The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

Late Payment Charges for Loan Defaults: What to Expect

Understanding Late Payment Charges for Loan Defaults is essential for anyone with a loan. Missing a payment can lead to unexpected fees and stress, but knowing what to expect can help you manage your finances and avoid deeper debt.

What Are Late Payment Charges?

Late payment charges are fees imposed by lenders when you fail to make a loan payment on time. These charges vary by lender and loan type, and they can accumulate quickly, complicating your debt situation.

How Do They Affect You?

Defaulting on a personal loan can significantly increase your total debt due to late payment charges. Here’s how they can affect you:

- Increased Interest Rates: Lenders may raise your interest rate, making future payments more costly.

- Negative Credit Impact: Late payments can damage your credit score, hindering future borrowing.

- Collection Efforts: Continued missed payments may lead to your account being sent to collections, resulting in more stress and potential legal issues.

Tips to Avoid Late Payment Charges

To avoid these charges, consider these steps:

- Set Up Reminders: Use your phone or calendar for payment reminders.

- Automate Payments: Set up automatic payments to ensure timely payments.

- Communicate with Your Lender: If you’re struggling, reach out to your lender for possible options to avoid default.

Understanding Late Payment Charges for Loan Defaults can help you take control of your finances and prevent unnecessary fees.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

How Are Late Payment Charges Calculated?

Understanding how Late Payment Charges for Loan Defaults work is essential for borrowers. Missing a payment can lead to additional fees that accumulate quickly. Knowing how these charges are calculated can help you avoid unnecessary costs and maintain your financial health.

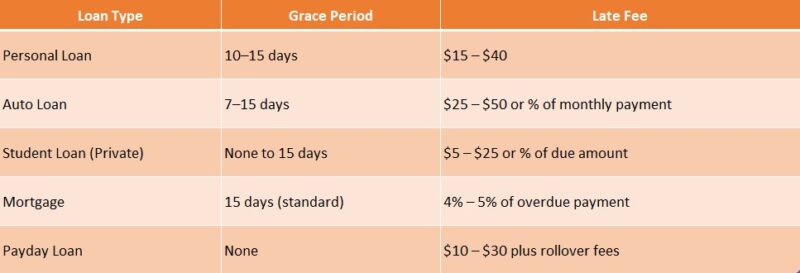

Late payment charges depend on several factors, including:

- Loan Amount: Higher amounts can lead to larger late fees.

- Interest Rate: Elevated rates often result in steeper penalties.

- Lender Policies: Each lender has different rules; some charge a flat fee, while others may apply a percentage of the missed payment.

When you default on a personal loan, lenders usually provide a grace period before imposing late fees. These fees can be either fixed or a percentage of the overdue payment. It’s crucial to read your loan agreement to understand these terms clearly. Late payment charges can accumulate quickly. For example, missing a payment may incur an immediate fee, followed by additional charges if the lateness continues, potentially leading to a cycle of debt.

The Importance of Timely Payments

Timely payments are vital not only to avoid late fees but also to maintain a good credit score. A poor credit score can hinder future borrowing, resulting in higher interest rates or loan denials.

Tips to Avoid Late Payment Charges

To avoid late payment charges, consider these tips:

- Set Up Reminders: Use your phone or calendar for payment due dates.

- Automate Payments: Set up automatic payments to never miss a due date.

- Communicate with Your Lender: If you’re struggling, contact your lender for options to avoid default.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

What Happens When You Default on a Loan?

When you take out a loan, you agree to pay it back on time. But what happens if you miss a payment? Understanding Late Payment Charges for Loan Defaults is crucial. These charges can add up quickly, making your financial situation even tougher. Let’s explore what you can expect if you default on a loan.

When you default on a loan, the lender may start charging late fees. These fees can vary but often increase the total amount you owe. Here’s what you might face:

Late Payment Charges

- Increased Fees: Each missed payment can lead to additional charges. This means you owe more than you initially borrowed.

- Higher Interest Rates: Some lenders may raise your interest rate after a default, making it even harder to pay off your debt.

- Credit Score Impact: Defaulting can hurt your credit score, affecting your ability to borrow in the future.

Personal Loan Default and Recovery

Recovering from a personal loan default can be challenging. However, there are steps you can take:

- Communicate with Your Lender: Let them know your situation. They may offer options to help you.

- Create a Budget: Assess your finances and prioritize paying off your debts.

- Seek Financial Advice: Sometimes, talking to a financial advisor can provide new strategies for recovery.

Also Read: Personal Loan Default and Recovery: What You Should Know

The Impact of Late Payment Charges on Your Credit Score

When you take out a loan, you agree to pay it back on time. But what happens if you miss a payment? Understanding the impact of Late Payment Charges for Loan Defaults is crucial. These charges can add up quickly and affect your financial health, especially your credit score.

What Are Late Payment Charges?

Late payment charges are fees lenders impose when you don’t pay your loan on time. These charges can vary, but they often increase your total debt. If you’re facing a Personal Loan Default, these fees can make recovery even harder.

How Do They Affect Your Credit Score?

Late payments can stay on your credit report for up to seven years. Here’s how they impact your score:

- Increased Debt: Late fees add to your total loan amount.

- Lower Credit Score: A lower score can make it harder to get future loans.

- Higher Interest Rates: Lenders may charge more for loans if they see late payments.

In short, missing payments not only costs you money but can also make it difficult to recover financially.

Can You Negotiate Late Payment Charges?

Late payment charges can feel like a heavy weight when you’re already struggling with a personal loan default. Understanding what to expect can help you navigate this tricky situation. But did you know that you might have some room to negotiate these charges? Let’s dive into how you can approach this.

Negotiating late payment charges is possible, but it requires a bit of strategy. Here are some steps to consider:

- Communicate Early: Reach out to your lender as soon as you realize you might miss a payment. They may be more willing to help if you contact them before the due date.

- Explain Your Situation: Share your story. If you’ve faced unexpected challenges, like job loss or medical issues, lenders may be sympathetic and willing to adjust your charges.

- Ask for Waivers: Politely request a waiver for late fees. Many lenders have policies for first-time offenders or those who have been loyal customers.

- Offer a Payment Plan: If you can’t pay the full amount, propose a plan that works for both you and the lender.

This shows your commitment to resolving the issue. By understanding late payment charges for loan defaults and knowing how to negotiate, you can take control of your financial situation and work towards recovery. Remember, communication is key!

Tips to Avoid Late Payment Charges for Loan Defaults

Late payment charges for loan defaults can feel overwhelming, but understanding them is crucial. When you miss a payment on a personal loan, not only do you face penalties, but it can also impact your credit score. This section will guide you through some practical tips to avoid these charges and keep your finances on track.

Stay Organized with Reminders

One of the best ways to avoid late payment charges for loan defaults is to set reminders. Use your phone or a calendar app to alert you a few days before your payment is due. This simple step can help you stay on top of your payments and avoid any unnecessary fees.

Automate Your Payments

Consider setting up automatic payments. Many lenders offer this feature, allowing you to schedule payments directly from your bank account. By automating your payments, you reduce the risk of forgetting and facing late fees. Just make sure you have enough funds in your account to cover the payment!

Communicate with Your Lender

If you ever find yourself in a tough spot, don’t hesitate to reach out to your lender. They may offer options or solutions to help you avoid personal loan default and recovery. Open communication can often lead to flexible arrangements that can save you from late payment charges.

How ExpressCash.com Can Help You Manage Loan Defaults

Managing loans can be tricky, especially regarding late payments. Understanding Late Payment Charges for Loan Defaults is crucial, as these charges can accumulate quickly, complicating recovery efforts. Knowing what to expect helps you navigate these challenges effectively.

Understanding Late Payment Charges

Late payment charges vary by lender and can include a percentage of the missed payment or a flat fee, leading to increased debt over time.

Personal Loan Default and Recovery

If you find yourself in a personal loan default, don’t panic! Here’s how ExpressCash.com can assist you:

- Expert Guidance: Access resources to understand your options.

- Negotiation Support: Get help negotiating with lenders to reduce charges.

- Financial Planning: Utilize tools to budget and avoid future defaults.

By staying informed and using the resources at ExpressCash.com, you can effectively manage loan defaults. Remember, it’s never too late to take control of your financial situation!

Tips for Avoiding Late Payment Charges

- Set Reminders: Use your phone or calendar for payment due dates.

- Automate Payments: Set up automatic payments to avoid missed deadlines.

- Communicate with Lenders: Reach out early if you’re struggling to discuss options.

The Importance of Timely Payments

Timely payments help avoid late fees and protect your credit score, leading to better loan terms in the future and saving you money in the long run.

Conclusion

Understanding Late Payment Charges for Loan Defaults is essential for financial health. With the right tools and support from ExpressCash.com, you can navigate defaults and work towards recovery.

FAQs

⚠️ What are late payment charges on a loan?

Late payment charges, also called penal charges, are extra fees added when a borrower misses a scheduled loan payment. These charges are meant to discourage late payments and cover administrative costs for the lender.

📆 When do late fees typically apply?

They usually apply after a grace period (if any), such as 5 to 15 days after the due date. The exact timing depends on the lender’s policy and your loan agreement.

💸 How much are loan default penalties?

Late fees may be:

-

A flat amount (e.g., $15–$40)

-

A percentage of the missed payment (e.g., 2%–5%)

Some lenders may also increase your interest rate or charge daily penalties until the balance is paid.

📉 Do late payments affect your credit score?

Yes. If a payment is 30+ days late, most lenders will report it to the credit bureaus, which can significantly lower your credit score and impact future loan approvals.

📞 What should I do if I can’t make a loan payment on time?

Contact your lender before the due date. Many offer:

-

Payment extensions

-

Hardship plans

-

Modified repayment terms

Early communication may help you avoid penalties or damage to your credit.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.