The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

Personal Loans for Students and Education: What’s Available?

When it comes to financing your education, understanding Personal Loans for Students and Education is crucial. These loans can help bridge the gap between your savings and the total cost of college. With so many options available, knowing what’s out there can make a big difference in your financial journey.

Types of Personal Loans for Students and Education

1. Federal Student Loans

These are government-backed loans with lower interest rates. They often come with flexible repayment options, making them a popular choice for students.

2. Private Student Loans

Offered by banks and credit unions, these loans can cover any remaining costs after federal loans. However, they usually require a good credit score or a co-signer.

3. Personal Loans

These loans can be used for various educational expenses, from tuition to textbooks. They typically have higher interest rates than federal loans, so it’s essential to compare options before borrowing. In summary, exploring the different types of Personal Loans for Students and Education can empower you to make informed decisions. Remember, each loan type has its pros and cons, so take your time to research and find the best fit for your needs. Your education is an investment in your future, and the right financing can help you succeed!

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

What Types of Personal Loans Are Available for Students?

When it comes to financing your education, understanding the options available is crucial. Personal loans for students and education can help bridge the gap between tuition costs and what you can afford. But what types of personal loans are available for students? Let’s explore the different options that can help you achieve your academic dreams.

Types of Personal Loans for Students

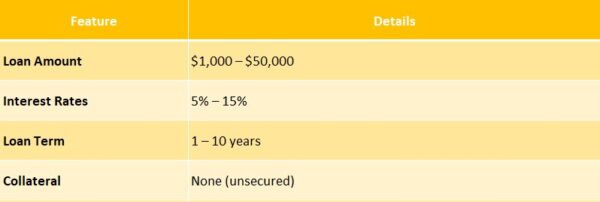

- Unsecured Personal Loans: These loans don’t require collateral, making them accessible for many students. However, they often come with higher interest rates.

- Secured Personal Loans: These loans require collateral, like a car or savings account. They usually have lower interest rates but come with the risk of losing your asset if you can’t repay.

- Peer-to-Peer Loans: These loans connect borrowers directly with individual lenders through online platforms. They can offer competitive rates and flexible terms, but it’s essential to research the platform thoroughly.

- Credit Union Loans: Many credit unions offer personal loans specifically for students. They often have lower interest rates and more favorable terms than traditional banks, making them a great option for financing education.

Benefits of Personal Loans for Students

- Flexible Use: You can use personal loans for tuition, books, or even living expenses.

- Quick Access to Funds: Many lenders provide fast approval, so you can get the money you need when you need it.

- Build Credit History: Successfully repaying a personal loan can help you build a positive credit history, which is beneficial for future financial endeavors.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

How to Choose the Right Personal Loan for Your Educational Needs?

Choosing the right personal loan for your educational needs can feel overwhelming. With so many options available, it’s important to understand what personal loans for students and education can offer. These loans can help cover tuition, books, and living expenses, making your academic journey smoother.

Types of Personal Loans to Consider

When exploring personal loans, it’s helpful to know the different types available. Here are a few common options:

- Unsecured Personal Loans: These don’t require collateral, making them easier to obtain but often come with higher interest rates.

- Secured Personal Loans: These require collateral, like a car or savings account, which can lower your interest rate but puts your asset at risk.

- Peer-to-Peer Loans: These connect borrowers directly with investors, often resulting in lower rates and flexible terms.

Key Factors to Evaluate

When selecting a loan, consider the following:

- Interest Rates: Look for competitive rates to save money over time.

- Repayment Terms: Choose a term that fits your budget and future plans.

- Fees: Be aware of any hidden fees that could increase your overall cost.

By understanding these aspects, you can confidently choose a personal loan that aligns with your educational goals and financial situation.

The Benefits of Personal Loans for Students: Why They Matter

When it comes to pursuing higher education, many students find themselves in need of financial support. Personal loans for students and education can be a helpful resource, allowing them to cover tuition, books, and living expenses. Understanding what’s available can make a big difference in a student’s academic journey.

Personal loans for students and education come with several advantages. Here are some key benefits:

- Flexibility: Unlike traditional student loans, personal loans can be used for various expenses, not just tuition. This means you can pay for housing, supplies, or even a laptop.

- Quick Access to Funds: Many lenders offer fast approval processes, so you can get the money you need quickly. This is especially helpful when unexpected costs arise.

- No Collateral Required: Most personal loans don’t require you to put up any assets as collateral, making them accessible to many students.

In addition to these benefits, it’s important to know the types of personal loans available. You can find secured loans, which require collateral, or unsecured loans that don’t. Each type has its pros and cons, so it’s essential to choose wisely based on your financial situation.

Are Personal Loans for Students a Good Idea? Pros and Cons Explained

When it comes to financing education, many students wonder about their options. Personal loans for students and education can be a useful tool, but they come with their own set of pros and cons. Understanding what’s available can help you make informed decisions about your financial future.

Pros of Personal Loans for Students

- Flexibility: Personal loans can be used for various educational expenses, from tuition to books.

- Quick Access to Funds: Unlike some student loans, personal loans can often be approved quickly, giving you immediate access to cash.

- No Collateral Needed: Most personal loans are unsecured, meaning you don’t have to put up your assets as collateral.

Cons of Personal Loans for Students

- Higher Interest Rates: Personal loans typically have higher interest rates compared to federal student loans.

- Debt Accumulation: Taking out a personal loan can lead to more debt, which may be hard to manage after graduation.

- Repayment Pressure: You may need to start repaying the loan sooner than with other types of student loans, which can be stressful while studying.

In summary, personal loans for students and education can be beneficial, but it’s essential to weigh the pros and cons carefully. Always consider your financial situation and future plans before making a decision.

How ExpressCash Can Help You Navigate Personal Loans for Education

Navigating personal loans for students and education can be overwhelming, but understanding your options is key to achieving your academic dreams. Whether you need funds for tuition, books, or living expenses, personal loans can be a valuable resource.

At ExpressCash, we simplify finding personal loans for students and education. Here’s how we assist you:

Understanding Types of Personal Loans

- Unsecured Personal Loans: No collateral needed, making them easier to obtain, though they may have higher interest rates.

- Secured Personal Loans: Require collateral, which can lead to lower interest rates but comes with risks.

- Federal Student Loans: Not personal loans, but often offer lower rates and flexible repayment options worth considering.

Key Benefits of Using ExpressCash

- Personalized Guidance: We help assess your financial situation to find the best loan options.

- Comparison Tools: Easily compare different loans to find the right fit for your needs.

- Educational Resources: Access articles and tips to understand the loan process and make informed decisions.

By using ExpressCash, you can confidently explore personal loans for students and education. We’re here to guide you every step of the way, ensuring you make the best choices for your future. The right loan can help you focus on your studies rather than your finances!

Tips for Managing Your Personal Loan Debt as a Student

Managing personal loan debt as a student can be daunting, but it’s essential for your financial future. Personal loans for students and education can help cover tuition, books, and living expenses. Knowing how to manage this debt is key to your success after graduation.

Create a Budget

Begin by creating a budget. List your income and expenses to track where your money goes. This helps you allocate funds for loan payments and avoid overspending. Stick to your budget to stay on top of your personal loans.

Make Payments on Time

Always pay your loans on time to avoid late fees and damage to your credit score. Set reminders or use automatic payments to ensure you never miss a due date. This simple habit can save you money in the long run.

Explore Repayment Options

Investigate different repayment options available for personal loans. Some lenders offer flexible plans based on your income. Researching these options can help you find a suitable plan that makes managing your debt easier.

Consider Consolidation

If you have multiple personal loans, think about consolidating them. This combines your loans into one, simplifying payments and possibly lowering your interest rate. It’s an efficient way to manage your debt.

Seek Financial Advice

Don’t hesitate to seek help! Many schools provide financial counseling services that can offer valuable insights into managing your loans and creating a workable plan. Remember, asking for guidance is always a good idea.

Stay Informed

Stay updated on your loan terms and any interest rate changes. Understanding your loans empowers you to make informed decisions, which is crucial for effectively managing personal loans for students and education.

FAQs

-

Can I use a personal loan to pay for college or education costs?

Yes, personal loans can be used for tuition, books, housing, or other educational expenses, especially when federal student aid isn’t enough or not available. -

What’s the difference between a student loan and a personal loan?

Student loans (federal or private) are designed specifically for education and often offer deferment, income-based repayment, and lower interest rates. Personal loans typically don’t offer these benefits but may be faster to obtain and don’t require school certification. -

Can students qualify for a personal loan without income or credit history?

It’s difficult but possible. Most lenders require a cosigner or proof of stable income. Students with no credit may need to apply with a parent or guardian as a co-applicant. -

What are the risks of using a personal loan for education?

Personal loans generally come with higher interest rates, shorter repayment terms, and no grace periods, which could lead to financial stress after graduation if not managed carefully. -

Are there better alternatives to personal loans for students?

Yes. Consider federal student loans first due to their flexible terms. Also explore scholarships, grants, or school payment plans before turning to personal loans.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.