The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

How to Avoid Loan Defaults and Stay on Track

Understanding how to avoid loan defaults is crucial for anyone who borrows money. When you take out a personal loan, you commit to repaying it. Failing to do so can lead to serious financial consequences. Let’s explore what loan defaults are and how you can stay on track.

What is a Loan Default?

A loan default occurs when you fail to make the required payments on your loan. This can happen with personal loans, mortgages, or credit cards. When you default, it can hurt your credit score and make it harder to borrow money in the future.

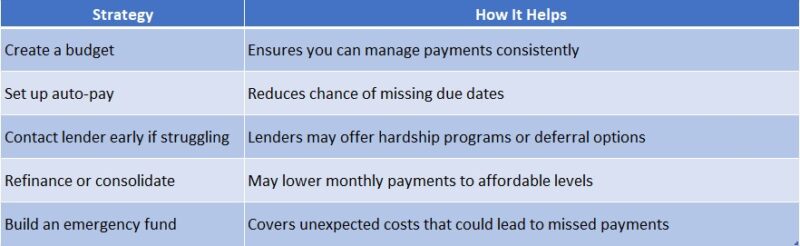

How to Avoid Loan Defaults

- Create a Budget: Track your income and expenses to ensure you can make your loan payments.

- Set Up Reminders: Use your phone or calendar to remind you when payments are due.

- Communicate with Lenders: If you’re struggling, talk to your lender. They may offer options to help you avoid default.

By understanding personal loan default and recovery, you can take proactive steps to protect your financial future. Remember, staying informed and organized is key to avoiding loan defaults and maintaining a healthy credit profile.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

How to Avoid Loan Defaults: Essential Strategies

Managing loans can feel overwhelming, but knowing how to avoid loan defaults is crucial for your financial health. Loan defaults can lead to serious consequences, including damaged credit scores and increased stress. By following some essential strategies, you can stay on track and ensure your loans remain manageable.

Create a Budget

Start by creating a budget that outlines your income and expenses. This helps you see where your money goes and allows you to allocate funds for loan payments. Stick to your budget to avoid overspending, which can lead to personal loan default.

Set Up Automatic Payments

Consider setting up automatic payments for your loans. This way, you won’t forget to make a payment, and you can avoid late fees. Just make sure you have enough money in your account to cover these payments each month!

Communicate with Your Lender

If you’re struggling to make payments, don’t hesitate to reach out to your lender. They may offer options for deferment or restructuring your loan. Open communication can help you find solutions before a personal loan default occurs.

Are You at Risk? Identifying Warning Signs of Default

Understanding how to avoid loan defaults is crucial for anyone who has borrowed money. Defaulting on a loan can lead to serious financial consequences, including damaged credit scores and increased stress. By recognizing the warning signs early, you can take steps to stay on track and maintain your financial health.

Many people don’t realize they’re at risk until it’s too late. Here are some common warning signs to watch for:

- Missed Payments: If you find yourself missing payments or making late payments, it’s a clear sign you might be heading toward personal loan default.

- Increased Debt: If your debt is piling up and you’re struggling to keep up, it’s time to reassess your financial situation.

- Living Paycheck to Paycheck: If you’re constantly worried about making ends meet, you may be at risk of defaulting on your loans.

Recognizing these signs early can help you take action. Whether it’s budgeting better or seeking financial advice, knowing how to avoid loan defaults is the first step toward recovery.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

Budgeting Wisely: The Key to Staying on Track

When it comes to managing loans, knowing how to avoid loan defaults is crucial. Staying on track with your payments not only protects your credit score but also ensures financial peace of mind. Budgeting wisely is the foundation of this journey, helping you navigate the ups and downs of life without falling behind.

Understand Your Income and Expenses

To avoid personal loan default, start by tracking your income and expenses. Create a simple budget that lists all your sources of income and monthly expenses. This clarity helps you see where your money goes and where you can cut back.

Set Priorities

Once you have a budget, prioritize your expenses. Make sure to allocate funds for loan payments first. Consider these tips:

- Pay yourself first: Set aside savings before spending.

- Cut unnecessary costs: Identify non-essential expenses to reduce.

- Plan for emergencies: Save a little each month for unexpected costs.

By budgeting wisely, you can stay on track with your loan payments. Remember, the goal is to avoid personal loan default and recover quickly if you ever face financial challenges. With a solid budget, you’ll be better prepared to handle your loans and achieve your financial goals.

Also Read: Personal Loan Default and Recovery: What You Should Know

The Importance of Communication with Lenders

When it comes to managing loans, understanding how to avoid loan defaults is crucial. Communication with your lender can make a significant difference in your financial journey. By keeping an open line of dialogue, you can address issues before they escalate into serious problems. This proactive approach helps you stay on track and avoid personal loan default and recovery situations.

Stay Informed

- Ask Questions: If you’re unsure about your loan terms, don’t hesitate to ask your lender for clarification. Understanding your obligations is key to avoiding defaults.

- Update Your Lender: If your financial situation changes, let your lender know. They may offer options to help you manage your payments better.

Build a Relationship

- Regular Check-Ins: Establishing a rapport with your lender can be beneficial. Regularly checking in can help you feel more comfortable discussing any potential issues.

- Be Honest: If you’re facing difficulties, communicate openly. Lenders appreciate honesty and may provide solutions to help you avoid defaulting on your loan.

How to Avoid Loan Defaults: The Role of Financial Education

Understanding how to avoid loan defaults is crucial for anyone who borrows money. When you take out a personal loan, you commit to repaying it. Failing to do so can lead to serious consequences, like damaged credit scores and financial stress. So, let’s explore how financial education plays a key role in keeping you on track.

The Importance of Financial Education

Know Your Loan Terms

- Understand your interest rates: Knowing how much interest you’ll pay helps you budget better.

- Be aware of repayment schedules: This ensures you never miss a payment.

Create a Budget

A solid budget helps you manage your money wisely. Track your income and expenses to see where your money goes. This way, you can allocate funds for loan repayments without stress.

Seek Help When Needed

If you’re struggling, don’t hesitate to ask for help. Financial advisors can provide valuable insights. They can guide you on personal loan default and recovery strategies, ensuring you stay informed and proactive. Remember, knowledge is power when it comes to avoiding loan defaults!

Leveraging Technology: Tools to Help You Manage Loans

Managing loans can feel overwhelming, but it’s crucial to know how to avoid loan defaults. Staying on track not only protects your credit score but also helps you achieve your financial goals. Thankfully, technology offers tools that can make this journey easier and more manageable.

Use Budgeting Apps

Budgeting apps can be your best friend. They help you track your spending and savings, ensuring you have enough money for your loan payments. Some popular apps include Mint and YNAB (You Need A Budget). These tools can alert you when bills are due, helping you avoid late payments that lead to personal loan default.

Set Up Reminders

Setting reminders on your phone or calendar can keep you organized. You can create alerts for payment due dates, ensuring you never miss a payment. This simple step is key in learning how to avoid loan defaults and stay on track with your finances.

Explore Loan Management Platforms

Consider using loan management platforms. These websites can help you monitor your loans, see payment schedules, and even provide tips for recovery if you fall behind. By leveraging these tools, you can stay informed and proactive about your financial health.

How ExpressCash.com Can Help You Stay Financially Secure

When it comes to managing loans, understanding how to avoid loan defaults is crucial. Defaulting on a personal loan can lead to serious financial consequences, including damaged credit scores and increased stress. At ExpressCash.com, we believe that staying financially secure is within everyone’s reach, and we’re here to help you navigate this journey.

1. Personalized Financial Advice

Our team offers tailored advice to help you understand your financial situation better. We guide you on budgeting and managing your expenses, ensuring you stay on track with your loan payments.

2. Loan Management Tools

We provide easy-to-use tools that help you track your loans and payments. By keeping an eye on your due dates, you can avoid missing payments and prevent personal loan default and recovery issues.

3. Educational Resources

Knowledge is power! Our website features articles and tips on how to avoid loan defaults. From understanding interest rates to creating a repayment plan, we cover everything you need to know to stay financially secure.

FAQs

💡 What is a loan default and why is it serious?

A loan default happens when you fail to repay your loan as agreed. It can hurt your credit score, lead to penalty fees, and may even result in legal action or loss of collateral in secured loans.

📆 How can I avoid missing EMIs?

Set up auto-debit payments, create a monthly budget, and maintain a buffer in your account to ensure EMIs are covered on the due date—even during emergencies.

📊 Should I take a loan if I’m unsure about repayment?

No. Only take a loan when you’re confident you can repay it on time. Avoid borrowing for non-essential expenses and never take a new loan to repay an old one unless it’s part of a structured debt consolidation plan.

📞 What should I do if I might miss a payment?

Contact your lender before the due date. They may offer solutions like EMI postponement, tenure extension, or temporary relief depending on your situation.

🧠 How does financial planning help prevent defaults?

Having a realistic budget, an emergency fund, and understanding your total debt-to-income ratio helps you stay in control and avoid over-borrowing, which is a major cause of loan defaults.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.