The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

Monthly Loan Installment Calculator: Estimate Your EMI

When you’re thinking about taking a loan, understanding how much you’ll pay each month is crucial. This is where the Monthly Loan Installment Calculator comes into play. It helps you estimate your Equated Monthly Installment (EMI), making it easier to plan your finances. Knowing your EMI can help you avoid surprises and manage your budget effectively.

What is a Monthly Loan Installment Calculator?

A Monthly Loan Installment Calculator is a simple tool that allows you to calculate your monthly payments on a loan. By entering the loan amount, interest rate, and loan tenure, you can quickly see how much you’ll need to pay each month. This is especially useful for personal loans, where knowing your EMI can help you decide if the loan fits your budget.

Benefits of Using a Personal Loan EMI Calculator

Using a Personal Loan EMI Calculator offers several advantages:

- Easy Planning: You can plan your monthly expenses better.

- Compare Loans: It helps you compare different loan offers.

- Financial Awareness: You gain a clearer understanding of your financial commitments.

- Stress Reduction: Knowing your EMI reduces anxiety about repayment.

By utilizing these calculators, you can make informed decisions and choose the best loan option for your needs.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

How Does the Monthly Loan Installment Calculator Work?

Understanding your finances can be tricky, especially when it comes to loans. That’s where the Monthly Loan Installment Calculator comes in handy! This tool helps you estimate your Equated Monthly Installment (EMI) for personal loans, making budgeting easier and more manageable.

Using a Personal Loan EMI Calculator is simple and straightforward. You just need to input a few key details:

- Loan Amount: The total money you plan to borrow.

- Interest Rate: The percentage charged by the lender.

- Loan Tenure: The duration over which you’ll repay the loan.

Once you enter these details, the calculator does the math for you! It uses a formula to determine your monthly payments, giving you a clear picture of what to expect. This way, you can plan your finances better and avoid surprises.

Why Use a Monthly Loan Installment Calculator?

Using this calculator offers several benefits:

- Clarity: You’ll know exactly how much you need to pay each month.

- Budgeting: Helps you plan your expenses around your EMI.

- Comparison: Easily compare different loan options to find the best fit for you.

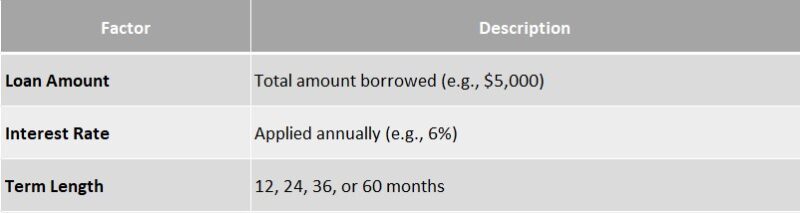

Key Factors Influencing Your EMI Calculation

When you’re thinking about taking a loan, understanding how much you’ll pay each month is super important. That’s where a Monthly Loan Installment Calculator comes in handy! It helps you estimate your EMI, or Equated Monthly Installment, so you can plan your budget better.

Loan Amount

The first thing to consider is the loan amount. The more money you borrow, the higher your EMI will be. Think of it like buying a video game; if you want the latest one, you might need to save up more!

Interest Rate

Next up is the interest rate. This is the cost of borrowing money. A lower interest rate means a lower EMI, which is great for your wallet! You can use a Personal Loan EMI Calculator to see how different rates affect your payments.

Loan Tenure

Lastly, the loan tenure plays a big role. This is how long you have to pay back the loan. A longer tenure means smaller EMIs, but you might end up paying more interest overall. It’s like stretching a rubber band; the longer you stretch it, the easier it is to hold, but it can snap if you stretch it too far! By keeping these factors in mind, you can use the Monthly Loan Installment Calculator effectively and make informed decisions about your loans.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

Why You Should Use a Monthly Loan Installment Calculator Before Borrowing

When considering a loan, understanding your monthly payments is crucial. A Monthly Loan Installment Calculator helps you estimate your Equated Monthly Installment (EMI) before you borrow. This tool is like a financial compass, guiding you through the often confusing world of loans.

Using a Monthly Loan Installment Calculator can save you from unexpected surprises. Here’s why it’s essential:

Clarity on Payments

- Know Your EMI: With a Personal Loan EMI Calculator, you can see how much you’ll pay each month. This clarity helps you budget better.

Compare Options

- Choose Wisely: By adjusting loan amounts and interest rates, you can compare different loans. This way, you can find the best deal that fits your needs.

Avoid Over-Borrowing

- Stay Within Limits: Knowing your EMI helps you avoid borrowing more than you can afford. It keeps your finances in check, ensuring you don’t end up in debt trouble. In conclusion, using a Monthly Loan Installment Calculator is a smart move. It empowers you with knowledge, helping you make informed decisions about your financial future. So, before you sign on the dotted line, take a moment to calculate your EMI!

Also Read: Personal Loan EMI Calculator: Find Your Monthly Installments

Tips for Accurately Estimating Your Monthly Loan Payments

When planning to take out a loan, knowing your monthly payment is crucial. A Monthly Loan Installment Calculator is a valuable tool that helps you estimate your EMI (Equated Monthly Installment), making budgeting simpler and providing peace of mind.

Understand the Key Factors

To get an accurate estimate, know the loan amount, interest rate, and loan tenure. These elements significantly impact your EMI, so precise inputs lead to better estimates!

Use a Personal Loan EMI Calculator

A Personal Loan EMI Calculator simplifies the process. Just input your details, and you’ll instantly see your monthly payments, making it feel like you have a financial advisor at your side!

Keep an Eye on Additional Costs

Remember to factor in extra fees like processing charges or insurance. Including these in your calculations helps you avoid unexpected costs later on.

Compare Different Scenarios

Adjust the loan amount or tenure in the Monthly Loan Installment Calculator to see how changes affect your EMI. This helps you find a plan that fits your budget!

Review Your Budget

Before finalizing your loan, check your monthly budget to ensure the estimated EMI is manageable with your other expenses, preventing financial strain later.

Seek Professional Advice

If you’re uncertain, don’t hesitate to seek help. Financial advisors can offer valuable insights and guide you through the loan process, making it less daunting.

How ExpressCash Can Simplify Your Loan Management

Managing loans can be daunting, but it doesn’t have to be! With a Monthly Loan Installment Calculator, estimating your EMI (Equated Monthly Installment) becomes a breeze. This tool simplifies loan management by helping you understand your monthly payments, making the process stress-free.

Easy Calculations

Our Personal Loan EMI Calculator allows you to quickly input your loan amount, interest rate, and tenure. In just a few clicks, you’ll see your monthly payment—no more guesswork!

Benefits of Using Our Calculator

- Clear Understanding: Know exactly what you’ll pay each month.

- Budgeting Made Simple: Plan your finances better with accurate EMI estimates.

- Time-Saving: Get instant results without complicated math.

With these insights, you can make informed decisions about your loans, ensuring you choose the best options for your financial future.

Make Informed Decisions

Knowing your EMI allows you to compare different loan offers, helping you select the best deal for your budget. This understanding can prevent surprises later on, boosting your confidence in financial choices.

Track Your Progress

Our calculator is useful throughout your loan term, enabling you to track payments and adjust your budget as needed. Staying on top of your finances has never been easier!

User-Friendly Experience

At ExpressCash, our Personal Loan EMI Calculator is designed for ease of use. Even non-experts can navigate it effortlessly. Just enter your details, and let the calculator do the rest!

Frequently Asked Questions About Monthly Loan Installment Calculators

-

What is a monthly loan installment calculator?

It’s a tool that helps you estimate your monthly payments based on the loan amount, interest rate, and repayment term. -

How do I use a loan installment calculator?

Enter the loan amount, annual interest rate, and loan term (in months or years) to instantly see your estimated monthly payment. -

What factors affect my monthly loan installment?

Your loan amount, interest rate, repayment term, and loan type (fixed or variable rate) all impact the size of your monthly payment. -

Can I use the calculator for different types of loans?

Yes, it’s useful for personal loans, car loans, home loans, and even student or business loans, as long as you know the basic loan terms. -

Does this calculator include fees or other charges?

Most basic calculators show principal and interest only. Be sure to factor in fees, insurance, or taxes separately if they apply.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.