The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

How to Pay Off Debts Faster and Improve Credit

Managing your finances effectively involves knowing how to pay off debts faster. This not only reduces stress but also helps you improve your credit score for a personal loan. A higher credit score can lead to lower interest rates and better financial opportunities. Here are some strategies to consider!

Create a Budget

Begin by tracking your income and expenses to understand your spending habits. This insight allows you to create a budget that focuses on debt repayment. Stick to this budget, and you’ll see your debts decrease over time!

Use the Snowball Method

Pay off your smallest debts first for motivation. Once a debt is cleared, use that payment amount to tackle the next smallest debt. This snowball effect can significantly speed up your debt repayment process.

Consider Debt Consolidation

If you have several debts, consolidating them into one loan can lower your interest rates and simplify your payments. This makes it easier to stay organized and can improve your credit score by reducing your credit utilization ratio.

Automate Payments

Set up automatic payments to ensure you never miss a due date, which can negatively impact your credit score. Automation helps you adhere to your budget, and you’ll be amazed at how quickly your debts can diminish!

Cut Unnecessary Expenses

Review your spending for any subscriptions or services you don’t use. Cutting these can free up cash for debt repayment, allowing you to pay off debts faster and enhance your financial health.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

Is the Snowball Method Right for You?

When it comes to managing debt, finding effective strategies is crucial. Many people wonder how to pay off debts faster while also improving their credit score. This is important because a better credit score can help you secure a personal loan with lower interest rates, making it easier to achieve your financial goals.

The Snowball Method is a popular debt repayment strategy. It involves paying off your smallest debts first, which can give you quick wins and boost your motivation. Here’s how it works:

- List Your Debts: Write down all your debts from smallest to largest.

- Make Minimum Payments: Pay the minimum on all debts except the smallest one.

- Focus on the Smallest Debt: Put any extra money towards the smallest debt until it’s gone.

- Repeat: Once the smallest debt is paid off, move to the next one on your list.

- Celebrate Wins: Each time you pay off a debt, celebrate! This keeps you motivated to continue.

Using the Snowball Method can help you feel accomplished, which is essential when learning how to pay off debts faster. Plus, as you eliminate debts, your credit utilization ratio improves, helping you to improve your credit score for a personal loan. Remember, the key is consistency and determination!

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

Strategies to Slash Your Monthly Payments

Paying off debts can feel like climbing a mountain, but with the right strategies, you can reach the top faster! Knowing how to pay off debts faster not only eases your financial burden but also helps improve your credit score for a personal loan. A better credit score means lower interest rates and more financial freedom!

Create a Budget

Start by tracking your income and expenses. This will help you see where your money goes. Once you know your spending habits, you can create a budget that prioritizes debt repayment. Stick to it, and watch your debts shrink!

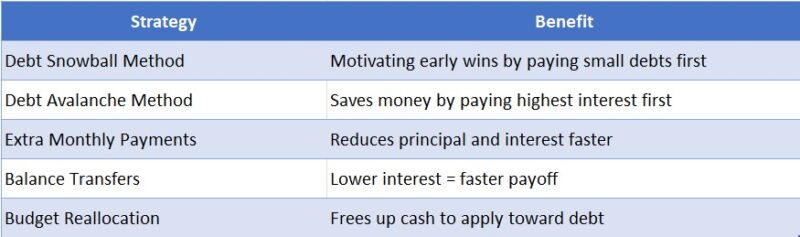

Consider Debt Snowball or Avalanche Methods

- Debt Snowball: Focus on paying off the smallest debts first. This builds momentum and keeps you motivated.

- Debt Avalanche: Pay off debts with the highest interest rates first. This saves you money in the long run. Choose the method that feels right for you!

Negotiate Lower Interest Rates

Don’t be afraid to call your creditors and ask for lower interest rates. Sometimes, just asking can lead to savings. If they agree, you’ll pay less each month, making it easier to pay off your debts faster!

The Role of Budgeting in Debt Reduction

Managing debt can be overwhelming, but learning how to pay off debts faster is essential for your financial well-being. It not only reduces stress but also helps improve your credit score for a personal loan. A solid budget is your best ally in this process!

Create a Clear Budget

Begin by tracking your income and expenses. Understanding where your money goes each month is crucial. This clarity allows you to identify areas to cut back, freeing up more funds for debt repayment.

Set Priorities

After establishing a budget, prioritize your debts. Focus on high-interest debts first, as they cost you more over time. Tackling these first enables you to pay off debts faster and save money in the long run.

Stick to Your Plan

Consistency is vital! Adhere to your budget and make adjustments as necessary. Celebrate small victories, like paying off a credit card, to stay motivated and on track to improve your credit score for a personal loan.

Use the Snowball Method

Consider the snowball method for debt repayment. Start with your smallest debt and pay it off first. This strategy builds momentum and keeps you motivated as you see debts disappear!

Automate Payments

Set up automatic payments for bills and debts to avoid missed payments, which can harm your credit score. This also simplifies your budgeting process.

Seek Help if Needed

If budgeting feels overwhelming, don’t hesitate to seek help from financial advisors or credit counseling services. They can provide tailored guidance to create a workable plan.

How to Improve Your Credit Score While Paying Off Debt

When you’re juggling debts, it can feel overwhelming. But did you know that paying off debts faster can also help improve your credit score? Understanding how to pay off debts faster is essential, especially if you’re looking to secure a personal loan in the future. A better credit score opens doors to lower interest rates and better loan terms.

Create a Budget

Start by making a budget. List all your income and expenses. This will help you see where you can cut back and allocate more money toward paying off debts. Remember, every little bit counts!

Pay More Than the Minimum

If you can, always try to pay more than the minimum payment on your debts. This reduces the principal faster and shows lenders that you’re serious about improving your credit score. Plus, it saves you money on interest in the long run!

Keep Old Accounts Open

Even if you’ve paid off a debt, keep the account open. This helps improve your credit score by showing a longer credit history. Just make sure there are no annual fees!

Monitor Your Credit Report

Regularly check your credit report for errors. If you find any mistakes, dispute them immediately. Keeping your credit report clean is crucial for improving your credit score while paying off debt.

Why You Should Consider Professional Help from ExpressCash

When it comes to managing your finances, knowing how to pay off debts faster and improve your credit score is crucial. A good credit score can open doors to better loan options, lower interest rates, and even job opportunities. But tackling debt can feel overwhelming, and that’s where professional help from ExpressCash can make a difference.

Expert Guidance

Navigating the world of debt repayment can be tricky. Professionals at ExpressCash can provide tailored strategies to help you pay off debts faster. They understand the ins and outs of financial management and can guide you through the process, making it less stressful.

Customized Plans

With ExpressCash, you’ll receive a customized plan that suits your unique financial situation. This personalized approach not only helps you pay off debts faster but also aids in improving your credit score for a personal loan. You’ll learn effective budgeting techniques and debt repayment strategies that work for you.

Ongoing Support

Having a team of experts by your side means you’re not alone in this journey. ExpressCash offers ongoing support and accountability, which can be the motivation you need to stay on track. With their help, you can confidently tackle your debts and watch your credit score improve over time.

Transform Your Financial Future: Steps to Take Today

Transforming your financial future starts with understanding how to pay off debts faster and improve your credit score. When you tackle your debts head-on, you not only lighten your financial load but also pave the way for better loan opportunities. A higher credit score can mean lower interest rates, saving you money in the long run!

Create a Budget

To pay off debts faster, begin by creating a budget. List your income and expenses to see where your money goes. This clarity helps you identify areas to cut back. For instance, can you skip that daily coffee? Every little bit adds up!

Prioritize Your Debts

Next, prioritize your debts. Focus on high-interest debts first, like credit cards. Pay more than the minimum on these while making minimum payments on others. This strategy, known as the avalanche method, helps you save on interest and pay off debts faster. Remember, each payment brings you closer to financial freedom!

Improve Your Credit Score for a Personal Loan

Finally, improving your credit score is crucial for securing a personal loan. Pay bills on time, reduce credit card balances, and avoid new debts. Regularly check your credit report for errors. Fixing these can give your score a nice boost, making it easier to get loans with favorable terms.

FAQs

-

What’s the best strategy to pay off debt quickly?

Two popular methods are the debt snowball (paying off smallest debts first) and the debt avalanche (tackling highest-interest debts first). -

Should I consolidate my debts to pay them off faster?

Yes, debt consolidation can simplify payments and potentially lower your interest rate, helping you repay faster. -

Can making extra payments speed up debt payoff?

Absolutely—making more than the minimum payment reduces your balance and interest, accelerating your payoff timeline. -

Does budgeting help with faster debt repayment?

Yes, a clear monthly budget helps identify spending cuts and allocate more money toward debt payments. -

Is it better to pay off high-interest debt first?

Yes, paying off high-interest debt first saves money over time and reduces your total repayment amount.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.