The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

Variable-Rate Personal Loans Guide: What to Expect

When considering a loan, understanding your options is crucial. Our Variable-Rate Personal Loans Guide helps you know what to expect, especially if you seek flexibility in repayments.

Variable-rate personal loans are unique because their interest rates can change over time, affecting your monthly payments based on market conditions. It’s essential to understand how these loans work before diving in.

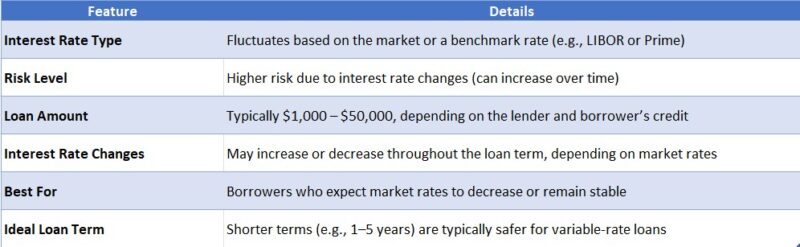

Key Features of Variable-Rate Personal Loans

- Interest Rate Fluctuations: Rates can change, impacting payment amounts.

- Potential Savings: If rates drop, you could save on interest.

- Risk Factor: If rates rise, your payments could increase, so be prepared!

Unlike fixed-rate loans, where interest remains constant, variable-rate loans offer a mix of benefits and risks. They can be advantageous if you expect lower rates in the future, but it’s vital to weigh these factors carefully.

Types of Personal Loans

Understanding the types of personal loans can help you choose wisely:

- Secured Loans: Backed by collateral, often with lower rates.

- Unsecured Loans: No collateral needed, but usually higher rates.

- Variable-Rate Loans: Interest rates can change, offering flexibility.

Benefits of Variable-Rate Personal Loans

Variable-rate personal loans offer several advantages:

- Lower Initial Rates: Often start lower than fixed loans.

- Flexibility: Payments can adjust based on market conditions.

- Potential for Savings: If rates decrease, you could pay less overall.

Things to Consider

Before opting for a variable-rate personal loan, consider:

- Market Trends: Monitor interest rate trends.

- Your Financial Situation: Ensure you can handle potential payment increases.

- Loan Terms: Understand the terms and conditions of your loan.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

How Do Variable-Rate Personal Loans Work?

When considering a loan, understanding how variable-rate personal loans work is crucial. This Variable-Rate Personal Loans Guide will help you navigate the ins and outs of these loans, so you know what to expect. Unlike fixed-rate loans, variable-rate loans can change over time, which can be both exciting and a bit nerve-wracking.

What is a Variable-Rate Personal Loan?

A variable-rate personal loan is a type of loan where the interest rate can fluctuate based on market conditions. This means your monthly payments might go up or down. It’s important to know that while you might save money when rates drop, you could also end up paying more if rates rise.

Key Features of Variable-Rate Personal Loans

- Interest Rate Changes: The rate is tied to an index, which means it can change periodically.

- Potential Savings: If rates decrease, your payments could lower, saving you money.

- Risk Factor: If rates increase, your payments may rise, which can affect your budget.

Understanding these features can help you decide if a variable-rate personal loan is right for you. Remember, it’s just one of the many types of personal loans available, so weigh your options carefully!

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

What Are the Benefits of Choosing a Variable-Rate Personal Loan?

When considering a personal loan, understanding the benefits of a variable-rate option is crucial. In our Variable-Rate Personal Loans Guide, we’ll explore what you can expect and why this type of loan might be the right fit for you. Let’s dive into the perks!

Lower Initial Rates

One of the standout benefits of variable-rate personal loans is their lower initial interest rates. Unlike fixed-rate loans, these rates can start off significantly lower, which means you might save money at the beginning of your loan term. This can be especially helpful if you’re looking to keep monthly payments manageable.

Potential for Decreasing Rates

With variable-rate loans, there’s a chance that your interest rate could decrease over time. If market rates drop, your loan rate may follow suit, leading to lower payments. This is a unique feature that can save you money in the long run, making it an attractive option among the various types of personal loans.

Flexibility and Adaptability

Variable-rate personal loans often come with flexible terms. This means you can adjust your repayment plan based on your financial situation. If you find yourself in a better position, you might pay off your loan faster without penalties. This adaptability can provide peace of mind as you navigate your financial journey.

Are There Risks Associated with Variable-Rate Personal Loans?

When considering a Variable-Rate Personal Loans Guide, it’s essential to understand the risks involved. Unlike fixed-rate loans, variable-rate loans can change over time, which means your monthly payments might increase or decrease. This unpredictability can be both exciting and nerve-wracking!

Understanding the Risks

Variable-rate personal loans come with a few risks that borrowers should keep in mind. Here are some key points to consider:

- Interest Rate Fluctuations: Your interest rate can rise, leading to higher payments.

- Budgeting Challenges: If rates increase, it may strain your monthly budget.

- Long-Term Costs: Over time, you might end up paying more than you would with a fixed-rate loan.

Weighing the Pros and Cons

Before diving into a variable-rate loan, think about your financial situation. Here are some questions to ask yourself:

- Can you handle potential increases in payments?

- Do you plan to pay off the loan quickly?

- Are you comfortable with the uncertainty of changing rates?

In conclusion, while variable-rate personal loans can offer lower initial rates, they come with risks that you should carefully consider. Understanding these factors is crucial in making an informed decision. Always remember, knowledge is power when navigating the world of personal loans!

How to Determine if a Variable-Rate Personal Loan is Right for You

When considering a loan, understanding your options is crucial. Our Variable-Rate Personal Loans Guide helps you navigate borrowing. But how do you know if a variable-rate loan is right for you? Let’s explore key factors to consider.

Assess Your Financial Situation

Before diving in, evaluate your finances. Ask yourself:

- Can you handle fluctuating payments?

- Do you have a stable income?

- Are you comfortable with potential interest rate increases?

These questions help gauge if a variable-rate loan suits your needs.

Understand the Benefits

Variable-rate personal loans can offer lower initial rates compared to fixed loans, potentially saving you money at first. However, rates can change. Consider the benefits:

- Lower starting interest rates

- Potential for lower overall costs if rates stay low

- Flexibility in repayment options

Weigh these benefits against your comfort with risk to make an informed decision.

Consider Your Loan Purpose

Think about why you need the loan. For short-term projects, a variable-rate loan might be beneficial. However, for long-term financing, like home renovations, a fixed-rate loan could provide more stability. Understanding your purpose helps you choose wisely.

Evaluate Market Trends

Keep an eye on interest rate trends. If rates are low and expected to rise, a variable-rate loan might be riskier. Conversely, if rates are stable or decreasing, you could benefit from a variable-rate loan. Researching market conditions can guide your decision-making process.

Consult a Financial Advisor

If you’re still unsure, consider talking to a financial advisor. They can provide personalized advice based on your situation, helping you understand the nuances of different types of personal loans.

Tips for Managing Your Variable-Rate Personal Loan Effectively

Managing a Variable-Rate Personal Loan can feel like riding a roller coaster. Interest rates can go up and down, affecting your monthly payments. That’s why our Variable-Rate Personal Loans Guide: What to Expect is essential. It helps you navigate the twists and turns, ensuring you stay on track financially.

Stay Informed About Interest Rates

Keep an eye on market trends. Understanding how interest rates fluctuate can help you anticipate changes in your payments. This knowledge is key to managing your budget effectively.

Create a Flexible Budget

Since your payments may vary, it’s smart to have a flexible budget. Set aside extra funds during low-rate periods. This way, you’ll be prepared for any increases when rates rise.

Consider Refinancing

If rates go up significantly, think about refinancing your loan. This could help you secure a lower fixed rate, making your payments more predictable. Always compare your options before deciding!

Communicate with Your Lender

Don’t hesitate to reach out to your lender. They can provide insights and options tailored to your situation. Building a good relationship can lead to better terms in the future.

How ExpressCash Can Help You Navigate Variable-Rate Personal Loans

Understanding variable-rate personal loans can be tricky, but it’s essential for making informed financial decisions. Our Variable-Rate Personal Loans Guide is designed to help you navigate this complex topic with ease. Knowing what to expect can save you time and money, ensuring you choose the right loan for your needs.

At ExpressCash, we simplify the process of exploring different types of personal loans. Here’s how we can assist you:

Expert Insights

- Comprehensive Guides: Our guides break down the details of variable-rate loans, making them easy to understand.

- Comparative Analysis: We help you compare variable-rate loans with fixed-rate options, highlighting the pros and cons of each.

Personalized Support

- Tailored Recommendations: We provide suggestions based on your financial situation, ensuring you find the best loan.

- FAQs and Resources: Our extensive FAQ section answers common questions, helping you feel confident in your choices.

User-Friendly Tools

- Loan Calculators: Use our easy-to-navigate calculators to estimate your monthly payments and total interest costs.

- Interactive Quizzes: Discover which type of personal loan suits you best with our fun quizzes, designed to match your needs.

Community Support

- Forums and Discussions: Join our community to share experiences and learn from others who have navigated variable-rate loans.

- Expert Webinars: Attend our webinars where financial experts discuss trends and answer your questions in real-time.

FAQs

-

What is a variable-rate personal loan?

A variable-rate loan has an interest rate that can change over time, typically based on a benchmark index like the prime rate or LIBOR. -

How often can the interest rate change?

Rate changes can occur monthly, quarterly, or annually, depending on your loan terms. Your lender will specify how often adjustments may happen. -

What are the advantages of a variable-rate loan?

These loans often start with lower initial interest rates, which can lead to lower early payments—ideal for short-term borrowing or if you expect rates to stay low. -

What are the risks of a variable-rate loan?

Your monthly payments can increase if interest rates rise, making it harder to budget and potentially leading to higher total loan costs over time. -

Can I switch from a variable to a fixed-rate loan?

Yes, some lenders allow you to refinance into a fixed-rate loan, especially if you’re concerned about future interest rate hikes.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.