The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

Loan Repayment Timeline Estimator: Plan Your Payoff Schedule

Understanding the Loan Repayment Timeline Estimator: What You Need to Know

When it comes to managing your finances, understanding your loan repayment schedule is crucial. A Loan Repayment Timeline Estimator can help you visualize how long it will take to pay off your loan. This tool not only gives you a clear picture of your payment timeline but also helps you plan your budget effectively. Let’s dive into how this estimator works and why it’s essential for your financial health.

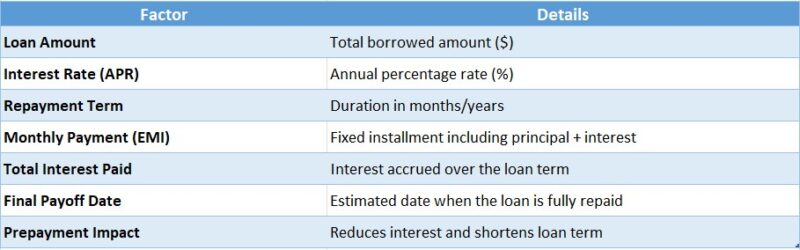

A Loan Repayment Timeline Estimator is a handy tool that calculates your loan payoff schedule. By inputting details like the loan amount, interest rate, and repayment term, you can see how much you need to pay each month. This way, you can stay on track and avoid surprises!

Benefits of Using a Personal Loan Repayment Calculator

Using a Personal Loan Repayment Calculator has several advantages:

- Clarity: It breaks down your payments into manageable chunks.

- Budgeting: Helps you plan your monthly expenses better.

- Goal Setting: You can set financial goals based on your repayment timeline.

- Flexibility: Adjust your inputs to see how changes affect your timeline.

By utilizing these tools, you can take control of your finances and make informed decisions about your loans.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

How to Use a Loan Repayment Timeline Estimator Effectively

Understanding your loan repayment timeline is essential for effective financial planning. A Loan Repayment Timeline Estimator allows you to visualize how long it will take to pay off your loan, helping you manage your finances and avoid unexpected surprises.

Using a Personal Loan Repayment Calculator is straightforward. Start by gathering your loan details: the amount borrowed, interest rate, and repayment term. Input these numbers into the estimator to see your monthly payments and total interest paid.

Key Benefits of Using an Estimator

- Clarity: Understand exactly how long it will take to pay off your loan.

- Budgeting: Knowing your monthly payments aids in effective budgeting.

- Goal Setting: Set financial goals based on your repayment timeline.

Using a Loan Repayment Timeline Estimator empowers you to take control of your finances and make informed decisions about your loans.

Adjusting Your Timeline

If your financial situation changes, you can easily adjust your repayment timeline. Simply re-enter your new loan details or payment amounts into the Personal Loan Repayment Calculator, allowing you to stay on track even during unexpected changes.

Tips for Accurate Estimates

For accurate results, consider these tips:

- Use Current Rates: Check for the latest interest rates.

- Include Fees: Factor in any additional fees related to your loan.

Stay Motivated

Tracking your progress can be motivating! Update your estimator as you make payments to see how close you are to being debt-free, and celebrate small milestones along the way.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

Key Factors Influencing Your Loan Payoff Schedule

Understanding your loan repayment timeline is crucial for managing your finances effectively. A Loan Repayment Timeline Estimator can help you visualize how long it will take to pay off your loan. This tool not only provides clarity but also empowers you to plan your budget better, ensuring you stay on track with your payments.

Interest Rates

Interest rates play a significant role in determining your monthly payments. Higher rates mean more interest over time, which can extend your payoff schedule. Using a Personal Loan Repayment Calculator can help you see how different rates affect your total repayment amount.

Loan Amount

The total amount you borrow directly influences how long it will take to pay off your loan. Larger loans typically require more time to repay. By inputting your loan amount into a Loan Repayment Timeline Estimator, you can estimate your payoff schedule more accurately.

Payment Frequency

How often you make payments can also impact your timeline. Monthly payments are common, but some loans allow bi-weekly or weekly payments. More frequent payments can reduce interest costs and shorten your payoff period. Consider this when using your Personal Loan Repayment Calculator.

Also Read: Personal Loan Repayment Calculator: Estimate Your Payments

What Are the Benefits of Planning Your Loan Repayment?

When you take out a loan, it’s important to know how and when you’ll pay it back. That’s where a Loan Repayment Timeline Estimator comes in handy! This tool helps you visualize your payment schedule, making it easier to manage your finances and avoid surprises. Planning your payoff schedule can save you money and stress in the long run.

Clear Understanding of Payments

Using a Personal Loan Repayment Calculator gives you a clear picture of your monthly payments. You’ll know exactly how much to set aside each month, which helps you budget better. No more guessing!

Avoiding Late Fees

By planning your repayment, you can avoid late fees and penalties. When you know your timeline, you can ensure that payments are made on time, keeping your credit score healthy and your finances in check.

Financial Freedom

Lastly, having a repayment plan means you can work towards financial freedom. Once you know when your loan will be paid off, you can start planning for future goals, like saving for a house or a vacation. It’s all about taking control of your financial journey!

Common Mistakes to Avoid When Estimating Loan Repayment Timelines

When planning to pay off a loan, a Loan Repayment Timeline Estimator can be invaluable. It helps you visualize your payment schedule, making financial management easier. However, many people make mistakes that can derail their repayment plans. Here are some common pitfalls to avoid!

Ignoring Interest Rates

One major mistake is overlooking interest rates. A Personal Loan Repayment Calculator can show how different rates affect your total repayment. Always factor in your interest rate for an accurate timeline.

Not Considering Extra Payments

Another mistake is forgetting about extra payments. If you have extra cash, applying it to your loan can significantly shorten your repayment timeline. Include potential extra payments in your Loan Repayment Timeline Estimator for a realistic plan.

Failing to Update Your Plan

Life changes can impact your repayment ability. If you get a new job or face unexpected expenses, update your repayment plan. Regularly revisiting your Personal Loan Repayment Calculator helps you stay on track.

Overlooking Fees

Don’t forget about fees! Some loans come with hidden costs that can affect your total repayment. Always check for additional fees when using your Loan Repayment Timeline Estimator to avoid surprises.

Setting Unrealistic Goals

Setting overly ambitious repayment goals can lead to frustration. Be realistic about what you can afford each month. A Personal Loan Repayment Calculator can help you find a comfortable payment plan.

Not Seeking Help

Finally, don’t hesitate to ask for help if you’re confused. Financial advisors can provide valuable insights. Using a Loan Repayment Timeline Estimator alongside expert advice can lead to better decision-making.

How ExpressCash Can Help You Create a Personalized Payoff Plan

When it comes to managing your loans, understanding your repayment schedule is crucial. A Loan Repayment Timeline Estimator can help you visualize how long it will take to pay off your debt. This tool not only keeps you informed but also empowers you to make smarter financial decisions. Planning your payoff schedule can lead to less stress and more savings in the long run.

At ExpressCash, we understand that every financial journey is unique. That’s why our Personal Loan Repayment Calculator is designed to cater to your specific needs. With just a few clicks, you can input your loan amount, interest rate, and repayment term. This allows you to see a clear timeline of your payments and when you’ll be debt-free!

Benefits of Using Our Tools

- Clarity: Know exactly when your last payment is due.

- Flexibility: Adjust your inputs to see how changes affect your timeline.

- Empowerment: Take control of your finances with a clear plan.

By using our Loan Repayment Timeline Estimator, you can create a personalized payoff plan that fits your lifestyle. It’s like having a financial coach right at your fingertips!

Frequently Asked Questions About Loan Repayment Timelines

What is a Loan Repayment Timeline Estimator?

A Loan Repayment Timeline Estimator is a handy tool that helps you calculate how long it will take to pay off your loan based on your monthly payments and interest rates. By inputting your loan amount and terms, you can see a detailed timeline of your repayment schedule.

How does a Personal Loan Repayment Calculator work?

A Personal Loan Repayment Calculator works similarly. You enter your loan details, and it provides you with monthly payment amounts, total interest paid, and the overall timeline. This way, you can plan your budget more effectively and avoid surprises.

Why should I use these tools?

Using these tools can help you:

- Stay organized: Keep track of your payments and due dates.

- Budget better: Understand how much you need to set aside each month.

- Reduce stress: Knowing your timeline can ease worries about repayment.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.