The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

Soft vs. Hard Credit Inquiries Explained

Soft vs. Hard Credit Inquiries Explained

When you apply for a loan, credit card, or even a job, someone may check your credit. This is called a credit inquiry. There are two types: soft and hard inquiries. They sound similar, but they are very different.

In this article, we’ll explain what soft and hard inquiries are, how they affect your credit score, and when they happen. We’ll keep everything simple so you can understand easily.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

What Is a Credit Inquiry?

A credit inquiry happens when someone checks your credit report. This could be a lender, landlord, employer, or even you.

There are two kinds of inquiries:

-

Soft inquiry

-

Hard inquiry

Each has its own rules and effects on your credit score.

What Is a Soft Credit Inquiry?

A soft inquiry is a gentle check of your credit. It does not affect your credit score. It happens when:

-

You check your own credit

-

A lender pre-approves you for an offer

-

An employer checks your credit during hiring

-

A credit card company checks your report for marketing

Soft inquiries are private. Only you can see them. They do not show up for lenders.

What Is a Hard Credit Inquiry?

A hard inquiry is a detailed credit check. It happens when you apply for credit or a loan. Lenders use it to see if you’re a good borrower.

Examples include:

-

Applying for a credit card

-

Getting a car loan

-

Applying for a mortgage

-

Requesting a personal loan

Hard inquiries can lower your credit score by a few points. They also stay on your report for up to 2 years, but they affect your score for only 1 year.

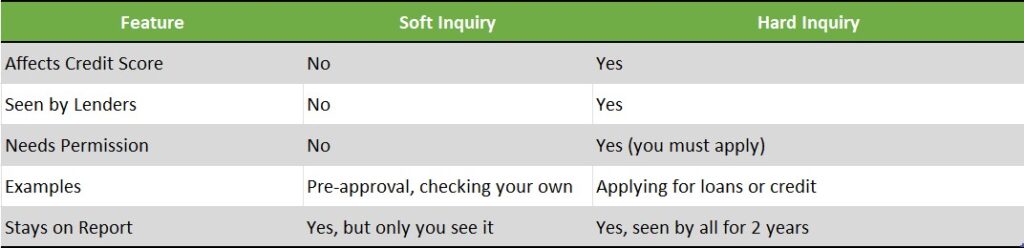

Key Differences Between Soft and Hard Inquiries

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

When Do Soft Inquiries Happen?

Here are common times you may get a soft inquiry:

-

You use a credit score app

-

You receive a credit card offer in the mail

-

You check your score online

-

A lender does a pre-approval

-

An employer checks before hiring you

Soft pulls are used to get a quick look at your credit. They do not dig too deep.

When Do Hard Inquiries Happen?

Hard inquiries happen when you actively apply for something:

-

Credit cards

-

Auto loans

-

Mortgages

-

Student loans

-

Personal loans

-

Rent applications (in some cases)

Lenders want a full picture of your credit history. They do a hard pull to decide if you are a safe borrower.

How Much Do Hard Inquiries Lower Your Score?

Each hard inquiry may lower your score by 2 to 5 points. It’s not a big drop, but too many inquiries can add up.

Here’s an example:

-

1 hard inquiry: -3 points

-

4 hard inquiries in 3 months: -12 points or more

Your score can bounce back in a few months if you don’t add more inquiries.

How Long Do Inquiries Stay on Your Credit Report?

| Inquiry Type | Stays on Report | Affects Score For |

|---|---|---|

| Soft Inquiry | 2 years (only you see it) | 0 months |

| Hard Inquiry | 2 years (everyone sees it) | 12 months |

Even though a hard inquiry stays for 2 years, it only affects your score for the first 12 months.

How to Limit Hard Inquiries

Here are some tips to protect your score:

-

Don’t apply for too many loans at once

-

Only apply when needed

-

Use pre-qualification tools

-

Space out applications

Be strategic. A few points can make a big difference in loan terms.

What Is Rate Shopping?

Rate shopping is when you apply to several lenders to find the best rate. The credit system understands this. So, if you apply for similar loans in a short time, it counts as one hard inquiry.

Here’s how it works:

-

Mortgage and auto loans: 14 to 45-day window (varies by scoring model)

-

Credit cards: No shopping window — each application is a new inquiry

Tip: If you’re comparing personal loan offers, apply within a 14-day period to be safe.

Does Pre-Approval Involve a Hard or Soft Inquiry?

Pre-approval or pre-qualification usually involves a soft inquiry. You can see offers without hurting your score.

But if you decide to accept the offer, then a hard inquiry will be made to finalize the approval.

Can Employers See Your Credit Score?

No. Employers can only see your credit report, not your score. Their inquiry is a soft pull and does not affect your score.

They may look for:

-

Bankruptcy

-

Late payments

-

High debt

You must give written permission before they check.

Can Landlords Do Hard Inquiries?

Sometimes. It depends on the landlord and the lease type.

-

Some landlords use a soft pull to check your report.

-

Others do a hard pull, especially for high-end or long-term rentals.

Always ask your landlord which type they will use before they check.

Do Utility Companies Check Credit?

Yes, but most use soft inquiries. Some may ask for a deposit if your credit is low.

Cell phone and internet companies may also do a soft pull or hard pull depending on the plan and company.

Can I See Who Pulled My Credit?

Yes. You can see all credit inquiries on your credit report.

Visit AnnualCreditReport.com to get your free credit report from:

-

Experian

-

TransUnion

-

Equifax

Look under the “inquiries” section.

What If There’s a Hard Inquiry I Don’t Recognize?

If you see a hard inquiry you don’t know:

-

Contact the company listed

-

Ask why they pulled your credit

-

If it’s fraud, dispute it with all three credit bureaus

Removing false inquiries can improve your credit score.

How to Handle Inquiries During Loan Shopping

Let’s say you want a personal loan. You should:

-

Use pre-qualification tools (soft inquiry)

-

Compare lenders within a short time

-

Apply only once you choose the best one

This way, your credit score won’t drop too much.

Common Myths About Credit Inquiries

Myth 1: Checking my credit hurts my score

False. When you check your own score, it’s a soft pull. It does not hurt your score.

Myth 2: All inquiries hurt credit

False. Only hard inquiries affect your score.

Myth 3: One inquiry ruins my score

False. One hard pull only drops your score by a few points.

Myth 4: All inquiries are the same

False. Hard and soft pulls are different and have different effects.

Pros and Cons of Soft Inquiries

| Pros | Cons |

|---|---|

| No impact on credit score | Lenders don’t rely on them |

| Used for pre-approval | Not final loan offers |

| You can check anytime | Results may not be guaranteed |

Pros and Cons of Hard Inquiries

| Pros | Cons |

|---|---|

| Can lead to loan approval | Can lower your credit score |

| Show real credit activity | Stay on your report for 2 years |

| Required for most serious lending | Too many can look risky to lenders |

Using ExpressCash Without Worry

At ExpressCash, we help people find personal loans fast. Many of our partners offer soft inquiry pre-approval, so you can check your options without hurting your score.

Benefits of Using ExpressCash

-

Fast pre-approval

-

No hard pull to see rates

-

Loans for all credit types

-

Safe and secure process

You can explore offers without stress. Only when you decide to move forward will a hard inquiry be done.

Summary Table: Quick Comparison

| Inquiry Type | Soft Inquiry | Hard Inquiry |

|---|---|---|

| Affects Score | No | Yes (2–5 points) |

| When It Happens | Pre-approval, checks by you | Applying for loans or credit |

| Seen by Lenders | No | Yes |

| How Long It Lasts | 2 years (only you see it) | 2 years (all can see it) |

Conclusion

Understanding the difference between soft and hard credit inquiries is key to managing your credit score. A soft inquiry is harmless and private. A hard inquiry affects your score but is needed for real credit applications.

Be smart about how and when you apply. Use soft inquiries to explore options, and limit hard inquiries to serious needs only. Always monitor your credit and know who is checking it.

If you’re looking for a loan, ExpressCash can help you find offers with soft inquiry pre-approval. This lets you shop without risk.

FAQs: Soft vs. Hard Credit Inquiries

1. Will checking my own credit hurt my score?

No. That’s a soft inquiry. It won’t affect your score.

2. How many points does a hard inquiry take off?

Usually 2 to 5 points. It depends on your credit profile.

3. Can I avoid a hard inquiry when applying for a loan?

Not if you’re applying seriously. But pre-qualification uses a soft pull.

4. How long do hard inquiries stay on my report?

Two years. But they only affect your score for one year.

5. Can I get a loan with multiple hard inquiries?

Yes, but too many inquiries may lower your score and scare lenders.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.