The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

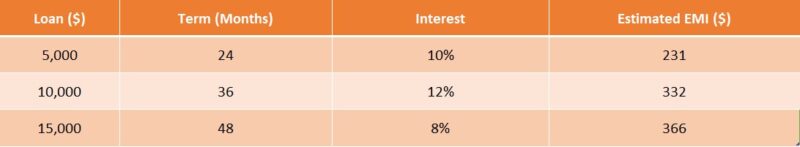

Loan EMI Table for Personal Loans: Check Monthly Payments

When considering a personal loan, grasping the Loan EMI Table for Personal Loans is essential. This table outlines your monthly payments, helping you budget effectively and avoid unexpected costs. Knowing your monthly obligations can provide peace of mind as you manage your finances.

What is a Loan EMI Table?

A Loan EMI Table is a straightforward chart displaying your monthly payments, or EMIs (Equated Monthly Installments), for a personal loan. It details the total amount borrowed, interest rate, and loan tenure, allowing you to see how much you owe each month and the duration of repayment.

Benefits of Using a Personal Loan EMI Calculator

Utilizing a Personal Loan EMI Calculator simplifies the process. Here are some advantages:

- Quick Estimates: Instantly calculate your monthly payments.

- Compare Options: Evaluate how varying interest rates and tenures impact your EMI.

- Budget Planning: Better manage your finances by understanding your monthly commitments.

By familiarizing yourself with the Loan EMI Table for Personal Loans, you can make informed choices and select the most suitable loan for your situation.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

How to Calculate Your Monthly Payments Using the Loan EMI Table

Understanding your monthly payments is crucial when taking out a personal loan. The Loan EMI Table for Personal Loans helps you visualize how much you need to pay each month. Knowing this can ease your budgeting and financial planning, making your loan experience smoother.

How to Use the Loan EMI Table

To calculate your monthly payments, you can use a simple formula or a Personal Loan EMI Calculator. Here’s how you can do it:

- Identify the Loan Amount: This is the total money you wish to borrow.

- Choose the Interest Rate: This is the percentage charged by the lender.

- Select the Loan Tenure: This is how long you plan to repay the loan, usually in months.

- Refer to the EMI Table: Find your loan amount and tenure to see your monthly payment.

Benefits of Using the EMI Table

Using the Loan EMI Table for Personal Loans has several advantages:

- Easy Comparison: You can compare different loan options quickly.

- Budgeting Help: Knowing your EMI helps you plan your monthly expenses better.

- Financial Clarity: It gives you a clear picture of your repayment obligations, reducing surprises.

Key Components of a Loan EMI Table Explained

When considering a personal loan, understanding your monthly payments is crucial. This is where the Loan EMI Table for Personal Loans comes into play. It helps you visualize how much you need to pay each month, making budgeting easier and more manageable.

A Loan EMI Table typically includes several important details:

- Loan Amount: The total money you borrow.

- Interest Rate: The cost of borrowing, expressed as a percentage.

- Loan Tenure: The duration over which you will repay the loan.

- Monthly EMI: The amount you pay each month, which combines both principal and interest. Using a Personal Loan EMI Calculator can simplify this process.

By entering your loan amount, interest rate, and tenure, you can instantly see your monthly payments. This tool helps you make informed decisions, ensuring you choose a loan that fits your financial situation.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

Why You Should Use a Loan EMI Table Before Borrowing

When considering a personal loan, understanding your monthly payments is crucial. This is where a Loan EMI Table for Personal Loans comes into play. It helps you visualize how much you will pay each month, making it easier to budget and plan your finances. Knowing your EMI can prevent surprises down the road!

What is a Loan EMI Table?

A Loan EMI Table is a simple chart that shows your monthly payments based on the loan amount, interest rate, and tenure. By using a Personal Loan EMI Calculator, you can quickly see how different factors affect your payments. This tool is essential for making informed borrowing decisions.

Benefits of Using a Loan EMI Table

- Clarity: It breaks down your payments, so you know exactly what to expect.

- Budgeting: Helps you plan your monthly expenses better.

- Comparison: You can compare different loans and choose the best option.

- Financial Control: Knowing your EMI empowers you to manage your finances effectively.

Using a Loan EMI Table ensures you borrow wisely and avoid financial strain.

Also Read: Personal Loan EMI Calculator: Find Your Monthly Installments

Comparing Different Personal Loan Options with an EMI Table

When considering a personal loan, understanding your monthly payments is crucial. This is where a Loan EMI Table for Personal Loans comes into play. It helps you visualize how much you need to pay each month, making budgeting easier and stress-free.

Why Use an EMI Table?

An EMI table allows you to compare different loan options side by side. You can see how varying interest rates and loan amounts affect your monthly payments. This way, you can choose the loan that fits your financial situation best.

Benefits of Using a Personal Loan EMI Calculator

- Easy Comparison: Quickly see how different loans stack up against each other.

- Budgeting Made Simple: Know exactly what to expect each month.

- Informed Decisions: Make choices based on clear data rather than guesswork.

Using a Personal Loan EMI Calculator can further simplify this process. Just enter your loan amount, interest rate, and tenure to get an instant calculation of your monthly payments.

What Factors Influence Your Monthly EMI Payments?

Understanding your monthly payments is crucial when taking out a personal loan. A Loan EMI Table for Personal Loans helps you visualize how much you need to pay each month. This table breaks down your loan amount, interest rate, and tenure, making it easier to plan your finances.

Several key factors determine your monthly EMI payments. Here’s a quick look:

- Loan Amount: The more you borrow, the higher your EMI. Think of it like buying a bigger toy; it costs more!

- Interest Rate: This is the cost of borrowing. A lower rate means lower EMIs, just like getting a discount on your favorite game!

- Loan Tenure: This is how long you’ll take to repay the loan. A longer tenure means smaller EMIs, but you’ll pay more interest overall.

It’s like stretching out your allowance over more weeks. To get a precise idea of your monthly payments, you can use a Personal Loan EMI Calculator. This handy tool lets you input your loan details and instantly see your EMIs. It’s like having a magic calculator for your finances!

Tips for Managing Your Personal Loan EMI Effectively

Managing your personal loan effectively can save you money and stress. Understanding your monthly payments is crucial, and that’s where a Loan EMI Table for Personal Loans comes in handy. It helps you visualize your payments over time, making budgeting easier and more straightforward.

Use a Personal Loan EMI Calculator

A Personal Loan EMI Calculator is a fantastic tool. It allows you to input your loan amount, interest rate, and tenure to see your monthly payments. This way, you can plan your finances better and avoid surprises.

Set Up Automatic Payments

Consider setting up automatic payments for your EMI. This ensures you never miss a payment, which can help maintain a good credit score. Plus, it saves you the hassle of remembering due dates!

Budget Wisely

Create a budget that includes your EMI. By allocating funds specifically for your loan payment, you can manage your finances more effectively. This way, you can enjoy peace of mind knowing your payments are covered.

How ExpressCash Can Help You Navigate Personal Loan Options

When considering a personal loan, understanding your monthly payments is crucial. This is where the Loan EMI Table for Personal Loans comes into play. It helps you visualize how much you’ll need to pay each month, making budgeting easier and more effective.

Easy Access to Information

With ExpressCash, you can easily access a comprehensive Loan EMI Table for Personal Loans. This table breaks down your potential monthly payments based on different loan amounts and interest rates, allowing you to make informed decisions.

Use Our Personal Loan EMI Calculator

Additionally, our Personal Loan EMI Calculator is a handy tool. Simply input your loan amount, interest rate, and tenure, and voila! You’ll see your monthly EMI instantly. This feature empowers you to compare various loan options effortlessly, ensuring you choose the best fit for your financial needs.

Common Mistakes to Avoid When Using a Loan EMI Table

Understanding the Loan EMI Table for Personal Loans is essential for borrowers. It clearly outlines your monthly payments, aiding in effective budgeting. However, many make mistakes that can lead to financial strain.

Common Mistakes to Avoid

- Ignoring the Interest Rate: Always consider how the interest rate impacts your payments, as even a small change can significantly affect your total cost.

- Not Using a Personal Loan EMI Calculator: This tool is invaluable for quickly estimating your payments—don’t overlook it!

Final Thoughts

By avoiding these common pitfalls, you can save money and manage your finances more effectively. Always double-check your calculations and utilize the Loan EMI Table for Personal Loans wisely.

Additional Considerations

Remember to factor in extra costs like processing fees and insurance, which can accumulate. Also, review your loan terms carefully for any prepayment penalties or hidden fees. Understanding these aspects can help you avoid unexpected charges and ensure a smoother borrowing experience.

FAQs

-

What is a loan EMI table?

A loan EMI table (also called an amortization schedule) shows the monthly payment breakdown of your loan into principal and interest components over time. -

Why should I check the EMI table before taking a personal loan?

It helps you understand total repayment, see how much you’ll pay in interest vs. principal, and plan your monthly budget more effectively. -

Does the EMI amount remain the same throughout the loan?

Yes, for fixed-rate personal loans, the EMI remains constant, though the interest portion reduces and the principal portion increases with each payment. -

Can I get an EMI table for different loan amounts and terms?

Yes, many lenders and websites offer EMI tables for various loan amounts, interest rates, and tenures, helping you compare options. -

How can I generate a personalized EMI table?

Use an online EMI calculator by entering your loan amount, interest rate, and tenure—the tool will instantly display a customized EMI schedule.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.