The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

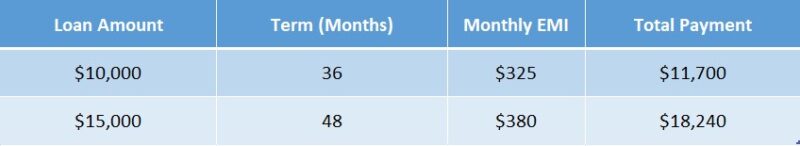

Total EMI Payment Calculator: See Full Repayment Amount

When you’re considering a personal loan, understanding how much you’ll repay is crucial. This is where the Total EMI Payment Calculator comes into play. It helps you see the full repayment amount, making it easier to plan your finances. Knowing your total EMI can save you from surprises later on!

What is a Total EMI Payment Calculator?

A Total EMI Payment Calculator is a handy tool that shows you the total amount you will pay back on your loan. It considers the principal amount, interest rate, and loan tenure. With this calculator, you can easily figure out how much you need to budget each month.

Benefits of Using the Calculator

- Clear Understanding: It gives you a clear picture of your financial commitment.

- Better Planning: Helps you plan your monthly expenses better.

- Comparison Tool: You can compare different loan offers easily!

Using a Personal Loan EMI Calculator can also help you adjust your loan terms to find the best fit for your budget. So, take advantage of these tools to make informed decisions!

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

How Does the Total EMI Payment Calculator Work?

Managing finances, especially loans, can be challenging. The Total EMI Payment Calculator simplifies this process by showing you the complete repayment amount of your loan. This clarity helps you budget effectively and avoid unexpected costs.

Using the Total EMI Payment Calculator is easy. Simply enter:

- Loan Amount: The total amount you wish to borrow.

- Interest Rate: The percentage charged by the lender.

- Loan Tenure: The duration for repayment.

After entering these details, the calculator computes your monthly EMI (Equated Monthly Installment) and the total repayment amount. This allows you to see the full picture of what you will pay back, beyond just the borrowed amount!

Benefits of Using the Calculator

- Easy Planning: Aids in budgeting your monthly expenses.

- Clear Understanding: Provides a precise idea of your total debt.

- Comparison Tool: Facilitates easy comparison of different loan options.

Key Benefits of Using a Total EMI Payment Calculator

When you’re planning to take a loan, understanding how much you’ll repay is crucial. This is where the Total EMI Payment Calculator comes into play. It helps you see the full repayment amount, making your financial planning much easier and clearer.

Clarity on Repayment Amount

Using a Personal Loan EMI Calculator gives you a clear picture of your total payments. You can see how much interest you’ll pay over time, which helps you avoid surprises later on.

Easy Comparisons

With the Total EMI Payment Calculator, you can easily compare different loan options. This way, you can choose the best deal that fits your budget and needs, ensuring you make an informed decision.

Budgeting Made Simple

Knowing your total EMI helps you budget better. You can plan your monthly expenses without worrying about unexpected costs. This peace of mind is invaluable when managing your finances.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

What Factors Influence Your Total EMI Payment?

When considering a loan, understanding your Total EMI Payment Calculator is crucial. It helps you see the full repayment amount, making it easier to plan your finances. Knowing what influences your EMI can save you from surprises down the road!

Loan Amount

The more money you borrow, the higher your EMI will be. Use a Personal Loan EMI Calculator to see how different amounts affect your payments.

Interest Rate

Interest rates can vary widely. A lower rate means lower EMIs, while a higher rate increases your total payment. Always compare rates before choosing a loan!

Loan Tenure

The duration of your loan also matters. A longer tenure reduces your monthly EMI but increases the total interest paid. Find a balance that works for you!

Prepayment Options

Some loans allow you to pay off part of the loan early. This can reduce your total EMI payment significantly, so check if your loan offers this feature.

Also Read: Personal Loan EMI Calculator: Find Your Monthly Installments

Calculating Your Total EMI: Step-by-Step Instructions

When you’re planning to take a personal loan, understanding your Total EMI Payment Calculator is crucial. This tool helps you see the full repayment amount, making it easier to budget your finances. Knowing your total EMI can save you from surprises later on!

How to Use the Total EMI Payment Calculator

Using a Total EMI Payment Calculator is simple. Just follow these steps:

- Input Loan Amount: Enter the total amount you wish to borrow.

- Set Interest Rate: Input the interest rate offered by your lender.

- Choose Loan Tenure: Select how long you want to repay the loan.

- Calculate: Hit the calculate button to see your total EMI and repayment amount!

Benefits of Knowing Your Total EMI

Understanding your Total EMI can help you:

- Plan Your Budget: Know how much to set aside each month.

- Avoid Over-Borrowing: See what you can realistically afford.

- Make Informed Decisions: Choose the best loan option for your needs. Using a Personal Loan EMI Calculator can make this process even easier!

Common Mistakes to Avoid When Using an EMI Calculator

Using a Total EMI Payment Calculator is a smart way to understand how much you’ll pay back on a loan. It helps you see the full repayment amount, making budgeting easier. However, many people make mistakes that can lead to confusion or unexpected costs. Let’s explore some common pitfalls to avoid!

Not Including All Costs

When using a Personal Loan EMI Calculator, remember to include all associated fees. Some loans have processing fees or insurance costs that can affect your total payment. Ignoring these can lead to a surprise when you see the final amount!

Misunderstanding the Interest Rate

Another common mistake is not fully grasping how interest rates work. A lower rate might seem better, but if it’s variable, your payments could change. Always check if the rate is fixed or floating to avoid future surprises.

How to Use the Total EMI Payment Calculator Effectively

Understanding your total repayment amount is essential when taking out a loan. The Total EMI Payment Calculator allows you to see how much you will repay over time, providing clarity on your financial commitment, especially for personal loans.

Using the Personal Loan EMI Calculator is easy. Here’s how to maximize its benefits:

- Input Your Loan Amount: Enter the total amount you wish to borrow, as this is crucial for calculations.

- Set the Interest Rate: Input the interest rate from your lender, which significantly affects your total repayment.

- Choose Your Tenure: Select the loan tenure, which is the repayment duration.

Longer tenures result in smaller EMIs but more interest paid overall. After entering these details, the calculator will display your monthly EMI and total repayment amount. This insight helps you manage your finances better and avoid unexpected costs.

Real-Life Scenarios: When to Use the Total EMI Payment Calculator

When you’re considering a personal loan, understanding your total repayment amount is crucial. This is where the Total EMI Payment Calculator comes into play. It helps you see how much you’ll pay over the loan’s life, making it easier to plan your finances. Knowing the full repayment amount can prevent surprises down the road!

Imagine you’re planning to buy a new car. You might wonder, “How much will I actually pay each month?” By using the Total EMI Payment Calculator, you can input the loan amount, interest rate, and tenure to get a clear picture of your monthly payments. This way, you can budget effectively and avoid overspending. Another scenario is when you’re comparing different loans. With a Personal Loan EMI Calculator, you can easily see how varying interest rates affect your total payment. This comparison helps you choose the best option that fits your financial situation, ensuring you make a smart decision.

Explore Additional Resources on Total EMI Payments

Understanding your Total EMI Payment is crucial when planning your finances. The Total EMI Payment Calculator helps you see the full repayment amount for your loans, making it easier to budget and avoid surprises. Knowing how much you owe each month can bring peace of mind and help you make informed decisions.

Benefits of Using a Total EMI Payment Calculator

- Clarity: It provides a clear picture of your total repayment amount.

- Budgeting: Helps you plan your monthly expenses better.

- Comparison: Easily compare different loan options to find the best fit for you.

Personal Loan EMI Calculator

Using a Personal Loan EMI Calculator can further simplify your loan management. It allows you to input your loan amount, interest rate, and tenure to calculate your monthly payments. This tool is especially useful for understanding how different factors affect your total EMI, ensuring you choose wisely.

How ExpressCash Can Simplify Your EMI Calculations

Managing your finances effectively requires a clear understanding of your total repayment amount. The Total EMI Payment Calculator is an essential tool that provides a comprehensive view of your loan obligations, simplifying calculations and empowering informed decisions about personal loans.

At ExpressCash, calculating your EMIs is straightforward. Our Total EMI Payment Calculator allows you to enter your loan amount, interest rate, and tenure for instant results. Here’s what you can expect:

- User-Friendly Interface: Easily navigate the tool without any hassle.

- Instant Results: Receive your total repayment amount in seconds, saving you time.

- Accurate Calculations: Rely on precise figures to effectively plan your budget.

Using a Personal Loan EMI Calculator is equally simple, helping you understand your monthly payments and manage your finances better. With ExpressCash, you can confidently take control of your loans and avoid unexpected surprises. Start calculating today to stay on top of your payments!

FAQs

-

What is a total EMI payment calculator?

It’s a tool that calculates the total amount you’ll repay over the loan tenure, including both principal and interest. -

How is the total EMI payment calculated?

It multiplies the monthly EMI by the number of months in your loan tenure:

Total EMI Payment = EMI × Tenure (in months) -

What inputs do I need to use the calculator?

You’ll typically need to enter the loan amount, interest rate, and loan tenure. -

Does the calculator show interest and principal separately?

Yes, many calculators break down the total repayment into interest paid and principal repaid for better understanding. -

Can I compare different loan scenarios with it?

Absolutely—these calculators let you adjust loan terms to see how they impact your total repayment cost.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.