The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

Loan Amount Estimator Tool: How Much Can You Borrow?

When considering a personal loan, understanding how much you can borrow is crucial. This is where the Loan Amount Estimator Tool comes into play. It helps you gauge your borrowing capacity based on your financial situation. Knowing this can save you time and help you avoid taking on too much debt.

What is a Loan Amount Estimator Tool?

A Loan Amount Estimator Tool is a simple online calculator that gives you an idea of how much money you can borrow. It takes into account your income, expenses, and credit score. This way, you can make informed decisions about your finances.

Benefits of Using the Tool

- Quick Insights: Get immediate feedback on your borrowing potential.

- Financial Planning: Helps you budget better for your loan repayment.

- Confidence: Knowing your limits can ease the loan application process.

Additionally, pairing the Loan Amount Estimator Tool with a Personal Loan Repayment Calculator can provide a clearer picture of your monthly payments. This combination allows you to see not just how much you can borrow, but also how much you’ll need to pay back each month, making your financial planning even easier.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

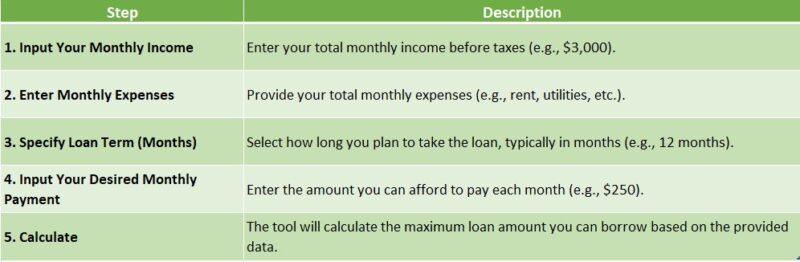

How Does the Loan Amount Estimator Tool Work?

When you’re thinking about borrowing money, knowing how much you can actually get is super important. That’s where the Loan Amount Estimator Tool comes in. It helps you figure out your borrowing capacity based on your financial situation. This tool can save you time and help you make informed decisions about your personal loans.

Using the Loan Amount Estimator Tool is pretty straightforward. First, you enter some basic information like your income, expenses, and credit score. Then, the tool crunches the numbers to give you an estimate of how much you can borrow. It’s like having a financial buddy that helps you understand your options!

Key Features of the Tool:

- User-Friendly: You don’t need to be a math whiz to use it!

- Quick Results: Get your loan estimate in just a few minutes.

- Personalized Estimates: Tailored to your financial situation, making it more accurate.

Additionally, many tools come with a Personal Loan Repayment Calculator. This feature allows you to see how much your monthly payments will be based on the loan amount and interest rate. By using both tools together, you can plan your finances better and avoid surprises down the road.

Factors Influencing Your Borrowing Capacity

When considering a loan, knowing how much you can borrow is essential. A Loan Amount Estimator Tool helps you assess your borrowing capacity based on several factors, guiding you to make informed choices. Let’s delve into what influences your borrowing limits!

Income Level

Your income is a key factor. Lenders want assurance that you can repay the loan. Generally, a higher income allows you to borrow more, as it indicates a greater ability to manage repayments.

Credit Score

Your credit score is also crucial. A higher score reflects responsible borrowing, leading to better loan terms and higher amounts. If your score is low, consider using a Personal Loan Repayment Calculator to understand how different payments can impact your score.

Existing Debt

Existing debt matters too. Lenders look at your debt-to-income ratio, which compares your monthly debt payments to your income. High debt levels can limit your borrowing capacity, so keeping debts manageable is vital.

Employment Stability

Job stability is important as well. A steady job increases lenders’ confidence in your repayment ability. Long-term employment can significantly enhance your borrowing capacity.

Loan Purpose and Terms

The purpose of the loan can affect how much you can borrow, with different limits for emergencies versus home improvements. Additionally, loan terms like interest rates and repayment duration play a role; lower rates can allow for higher borrowing amounts. Always compare options for the best deal!

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

Why Use a Loan Amount Estimator Tool Before Applying?

When you’re thinking about borrowing money, knowing how much you can actually get is super important. That’s where a Loan Amount Estimator Tool comes in handy. It helps you figure out your borrowing capacity before you even apply. This way, you can plan better and avoid surprises later on!

Why Use a Loan Amount Estimator Tool?

Using a Loan Amount Estimator Tool can save you time and stress. Here’s why:

- Understand Your Limits: It gives you a clear idea of how much you can borrow based on your income and expenses.

- Better Planning: Knowing your loan amount helps you budget for monthly payments. You can use a Personal Loan Repayment Calculator to see how different amounts affect your budget.

- Avoid Rejections: By estimating your loan amount, you can apply for a sum that you’re more likely to get approved for, reducing the chances of rejection.

In short, using a loan estimator tool is like having a map before a journey. It guides you on how much you can borrow, making the whole process smoother and more predictable. So, before you dive into the world of loans, take a moment to use this tool!

Also Read: Personal Loan Repayment Calculator: Estimate Your Payments

Common Misconceptions About Loan Amount Estimators

When considering a loan, many people turn to a Loan Amount Estimator Tool to figure out how much they can borrow. This tool is essential because it helps you understand your financial limits and plan your repayments. However, there are several misconceptions that can lead to confusion and poor financial decisions.

It Guarantees Approval

One common myth is that using a Loan Amount Estimator Tool guarantees loan approval. In reality, this tool only provides an estimate based on your financial situation. Lenders will still assess your credit score and income before making a final decision.

It Accounts for All Costs

Another misconception is that the estimator includes all potential costs. While it gives a good starting point, it often doesn’t factor in fees, interest rates, or other expenses. Using a Personal Loan Repayment Calculator alongside the estimator can help clarify your total repayment amount, making it easier to budget.

It’s Only for Personal Loans

Lastly, some believe that these tools are only useful for personal loans. In truth, they can be applied to various loan types, including mortgages and auto loans. This versatility makes them valuable for anyone looking to borrow money, regardless of the purpose.

How ExpressCash Can Help You Maximize Your Loan Potential

When it comes to borrowing money, knowing how much you can get is crucial. That’s where a Loan Amount Estimator Tool comes into play. It helps you understand your borrowing potential, making the loan process smoother and less stressful. With the right tools, you can make informed decisions about your finances.

Understand Your Options

Using our Loan Amount Estimator Tool, you can easily calculate how much you might qualify for. This tool considers your income, credit score, and existing debts, giving you a clearer picture of your borrowing capacity.

Plan Your Repayment

Additionally, our Personal Loan Repayment Calculator helps you visualize your monthly payments. You can adjust the loan amount and term to see how it affects your budget. This way, you can choose a loan that fits your financial situation without stretching your limits.

Key Benefits of Using Our Tools

- Clarity: Get a clear estimate of how much you can borrow.

- Confidence: Make informed decisions about your loans.

- Control: Adjust variables to find the best loan terms for you.

By utilizing these tools, you empower yourself to take charge of your financial future. So, why wait? Start exploring your loan options today!

Tips for Using the Loan Amount Estimator Tool Effectively

When considering a personal loan, knowing how much you can borrow is crucial. The Loan Amount Estimator Tool helps you figure this out, ensuring you don’t take on more debt than you can handle. Understanding your borrowing limits can save you from financial stress down the road.

Know Your Financial Situation

Before diving into the Loan Amount Estimator Tool, take a moment to assess your finances. Gather information about your income, expenses, and existing debts. This will give you a clearer picture of what you can afford to borrow.

Use the Personal Loan Repayment Calculator

Once you have your numbers, use a Personal Loan Repayment Calculator. This tool helps you see how monthly payments will fit into your budget. It’s like trying on shoes before you buy them—make sure they fit!

Experiment with Different Amounts

Don’t hesitate to play around with different loan amounts in the estimator. This way, you can see how varying amounts affect your monthly payments. It’s a great way to find a balance between what you need and what you can afford.

FAQs

-

What is a loan amount estimator tool?

A loan amount estimator helps determine how much you may qualify to borrow based on your income, expenses, credit score, and repayment capacity. -

How does a loan estimator calculate the maximum loan amount?

It considers factors like monthly income, existing debts, interest rate, loan tenure, and lender-specific criteria to estimate the highest loan amount you can afford. -

Can I use this tool for different types of loans?

Yes, you can use it for personal loans, home loans, car loans, and business loans by adjusting the interest rate and repayment period accordingly. -

Does using a loan estimator affect my credit score?

No, using an estimator is a soft inquiry that does not impact your credit score, unlike actual loan applications that may involve hard credit checks. -

How accurate is a loan amount estimator?

The tool provides an approximate loan amount based on general lender criteria, but actual approval depends on your lender’s evaluation and creditworthiness.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.