The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

Refinance Calculator for Personal Loans: Estimate Your Savings

Unlocking your financial potential is easier than you think! A Refinance Calculator for Personal Loans helps you estimate your savings when you consider refinancing your existing loans. This tool is like having a financial advisor in your pocket, guiding you to make smarter decisions about your money.

Why Use a Refinance Calculator?

Using a refinance calculator can reveal how much you could save by switching to a lower interest rate or extending your loan term. Here’s why it matters:

- Understand Your Options: Explore various personal loan refinance options that suit your needs.

- Make Informed Decisions: See the potential savings and costs associated with refinancing.

- Plan for the Future: Knowing your savings can help you budget better and achieve your financial goals.

How to Use the Calculator

Using a refinance calculator is simple! Just follow these steps:

- Input Your Current Loan Details: Enter your existing loan amount, interest rate, and remaining term.

- Enter New Loan Information: Fill in the new interest rate and term you’re considering.

- Calculate Your Savings: Hit the calculate button and watch the magic happen! You’ll see how much you can save each month and over the life of the loan.

With this information, you can confidently explore your refinancing options and unlock your financial potential!

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

How Does a Refinance Calculator for Personal Loans Work?

When considering a personal loan refinance, understanding how a Refinance Calculator for Personal Loans works can be a game-changer. This tool helps you estimate potential savings, making it easier to decide if refinancing is right for you. It’s like having a financial compass guiding you through your options!

How Does a Refinance Calculator Work?

A Refinance Calculator for Personal Loans takes your current loan details and compares them with new loan offers. Here’s how it typically works:

- Input Your Current Loan Details: Enter your current loan amount, interest rate, and remaining term.

- Explore New Loan Options: Input potential new loan amounts, interest rates, and terms you’re considering.

- Calculate Your Savings: The calculator will show you how much you could save monthly and over the life of the loan. It’s that simple!

Benefits of Using a Refinance Calculator

Using a refinance calculator has several advantages:

- Quick Estimates: Get instant insights into your potential savings.

- Informed Decisions: Understand your personal loan refinance options better before committing.

- Budgeting Help: See how refinancing can fit into your overall financial plan.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

Discover the Benefits of Using a Refinance Calculator for Personal Loans

When it comes to managing your finances, understanding how to save money is crucial. A Refinance Calculator for Personal Loans can be your best friend in this journey. It helps you see how much you could save by refinancing your existing loans. Imagine being able to lower your monthly payments or reduce the total interest you pay!

Why Use a Refinance Calculator?

Using a refinance calculator is simple and effective. Here’s why you should consider it:

- Estimate Your Savings: Quickly see how much you could save by refinancing. This tool gives you a clear picture of your potential savings.

- Explore Personal Loan Refinance Options: It helps you compare different loan terms and interest rates, making it easier to find the best deal.

- Make Informed Decisions: With accurate estimates, you can confidently decide whether refinancing is the right choice for you.

How to Use the Calculator

Using the refinance calculator is easy! Just follow these steps:

- Input Your Current Loan Details: Enter your existing loan amount, interest rate, and remaining term.

- Enter New Loan Information: Fill in the new loan amount and interest rate you’re considering.

- Calculate: Hit the calculate button and watch the magic happen! You’ll see your estimated savings right away.

In conclusion, a Refinance Calculator for Personal Loans is a powerful tool that can help you take control of your finances. By understanding your options and potential savings, you can make smarter financial choices that benefit you in the long run.

Also Read: Personal Loan Refinance Options: Best Ways to Lower Your Payments

Are You Ready to Refinance? Key Factors to Consider

Are you feeling overwhelmed by your current personal loan payments? If so, a Refinance Calculator for Personal Loans can be your best friend. This handy tool helps you estimate potential savings when you consider refinancing your loan. It’s like having a financial compass guiding you toward better options!

Before diving into personal loan refinance options, think about these key factors:

Interest Rates

- Current Rates: Are interest rates lower than when you first took out your loan? Lower rates can mean lower monthly payments!

Loan Terms

- Length of Loan: Are you comfortable extending your loan term? A longer term can reduce payments but may increase total interest paid.

Your Credit Score

- Credit Health: Has your credit score improved? A better score can unlock better refinancing deals, saving you money.

Fees and Costs

- Hidden Fees: Always check for any fees associated with refinancing. Sometimes, the costs can outweigh the benefits! Using a Refinance Calculator for Personal Loans can help you weigh these factors. It’s like having a personal finance coach right at your fingertips, guiding you to make the best decision for your financial future.

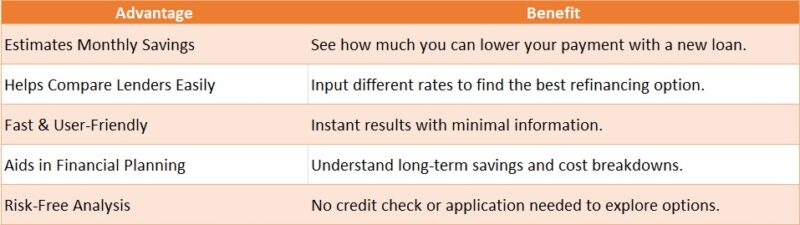

Advantages of Using a Refinance Calculator

Maximize Your Savings: Tips for Using a Refinance Calculator for Personal Loans

When it comes to managing your finances, knowing how to use a Refinance Calculator for Personal Loans can make a huge difference. This handy tool helps you estimate your potential savings when considering personal loan refinance options. By understanding your numbers, you can make informed decisions that could save you money in the long run.

Understand Your Current Loan Terms

Before diving into the refinance calculator, gather details about your current loan. This includes your interest rate, remaining balance, and monthly payment. Knowing these figures will help you see how much you can save by refinancing.

Compare Different Scenarios

When using the refinance calculator, try out various scenarios. Change the interest rates and loan terms to see how they affect your monthly payments. This way, you can find the best personal loan refinance options that suit your budget and financial goals.

Don’t Forget Additional Costs

While the refinance calculator gives you a good estimate, remember to factor in any fees associated with refinancing. These could include closing costs or application fees. By considering these costs, you’ll get a clearer picture of your actual savings.

How ExpressCash Can Simplify Your Personal Loan Refinancing Process

Refinancing your personal loan may seem daunting, but it doesn’t have to be. A Refinance Calculator for Personal Loans can help you estimate savings and make informed decisions. By understanding your options, you can lower monthly payments and save money over time.

At ExpressCash, we believe navigating personal loan refinance options should be easy. Our user-friendly refinance calculator allows you to input your current loan details and see potential savings instantly. It’s like having a financial advisor at your fingertips!

Key Benefits of Using Our Refinance Calculator:

- Quick Estimates: Get immediate feedback on potential savings.

- Easy Comparisons: View different scenarios based on varying interest rates and loan terms.

- Informed Decisions: Make choices that align with your financial goals.

With just a few clicks, you can explore refinancing options and take control of your financial future. Let ExpressCash guide you through the process!

Steps to Use the Refinance Calculator:

- Enter Your Current Loan Details: Input your loan amount, interest rate, and term.

- Choose New Loan Terms: Adjust the interest rate and term you’re considering.

- Calculate Savings: Click to see your estimated monthly payment and total savings.

This simple process empowers you to make smarter financial choices!

Why Choose ExpressCash?

- User-Friendly Interface: Designed for everyone, regardless of financial expertise.

- Comprehensive Information: Insights on various personal loan refinance options to help you choose wisely.

- Supportive Resources: Access articles and guides to deepen your understanding of refinancing.

What to Expect After Refinancing Your Personal Loan

Refinancing your personal loan can feel like a big step, but it’s often a smart move. Using a Refinance Calculator for Personal Loans helps you see how much you can save. Understanding what to expect after refinancing can make the process less daunting and more rewarding.

Lower Monthly Payments

One of the biggest benefits of refinancing is the potential for lower monthly payments. This happens when you secure a lower interest rate or extend your loan term. Imagine having extra cash each month for things you enjoy!

Improved Financial Flexibility

Refinancing can also improve your financial flexibility. With a lower payment, you might find it easier to budget for other expenses or even save for future goals. This is especially true if you explore various personal loan refinance options that fit your needs.

A Fresh Start

Lastly, refinancing gives you a fresh start. It’s a chance to reassess your financial situation and make better choices moving forward. Whether you want to pay off debt faster or save for a big purchase, refinancing can be a powerful tool.

FAQs

-

What is a refinance calculator for personal loans?

A refinance calculator helps you estimate your potential savings by comparing your current loan with a new loan option, factoring in interest rate, loan term, and fees. -

How does a refinance calculator work?

You input your existing loan balance, interest rate, remaining term, and the new loan’s rate and term. The calculator then shows your new monthly payment and total savings. -

Why should I use a refinance calculator before applying?

It helps you determine if refinancing will actually save you money or if the costs (like processing fees) outweigh the benefits. -

Can I calculate the break-even point using a refinance calculator?

Yes, many calculators show when you’ll recoup the costs of refinancing, helping you decide if it’s worth it based on how long you plan to keep the loan. -

Is the refinance calculator accurate for all loan types?

It’s best suited for fixed-rate personal loans. For variable-rate loans or loans with special features, consult with your lender for exact figures.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.