The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

Loan Dispute Resolution Process: What Are Your Options?

Understanding the Loan Dispute Resolution Process is vital for anyone with personal loans. Knowing your options can save time, money, and stress, especially if you’re facing a personal loan default or need clarity on recovery. This guide will help you navigate the process effectively.

What is the Loan Dispute Resolution Process?

The Loan Dispute Resolution Process is a structured method for addressing disagreements between borrowers and lenders. It ensures both parties can present their cases and find a fair solution, protecting your rights and preventing escalation.

Your Options for Resolution

If you encounter a loan dispute, consider these options:

- Direct Communication: Talk to your lender; a simple conversation can resolve misunderstandings.

- Mediation: If direct talks fail, a neutral third party can help find common ground.

- Arbitration: A more formal process where an arbitrator makes a decision, usually quicker than court.

- Legal Action: As a last resort, consider legal action if your rights are violated.

Understanding these options empowers you to take control and work towards a resolution.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

What Triggers a Loan Dispute?

Understanding the Loan Dispute Resolution Process is essential for borrowers, as disputes can arise unexpectedly. Knowing your options can save you time, money, and stress. So, what triggers a loan dispute? Here are some common scenarios.

Common Triggers for Loan Disputes

- Personal Loan Default: Missing payments can lead to disputes and negatively impact your credit score.

- Miscommunication: Misunderstandings about loan terms can cause disputes, highlighting the importance of clear communication.

- Fraudulent Activity: If you suspect fraud, act quickly. Unauthorized transactions or identity theft can lead to serious disputes that need immediate attention.

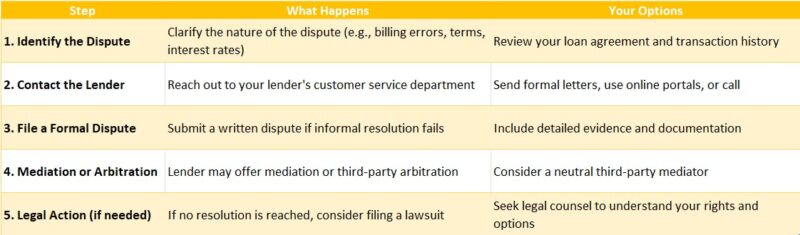

Steps to Resolve a Loan Dispute

- Contact Your Lender: Discuss the issue directly with your lender for potential solutions.

- Document Everything: Keep detailed records of all communications and transactions, as this can be crucial for resolution.

- Seek Mediation: If direct communication fails, mediation can help both parties reach a fair resolution without going to court.

Exploring Your Options: Mediation vs. Arbitration

When facing a loan dispute, understanding your options is crucial. The Loan Dispute Resolution Process can help you navigate challenges like personal loan default and recovery. Knowing whether to choose mediation or arbitration can make a significant difference in resolving your issues effectively.

Mediation: A Friendly Approach

Mediation is like having a conversation with a neutral third party. They help both sides talk it out and find common ground. This option is often quicker and less formal, making it a great choice for those who want to maintain a good relationship with their lender.

Arbitration: A More Formal Route

On the other hand, arbitration is more structured. An arbitrator listens to both sides and makes a binding decision. This can be beneficial if you want a clear resolution but might feel more intimidating. It’s essential to weigh the pros and cons of each option before deciding.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

How to Prepare for a Loan Dispute Resolution

When you find yourself in a tough spot with your loan, understanding the Loan Dispute Resolution Process can make all the difference. Knowing your options helps you tackle issues like Personal Loan Default and Recovery with confidence. Let’s dive into how you can prepare for this journey.

Understand Your Rights

Before you start, it’s crucial to know your rights as a borrower. Familiarize yourself with the terms of your loan agreement. This knowledge empowers you to identify any unfair practices and strengthens your position during the dispute resolution process.

Gather Your Documentation

Collect all relevant documents, such as loan agreements, payment records, and any communication with your lender. Having these at hand will support your case and clarify any misunderstandings. Remember, clear evidence is key to resolving disputes effectively.

Also Read: Personal Loan Default and Recovery: What You Should Know

The Role of Documentation in the Loan Dispute Resolution Process

When facing a loan dispute, understanding the Loan Dispute Resolution Process is crucial. It can help you navigate through challenges like personal loan default and recovery. Knowing your options can empower you to take action and potentially resolve issues effectively.

The Importance of Documentation

Documentation plays a vital role in the loan dispute resolution process. It serves as proof of your claims and can significantly influence the outcome. Without proper records, it’s like trying to win a game without knowing the rules!

Key Documents to Gather

- Loan Agreement: This outlines the terms and conditions of your loan.

- Payment Records: Keep track of all payments made to show your commitment.

- Correspondence: Any communication with your lender can help clarify misunderstandings.

Having these documents ready can streamline the resolution process and strengthen your position.

When to Seek Legal Advice in Loan Disputes

Understanding the Loan Dispute Resolution Process is essential for anyone dealing with loan issues. Whether it’s a personal loan default or a misunderstanding with your lender, knowing your options can save you time, money, and stress. But when should you seek legal advice?

Consider consulting a lawyer if you experience:

- Repeated Denials: Your lender continually denies your requests for adjustments.

- Legal Threats: You receive legal notices regarding your loan.

- Complexity: The loan terms are confusing, and you’re unsure of your rights.

- Personal Loan Default: Facing potential recovery actions can jeopardize your interests, making legal advice crucial.

Seeking legal advice early can help you navigate the Loan Dispute Resolution Process effectively. A lawyer can clarify your situation and explore all available options, ensuring you make informed decisions. Don’t hesitate to reach out for help when needed!

The Importance of Timeliness in Resolving Loan Disputes

When it comes to the Loan Dispute Resolution Process, understanding your options is crucial. Timeliness plays a significant role in resolving disputes effectively. The sooner you address issues, the better your chances of a favorable outcome. Ignoring problems can lead to complications, especially in cases of Personal Loan Default and Recovery.

Why Timeliness Matters

Acting quickly can prevent a small issue from escalating into a larger problem. If you notice discrepancies in your loan terms or payments, reach out to your lender immediately. This proactive approach can save you time, money, and stress in the long run.

Key Steps to Take

- Document Everything: Keep records of all communications.

- Contact Your Lender: Discuss your concerns as soon as possible.

- Explore Options: Understand the different paths available for resolution.

By following these steps, you can navigate the Loan Dispute Resolution Process more effectively and ensure a smoother recovery from any personal loan issues.

How ‘ExpressCash’ Can Support You in Loan Dispute Resolution

Understanding the Loan Dispute Resolution Process is crucial for anyone facing challenges with their loans. Whether you’re dealing with a personal loan default or seeking recovery options, knowing your rights and the available paths can make a significant difference in your financial journey. That’s where ‘ExpressCash’ comes in to support you.

How ‘ExpressCash’ Can Help You

At ‘ExpressCash’, we believe in empowering you through the Loan Dispute Resolution Process. Here’s how we can assist you:

- Expert Guidance: Our team provides clear advice tailored to your situation, helping you navigate the complexities of loan disputes.

- Negotiation Support: We can help negotiate with lenders on your behalf, aiming for a fair resolution that suits your needs.

- Resource Access: Gain access to valuable resources and tools that can aid in understanding your rights and options during a personal loan default and recovery process.

By choosing ‘ExpressCash’, you’re not just getting support; you’re gaining a partner in your financial recovery journey.

Common Mistakes to Avoid During the Loan Dispute Process

Navigating the Loan Dispute Resolution Process can be daunting, especially during a personal loan default. Understanding your options is essential, but many borrowers make mistakes that complicate matters. Here are some common pitfalls to avoid:

Ignoring Communication

Failing to communicate with your lender can lead to misunderstandings. Always respond to calls and letters promptly, and keep records of all interactions to support your case.

Not Knowing Your Rights

Many borrowers are unaware of their rights regarding personal loans. Familiarizing yourself with relevant laws empowers you to advocate for yourself effectively against unfair practices.

Failing to Document Everything

Not keeping thorough documentation is another mistake. Save copies of loan agreements, payment records, and correspondence, as these are crucial for your dispute resolution process.

Rushing the Process

Many borrowers rush for a quick resolution. Take your time to understand each step, as patience can lead to better outcomes.

Neglecting Professional Help

Lastly, don’t hesitate to seek help from financial advisors or legal experts. They can provide valuable insights and guide you through the complexities of personal loan default and recovery.

What Happens After a Loan Dispute is Resolved?

Resolving a loan dispute can be a challenging experience, but understanding what comes next is essential. The Loan Dispute Resolution Process aims to provide clarity and peace of mind after disagreements with lenders. Knowing your options is crucial for moving forward.

Understanding Your Options

Once a loan dispute is resolved, you have several paths to consider. If an agreement is reached, it’s vital to adhere to the terms, which may involve modified loan payments or a repayment plan. For those facing Personal Loan Default and Recovery, being proactive is essential.

Key Steps to Take

- Review the Agreement: Ensure you understand all terms.

- Communicate with Your Lender: Maintain open communication for future issues.

- Monitor Your Credit: Regularly check for changes that could impact your credit score.

- Seek Financial Advice: Consult a financial advisor if necessary to help navigate your next steps.

By following these steps, you can facilitate a smoother transition after resolving your loan dispute.

FAQs

-

What is a loan dispute?

A loan dispute occurs when a borrower disagrees with the terms, charges, repayment status, or actions taken by a lender, such as reporting incorrect information to credit bureaus. -

How do I start the loan dispute resolution process?

Begin by contacting your lender in writing, clearly stating the issue and providing supporting documents. If unresolved, you can escalate the dispute to a financial ombudsman or regulator. -

What documents should I provide in a loan dispute?

Include your loan agreement, payment records, communication history, and any evidence of errors or unfair practices. -

Can I dispute a loan default on my credit report?

Yes. If the default is reported in error, you can file a dispute with the credit bureau and request a correction. The bureau will investigate within 30–45 days. -

What if the lender refuses to resolve the dispute?

If the lender is unresponsive or denies your claim unfairly, you can file a formal complaint with a consumer protection agency, such as the CFPB in the U.S., or seek legal help.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.