The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

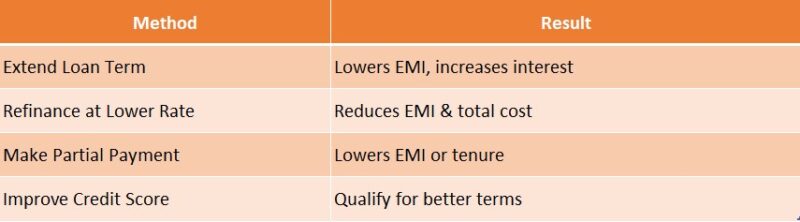

How to Lower Monthly EMI Payments Without Extending Tenure

Understanding how to lower monthly EMI payments without extending tenure is essential for borrowers. It helps reduce financial stress while maintaining your loan term. By analyzing your current EMI structure, you can find effective ways to lower your monthly payments.

Analyze Your Current EMI Structure

Begin with a Personal Loan EMI Calculator. This tool allows you to input your loan amount, tenure, and interest rate to see your monthly payments. This insight is crucial for making informed decisions.

Consider Refinancing Options

If your interest rate is high, think about refinancing your loan. Look for lenders with lower rates, as even a slight decrease can significantly reduce your EMI without extending the tenure. Always compare offers for the best deal!

Make Extra Payments

Making extra payments can also help. Use bonuses or tax refunds to pay down your principal, which lowers your EMI and saves on interest over time.

Negotiate with Your Lender

Don’t hesitate to discuss your EMI with your lender. They might offer a better rate or restructure your loan terms without extending the tenure, leading to significant savings!

Explore Loan Restructuring

Loan restructuring can adjust your loan terms for easier payments. Just ensure it doesn’t extend your tenure, as that could increase total interest paid.

Stay Informed About Market Rates

Monitor market interest rates. If they drop, consider switching lenders to secure a lower EMI while keeping your original loan duration.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

Can Refinancing Help You Save on EMIs?

When it comes to managing your finances, lowering your monthly EMI payments can make a significant difference. Many people wonder how to lower monthly EMI payments without extending their loan tenure. One effective solution is refinancing, which can help you save money while keeping your repayment period the same.

Refinancing is like getting a new loan to pay off your existing one, often at a lower interest rate. This means you can reduce your monthly payments without stretching out your repayment period. Here are some key points to consider:

- Lower Interest Rates: If interest rates have dropped since you took out your loan, refinancing can help you take advantage of these lower rates.

- Improved Credit Score: If your credit score has improved, lenders may offer you better terms, resulting in lower EMIs.

- Personal Loan EMI Calculator: Use a personal loan EMI calculator to see how refinancing can impact your payments. This tool helps you visualize potential savings and make informed decisions.

In summary, refinancing can be a smart way to lower your monthly EMI payments without extending your loan tenure. It’s worth exploring if you want to ease your financial burden while staying on track with your repayment plan.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

Exploring the Benefits of Making Extra Payments

Managing loans often leads to the question of how to lower monthly EMI payments without extending tenure. This is crucial as lower payments can free up cash for other expenses. One effective strategy is making extra payments on your loan, which can provide significant benefits!

Understanding Extra Payments

Extra payments mean paying more than your regular EMI, reducing the principal faster and leading to lower interest costs. This approach can save you money and help you pay off your loan sooner!

Benefits of Extra Payments

- Reduced Interest: Extra payments lower the total interest paid over time.

- Shorter Loan Duration: You can pay off your loan earlier without extending the tenure.

- Improved Credit Score: A lower outstanding balance positively impacts your credit score.

Using a Personal Loan EMI Calculator can help visualize how extra payments affect your loan, making it easier to see your savings!

How to Make Extra Payments

Making extra payments is simple! You can:

- Add a Fixed Amount: Decide on a specific amount to pay extra each month.

- Make Lump-Sum Payments: Use bonuses or tax refunds to pay down your loan.

These strategies significantly reduce your principal balance and save on interest!

Timing Matters

Timing is crucial for extra payments:

- Early Payments: The sooner you pay extra, the more you save on interest.

- Check Loan Terms: Ensure there are no penalties for extra payments.

Being strategic about when you pay can maximize your savings!

Stay Consistent

Consistency is key!

- Set a Budget: Include extra payments in your monthly budget.

- Track Progress: Use a Personal Loan EMI Calculator to monitor the impact of your extra payments.

Staying committed to this strategy can lead to significant financial benefits over time!

Also Read: Personal Loan EMI Calculator: Find Your Monthly Installments

Negotiating with Your Lender: A Key to Lowering EMIs?

When it comes to managing your finances, knowing how to lower monthly EMI payments is crucial. High EMIs can strain your budget, making it hard to save or spend on other essentials. Fortunately, negotiating with your lender can be a game-changer, allowing you to reduce your monthly payments without extending your loan tenure.

Understand Your Current Situation

Before you approach your lender, take a moment to assess your financial situation. Use a personal loan EMI calculator to determine how much you can realistically afford. This will give you a clear idea of what to ask for during negotiations.

Be Honest and Direct

When you contact your lender, be open about your financial challenges. Explain why you need lower EMIs. Lenders appreciate honesty and may be more willing to help if they understand your situation. Remember, they want to keep you as a customer!

Explore Options

Ask your lender about different options to lower your EMIs. They might offer:

- A temporary reduction in interest rates

- A switch to a different loan product

- Waiving certain fees or charges

By exploring these options, you can find a solution that works for both you and your lender.

The Impact of Credit Score on Your EMI Rates: What You Need to Know

When it comes to managing your finances, lowering your monthly EMI payments can feel like a daunting task. However, understanding how to lower monthly EMI payments without extending your loan tenure is crucial. One of the most significant factors influencing your EMI rates is your credit score. A good credit score can unlock better interest rates, making your monthly payments more manageable.

Why Your Credit Score Matters

Your credit score is like a report card for your financial health. Lenders use it to determine how risky it is to lend you money. A higher score often means lower interest rates, which directly affects your EMI payments. If your score is high, you could save a lot!

Tips to Improve Your Credit Score

- Pay Bills on Time: Late payments can hurt your score.

- Keep Credit Utilization Low: Try to use less than 30% of your available credit.

- Check Your Credit Report: Look for errors and dispute them if necessary.

By focusing on these areas, you can boost your credit score and potentially lower your EMI rates. Remember, using a personal loan EMI calculator can help you see how changes in your interest rate affect your monthly payments.

How to Lower Monthly EMI Payments with Smart Budgeting Strategies

When it comes to managing finances, knowing how to lower monthly EMI payments is crucial. Many people feel trapped by high EMIs, but there are smart budgeting strategies that can help you ease that burden without extending your loan tenure. Let’s explore how you can take control of your finances and make your monthly payments more manageable.

Understand Your Current Financial Situation

Start by assessing your income and expenses. Use a Personal Loan EMI Calculator to see how much you’re currently paying. This tool can help you visualize your financial landscape and identify areas where you can cut back. For instance, if you notice you’re spending a lot on dining out, consider cooking at home more often.

Create a Budget

Once you know where your money goes, create a budget. List your essential expenses and see where you can save. Here are some tips:

- Prioritize Needs Over Wants: Focus on what you truly need.

- Set Savings Goals: Aim to save a specific amount each month.

- Track Your Spending: Keep an eye on your expenses to avoid overspending.

By following these steps, you can free up extra cash to pay down your loan faster, ultimately lowering your EMI payments without extending your tenure.

Discover How ExpressCash Can Help You Reduce Your EMI Burden

When it comes to managing your finances, understanding how to lower monthly EMI payments without extending tenure is crucial. High EMIs can strain your budget, making it hard to save or spend on other essentials. Thankfully, there are effective strategies to ease this burden without prolonging your loan term.

Explore Your Options

One way to lower your EMI is by refinancing your loan. This means taking a new loan at a lower interest rate to pay off the existing one. By doing this, you can significantly reduce your monthly payments. Additionally, using a Personal Loan EMI Calculator can help you see how different interest rates affect your payments, making it easier to choose the best option for you.

Consider a Higher Down Payment

Another strategy is to increase your down payment. By putting more money down upfront, you reduce the principal amount of the loan, which in turn lowers your EMI. This not only makes your monthly payments more manageable but also reduces the total interest paid over the loan’s life. Remember, every little bit helps!

FAQs

-

What is the easiest way to lower my EMI?

You can lower your EMI by increasing the loan tenure, which spreads the repayment over a longer period. -

Can refinancing help reduce EMI payments?

Yes, refinancing your loan at a lower interest rate can significantly reduce your monthly EMI. -

Is partial prepayment a good way to lower EMI?

Absolutely—making a partial lump sum prepayment reduces the outstanding loan amount, leading to lower EMIs. -

Will negotiating with the lender help reduce EMI?

In some cases, lenders may restructure your loan or offer temporary relief options if you’re struggling financially. -

Does switching from fixed to variable interest affect EMI?

Switching to a variable rate might lower your EMI if interest rates fall, but it also increases risk if rates rise later.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.