The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

Personal Loan EMI Breakdown: Know Your Payment Details

Understanding your Personal Loan EMI Breakdown is crucial for managing your finances effectively. When you take out a personal loan, you commit to repaying it over time, and knowing how your payments are structured can help you plan better. This breakdown reveals how much of your monthly payment goes towards the principal and how much covers interest.

What is Personal Loan EMI Breakdown?

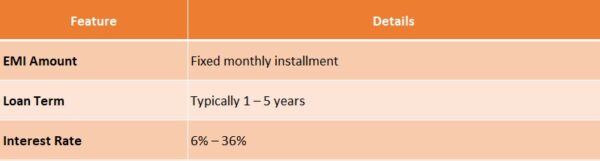

The Personal Loan EMI Breakdown shows the details of your Equated Monthly Installments (EMIs). It breaks down your payment into two parts:

- Principal Amount: This is the actual loan amount you borrowed.

- Interest: This is the cost of borrowing the money.

Understanding this breakdown helps you see how your debt decreases over time, making it easier to manage your budget.

Using a Personal Loan EMI Calculator

A Personal Loan EMI Calculator is a handy tool that helps you estimate your monthly payments. By entering the loan amount, interest rate, and tenure, you can see how much you will pay each month. This way, you can plan your finances better and avoid surprises.

In conclusion, knowing your Personal Loan EMI Breakdown empowers you to make informed decisions about your finances. It’s not just about borrowing money; it’s about understanding how to repay it smartly.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

How is Your Personal Loan EMI Calculated?

Understanding how your Personal Loan EMI is calculated is crucial for managing your finances. Knowing your Personal Loan EMI Breakdown helps you plan your budget effectively. It’s not just about borrowing money; it’s about knowing how much you’ll pay back each month and for how long.

The calculation of your EMI involves three main components: the principal amount, the interest rate, and the loan tenure. Let’s break it down:

Key Components:

- Principal Amount: This is the actual loan amount you borrow.

- Interest Rate: This is the cost of borrowing the money, expressed as a percentage.

- Loan Tenure: This is the duration over which you will repay the loan, usually in months.

To calculate your EMI, you can use a Personal Loan EMI Calculator. This handy tool takes the above components and gives you a clear picture of your monthly payments. It’s simple and saves you from manual calculations!

Why Use an EMI Calculator?

Using a Personal Loan EMI Calculator helps you:

- Plan Your Budget: Know exactly how much you need to set aside each month.

- Compare Loans: See how different interest rates and tenures affect your EMI.

- Make Informed Decisions: Choose a loan that fits your financial situation without surprises.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

The Components of Your EMI: Principal vs. Interest Explained

Understanding your Personal Loan EMI Breakdown is essential for effective financial management. Knowing your monthly payments helps you plan better and avoid surprises. Let’s explore the two main components of your EMI: principal and interest.

What is Principal?

The principal is the original amount borrowed from the bank. For instance, if you take a loan of $10,000, that’s your principal. Each month, part of your EMI reduces this amount, lowering your debt over time.

What is Interest?

Interest is the cost of borrowing, calculated as a percentage of the principal. For example, with a 10% interest rate on a $10,000 loan, you’ll pay $1,000 in interest over a year. You can easily calculate this using a Personal Loan EMI Calculator, which shows your total payments.

How They Work Together

Your EMI combines both principal and interest. As you pay your EMI, the principal decreases, leading to lower interest payments over time. This understanding is vital for managing your loan effectively.

Why It Matters

Knowing the breakdown of your payments helps you make informed decisions. If you want to pay off your loan faster, consider making extra payments towards the principal to reduce overall interest costs.

Also Read: Personal Loan EMI Calculator: Find Your Monthly Installments

Why is Knowing Your Personal Loan EMI Breakdown Important?

Understanding your Personal Loan EMI Breakdown is crucial for managing your finances effectively. When you take out a personal loan, you agree to repay it in monthly installments, known as EMIs. Knowing how these payments are structured helps you plan your budget better and avoid surprises later on.

Clarity on Payment Structure

When you break down your EMI, you see how much goes toward the principal and how much is for interest. This clarity helps you understand the cost of borrowing and can motivate you to pay off the loan faster, saving you money in the long run.

Using a Personal Loan EMI Calculator

A Personal Loan EMI Calculator can simplify this process. By entering your loan amount, interest rate, and tenure, you can quickly see your monthly payments. This tool not only helps you visualize your financial commitment but also aids in comparing different loan offers effectively.

Benefits of Knowing Your EMI Breakdown

- Better Budgeting: Knowing your EMIs allows you to allocate funds wisely each month.

- Early Repayment Decisions: Understanding your breakdown can encourage you to make extra payments, reducing your overall interest.

- Financial Awareness: It keeps you informed about your financial health, helping you make smarter decisions in the future.

Tips for Managing Your Personal Loan Payments Effectively

Managing your personal loan payments effectively is crucial for your financial health. Understanding your Personal Loan EMI Breakdown helps you know exactly what you owe each month. This knowledge can empower you to make informed decisions and avoid any surprises down the road.

Create a Budget

Start by setting a monthly budget that includes your personal loan EMI. This way, you can ensure you have enough funds set aside for your payments without stretching your finances too thin.

Use a Personal Loan EMI Calculator

A Personal Loan EMI Calculator can be your best friend. It allows you to see how different loan amounts and interest rates affect your monthly payments. This tool helps you plan better and choose a loan that fits your budget.

Set Up Automatic Payments

Consider setting up automatic payments for your personal loan. This ensures you never miss a due date, which can save you from late fees and a negative impact on your credit score. Plus, it’s one less thing to worry about each month!

What Happens If You Miss an EMI Payment?

Understanding your Personal Loan EMI Breakdown is crucial. It helps you manage your finances better and avoid surprises. But what happens if you miss an EMI payment? Let’s explore the consequences and how to handle them effectively.

Missing an EMI can lead to several issues. First, your lender may charge a late fee. This fee can add up quickly, making your loan more expensive than planned. Additionally, your credit score may take a hit, affecting your future borrowing ability.

Key Consequences of Missing an EMI:

- Late Fees: Lenders often impose penalties for missed payments.

- Credit Score Impact: A missed payment can lower your credit score significantly.

- Increased Financial Stress: You may feel overwhelmed by the added costs and pressure to catch up.

To avoid these pitfalls, consider using a Personal Loan EMI Calculator. This tool helps you plan your payments and stay on track. Remember, communication with your lender is key. If you anticipate a missed payment, reach out to discuss options.

How ExpressCash Can Help You Navigate Your Personal Loan EMI

Understanding your Personal Loan EMI Breakdown is crucial for managing your finances effectively. It helps you know exactly how much you need to pay each month and what portion goes towards interest versus the principal. This knowledge can empower you to make informed decisions about your loan and budgeting.

Easy Access to a Personal Loan EMI Calculator

At ExpressCash, we provide a user-friendly Personal Loan EMI Calculator. This tool allows you to input your loan amount, interest rate, and tenure to see your monthly payments instantly. It’s like having a financial advisor at your fingertips!

Benefits of Knowing Your EMI Breakdown

- Clarity on Payments: Knowing how your EMI is structured helps you understand your financial commitments better.

- Budgeting Made Simple: With clear payment details, you can plan your monthly budget without surprises.

- Early Repayment Insights: Understanding your breakdown can guide you if you decide to pay off your loan early, saving you money on interest.

Frequently Asked Questions About Personal Loan EMI Breakdown

-

What does EMI stand for in a personal loan?

EMI stands for Equated Monthly Installment, which is the fixed amount you repay every month, covering both principal and interest. -

How is my personal loan EMI calculated?

EMI is calculated based on the loan amount, interest rate, and repayment tenure using the formula:

EMI=P×R×(1+R)N(1+R)N−1EMI = \frac{P \times R \times (1+R)^N}{(1+R)^N – 1}

where P = principal, R = monthly interest rate, and N = number of months. -

What is included in my EMI payment?

Each EMI includes a portion of the principal amount and interest charges, with the interest portion higher at the beginning and decreasing over time. -

Does my EMI amount change during the loan tenure?

For a fixed-rate loan, EMI stays the same. For a floating-rate loan, EMI may change if the interest rate fluctuates. -

Can I see a month-by-month EMI breakdown?

Yes, most lenders provide an amortization schedule, showing how much of each EMI goes toward principal vs. interest over the loan period.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.