.

Preventing Default: Strategies to Avoid Loan Default

When you take out a loan, you promise to pay it back. But what happens when you default on a loan? This can lead to serious consequences, like damaged credit scores and increased stress. Understanding how to prevent default is crucial for your financial health.

Create a Budget

Start by making a budget. This helps you track your income and expenses. Knowing where your money goes can prevent overspending and ensure you can make your loan payments on time.

Communicate with Your Lender

If you’re struggling, talk to your lender. They may offer options like payment plans or temporary relief. Remember, ignoring the problem only makes it worse. Open communication can lead to solutions that help you avoid personal loan default and recovery challenges.

Set Up Automatic Payments

Consider setting up automatic payments. This way, you won’t forget to pay your loan. It’s a simple step that can save you from late fees and potential default. Staying proactive is key to managing your loans effectively.

How ExpressCash.com Can Help You Navigate Loan Default Challenges

Understanding what happens when you default on a loan is crucial for anyone who has borrowed money. Defaulting can lead to serious consequences, including damaged credit scores and legal actions. But don’t worry! At ExpressCash.com, we’re here to help you navigate these challenges and find a path to recovery.

How ExpressCash.com Can Help You

When you face a personal loan default, it’s essential to know your options. Here’s how we can assist you:

- Expert Guidance: Our team offers personalized advice tailored to your situation.

- Debt Management Plans: We can help you create a plan to manage your debts effectively.

- Negotiation Support: We can assist in negotiating with lenders to find a more manageable repayment solution.

By understanding the implications of defaulting, you can take proactive steps to recover. Remember, you’re not alone in this journey, and ExpressCash.com is here to support you every step of the way.

FAQs

-

What does it mean to default on a loan?

Loan default happens when you fail to make payments for a certain period (usually 90 days or more), breaching the loan agreement terms. -

What are the immediate consequences of defaulting?

You may face late fees, penalty interest rates, and collection efforts from the lender or a third-party agency. -

How does loan default affect my credit score?

It can cause a significant drop in your credit score and stay on your credit report for up to 7 years, making future borrowing difficult. -

Can a lender take legal action after default?

Yes, lenders can sue you in court, garnish your wages, or seize assets—depending on your loan type and state laws. -

Is it possible to recover from a loan default?

Yes. You can negotiate with the lender, settle the debt, or enter a repayment plan. Over time, responsible financial behavior can help rebuild your credit.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.