The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

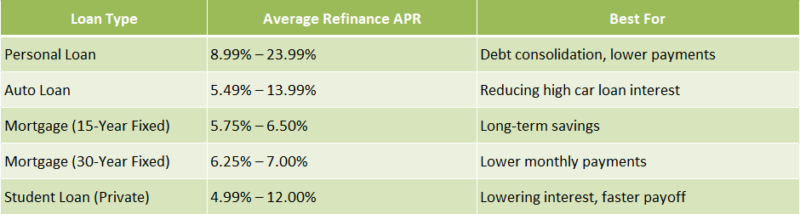

Refinance Interest Rate Comparison: Find the Lowest APR

Understanding your options for refinancing can save you a lot of money. When you compare refinance interest rates, you’re looking for the lowest APR, which can significantly reduce your monthly payments. This is especially important if you want to lower your financial burden or consolidate debt.

Why Compare Refinance Interest Rates?

When you take the time to do a refinance interest rate comparison, you can discover better personal loan refinance options. Here’s why it matters:

- Lower Monthly Payments: A lower APR means you pay less each month.

- Save on Interest: Over time, a lower rate can save you thousands in interest.

- Flexible Options: Different lenders offer various terms, so you can find what fits your needs best.

How to Compare Rates Effectively

To make the most of your refinance interest rate comparison, follow these steps:

- Research Lenders: Look for banks, credit unions, and online lenders.

- Check Your Credit Score: A higher score can get you better rates.

- Use Online Tools: Many websites allow you to compare rates easily.

- Read the Fine Print: Always check for fees or penalties that might apply.

By understanding these factors, you can confidently choose the best refinance option for your situation.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

Why Comparing APRs is Crucial for Homeowners

When it comes to refinancing your home, understanding the importance of a Refinance Interest Rate Comparison is key. Finding the lowest APR can save you thousands over the life of your loan. But why is this comparison so crucial for homeowners? Let’s dive in!

The Impact of APR on Your Finances

The Annual Percentage Rate (APR) is more than just a number; it represents the true cost of borrowing. A lower APR means lower monthly payments and less interest paid over time. This can free up cash for other expenses or savings, making it a vital factor in your financial planning.

Benefits of Comparing APRs

- Save Money: Even a small difference in APR can lead to significant savings.

- Better Loan Terms: Comparing options can help you negotiate better terms.

- Personal Loan Refinance Options: Exploring various refinance options can provide flexibility tailored to your needs.

In summary, taking the time to compare refinance interest rates can lead to smarter financial decisions and a more secure future.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

Top Factors Influencing Your Refinance Interest Rate

When considering a refinance interest rate comparison, understanding the factors that influence your rate is crucial. Finding the lowest APR can save you a significant amount of money over time. Let’s explore what affects your refinance interest rate and how you can secure the best deal.

Credit Score

Your credit score plays a major role in determining your refinance interest rate. A higher score often means lower rates. So, check your score and work on improving it if needed!

Loan-to-Value Ratio (LTV)

The loan-to-value ratio is another key factor. It compares your loan amount to the value of your home. A lower LTV can lead to better rates, so consider this when looking at personal loan refinance options.

Market Conditions

Interest rates fluctuate based on market conditions. Keeping an eye on economic trends can help you time your refinance for the best rate. Remember, patience can pay off!

Loan Type

Different types of loans come with varying rates. For example, fixed-rate loans may have different rates compared to adjustable-rate mortgages. Choose wisely based on your financial goals!

Also Read: Personal Loan Refinance Options: Best Ways to Lower Your Payments

How to Effectively Compare Refinance Offers

When considering refinancing your loan, understanding how to effectively compare refinance offers is crucial. A good refinance interest rate comparison can save you money over time, making it easier to manage your finances. Finding the lowest APR can significantly impact your monthly payments and overall loan cost.

Start with Your Current Rate

Begin by knowing your current interest rate. This gives you a baseline to compare against. If you find lower rates, it might be time to consider refinancing. Remember, even a small difference in rates can lead to big savings!

Gather Multiple Offers

Don’t settle for the first offer you see. Instead, gather multiple refinance offers. Look for personal loan refinance options from different lenders. This way, you can see who offers the best terms and rates. Compare not just the APR, but also any fees involved.

- Check the APR: This is the most important number.

- Look for hidden fees: Some lenders may charge extra costs that can add up.

- Consider the loan term: Shorter terms usually mean higher payments but less interest overall.

The Benefits of Finding the Lowest APR

When it comes to managing your finances, finding the best deal on a loan can make a huge difference. That’s why a Refinance Interest Rate Comparison is so important. By comparing rates, you can discover the lowest APR, which can save you money over time. Who wouldn’t want to pay less interest?

Why Compare Rates?

Comparing refinance interest rates helps you understand your options. It’s like shopping for the best price on a new video game. You wouldn’t want to pay full price if you can find it cheaper elsewhere! Here are some benefits of finding the lowest APR:

- Lower Monthly Payments: A lower APR means you pay less each month, freeing up cash for other expenses.

- Save Money Overall: Over the life of the loan, a lower rate can save you thousands of dollars in interest.

- Better Loan Terms: You might qualify for better terms, making your loan more manageable.

Explore Personal Loan Refinance Options

Don’t forget to look into personal loan refinance options. These can offer flexibility and potentially lower rates. By taking the time to compare, you empower yourself to make informed financial decisions. Remember, every little bit counts when it comes to saving money!

Common Mistakes to Avoid in Refinance Interest Rate Comparison

When considering refinancing your loan, a Refinance Interest Rate Comparison is crucial. It helps you find the lowest APR, which can save you money over time. However, many people make mistakes that can cost them dearly. Let’s explore some common pitfalls to avoid during this process.

Not Shopping Around Enough

One of the biggest mistakes is not comparing enough lenders. You might think one offer is great, but there could be better options out there. Take your time and check multiple lenders to ensure you’re getting the best deal.

Ignoring Fees and Costs

Another common error is focusing solely on the interest rate. Remember, fees and closing costs can add up. Always look at the total cost of refinancing, not just the APR. This will give you a clearer picture of what you’re really paying.

Overlooking Personal Loan Refinance Options

Lastly, don’t forget to explore personal loan refinance options. These can sometimes offer lower rates or better terms than traditional loans. Make sure to include them in your comparison to find the best fit for your financial situation.

How ExpressCash Can Help You Secure the Best Rates

When it comes to refinancing, finding the best interest rate can save you a lot of money. A good Refinance Interest Rate Comparison helps you see all your options clearly. This way, you can make an informed decision that fits your financial goals. Lowering your APR can mean lower monthly payments and more cash in your pocket!

At ExpressCash, we simplify the process of comparing rates. Our user-friendly platform allows you to explore various Personal Loan Refinance Options tailored to your needs. You can easily see which lenders offer the lowest APRs, making your decision much easier.

Key Benefits of Using ExpressCash:

- Comprehensive Comparisons: We gather rates from multiple lenders, so you don’t have to.

- User-Friendly Tools: Our calculators help you understand potential savings.

- Expert Guidance: Our resources provide tips on improving your credit score, which can lead to better rates.

By using ExpressCash, you can confidently navigate the refinancing landscape and secure the best possible rates for your financial future.

What to Do After Finding the Lowest Refinance Interest Rate

Finding the lowest refinance interest rate is just the beginning of your financial journey. Once you’ve identified the best APR, it’s crucial to take the right steps to secure that rate and make the most of your refinancing options. This can lead to significant savings over time, making your financial future brighter.

1. Gather Your Documents

Before you proceed, collect all necessary documents. This includes your income statements, tax returns, and details about your current loan. Having everything ready will streamline the process and help lenders assess your application quickly.

2. Compare Personal Loan Refinance Options

Not all lenders offer the same terms. Use your refinance interest rate comparison to evaluate different personal loan refinance options. Look for fees, terms, and customer reviews to ensure you choose the best lender for your needs.

3. Lock in Your Rate

Once you find a lender that meets your needs, consider locking in your rate. This protects you from potential rate increases while your application is processed. A locked rate can save you money in the long run, so don’t hesitate!

FAQs

-

Why should I compare refinance interest rates?

Comparing interest rates helps you find the lowest cost option, so you can save money over the life of your loan by paying less interest. -

What factors affect refinance interest rates?

Rates depend on your credit score, income, loan amount, repayment term, and the lender’s risk policies at the time of application. -

Do online lenders offer better refinance rates than banks?

Sometimes, yes. Online lenders often have lower overhead costs, which allows them to offer competitive or even lower rates than traditional banks. -

Is the lowest interest rate always the best option?

Not necessarily. Look at total cost, including processing fees, prepayment penalties, and other charges that might reduce or negate savings. -

How often should I check for better refinance rates?

It’s wise to check every 6–12 months, especially if your credit score improves or market rates drop, which may qualify you for better offers.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.