The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

How to Maintain a High Credit Score Consistently

How to Maintain a High Credit Score

Your credit score matters. It’s like a financial report card. It tells lenders how well you manage money. A high credit score helps you get better loan offers, lower interest rates, and even more job or rental options. But building a good credit score is only part of the journey. You also need to maintain it. This blog explains how to maintain a high credit score—step by step, in simple language.

What Is a Credit Score?

A credit score is a number between 300 and 850. The higher the number, the better.

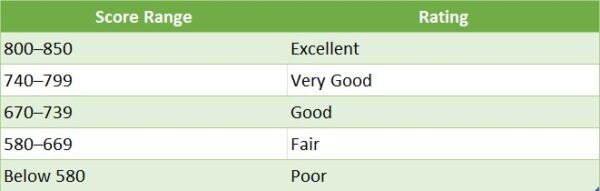

Here’s how credit scores are ranked:

Credit scores are used by banks, lenders, landlords, and even some employers.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

What Affects Your Credit Score?

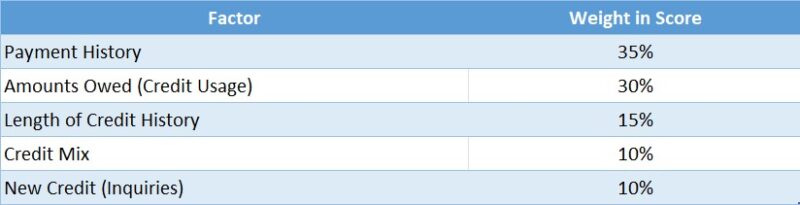

Here’s a breakdown of what goes into your credit score:

Now let’s look at how to maintain a high score across all these areas.

1. Always Pay Your Bills on Time

This is the most important factor in keeping a high credit score. Late payments can drop your score quickly. Even one late payment stays on your report for up to 7 years.

Tips to pay on time:

-

Set up automatic payments

-

Use calendar reminders

-

Choose payment alerts on your bank app

📌 Note: This includes credit cards, loans, rent, utilities, and even phone bills.

2. Keep Credit Card Balances Low

Don’t use too much of your credit limit. This is called your credit utilization rate.

Rule of thumb:

Use less than 30% of your credit limit. Lower is even better.

Example:

If your credit limit is $1,000, try to keep your balance under $300. High balances can lower your score, even if you pay on time.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

3. Don’t Close Old Credit Cards

Older accounts help your credit history length, which makes up 15% of your score. Keep old accounts open—even if you don’t use them often—as long as they don’t have high annual fees.

4. Avoid Too Many Credit Inquiries

When you apply for new credit, lenders do a hard inquiry. Too many hard pulls in a short time can hurt your score.

Only apply for credit when:

-

You need it

-

You’re confident of approval

-

You’ve compared your options

✅ Soft inquiries (like checking your own score) do not affect your credit.

5. Diversify Your Credit Mix

A mix of credit types helps your score. It shows you can handle different loans.

Good examples of credit mix:

-

Credit cards

-

Auto loans

-

Student loans

-

Mortgage

You don’t need every type. Just avoid having only one kind of credit.

6. Check Your Credit Reports Regularly

You can get a free copy of your credit report from all three bureaus once a year at:

➡️ AnnualCreditReport.com

Check for:

-

Mistakes in your name or accounts

-

Wrong balances or missed payments

-

Identity theft or fraud

📌 Fix errors fast by contacting the credit bureau.

7. Set Up Alerts for Suspicious Activity

Use your bank or credit card app to turn on alerts. You’ll be notified when:

-

A new charge happens

-

Your balance is high

-

A payment is due

-

A new account is opened

Catching problems early helps protect your score.

8. Pay Off Credit Cards in Full

Carrying a balance means paying interest. It can also hurt your score if the balance is too high.

Whenever possible:

-

Pay off your card in full each month

-

At least pay more than the minimum

This keeps your credit usage low and saves you money.

9. Use Credit Cards Responsibly

Credit cards are not free money. Use them wisely.

Smart card habits:

-

Use for regular bills or gas

-

Don’t buy things you can’t afford

-

Pay off the full amount

📌 Tip: Set a spending limit lower than the actual card limit to avoid temptation.

10. Avoid Co-Signing Loans

When you co-sign, you’re responsible if the other person doesn’t pay. Their missed payments can hurt your credit.

Only co-sign if:

-

You fully trust the person

-

You can afford to take over the loan

11. Don’t Apply for Too Many Store Cards

Store credit cards often have high interest rates and low limits. They may offer a quick discount but could hurt your credit score in the long run. Too many new cards = more inquiries + more temptation to spend.

12. Build an Emergency Fund

If you have savings, you’re less likely to miss payments. That protects your score during emergencies like:

-

Job loss

-

Medical bills

-

Car repairs

Start small: even $500 helps. Aim for 3–6 months of expenses.

13. Use Tools Like Experian Boost

Experian Boost lets you add rent, phone, and utility payments to your credit report.

This helps you:

-

Improve thin credit files

-

Boost your score quickly

Only works with Experian, but it’s free and easy to use.

14. Avoid Carrying High Balances Across Cards

Spread your spending across cards if needed. Keeping just one card maxed out looks bad—even if you’re under 30% across all cards.

Try to keep each card under 30%, not just your total usage.

15. Keep Track of Due Dates

Late payments hurt. If you have multiple accounts, keeping track can be hard.

Try this:

-

Use a calendar or planner

-

Get email or text alerts

-

Sync due dates to payday

Automation helps you stay on time.

Credit Score Mistakes to Avoid

| Mistake | Why It Hurts |

|---|---|

| Missing payments | Biggest score dropper |

| Maxing out cards | High utilization = lower score |

| Applying for lots of credit | Too many inquiries |

| Closing old cards | Hurts credit age |

| Ignoring credit reports | You won’t catch errors or fraud |

Credit Score Success Story

Sara, a nurse from Florida, wanted to buy a home. Her credit score was stuck at 650. She took these steps:

-

Paid all bills on time

-

Used only 10% of her credit

-

Didn’t apply for new cards

-

Used ExpressCash to consolidate credit card debt

After 8 months, her score rose to 745. She got a low mortgage rate and saved thousands.

Pros and Cons of High Credit Scores

| Pros | Cons |

|---|---|

| Lower loan interest rates | Takes time to maintain |

| Higher chances of approval | One mistake can hurt |

| Better rental and job options | Must watch spending habits |

| Easier access to credit | Can lead to overconfidence |

How a High Score Helps with Loans

If you have a score above 700, you may qualify for:

-

Lower rates on personal loans

-

Better auto loan offers

-

Larger credit card limits

-

Easier home loan approval

ExpressCash offers fast personal loans—and having a strong credit score helps you get better terms.

Conclusion

Maintaining a high credit score isn’t hard—but it takes discipline. Pay on time, keep your debt low, and stay informed. With good habits, you’ll protect your financial future and open more doors in life. Whether you’re applying for a loan, renting an apartment, or buying a car, your credit score will be on your side. If you ever need a personal loan with fair terms, ExpressCash is here to help.

FAQs: How to Maintain a High Credit Score

1. How often should I check my credit score?

Check at least once every 3 months. Many banks offer free access.

2. Do student loans affect my credit score?

Yes. They add to your credit mix and payment history.

3. Is it bad to pay off a loan early?

No. Paying off loans early helps your score, unless there’s a prepayment penalty.

4. What is the best way to maintain a high score?

Pay all bills on time and keep credit card balances low.

5. Will checking my credit hurt my score?

Not if you check it yourself. That’s called a soft inquiry and it doesn’t affect your score.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.