The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

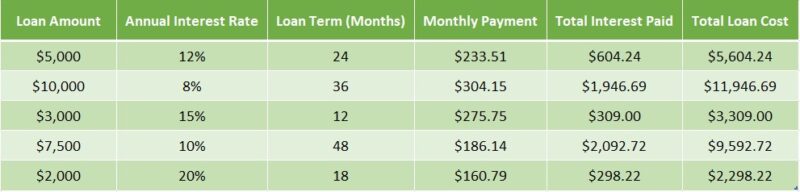

Total Loan Cost Calculator: Find Out the Real Cost of Borrowing

Understanding the Total Loan Cost Calculator: What You Need to Know

When you’re thinking about borrowing money, understanding the real cost is crucial. That’s where the Total Loan Cost Calculator comes in. This handy tool helps you see beyond just the monthly payments, revealing the total amount you’ll pay over the life of the loan. Knowing this can save you from unexpected surprises!

Using a Personal Loan Repayment Calculator can help you make informed decisions. Here are some key benefits:

- Clarity: It breaks down your loan into understandable parts.

- Budgeting: You can plan your finances better with a clear picture of costs.

- Comparison: Easily compare different loan offers to find the best deal.

How to Use the Calculator

Using the Total Loan Cost Calculator is simple! Just follow these steps:

- Enter the loan amount you need.

- Input the interest rate offered.

- Specify the loan term (how long you’ll take to pay it back).

- Hit calculate and see the total cost!

This way, you can confidently choose the right loan for your needs.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

How Does a Total Loan Cost Calculator Work?

Understanding the real cost of borrowing is essential for anyone considering a loan. A Total Loan Cost Calculator goes beyond monthly payments, revealing the total amount you’ll pay over the loan’s life, including interest and fees. This insight empowers you to make informed financial decisions.

To use a Total Loan Cost Calculator, input key details like the loan amount, interest rate, and repayment term. It then calculates:

- Total Interest Paid: The additional money you’ll pay on top of the loan.

- Total Loan Cost: The total of the loan amount and interest.

- Monthly Payments: Your monthly payment amount.

This tool is akin to a Personal Loan Repayment Calculator but offers a broader perspective on your financial commitment. Using a Total Loan Cost Calculator helps you avoid unexpected surprises. By understanding the total cost upfront, you can easily compare different loans and select the best option for your budget, reducing future financial stress. Remember, knowledge is power when borrowing!

The Importance of Knowing Your Total Loan Costs

When considering a loan, understanding the total cost is crucial. The Total Loan Cost Calculator helps you see beyond just the monthly payments. It reveals the true financial impact of borrowing, including interest rates and fees, ensuring you make informed decisions.

Why Use a Total Loan Cost Calculator?

Using a Personal Loan Repayment Calculator can simplify your financial planning. It allows you to:

- Compare Loans: See how different loans stack up against each other.

- Budget Better: Know exactly how much you’ll pay over time.

- Avoid Surprises: Understand all costs upfront, preventing unexpected financial stress.

Key Benefits of Knowing Your Total Loan Costs

Understanding your total loan costs can save you money and headaches. Here are some benefits:

- Informed Choices: Make better decisions based on clear data.

- Financial Confidence: Feel secure in your borrowing choices.

- Long-term Planning: Prepare for future payments and financial goals.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

Key Factors That Influence Total Loan Costs

Understanding the total cost of a loan is essential for making informed decisions. A Total Loan Cost Calculator goes beyond monthly payments, revealing the true cost of borrowing, including interest and fees. Let’s look at the key factors that influence these costs.

Interest Rates

Interest rates significantly impact your total loan cost. Lower rates mean less money paid over time, so it’s wise to compare offers from various lenders to secure the best deal.

Loan Term

The duration of your loan also affects interest payments. Shorter loan terms typically result in higher monthly payments but less interest overall. A Personal Loan Repayment Calculator can help you assess how different terms affect your payments.

Fees and Charges

Be mindful of fees such as origination, late payment, and prepayment penalties, as they can accumulate quickly. Always read the fine print to grasp all potential costs.

Credit Score

Your credit score plays a crucial role in determining your interest rate. A higher score often leads to better rates, ultimately reducing your total loan cost. Maintaining a healthy credit score can save you money!

Also Read: Personal Loan Repayment Calculator: Estimate Your Payments

Comparing Loan Options: Why Use a Total Loan Cost Calculator?

When considering a loan, understanding the total cost is crucial. A Total Loan Cost Calculator helps you see beyond just the monthly payments. It reveals the real cost of borrowing, including interest rates and fees, so you can make informed decisions. Let’s dive into why this tool is essential for comparing loan options.

The Importance of Clarity

Using a Total Loan Cost Calculator can simplify your loan search. It breaks down complex numbers into easy-to-understand figures. Here’s why it matters:

- Transparency: Know exactly what you’ll pay over time.

- Comparison: Easily compare different loans side by side.

- Budgeting: Helps you plan your finances better by showing total repayment amounts.

Making Smart Choices

With a Personal Loan Repayment Calculator, you can estimate your monthly payments based on the total loan cost. This way, you can:

- Assess Affordability: Determine if the loan fits your budget.

- Avoid Surprises: Understand the full financial commitment before signing.

- Choose Wisely: Make informed choices that align with your financial goals.

Common Misconceptions About Total Loan Costs

When borrowing money, many focus only on the interest rate, but understanding the total loan cost is essential. A Total Loan Cost Calculator reveals not just the interest but also various fees and charges, helping you make informed financial decisions.

Many borrowers mistakenly believe that the interest rate is the sole factor affecting their loan. In reality, fees such as origination fees, late payment penalties, and insurance can accumulate. A Personal Loan Repayment Calculator can clarify these costs, ensuring you know your true expenses.

Key Insights to Consider

- Interest Rates Aren’t Everything: They are just one part of the equation.

- Fees Matter: Additional charges can significantly raise your total cost.

- Long-Term Impact: Even a small rate difference can lead to substantial changes in total repayment over time.

Using tools like the Total Loan Cost Calculator helps you uncover the real cost of borrowing, allowing you to avoid unexpected surprises.

How to Use the Total Loan Cost Calculator Effectively

Understanding the true cost of borrowing is essential for anyone considering a loan. The Total Loan Cost Calculator goes beyond monthly payments, revealing the total amount you’ll pay over the loan’s life, including interest and fees. This insight helps you budget effectively.

Using the Total Loan Cost Calculator is straightforward. First, gather your loan details: principal amount, interest rate, and loan term. Input this information into the calculator to see your total repayment amount clearly.

Key Steps to Follow:

- Input Loan Details: Enter the principal, interest rate, and term.

- Calculate: Click the calculate button to find your total loan cost.

- Compare Options: Use the results to evaluate different loan offers and choose the best one.

The Total Loan Cost Calculator is your financial ally. When paired with a Personal Loan Repayment Calculator, it empowers you to make informed decisions, ensuring you know what to expect before signing any agreements. Remember, knowledge is power in borrowing!

Real-Life Scenarios: When to Use a Total Loan Cost Calculator

When considering a loan, understanding the total cost is crucial. A Total Loan Cost Calculator helps you see beyond just the monthly payments. It reveals the real cost of borrowing, including interest and fees, allowing you to make informed decisions. Let’s explore when to use this handy tool.

- Planning for a Major Purchase: If you’re eyeing a new car or home, this calculator can show you how much you’ll actually pay over time.

- Comparing Loan Offers: Different lenders might offer varying terms. Use the calculator to compare total costs and find the best deal.

- Budgeting for Repayments: Knowing the total cost helps you budget better. A Personal Loan Repayment Calculator can help you plan monthly payments based on your financial situation.

In each of these scenarios, the Total Loan Cost Calculator is your best friend. It simplifies complex numbers into clear insights, making it easier to choose the right loan for your needs. Remember, knowledge is power when it comes to borrowing!

How ExpressCash Can Help You Calculate Your Total Loan Costs

When it comes to borrowing money, understanding the total cost is crucial. A Total Loan Cost Calculator can help you see beyond just the interest rate, revealing the real expenses involved in your loan. This tool is essential for making informed financial decisions, ensuring you don’t end up with unexpected costs.

At ExpressCash, we provide a user-friendly Total Loan Cost Calculator that simplifies the process. With just a few clicks, you can input your loan amount, interest rate, and term. Our calculator will break down the total cost, including interest and fees, so you know exactly what to expect.

Key Benefits of Using Our Calculator

- Clear Breakdown: Understand how much you’ll pay in total, not just monthly payments.

- Compare Options: Easily compare different loan offers to find the best deal.

- Plan Ahead: Use our Personal Loan Repayment Calculator to budget your monthly payments effectively.

With these tools, you can confidently navigate your borrowing journey.

Maximizing Your Savings: Tips for Reducing Total Loan Costs

Understanding the total loan cost is essential when borrowing money. A Total Loan Cost Calculator helps you look beyond monthly payments, revealing the real cost of borrowing, including interest rates and fees. This insight allows for informed financial decisions.

Shop Around for the Best Rates

Always compare loan offers. Utilize a Personal Loan Repayment Calculator to evaluate different lenders and find the best interest rates and terms that fit your budget.

Consider Shorter Loan Terms

Although longer loan terms may offer lower monthly payments, they can result in higher total costs. Choosing a shorter loan term can save you money on interest and help you pay off your debt faster!

Make Extra Payments

Whenever possible, make extra payments towards your loan principal. This strategy reduces the total interest paid over the loan’s life. Even small additional payments can accumulate and lead to significant savings.

FAQs

-

What is a Total Loan Cost Calculator?

A Total Loan Cost Calculator helps estimate the full amount you will pay over the life of a loan, including principal, interest, and any additional fees. -

How is the total cost of a loan calculated?

The total cost is calculated by adding the loan principal to the total interest paid over the loan term. Some calculators also factor in extra charges like origination fees and insurance. -

Why is it important to calculate the total loan cost?

Knowing the total cost helps borrowers compare loan options, plan finances, and avoid loans with excessive interest or hidden fees. -

Can making extra payments reduce my total loan cost?

Yes, paying more than the required monthly amount reduces the principal faster, lowering the total interest paid and shortening the loan term. -

Does the total loan cost include prepayment penalties or late fees?

Most basic calculators do not include these fees, so borrowers should check the loan agreement for potential extra costs.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.