The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

Personal Loans for Home Renovation: Best Options

When it comes to sprucing up your home, personal loans for home renovation can be a game changer. Whether you’re dreaming of a new kitchen or a cozy bathroom, these loans can help turn your vision into reality. But with so many options available, how do you choose the best one?

Types of Personal Loans

There are several types of personal loans that can fund your renovation project. Here are a few popular options:

- Unsecured Personal Loans: These don’t require collateral, making them easier to obtain. However, they often come with higher interest rates.

- Secured Personal Loans: These loans require collateral, like your home. They usually have lower interest rates but come with the risk of losing your asset if you default.

- Home Equity Loans: If you have equity in your home, this option allows you to borrow against it. It can offer lower rates but requires a good amount of equity built up.

Choosing the right personal loan for home renovation is crucial. Consider your budget, the total cost of the project, and how quickly you need the funds. Always compare interest rates and terms from different lenders to find the best fit for your needs. Remember, a little research can save you a lot of money!

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

Top Benefits of Using Personal Loans for Home Renovation

Using Personal Loans for Home Renovation is a smart way to finance your home improvement projects without emptying your savings. Whether you’re updating your kitchen or adding a deck, knowing the benefits can guide your decision-making.

Quick Access to Funds

One major advantage is the quick access to cash. Personal loans can often be approved in just a few days, allowing you to start your renovation sooner!

Flexible Loan Amounts

With various Types of Personal Loans available, you can select an amount that suits your needs. Whether it’s a small loan for minor repairs or a larger sum for a complete overhaul, this flexibility helps in budgeting your renovations.

Competitive Interest Rates

Personal loans typically offer competitive interest rates compared to credit cards, making them a more affordable financing option. This can save you money over time!

No Collateral Required

Most personal loans are unsecured, meaning you don’t need to put up your home as collateral. This reduces your risk and makes it easier to qualify, especially with a good credit score.

Improve Home Value

Investing in renovations can boost your home’s value. By using personal loans wisely, you enhance your living space and increase your property’s market appeal, which is beneficial if you plan to sell.

Simple Application Process

Applying for a personal loan is often easy, with many lenders offering online applications that can be completed in minutes. Just a few documents can get your renovation plans underway!

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

How to Choose the Right Personal Loan for Your Renovation Project

When it comes to sprucing up your home, choosing the right financing can make all the difference. Personal loans for home renovation are a popular choice, offering flexibility and quick access to funds. But with so many options available, how do you pick the best one for your project?

Understand Your Needs

Before diving into the types of personal loans, take a moment to assess your renovation goals. Are you planning a small update or a major overhaul? Knowing your budget will help you narrow down your options and choose a loan that fits your needs.

Explore Types of Personal Loans

There are several types of personal loans to consider:

- Secured Loans: These require collateral, often resulting in lower interest rates.

- Unsecured Loans: No collateral needed, but they may come with higher rates.

- Fixed-Rate Loans: Your interest rate stays the same, making budgeting easier.

- Variable-Rate Loans: Rates can change, which might save you money but adds risk.

Choosing the right type depends on your financial situation and comfort level with risk.

Compare Lenders

Once you know what you need, it’s time to shop around. Different lenders offer various terms, rates, and fees. Make sure to compare:

- Interest Rates: Lower rates save you money.

- Loan Terms: Longer terms mean smaller payments but more interest overall.

- Fees: Look out for hidden costs that can add up.

Taking the time to compare can lead to significant savings on your renovation project.

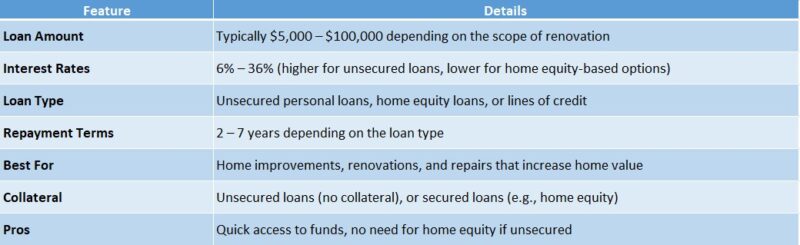

Comparing Personal Loans for Home Renovation: Rates and Terms Explained

When it comes to sprucing up your home, understanding the best options for Personal Loans for Home Renovation is crucial. These loans can help you transform your living space without breaking the bank. But how do you choose the right one? Let’s dive into the details!

Types of Personal Loans

- Unsecured Personal Loans: These don’t require collateral, making them a popular choice. However, they often come with higher interest rates.

- Secured Personal Loans: These loans are backed by an asset, like your home. They usually have lower rates but come with the risk of losing your asset if you default.

- Home Equity Loans: If you have equity in your home, this can be a great option. They typically offer lower rates, but you’re borrowing against your home’s value.

Key Factors to Consider

- Interest Rates: Look for competitive rates to save money over time.

- Loan Terms: Shorter terms mean higher payments but less interest paid overall. Longer terms offer lower payments but can cost more in interest.

- Fees: Always check for hidden fees that could increase your loan cost.

Is a Personal Loan the Best Option for Your Home Renovation?

When it comes to home renovations, many homeowners find themselves asking: is a personal loan the best option? Personal Loans for Home Renovation can be a smart choice, especially if you need quick access to funds. Let’s explore why these loans might be the right fit for your project.

Personal loans come in various types, making it easier to find one that suits your needs. Here are some popular options:

- Unsecured Personal Loans: These don’t require collateral, which means you won’t risk your home. However, they often come with higher interest rates.

- Secured Personal Loans: These loans require collateral, like your home or car. They usually have lower interest rates but come with more risk.

- Fixed-Rate Personal Loans: With a fixed rate, your monthly payments stay the same, making budgeting easier.

- Variable-Rate Personal Loans: These can fluctuate, which might save you money if rates drop, but they can also increase your payments unexpectedly.

Choosing the right type of personal loan can make your renovation dreams a reality. Just remember to compare interest rates and terms to find the best deal for your budget.

How ExpressCash Can Help You Secure the Best Personal Loan

When it comes to transforming your home, personal loans for home renovation can be a game changer. Whether you want to update your kitchen or add a cozy deck, having the right financing can make all the difference. But how do you find the best options? That’s where ExpressCash comes in!

At ExpressCash, we understand that navigating the world of personal loans can feel overwhelming. With so many types of personal loans available, it’s crucial to find one that fits your needs. Here’s how we can assist you:

Expert Guidance

- Personalized Advice: Our team offers tailored advice based on your financial situation.

- Loan Comparisons: We help you compare different lenders and their offers, ensuring you get the best rates.

- Application Support: From filling out forms to understanding terms, we guide you every step of the way.

By choosing ExpressCash, you’re not just getting a loan; you’re gaining a partner in your home renovation journey. With our help, you can confidently secure the funding you need to create the home of your dreams.

Tips for Successfully Managing Your Personal Loan for Home Renovation

When it comes to improving your home, personal loans for home renovation can be a great solution. They provide the funds needed to transform your space without breaking the bank. Understanding how to manage these loans effectively is crucial for a smooth renovation experience.

Know Your Loan Options

Before diving into renovations, explore the types of personal loans available. You can choose from secured loans, which require collateral, or unsecured loans, which don’t. Each type has its pros and cons, so pick one that fits your financial situation.

Create a Budget

Setting a clear budget is essential. List all renovation costs, including materials and labor. This way, you can determine how much you need to borrow and avoid overspending. Stick to your budget to keep your finances in check during the renovation process.

Make Timely Payments

Once you secure your personal loan for home renovation, make sure to pay on time. Late payments can lead to extra fees and hurt your credit score. Set reminders or automate payments to stay on track. This will help you enjoy your new space without financial stress.

FAQs

-

Can I use a personal loan for home renovations?

Yes, personal loans are a popular financing option for home improvement projects, especially if you need quick access to funds without using your home as collateral. -

What are the benefits of using a personal loan for renovations?

Personal loans offer fast approval, no need for home equity, and fixed monthly payments, making budgeting for your renovation easier. -

How much can I borrow for home improvements?

Loan amounts vary by lender, but most offer between $1,000 and $50,000, depending on your creditworthiness and income. -

Is it better to use a personal loan or a home equity loan?

A personal loan is ideal if you don’t have enough equity in your home or prefer an unsecured option. Home equity loans may offer lower interest rates but require your home as collateral. -

Do I need to show renovation plans or contractor quotes?

Typically, no. Most lenders don’t require detailed plans or quotes—just proof of income and your credit information to assess eligibility.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.