The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

Fixing Errors on Your Credit Report: Step-by-Step

Your credit report acts as a report card for your financial health, reflecting how well you manage debts and payments. Fixing errors on your credit report is essential, as even minor mistakes can lower your credit score, making it harder to obtain personal loans or credit cards. Understanding how to correct these errors is the first step toward improving your credit score for a personal loan.

Why Your Credit Report Matters

Your credit report influences many areas of your life. Lenders rely on it to determine your creditworthiness. A good credit score can lead to lower interest rates and better loan terms, while errors can result in higher costs or loan denials. Here’s why it’s important:

- Financial Opportunities: A clean report opens doors to better loans.

- Peace of Mind: An accurate report provides security about your finances.

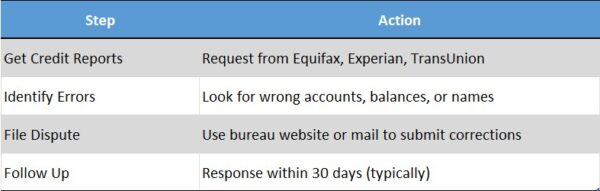

Steps to Fix Errors

Fixing errors on your credit report is straightforward. Here’s how to start:

- Get Your Report: Request a free copy of your credit report.

- Check for Mistakes: Look for errors like incorrect names or balances.

- Dispute Errors: Contact the credit bureau to report mistakes; they will investigate.

- Follow Up: Ensure errors are corrected and check your report again.

Following these steps can help improve your credit score and secure the personal loan you need!

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

What Are Common Errors Found on Credit Reports?

Fixing errors on your credit report is crucial because even small mistakes can impact your financial future. A single error can lower your credit score, making it harder to secure a personal loan or get favorable interest rates. Understanding common errors helps you take the right steps to correct them.

1. Incorrect Personal Information

Sometimes, your name, address, or Social Security number might be wrong. This can happen due to typos or outdated information. Always check these details first!

2. Duplicate Accounts

You might find the same account listed more than once. This can confuse lenders and hurt your credit score. If you spot duplicates, it’s time to take action!

3. Late Payments That Aren’t Yours

Imagine seeing a late payment on your report that you never made! This can happen if your account was mixed up with someone else’s. If you find this, you need to dispute it right away.

How to Obtain Your Credit Report for Free

Fixing Errors on Your Credit Report: Step-by-Step is crucial because even small mistakes can hurt your credit score. A low score can make it harder to get a personal loan or secure favorable interest rates. So, let’s dive into how you can obtain your credit report for free and start correcting those errors!

Step 1: Visit AnnualCreditReport.com

This is the official site where you can request your free credit report once a year from each of the three major credit bureaus: Experian, TransUnion, and Equifax. It’s safe and easy!

Step 2: Fill Out Your Information

You’ll need to provide some personal details like your name, address, and Social Security number. This helps verify your identity and ensures you get the right report.

Step 3: Review Your Report

Once you have your report, check it carefully for any errors. Look for incorrect account details or unfamiliar accounts. Remember, fixing errors on your credit report can significantly improve your credit score for a personal loan!

Step 4: Keep Track

Make a note of any errors you find. This will help you when you contact the credit bureaus to dispute them.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

Step-by-Step Guide to Fixing Errors on Your Credit Report

Fixing errors on your credit report is crucial because even small mistakes can hurt your credit score. This can make it harder to get a personal loan or secure favorable interest rates. So, let’s dive into the step-by-step guide to help you correct those errors and improve your credit score for a personal loan.

Step 1: Obtain Your Credit Report

First, you need to get a copy of your credit report. You can request one for free from each of the three major credit bureaus: Experian, TransUnion, and Equifax. Make sure to check all three reports, as they may contain different information.

Step 2: Identify Errors

Next, carefully review your reports for any inaccuracies. Look for:

- Misspelled names

- Incorrect account balances

- Accounts that don’t belong to you If you find any mistakes, note them down. This is the first step in fixing errors on your credit report!

Step 3: Dispute the Errors

Now, it’s time to dispute the errors. Contact the credit bureau that has the incorrect information. You can usually do this online. Provide them with details about the error and any supporting documents. They will investigate and respond within 30 days.

Gathering Evidence: What Documentation Do You Need?

Fixing errors on your credit report is crucial for your financial health. A clean credit report can help you improve your credit score for a personal loan, making it easier to secure favorable terms. But before you can fix those pesky errors, you need to gather the right documentation. Let’s dive into what you need!

Essential Documents to Collect

To effectively dispute errors, you’ll need to gather specific documents. Here’s a quick list to help you get started:

- Credit Report Copies: Obtain your credit reports from all three major bureaus.

- Identification: A government-issued ID, like a driver’s license or passport.

- Proof of Address: Utility bills or bank statements showing your current address.

- Supporting Evidence: Any documents that support your claim, like payment receipts or account statements.

Organizing Your Evidence

Once you have your documents, organize them neatly. This will make it easier to reference them when you file your dispute. Keep copies of everything you send, and consider using a checklist to ensure you don’t miss anything. Remember, having solid evidence is key to successfully fixing errors on your credit report!

How to Dispute Errors with Credit Bureaus Effectively

Fixing errors on your credit report is essential, as even minor mistakes can negatively impact your credit score. This can complicate your chances of obtaining a personal loan or getting favorable interest rates. Here’s how to effectively dispute these errors with credit bureaus to improve your credit score for a personal loan.

Gather Your Information

Start by collecting all necessary documents, including your credit report, supporting evidence, and personal identification. Having everything organized will streamline the process.

Dispute the Error

- Contact the Credit Bureau: Reach out to the bureau that reported the error via online, mail, or phone.

- Explain the Issue: Clearly describe the error and provide evidence. Be concise yet thorough.

- Follow Up: After submitting your dispute, track your request. The bureau has 30 days to investigate, so check back if you don’t receive updates.

Wait for Results

After the investigation, the credit bureau will inform you of the outcome. If the error is corrected, your credit score may improve, making it easier to secure a personal loan. If not, consider escalating the dispute or contacting the creditor directly.

The Role of ‘ExpressCash’ in Resolving Credit Report Issues

Fixing errors on your credit report is essential for anyone seeking a personal loan. A clean report can greatly enhance your credit score, making approval easier and securing better interest rates. So, how do you approach this task? That’s where ‘ExpressCash’ comes in!

Easy Steps to Fix Errors

- Identify Errors: Review your credit report for inaccuracies like misspelled names or incorrect account details.

- Gather Evidence: Collect supporting documents, such as bank statements or creditor letters.

- Contact Credit Bureaus: Dispute the errors with credit bureaus. ‘ExpressCash’ offers templates and guidance to streamline this process.

Why Choose ‘ExpressCash’?

- User-Friendly: The site provides straightforward steps to simplify error correction.

- Expert Advice: Access tips from professionals on improving credit scores for personal loans.

- Support: Get customer support for any questions you may have.

Using ‘ExpressCash’, you can effectively navigate the steps to fix errors on your credit report, boosting your chances of obtaining that personal loan!

Monitoring Your Credit Report After Corrections

Monitoring your credit report after making corrections is essential. Once you’ve fixed errors, keeping an eye on your report ensures the changes remain and no new mistakes arise. A clean report can significantly improve your credit score for a personal loan!

Why Monitor Your Credit Report?

Regularly monitoring your credit report helps you catch new errors early, much like checking your homework before submission. It’s also vital for spotting potential identity theft, which can have serious consequences.

How to Monitor Your Credit Report

- Check Regularly: Review your report at least once a year. You can obtain a free report from each credit bureau annually.

- Set Alerts: Use services that provide alerts for changes to your report, keeping you informed.

- Use Credit Monitoring Services: Consider these services for ongoing updates, helping you quickly identify issues.

By being proactive, you can maintain a healthy credit report and enhance your credit score for a personal loan. A good score opens doors to better financial opportunities!

Tips for Maintaining a Healthy Credit Report

Maintaining a healthy credit report is crucial for your financial future. It can affect your ability to secure loans, rent an apartment, or even land a job. That’s why understanding how to fix errors on your credit report is so important. Let’s dive into some tips that can help you keep your credit report in top shape!

Regularly Check Your Credit Report

Make it a habit to check your credit report at least once a year. This way, you can spot any inaccuracies early on. If you find errors, don’t hesitate to take action. Fixing errors on your credit report can significantly improve your credit score for a personal loan, making it easier to get the funds you need.

Dispute Errors Promptly

If you discover a mistake, act quickly! Gather any supporting documents and contact the credit bureau. They are required to investigate your claim. Remember, the sooner you dispute an error, the sooner you can improve your credit score and enjoy better loan options.

FAQs

-

How do I find errors on my credit report?

You can request a free credit report from each major bureau (Experian, Equifax, TransUnion) and review it for mistakes like incorrect accounts or payments. -

What types of errors should I look for?

Common errors include wrong account balances, missed payments you actually made, duplicate entries, or accounts that don’t belong to you. -

How do I dispute an error on my credit report?

File a dispute online or by mail with the credit bureau that reported the error. Include documentation to support your claim. -

How long does it take to fix a credit report error?

Credit bureaus typically resolve disputes within 30 days and will notify you once the investigation is complete. -

Will fixing errors improve my credit score?

Yes—removing inaccurate negative items like false late payments or collections can boost your credit score significantly.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.