The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

Unsecured Personal Loans Guide: Benefits & Risks

Understanding your borrowing options is vital, and our Unsecured Personal Loans Guide is here to help. These loans allow you to access cash without collateral, but they come with both benefits and risks that you should know about.

Benefits of Unsecured Personal Loans

Why Choose Unsecured Loans?

- No Collateral Required: You won’t risk your home or car.

- Quick Access to Funds: Many lenders provide fast approvals, ensuring you get money when needed.

- Flexible Use: Funds can be used for various purposes, like debt consolidation or unexpected expenses.

Risks to Consider

- Higher Interest Rates: Without collateral, lenders may charge higher rates.

- Impact on Credit Score: Missing payments can negatively affect your credit rating.

- Debt Cycle: Borrowing excessively can lead to financial difficulties.

In conclusion, while unsecured personal loans can offer quick relief, it’s crucial to balance the benefits with the risks. Always assess your financial situation before proceeding!

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

What Are the Key Benefits of Unsecured Personal Loans?

Understanding the Unsecured Personal Loans Guide is essential when considering financial options. These loans offer quick cash without requiring collateral, making them attractive to many borrowers. Knowing the benefits can empower you to make informed financial decisions.

Quick Access to Funds

A major advantage of unsecured personal loans is the rapid access to funds. Unlike secured loans that require collateral, these loans typically have a simpler application process, allowing you to obtain money quickly for emergencies or unexpected expenses.

No Collateral Required

Unsecured personal loans do not require you to risk your assets, which is a significant relief for borrowers. You can secure funds without putting your home or car at risk, reducing stress and financial vulnerability.

Flexible Use of Funds

These loans also offer flexibility in how you can use the money. Whether for home improvements, medical bills, or debt consolidation, unsecured personal loans can meet various needs, making them a popular choice among the different types of personal loans available.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

Are There Risks Associated with Unsecured Personal Loans?

When borrowing money, understanding the risks is as crucial as knowing the benefits. In our Unsecured Personal Loans Guide, we highlight the potential pitfalls of these loans. They can be useful financial tools, but they also present challenges that borrowers should recognize.

High Interest Rates

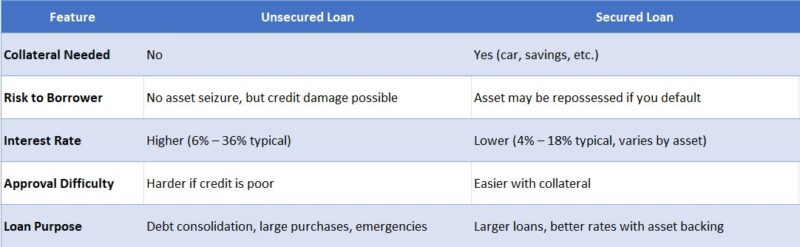

A significant risk of unsecured personal loans is their high interest rates. Unlike secured loans that use collateral, unsecured loans typically have higher rates due to increased lender risk. This can lead to repaying much more than you initially borrowed!

Impact on Credit Score

Another concern is the potential impact on your credit score. Missing payments can cause your score to drop, making future loans harder to obtain or resulting in higher rates on other personal loans.

Debt Cycle

Finally, there’s the risk of falling into a debt cycle. Relying on these loans without a solid repayment plan may force you to borrow more just to manage existing debts. It’s essential to borrow wisely and fully understand your financial situation.

How to Determine If an Unsecured Personal Loan Is Right for You

When considering an unsecured personal loan, it’s crucial to understand its role in your financial situation. The Unsecured Personal Loans Guide: Benefits & Risks can help you evaluate your choices. These loans are useful for covering unexpected expenses but come with challenges.

Assess Your Financial Needs

Think about why you need the loan. Are you consolidating debt, covering medical bills, or financing a big purchase? Knowing your purpose will guide your decision.

Evaluate Your Credit Score

Your credit score is vital for qualifying for an unsecured personal loan. A higher score usually means better interest rates. Check your score to ensure it meets lender requirements.

Consider Your Repayment Ability

Finally, consider if you can comfortably make the monthly payments. Create a budget to see if the loan fits your financial plan. Remember, while these loans can be beneficial, they shouldn’t lead to deeper debt.

Comparing Unsecured Personal Loans: What to Look For

When considering an unsecured personal loan, it’s essential to understand what you’re getting into. This Unsecured Personal Loans Guide: Benefits & Risks will help you navigate the options available. Knowing the types of personal loans can empower you to make informed decisions that suit your financial needs.

Interest Rates

Look for competitive interest rates. A lower rate can save you money over time. Compare offers from different lenders to find the best deal.

Loan Terms

Consider the loan term length. Shorter terms may have higher monthly payments but less interest overall. Longer terms can mean lower payments but more interest paid in the end.

Fees and Charges

Be aware of any hidden fees. Some lenders charge origination fees or prepayment penalties. Always read the fine print to avoid surprises!

Customer Service

Good customer service can make a big difference. Choose a lender that is responsive and helpful. This can ease the process and provide support when you need it.

The Application Process for Unsecured Personal Loans Explained

Understanding the application process for an unsecured personal loan is essential. This Unsecured Personal Loans Guide will help you navigate the steps, empowering you to make informed decisions and avoid pitfalls.

Step 1: Research Lenders

Begin by researching various lenders. Compare interest rates, terms, and fees to find the best deal among different types of personal loans. Checking reviews can also help assess lender reliability.

Step 2: Gather Necessary Documents

Next, collect your documents, including proof of income, identification, and possibly your credit score. Having these ready can streamline the application process.

Step 3: Complete the Application

After selecting a lender, fill out the application accurately. Inaccuracies can delay approval, so be thorough. The lender will review your information and make a decision.

Step 4: Review Loan Terms

If approved, carefully review the loan terms, including interest rates and fees, to avoid surprises.

Step 5: Accept the Loan

Finally, if everything is satisfactory, accept the loan. Funds are usually disbursed quickly, so you can use them as needed. Responsible borrowing is crucial for your financial health.

Tips for Securing the Best Rates on Unsecured Personal Loans

Understanding unsecured personal loans is essential for making informed borrowing decisions. This Unsecured Personal Loans Guide: Benefits & Risks provides insights to help you secure the best rates, ultimately saving you money and reducing stress. Here are some tips to consider:

Shop Around

Always compare offers from various lenders, including banks, credit unions, and online options. Rates can vary significantly, so exploring multiple choices is key!

Check Your Credit Score

Your credit score significantly impacts your loan rate. Before applying, review your score and take steps to improve it if necessary. A better score can lead to lower interest rates, making your loan more affordable!

Consider the Loan Amount and Term

Evaluate how much you need and the repayment period. Smaller loans or shorter terms may offer better rates. Clearly defining your needs will help you find the most suitable option!

How Unsecured Personal Loans Can Impact Your Credit Score

When considering an Unsecured Personal Loans Guide, understanding how these loans can impact your credit score is crucial. Many people seek personal loans for various reasons, but it’s important to know the potential effects on your financial health. Let’s dive into this topic!

Positive Impacts

- Improved Credit Mix: Having different types of personal loans can enhance your credit profile. This variety shows lenders that you can handle various types of debt responsibly.

- On-Time Payments: Making consistent, on-time payments can boost your credit score over time. This demonstrates reliability to future lenders.

Negative Impacts

- Hard Inquiries: When you apply for an unsecured personal loan, lenders perform a hard inquiry on your credit report. This can temporarily lower your score.

- Increased Debt Load: Taking on more debt can raise your credit utilization ratio, which might negatively affect your score. It’s essential to manage your debt wisely!

Real-Life Scenarios: When to Consider an Unsecured Personal Loan

When considering an unsecured personal loan, it’s essential to understand when it might be the right choice for you. This Unsecured Personal Loans Guide: Benefits & Risks can help you navigate through real-life scenarios where these loans can be beneficial. Let’s explore some situations where an unsecured personal loan could be a smart move.

Emergency Expenses

Imagine your car breaks down unexpectedly, and you need funds for repairs. An unsecured personal loan can provide quick cash without putting your home or other assets at risk. This type of personal loan can be a lifesaver in urgent situations, allowing you to get back on the road without delay.

Consolidating Debt

If you have multiple credit card debts, an unsecured personal loan might help simplify your finances. By consolidating your debts into one loan, you can potentially lower your monthly payments and save on interest. This strategy can make managing your finances easier and less stressful.

How ExpressCash Can Help You Navigate Unsecured Personal Loans

Navigating unsecured personal loans can be overwhelming, but our Unsecured Personal Loans Guide: Benefits & Risks is designed to simplify the process. Understanding the benefits and risks empowers you to make informed financial decisions.

Understanding Your Options

Unsecured loans are popular because they don’t require collateral, allowing you to borrow without risking your home or car. Our guide details the various types of personal loans available, helping you choose the best option for your needs.

Key Benefits of Unsecured Personal Loans

- No Collateral Needed: Protect your assets.

- Quick Access to Funds: Get your money faster than with secured loans.

- Flexible Use: Spend the funds on anything from home improvements to unexpected expenses.

While these loans offer significant benefits, it’s essential to understand the associated risks. Our guide provides the information you need to weigh these factors, ensuring you are well-prepared for your financial journey.

FAQs

-

What is an unsecured personal loan?

An unsecured personal loan is a loan that does not require collateral. Approval is based on your credit score, income, and financial history. -

Who is eligible for an unsecured personal loan?

Borrowers with good to excellent credit, a steady income, and a low debt-to-income ratio are more likely to qualify for unsecured loans. -

Are interest rates higher on unsecured personal loans?

Yes, unsecured loans typically have higher interest rates than secured loans because they involve more risk for the lender. -

Can I get an unsecured loan with bad credit?

It’s possible, but you may face higher rates, lower loan amounts, or be asked to add a co-signer to improve approval chances. -

What can I use an unsecured personal loan for?

These loans are flexible and can be used for debt consolidation, medical bills, home improvements, emergency expenses, or even vacations.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.