The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

EMI Payment Due Date Tracker: Never Miss a Payment

Managing finances can be tricky, especially when it comes to loans. An EMI Payment Due Date Tracker is your best friend in this journey. It helps you keep track of your monthly payments, ensuring you never miss a deadline. Missing a payment can lead to penalties and affect your credit score, which is why this tool is essential!

Why Use an EMI Payment Due Date Tracker?

- Stay Organized: With a tracker, you can see all your payment dates in one place.

- Avoid Late Fees: Timely payments mean no extra charges.

- Boost Your Credit Score: Consistent payments improve your credit rating, making future loans easier to obtain.

How to Get Started

Using an EMI Payment Due Date Tracker is simple! You can find many apps or online tools that offer this feature. Additionally, you can use a Personal Loan EMI Calculator to understand your payment structure better. This way, you can plan your budget effectively and ensure you’re always prepared for your next EMI.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

How to Set Up Your EMI Payment Due Date Tracker Effectively?

Keeping track of your EMI payments is crucial to avoid penalties and maintain a good credit score. An EMI Payment Due Date Tracker helps you stay organized and ensures you never miss a payment. With the right setup, you can manage your finances better and enjoy peace of mind.

1. Choose the Right Tool

Start by selecting an EMI Payment Due Date Tracker that suits your needs. You can use a simple spreadsheet, a mobile app, or even reminders on your phone. The key is to find something that you will consistently check.

2. Input Your Loan Details

Next, enter your loan details into the tracker. Include the loan amount, interest rate, and tenure. If you’re unsure about your EMI amount, a Personal Loan EMI Calculator can help you determine it easily. This will give you a clear picture of your monthly obligations.

3. Set Reminders

Finally, set reminders a few days before each due date. This way, you’ll have enough time to arrange the funds and make the payment. Regular reminders can be a lifesaver, ensuring you never miss a payment again.

Top Features to Look for in an EMI Payment Due Date Tracker

Managing finances can be challenging, especially when it comes to paying EMIs on time. An EMI Payment Due Date Tracker is a valuable tool that helps you monitor your payments, ensuring you never miss a deadline. This not only prevents late fees but also safeguards your credit score.

User-Friendly Interface

A good tracker should be easy to navigate. Look for one with a simple layout that allows you to input loan details and view upcoming payments effortlessly.

Payment Reminders

Opt for a tracker that sends reminders before due dates, giving you ample time to prepare your payments and avoid surprises.

Integration with Personal Loan EMI Calculator

Some trackers integrate with a Personal Loan EMI Calculator, helping you estimate future payments and manage your budget effectively.

Customizable Alerts

Customizable alerts are essential. They let you set reminders at your preferred times, ensuring you receive notifications that fit your schedule.

Secure Data Management

Finally, choose a tracker that prioritizes data security, protecting your financial information and providing peace of mind as you manage your loans.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

Are You Missing Payments? Signs You Need an EMI Payment Due Date Tracker

Missing payments can lead to extra fees and stress. That’s why an EMI Payment Due Date Tracker is essential. It helps you stay organized and ensures you never miss a payment. With this tool, you can keep your finances in check and avoid unnecessary penalties.

Common Signs to Watch For

- Late Fees: If you find yourself paying late fees often, it’s a clear sign you need a tracker.

- Forgotten Dates: Do you frequently forget when your payments are due? A tracker can help you remember.

- Rising Stress: If managing your loans feels overwhelming, it’s time to simplify with a tracker.

Using a Personal Loan EMI Calculator can also help you plan your payments better. By knowing how much you owe and when, you can budget effectively. Combine this with an EMI Payment Due Date Tracker, and you’ll be on top of your finances in no time!

Also Read: Personal Loan EMI Calculator: Find Your Monthly Installments

The Consequences of Missing Your EMI Payments: What You Should Know

Missing your EMI payments can feel like a small mistake, but it can lead to big problems. An EMI Payment Due Date Tracker is your best friend in this situation. It helps you remember when payments are due, ensuring you never miss a deadline. This is crucial for maintaining a good credit score and avoiding extra fees.

The Ripple Effect of Missing Payments

When you miss a payment, several things can happen:

- Late Fees: Lenders often charge extra fees for missed payments.

- Credit Score Impact: Your credit score can drop, making future loans more expensive.

- Increased Interest Rates: Lenders may raise your interest rates if you miss payments consistently.

How to Avoid Missing Payments

Using a Personal Loan EMI Calculator can help you plan your finances better. It shows you how much you need to pay each month, making it easier to budget. Combine this with an EMI Payment Due Date Tracker, and you’ll stay on top of your payments effortlessly.

How an EMI Payment Due Date Tracker Can Save You Money

Managing your finances can be tricky, especially when it comes to paying your EMIs on time. An EMI Payment Due Date Tracker is a handy tool that helps you stay organized and avoid late fees. Missing a payment can lead to extra charges and affect your credit score, which is why this tracker is essential for anyone with a personal loan.

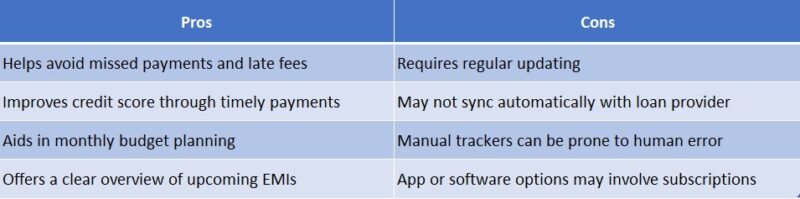

Benefits of Using an EMI Payment Due Date Tracker

- Stay Organized: With a tracker, you can see all your due dates in one place.

- Avoid Late Fees: Timely payments mean no extra charges.

- Improve Credit Score: Consistent payments can boost your credit rating.

Using a Personal Loan EMI Calculator alongside your tracker can also help you plan your finances better. You can calculate how much you owe each month and adjust your budget accordingly. This way, you can ensure that you always have enough money set aside for your payments, making financial management a breeze!

Tips for Staying Organized with Your EMI Payments

Managing your EMI payments can feel overwhelming, but with an EMI Payment Due Date Tracker, you can stay on top of your finances. Missing a payment can lead to penalties and affect your credit score. So, let’s explore some tips to help you stay organized and never miss a payment again!

Create a Payment Calendar

One of the best ways to keep track of your EMI payments is to create a payment calendar. Mark the due dates clearly, and set reminders a few days in advance. This way, you’ll always be prepared and avoid any last-minute rush!

Use Technology to Your Advantage

Consider using an EMI Payment Due Date Tracker app. These tools can send you notifications and help you manage your payments efficiently. Additionally, a Personal Loan EMI Calculator can help you understand how much you owe and when, making budgeting easier.

How ExpressCash Can Help You Manage Your EMI Payments

Managing EMI payments can be overwhelming, especially with multiple loans. An EMI Payment Due Date Tracker is essential for keeping track of payment deadlines, helping you avoid late fees and protect your credit score.

Easy Tracking

Our EMI Payment Due Date Tracker allows you to monitor all your payment dates in one place. Simply input your loan details, and you’ll receive reminders before each due date, enabling better financial planning and avoiding surprises.

Calculate Your Payments

Our Personal Loan EMI Calculator is another valuable tool. It helps you estimate monthly payments based on loan amount, interest rate, and tenure. Knowing your EMI in advance aids in effective budgeting and stress-free expense management.

Benefits of Using Our Tools

- Stay Organized: Keep all payment dates in one app.

- Avoid Late Fees: Receive timely reminders.

- Plan Ahead: Understand your financial commitments better with the calculator.

In conclusion, with ExpressCash, managing your EMI payments is easy, giving you more control over your finances and reducing anxiety about missed payments.

Frequently Asked Questions About EMI Payment Due Date Trackers

📆 What is an EMI Payment Due Date Tracker?

It’s a tool or system that helps you keep track of your loan EMI (Equated Monthly Installment) payment dates to avoid missed payments and penalties.

🔔 How does an EMI tracker remind me of due dates?

Most trackers send you notifications via SMS, email, or app alerts before your EMI is due, ensuring timely payments.

💳 Can I track multiple EMIs with one tracker?

Yes, many EMI trackers allow you to manage and monitor multiple loans, including personal, home, and auto loans in one place.

📱 Is there a mobile app for EMI tracking?

Yes, several apps like Walnut, Cred, and Money Manager offer EMI tracking features directly from your smartphone.

🧾 What happens if I miss an EMI due date?

Missing an EMI can lead to late fees, a drop in your credit score, and a negative mark on your credit report, so using a tracker helps avoid this.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.