The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

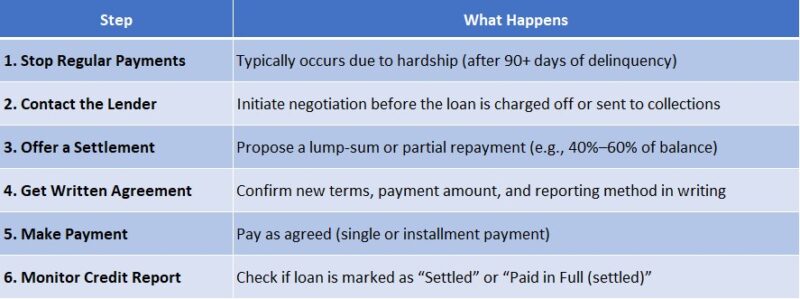

Personal Loan Settlement Process: Step-by-Step Guide

Understanding the Personal Loan Settlement Process is crucial for anyone facing financial difficulties. When you find yourself unable to repay your personal loan, knowing the steps to settle it can save you from further stress. This guide will walk you through the process, making it easier to navigate your options.

What is Personal Loan Settlement?

Personal loan settlement is an agreement between you and your lender to pay a reduced amount to clear your debt. This process is especially important if you’re facing a Personal Loan Default. It helps you avoid legal actions and can improve your financial situation.

Steps in the Personal Loan Settlement Process

- Assess Your Financial Situation:

- Determine how much you can afford to pay.

- Contact Your Lender:

- Discuss your situation openly.

- Negotiate a Settlement Amount:

- Aim for a lower amount than what you owe.

- Get Everything in Writing:

- Ensure all agreements are documented.

- Make the Payment:

- Pay the agreed amount to settle your loan.

- Confirm the Settlement:

- Request a letter confirming your loan is settled.

Following these steps can help you navigate the Personal Loan Recovery process smoothly, allowing you to regain control of your finances.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

Why Consider Settling Your Personal Loan?

When unexpected challenges arise, managing a personal loan can feel overwhelming. Understanding the Personal Loan Settlement Process is essential for those struggling with repayments. Settling your loan can offer a fresh start and help you regain financial control.

Avoiding Personal Loan Default

Settling your loan can prevent a Personal Loan Default, which negatively affects your credit score. By negotiating a lower payoff amount, you can avoid the long-term consequences of defaulting.

Recovery from Financial Struggles

The Personal Loan Settlement Process helps you recover from financial difficulties, relieving stress and providing a clear path forward. This allows you to focus on rebuilding your financial health.

Benefits of Settling Your Loan

- Lower Payments: You may pay less than owed.

- Less Stress: Reduces anxiety from unpaid debts.

- Improved Credit Score: You can work on rebuilding your credit.

- Fresh Start: Move forward without debt burdens.

Steps to Start the Settlement Process

- Assess Your Situation: Know how much you owe.

- Contact Your Lender: Discuss your difficulties.

- Negotiate Terms: Suggest an affordable settlement amount.

- Get Everything in Writing: Document all agreements.

- Make the Payment: Complete the agreed payment to settle your loan.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

Step 1: Assessing Your Financial Situation Before Settlement

Understanding the Personal Loan Settlement Process is vital for anyone struggling with financial issues. If you’re unable to repay your personal loan, knowing how to navigate the settlement process can alleviate stress and help you regain control of your finances. Let’s explore the first step: assessing your financial situation before settlement.

Before settling your personal loan, it’s crucial to evaluate your finances. This involves understanding your total debt, income, and expenses. Consider these key points:

- Total Debt: Calculate how much you owe on your personal loan.

- Income: Review your monthly income to determine what you can afford to pay.

- Expenses: List your monthly expenses to find areas to cut back.

By assessing these factors, you can decide if a settlement is right for you. This understanding is the first step in the Personal Loan Default and Recovery journey. With a clear picture of your finances, you can make informed decisions and negotiate effectively with your lender, helping you avoid deeper debt. Take your time, gather your financial documents, and prepare for the journey ahead.

Also Read: Personal Loan Default and Recovery: What You Should Know

Step 2: Contacting Your Lender: How to Start the Conversation

When you’re facing challenges with your personal loan, understanding the Personal Loan Settlement Process can be a lifesaver. This step-by-step guide is designed to help you navigate the tricky waters of loan default and recovery, making it easier to communicate with your lender and find a solution that works for you.

Reaching out to your lender might feel daunting, but it’s a crucial step in the Personal Loan Settlement Process. Start by gathering all your loan details, including your account number and payment history. This preparation shows your lender that you’re serious about resolving the issue.

Tips for a Successful Conversation

- Be Honest: Explain your situation clearly. Lenders appreciate transparency.

- Stay Calm: Approach the conversation with a positive attitude. It helps build rapport.

- Ask Questions: Don’t hesitate to inquire about your options. Understanding your choices is key to recovery. By initiating this conversation, you take control of your financial situation, paving the way for a potential settlement that can ease your burden.

What Documents Do You Need for the Personal Loan Settlement Process?

Understanding the Personal Loan Settlement Process is crucial for anyone facing difficulties with their loans. When you find yourself unable to make payments, knowing what documents you need can make the recovery journey smoother. Let’s dive into what you’ll need to gather for a successful settlement.

Essential Documents for Settlement

To start the Personal Loan Settlement Process, you’ll need a few key documents. These include:

- Loan Agreement: This outlines the terms of your loan and is essential for negotiations.

- Payment History: A record of your payments shows your lender your commitment and current situation.

- Income Proof: Documents like pay stubs or bank statements help demonstrate your financial status.

- Identity Proof: A government-issued ID verifies your identity during the process.

Having these documents ready not only speeds up the process but also helps in negotiating better terms. Remember, being organized can make a significant difference in your Personal Loan Default and Recovery journey!

Step 3: Negotiating Terms: Tips for a Successful Settlement

When you’re in a tough spot with your personal loan, understanding the Personal Loan Settlement Process can be a game changer. This step-by-step guide helps you navigate the complexities of negotiating your loan terms, especially after a Personal Loan Default. Let’s dive into Step 3: Negotiating Terms, where the real magic happens!

Know Your Numbers

Before you start negotiating, gather all the details about your loan. Know how much you owe, your payment history, and any fees involved. This information empowers you during discussions and shows the lender you’re serious about settling your debt.

Tips for Successful Negotiation

- Be Honest: Share your financial situation openly. Lenders appreciate transparency.

- Stay Calm: Emotions can run high, but keeping a cool head helps you think clearly.

- Offer a Reasonable Amount: Propose a settlement amount you can afford. This shows you’re committed to resolving the issue.

- Get Everything in Writing: Once you reach an agreement, ensure you have it documented. This protects you in the future.

Negotiating terms is crucial in the Personal Loan Settlement Process, especially if you’re looking to recover from a default. With these tips, you’re on your way to a successful settlement!

Step 4: Finalizing the Agreement: What to Expect

Finalizing the agreement is a crucial step in the Personal Loan Settlement Process. It’s where everything you’ve worked for comes together. Understanding what to expect can ease your worries and help you feel more confident about the outcome.

What Happens Next?

Once you and the lender agree on the settlement terms, you’ll receive a formal agreement. This document outlines the new terms, including the reduced amount you’ll pay. Make sure to read it carefully!

Key Points to Remember:

- Review the Agreement: Ensure all details are correct.

- Ask Questions: If something is unclear, don’t hesitate to ask your lender.

- Get Everything in Writing: This protects you in case of future disputes.Finalizing the agreement marks a significant milestone in your journey through personal loan default and recovery. It’s your chance to start fresh, so embrace it!

How Can ExpressCash Help You Navigate the Personal Loan Settlement Process?

Understanding the Personal Loan Settlement Process is crucial for anyone facing financial challenges. It helps you regain control over your finances and avoid the stress of a Personal Loan Default. At ExpressCash, we’re here to guide you through each step, making the process smoother and less daunting.

Expert Guidance

Our team of experts provides personalized advice tailored to your situation. We break down the Personal Loan Settlement Process into simple steps, ensuring you know what to expect.

Step-by-Step Support

We offer a clear roadmap:

- Assess Your Situation: Understand your financial standing.

- Negotiate with Lenders: We help you communicate effectively with your lenders.

- Finalize the Settlement: Ensure all terms are clear and documented.

Ongoing Assistance

Even after settling, we’re here for you. Our resources help you learn about Personal Loan Default and Recovery, so you can avoid future pitfalls and build a stronger financial future.

Common Mistakes to Avoid During the Personal Loan Settlement Process

Understanding the Personal Loan Settlement Process is crucial for anyone facing financial difficulties. When you find yourself in a situation of Personal Loan Default, knowing how to navigate the settlement process can save you from further complications. Let’s dive into some common mistakes to avoid during this journey.

Ignoring Communication with Lenders

One major mistake is not communicating with your lender. Ignoring their calls or emails can worsen your situation. Instead, keep an open line of communication. This shows your willingness to resolve the issue and can lead to better settlement options.

Delaying the Settlement Process

Another pitfall is procrastination. Delaying the Personal Loan Settlement Process can lead to increased fees and interest. Act promptly! The sooner you start negotiating, the better your chances of a favorable outcome. Remember, time is of the essence when it comes to loan recovery.

Not Seeking Professional Help

Lastly, many people try to handle everything alone. Not seeking professional help can be a costly mistake. Financial advisors or debt settlement companies can provide valuable insights and strategies to help you navigate the settlement process effectively. Don’t hesitate to ask for help!

FAQs

-

What is the personal loan settlement process?

It’s when a borrower negotiates with the lender to pay a lump sum that’s less than the total outstanding amount to settle the loan, usually after default or severe financial hardship. -

When can I opt for a loan settlement?

You can request settlement if you’re unable to repay the full loan, typically after missing several payments and demonstrating financial hardship to the lender. -

How is the settlement amount determined?

Lenders usually assess your financial condition, the amount already paid, and potential recovery losses, then propose a reduced payoff amount—often 40% to 70% of the original balance. -

Does settling a personal loan affect my credit score?

Yes, settled loans are marked as “settled” on your credit report, which can negatively impact your credit score and make it harder to get credit in the future. -

Is loan settlement better than continuing default?

In many cases, yes. While both hurt your credit, a settlement stops collections and closes the loan, whereas default can lead to court judgments, wage garnishment, and prolonged damage.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.