The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

Personal Loan Repayment Calculator: Estimate Your Payments

Understanding the Personal Loan Repayment Calculator: A Comprehensive Guide

When considering a personal loan, understanding how much you’ll need to pay back is crucial. This is where the Personal Loan Repayment Calculator comes into play. It helps you estimate your monthly payments, making it easier to plan your budget and avoid surprises later on.

A Personal Loan Repayment Calculator is a simple tool that allows you to input your loan amount, interest rate, and repayment term. In seconds, it calculates your estimated monthly payments. This way, you can see how much you’ll owe each month and how long it will take to pay off the loan.

Why Use a Personal Loan Repayment Calculator?

Using this calculator offers several benefits:

- Budgeting Made Easy: Knowing your monthly payment helps you manage your finances better.

- Compare Loan Options: You can try different amounts and rates to find the best deal.

- Avoid Overborrowing: It helps you understand what you can realistically afford, preventing you from taking on too much debt.

Overall, the Personal Loan Repayment Calculator is a handy tool that empowers you to make informed financial decisions.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

How Does a Personal Loan Repayment Calculator Work?

When considering a personal loan, understanding how much you’ll need to pay back is crucial. This is where a Personal Loan Repayment Calculator comes into play. It helps you estimate your monthly payments, making it easier to budget and plan your finances. Knowing your payment amount can reduce stress and help you make informed decisions.

A Personal Loan Repayment Calculator works by taking a few key pieces of information. You’ll typically need to input:

- Loan Amount: The total money you plan to borrow.

- Interest Rate: The cost of borrowing, expressed as a percentage.

- Loan Term: The duration over which you’ll repay the loan, usually in months or years.

Once you enter these details, the calculator does the math for you. It calculates your monthly payment based on the loan amount, interest rate, and term. This way, you can see how different factors affect your payments.

Why Use a Personal Loan Repayment Calculator?

Using a Personal Loan Repayment Calculator is beneficial because it helps you:

- Budget Better: Knowing your monthly payment helps you plan your expenses.

- Compare Loans: You can see how different interest rates and terms impact your payments.

- Avoid Surprises: Understanding your payment upfront can prevent financial stress later on.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

Key Factors Influencing Your Loan Repayment Amount

When considering a personal loan, knowing your repayment amount is essential. A Personal Loan Repayment Calculator helps you estimate payments, making budgeting easier and preventing surprises later on!

Loan Amount

The total amount borrowed affects monthly payments. More borrowed means higher payments, so consider your needs carefully!

Interest Rate

Interest rates vary widely. Lower rates lead to lower payments, while higher rates increase costs. Always shop around for the best rates!

Loan Term

The loan length matters too. Shorter terms mean higher monthly payments but less overall interest. Longer terms lower payments but can increase total interest. Balance is key!

Additional Fees

Watch out for fees! Some loans have origination fees that can impact total repayment. Always read the fine print!

Monthly Payment Frequency

Payment frequency can influence costs. Monthly payments are standard, but bi-weekly options can help pay off loans faster!

Credit Score

Your credit score affects your interest rate. A higher score usually means lower rates and smaller payments. Keep your credit healthy!

Prepayment Options

Some loans allow early payoff without penalties, saving you money on interest. Check if your loan offers this!

Personal Financial Situation

Your income and expenses are crucial. Lenders assess your finances to ensure affordability, so be honest about your budget!

Loan Purpose

The reason for the loan can affect terms and rates. Understand your loan’s purpose to make informed decisions!

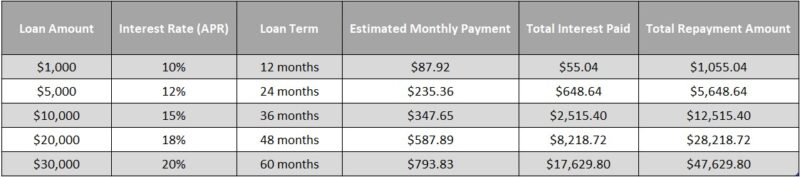

Personal Loan Repayment Estimates

Why You Should Use a Personal Loan Repayment Calculator Before Borrowing

When considering a personal loan, understanding your repayment options is crucial. A Personal Loan Repayment Calculator can help you estimate your monthly payments, making it easier to plan your budget. Knowing what to expect can save you from financial surprises down the road.

Using a Personal Loan Repayment Calculator offers several benefits:

Clarity on Monthly Payments

- Estimate Costs: It shows how much you’ll pay each month, helping you decide if you can afford the loan.

- Compare Options: You can adjust loan amounts and interest rates to see how they affect your payments.

Financial Planning Made Easy

- Budgeting: Knowing your monthly payment helps you budget better and avoid overspending.

- Avoiding Debt: It can prevent you from borrowing more than you can handle, keeping your finances healthy.

In summary, a Personal Loan Repayment Calculator is a valuable tool. It not only helps you understand your potential payments but also empowers you to make informed decisions about borrowing. So, before you sign on the dotted line, take a moment to calculate your repayment options!

Estimating Your Monthly Payments: Step-by-Step Instructions

When considering a personal loan, understanding how much you’ll need to pay each month is crucial. That’s where a Personal Loan Repayment Calculator comes in handy. This tool helps you estimate your monthly payments, making it easier to budget and plan your finances. Let’s dive into how to use it effectively!

Step 1: Gather Your Loan Details

To start, you’ll need some key information: the loan amount, interest rate, and loan term. Knowing these details helps the calculator provide accurate estimates.

Step 2: Input Your Information

Next, enter your gathered details into the Personal Loan Repayment Calculator. Most calculators will have fields for each piece of information. Just fill them in!

Step 3: Calculate and Review

Once you hit the calculate button, the magic happens! The calculator will show you your estimated monthly payment. Review this amount to see if it fits your budget. If it doesn’t, you might want to adjust the loan amount or term.

Benefits of Using the Calculator

- Quick Estimates: Get instant feedback on your potential payments.

- Budget Planning: Helps you plan your monthly expenses better.

- Informed Decisions: Make smarter choices about borrowing.

Using a Personal Loan Repayment Calculator is a simple yet powerful way to take control of your finances. Happy calculating!

Maximizing Your Savings: Tips for Using the Calculator Effectively

When you’re considering a personal loan, understanding how much you’ll pay back is crucial. A Personal Loan Repayment Calculator can help you estimate your monthly payments and total interest. This tool not only simplifies your budgeting but also empowers you to make informed financial decisions. Let’s explore how to maximize your savings with this handy calculator.

Know Your Loan Details

Before diving into the calculator, gather essential information about your loan. This includes:

- Loan Amount: How much money do you need?

- Interest Rate: What is the lender offering?

- Loan Term: How long will you take to repay it?

Having these details ready will make your calculations smoother and more accurate.

Experiment with Different Scenarios

One of the best features of a Personal Loan Repayment Calculator is its flexibility. Try adjusting the loan amount, interest rate, or term length. This way, you can see how each change affects your monthly payments. You might discover that a slightly lower loan amount or a longer term can save you money each month!

Set a Budget

Once you have your estimated payments, compare them to your monthly budget. Make sure you can comfortably afford the payments without stretching your finances too thin. If the numbers seem high, consider re-evaluating your loan options or terms. Remember, the goal is to find a loan that fits your financial situation without causing stress.

How ExpressCash Can Simplify Your Personal Loan Repayment Planning

Managing finances can be daunting, especially when it comes to repaying a personal loan. A Personal Loan Repayment Calculator is a valuable tool that helps you estimate your monthly payments, making budgeting easier and preventing unexpected surprises.

Using ExpressCash’s Personal Loan Repayment Calculator is straightforward! Simply enter the loan amount, interest rate, and repayment term, and you’ll quickly see your estimated monthly payment. This clarity empowers you to make informed financial decisions.

Benefits of Using Our Calculator

- Easy to Use: No complex formulas—just input your numbers.

- Quick Estimates: Get instant results for better planning.

- Budget-Friendly: Knowing your payments helps manage your spending effectively.

With ExpressCash, you can take charge of your personal loan repayment journey. Accurate estimates help you avoid financial stress and focus on what truly matters.

Why Accurate Estimates Matter

Accurate estimates from a Personal Loan Repayment Calculator can prevent unexpected financial strain. Understanding your monthly payment allows for effective budgeting, ensuring you meet your obligations without compromising your lifestyle.

How to Use the Calculator

- Input Loan Amount: Enter how much you plan to borrow.

- Enter Interest Rate: This is typically provided by your lender.

- Select Repayment Term: Choose your repayment duration.

After entering these details, hit ‘calculate’ to receive a clear breakdown of your monthly payments, making financial planning a breeze.

FAQs

-

What is a personal loan repayment calculator?

A personal loan repayment calculator helps estimate monthly payments, total interest, and repayment schedules based on loan amount, interest rate, and tenure. -

How do I use a personal loan repayment calculator?

Enter the loan amount, interest rate, and repayment period into the calculator, and it will automatically show your estimated monthly payment and total repayment cost. -

Can a repayment calculator help me choose the right loan tenure?

Yes, by adjusting the loan term in the calculator, you can compare different repayment plans and choose a tenure that balances affordability and total interest paid. -

Does the calculator include additional loan fees?

Some calculators allow you to input processing fees or other charges, while others only estimate payments based on interest rates and tenure. -

Is a personal loan repayment calculator accurate?

It provides an estimate, but actual loan payments may vary based on lender-specific terms, interest rate fluctuations, and additional fees.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.