The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

Emergency Personal Loans Options: Fast Funding Solutions

When unexpected challenges arise, quick access to cash can be crucial. Emergency Personal Loans Options are designed to provide fast funding for urgent needs like medical bills or car repairs. Understanding these options is essential for making informed decisions when time is tight.

Types of Personal Loans

1. Unsecured Personal Loans

These loans don’t require collateral, making them easier to obtain, but they often come with higher interest rates due to increased lender risk.

2. Secured Personal Loans

These loans require collateral, such as a car or savings account, and usually have lower interest rates. However, there’s a risk of losing your asset if you fail to repay.

3. Payday Loans

These short-term loans offer quick cash but carry high interest rates, potentially leading to a cycle of debt if not managed wisely. In summary, being aware of the different Emergency Personal Loans Options can help you select the best financial solution. Always evaluate the terms and your repayment ability before proceeding.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

Why Choose Emergency Personal Loans for Quick Financial Relief?

When life throws unexpected expenses your way, finding quick financial relief can feel overwhelming. That’s where Emergency Personal Loans Options come into play. These loans are designed to help you tackle urgent costs, like medical bills or car repairs, without the long wait times of traditional loans.

Fast Access to Funds

One of the biggest advantages of emergency personal loans is their speed. Many lenders offer quick approvals, sometimes within hours. This means you can get the money you need almost immediately, allowing you to focus on what really matters: resolving your financial crisis.

Flexible Types of Personal Loans

Emergency personal loans come in various forms. Here are a few common types of personal loans you might consider:

- Unsecured Personal Loans: No collateral needed, making them accessible to many.

- Secured Personal Loans: Backed by an asset, often with lower interest rates.

- Payday Loans: Short-term loans that can be helpful but come with high fees.

Choosing the right type can make a big difference in your financial journey.

The Different Types of Emergency Personal Loans Options Available

When unexpected challenges arise, knowing your emergency personal loan options can be crucial. These loans offer quick cash access for urgent expenses like medical bills or car repairs. Let’s look at the types of emergency personal loans available to you.

Types of Personal Loans

- Unsecured Personal Loans: No collateral is needed, making these loans accessible, though they often come with higher interest rates.

- Secured Personal Loans: These require collateral, such as your car or home, which can lead to lower interest rates. Be cautious, as defaulting may result in losing your asset.

- Payday Loans: Short-term loans meant for immediate expenses until your next paycheck. They are easy to obtain but can carry high fees, so use them wisely!

Key Benefits of Emergency Personal Loans

- Fast Approval: Many lenders provide quick online applications, with funds available in as little as 24 hours.

- Flexible Use: The money can be used for various emergencies, from medical bills to home repairs.

- Improved Credit Options: Timely payments on some loans can help build your credit.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

How to Qualify for Emergency Personal Loans: Key Requirements

When life throws unexpected challenges your way, knowing about Emergency Personal Loans Options can be a lifesaver. These fast funding solutions can help you cover urgent expenses like medical bills or car repairs. Understanding how to qualify for these loans is essential to get the help you need quickly.

Basic Requirements

To qualify for Emergency Personal Loans, lenders typically look for a few key factors. You usually need to be at least 18 years old, a U.S. citizen or resident, and have a steady income. This helps lenders feel confident that you can repay the loan.

Credit Score Considerations

While some lenders offer loans with flexible credit requirements, a better credit score can open up more options. If your score is low, consider improving it before applying. Remember, even small changes can make a big difference in the types of personal loans available to you.

Comparing Interest Rates on Emergency Personal Loans: What to Look For

When life throws unexpected challenges your way, knowing your Emergency Personal Loans Options can be a lifesaver. Fast funding solutions can help you cover urgent expenses like medical bills or car repairs. But before you dive in, it’s crucial to understand how interest rates can impact your financial future.

Key Factors to Consider

- Loan Amount: Different lenders offer various amounts. Make sure you know how much you need.

- Repayment Terms: Look for flexible repayment options that suit your budget.

- Fees: Some loans come with hidden fees. Always read the fine print! Interest rates can vary widely among different types of personal loans.

A lower rate means you’ll pay less over time. So, compare rates from multiple lenders. Don’t forget to check if they offer pre-qualification, which won’t affect your credit score. This way, you can find the best deal for your emergency needs.

The Application Process for Emergency Personal Loans: A Step-by-Step Guide

When unexpected financial challenges arise, knowing your Emergency Personal Loans Options can be a lifesaver. These fast funding solutions can help cover urgent expenses like medical bills or car repairs. Navigating the application process is essential for quick assistance.

Step 1: Research Your Options

Begin by exploring various types of personal loans. Compare interest rates, terms, and eligibility to find the best fit for your needs.

Step 2: Gather Necessary Documents

Prepare your identification, proof of income, and any required documents to expedite the application process.

Step 3: Fill Out the Application

Accurately complete the application form, being honest about your financial situation to improve your approval chances.

Step 4: Review and Submit

Double-check your application for errors. Once everything is correct, submit it and wait for a response. Many lenders provide quick approvals, so you won’t have to wait long!

By following these steps, you can streamline the application process for Emergency Personal Loans and get the help you need in tough times.

How to Use Emergency Personal Loans Wisely: Tips for Responsible Borrowing

When unexpected expenses arise, knowing your Emergency Personal Loans Options can be crucial. These fast funding solutions can help you address urgent financial needs, but responsible borrowing is essential to avoid debt traps. Let’s look at how to borrow wisely.

Know Your Loan Types

Before borrowing, it’s important to understand the Types of Personal Loans available:

- Unsecured Loans: No collateral required, but typically have higher interest rates.

- Secured Loans: Backed by an asset, which can lower rates but risks losing that asset if you default.

- Payday Loans: Quick cash options with high fees; use these only as a last resort!

Tips for Responsible Borrowing

To maximize your emergency loan benefits, keep these tips in mind:

- Borrow Only What You Need: Limit your loan amount to what is necessary for manageable repayments.

- Read the Fine Print: Be aware of the terms, fees, and interest rates before committing.

- Create a Repayment Plan: Outline how you will repay the loan to avoid late fees and stress.

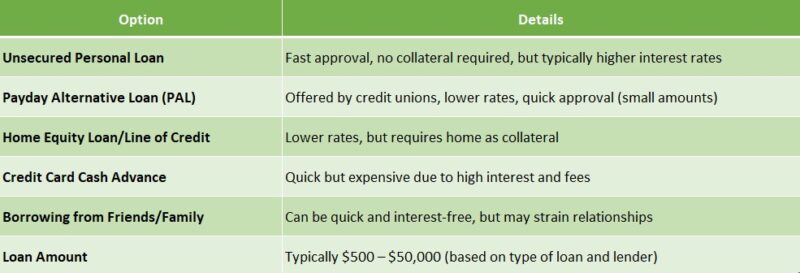

Exploring Alternative Emergency Funding Solutions: Beyond Personal Loans

When life throws unexpected challenges your way, having quick access to funds can make all the difference. While Emergency Personal Loans Options are popular for fast funding, there are other avenues worth exploring. Understanding these alternatives can help you make informed decisions during tough times.

Credit Cards: A Quick Fix

Using a credit card can be a fast solution for emergencies. If you have available credit, you can cover urgent expenses immediately. Just remember, high-interest rates can add up quickly!

Peer-to-Peer Lending

Another option is peer-to-peer lending. This involves borrowing money from individuals through online platforms. It often has lower interest rates than traditional loans, making it a smart choice for some.

Personal Lines of Credit

A personal line of credit offers flexibility. You can borrow what you need, when you need it, and only pay interest on the amount used. This can be a great alternative to traditional Emergency Personal Loans Options.

How ExpressCash Can Help You Find the Right Emergency Personal Loan

When unexpected expenses arise, knowing your options for emergency personal loans can be a lifesaver. Fast funding solutions can help you tackle urgent bills, medical emergencies, or car repairs without the stress of long waiting periods. At ExpressCash, we understand how crucial it is to find the right financial support quickly.

Navigating through various emergency personal loans options can feel overwhelming. But don’t worry! We’re here to simplify the process. Our platform connects you with lenders who offer different types of personal loans tailored to your needs. You can compare rates and terms easily, ensuring you make an informed choice.

Benefits of Using ExpressCash

- Quick Comparisons: See multiple loan options side by side.

- Tailored Recommendations: Get suggestions based on your financial situation.

- User-Friendly Interface: Navigate effortlessly to find what you need.

With our help, you can secure the funds you need swiftly, allowing you to focus on what truly matters—getting back on track.

Common Mistakes to Avoid When Applying for Emergency Personal Loans

When life throws unexpected expenses your way, understanding Emergency Personal Loans Options can be a lifesaver. These fast funding solutions can help you cover urgent bills, medical expenses, or car repairs. However, applying for these loans can be tricky if you’re not careful. Let’s explore some common mistakes to avoid.

Not Researching Loan Types

One of the biggest mistakes is not exploring the different Types of Personal Loans available. Each type has its own terms, interest rates, and repayment plans. Take the time to compare options to find the best fit for your needs.

Ignoring Your Credit Score

Another mistake is overlooking your credit score. Lenders often use this number to determine your eligibility and interest rates. Check your score before applying, and consider improving it if possible. A better score can lead to lower rates and better loan options.

FAQs

-

What is an emergency personal loan?

An emergency personal loan provides quick funds to cover unexpected expenses like medical bills, car repairs, or urgent travel. -

How fast can I get an emergency personal loan?

Many lenders offer same-day or next-day funding, especially if you apply early in the day and meet all documentation requirements. -

What are common reasons to take an emergency loan?

Common reasons include medical emergencies, urgent home or car repairs, unexpected travel, or job loss support. -

Can I get an emergency personal loan with bad credit?

Yes, some lenders specialize in loans for those with bad or fair credit, but they might charge higher interest rates. -

What alternatives exist to emergency personal loans?

Alternatives include credit cards, payday loans, borrowing from family or friends, or emergency assistance programs if available.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.