The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

How to Qualify for Lower Loan Rates: Tips for Better Approval

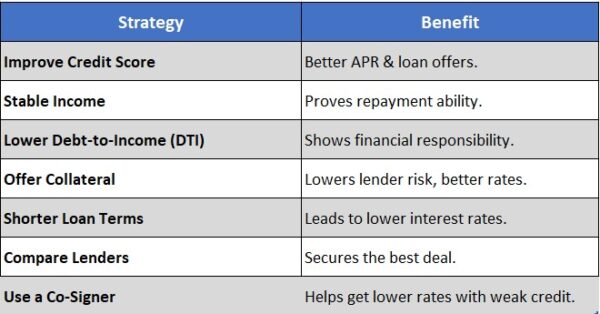

Understanding loan rates is essential for anyone borrowing money, whether for a home, car, or personal expenses. These rates significantly affect your monthly payments and overall financial health. Lower rates mean less money paid over time, allowing you to allocate funds to other important expenses. How to qualify for lower loan rates, it’s crucial to know what lenders consider when assessing your eligibility. When comparing bank loan rates to online loan rates, it’s important to note the differences. Traditional banks typically offer lower rates due to their established reputation, while online lenders may provide more flexible terms and faster approvals. Here are some tips to secure the best rates:

- Check your credit score: A higher score can lead to better rates.

- Reduce your debt-to-income ratio: Lenders prefer borrowers with manageable debt levels.

- Consider a larger down payment: This can lower your loan amount and improve your chances of approval.

- Shop around: Different lenders have varying rates, so comparing offers is beneficial.

Qualifying for lower loan rates requires a proactive approach. By enhancing your credit profile and understanding the differences between bank and online loan rates, you can improve your financial outcomes. Remember, every percentage point counts, so take the time to explore your options and make informed decisions that will benefit your wallet in the long run.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

Key Factors Lenders Consider for Lower Loan Rates

Securing a loan with favorable rates can significantly impact your financial journey. To qualify for lower loan rates, it is essential to understand the key factors lenders evaluate. By being informed, you can take proactive steps to enhance your chances of obtaining a better deal.

Credit Score: This is a critical factor; a higher score often leads to lower rates. For example, individuals with scores above 740 typically qualify for better rates than those below 620.

Debt-to-Income Ratio: Lenders assess your debt-to-income ratio, which compares monthly debt payments to gross income. A lower ratio indicates manageable debt levels, making you a more appealing candidate for lower rates. Aim for a ratio below 36 percent for optimal results.

Loan Type and Amount: The type of loan affects your rate. Bank loan rates may be more favorable for mortgages than personal loans, while online loan rates can vary widely. Understanding these differences helps you choose the right financial path.

Employment History: A stable job history reassures lenders of your repayment ability.

Down Payment: A larger down payment can lead to lower rates, reducing lender risk and demonstrating your commitment.

By focusing on these factors, you can improve your chances of securing better loan rates, whether through banks or online lenders.

How to Improve Your Credit Score for Better Loan Approval

Improving your credit score is crucial for qualifying for lower loan rates, as lenders heavily rely on this score to determine interest rates. A higher credit score can lead to better rates, saving you money over the life of your loan. Here are some effective steps to boost your credit score: First, check your credit report for errors. Inaccuracies can negatively impact your score, so request a free report from major credit bureaus annually and dispute any mistakes you find.

Next, ensure you pay your bills on time, as late payments can significantly harm your score. Setting up automatic payments or reminders can help you stay punctual. Additionally, work on reducing your credit utilization ratio by paying down existing debts. Aim to keep your credit card balances below 30 percent of your total credit limit, demonstrating responsible credit management.

Finally, understand the differences between bank loan rates and online loan rates. While traditional banks may offer lower rates for those with excellent credit, online lenders often provide competitive rates for those with average scores. Shopping around can lead to better loan options. By implementing these strategies, you can enhance your credit score and improve your chances of qualifying for lower loan rates, making your financial journey more manageable and cost-effective.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

The Importance of Debt-to-Income Ratio in Loan Applications

Understanding your debt-to-income ratio is essential when securing a loan. This ratio compares your monthly debt payments to your gross monthly income and significantly influences how lenders evaluate your financial health. A lower ratio indicates manageable debt levels, making you a more appealing candidate for lower loan rates. For example, if you earn three thousand dollars monthly with total debt payments of six hundred dollars, your ratio is twenty percent, which lenders typically view favorably compared to those above thirty-six percent. To enhance your chances of qualifying for lower loan rates, consider these practical tips:

- Pay down existing debts: Lowering credit card balances or other loans can reduce your debt-to-income ratio.

- Increase your income: A side job or a raise can help improve your ratio.

- Avoid new debts: Refrain from taking on new loans or credit lines before applying for a mortgage or personal loan.

By implementing these strategies, you can present a stronger financial profile to lenders, potentially leading to better loan terms. Additionally, be aware of the differences between bank loan rates and online loan rates. Traditional banks often have stricter criteria, resulting in higher rates for those with less-than-perfect credit.

In contrast, online lenders may offer more competitive rates and flexible terms, especially for borrowers with a solid debt-to-income ratio. Understanding your financial situation can empower you to make informed decisions and secure the best rates.

Read Also: Bank Loan Rates vs. Online Loan Rates: Which Is Cheaper?

Tips for Building a Strong Financial Profile

Securing a loan with favorable terms often hinges on having a strong financial profile. Lenders are more inclined to offer lower loan rates to borrowers who exhibit financial responsibility. Here are some practical tips to help you build that profile.

Understand Your Credit Score: Your credit score plays a crucial role in determining your loan rates. Aim for a score of 700 or higher to access better rates. Regularly check your credit report for errors and dispute inaccuracies, as correcting mistakes can significantly boost your score.

Manage Your Debt-to-Income Ratio: Lenders prefer a debt-to-income ratio below 36 percent, meaning your monthly debt payments should not exceed this percentage of your gross income. To improve this ratio, consider paying down debts or increasing your income through side jobs, enhancing your chances of approval and lower rates.

Save for a Larger Down Payment: A larger down payment reduces the lender’s risk, potentially leading to lower rates. Aim for at least 20 percent if possible.

Consider a Co-Signer: If your credit history is weak, a co-signer with a strong financial profile can help you qualify for better rates.

Shop Around for Lenders: Different lenders offer varying rates, so compare bank loan rates with online loan rates to find the best deal for your needs.

Exploring Different Types of Loans for Better Rates

Securing a loan requires a solid understanding of the various types available, as this knowledge can greatly influence your ability to qualify for lower loan rates. Whether you are looking at personal loans, mortgages, or auto loans, each type has distinct criteria and benefits. For example, personal loans typically carry higher interest rates than secured loans like mortgages, which are backed by property. Therefore, if you’re aiming for better rates, considering secured options is advisable. To help you navigate the loan landscape, here are some essential insights:

- Research Different Lenders: Bank loan rates can vary significantly from online loan rates. Online lenders often have lower overhead, leading to better rates for borrowers. However, traditional banks may provide more personalized service and additional perks, so evaluate your options carefully.

- Check Your Credit Score: A higher credit score can lead to lower rates. Before applying, review your credit report for errors and take steps to enhance your score if needed, such as paying down debts or making timely payments on existing loans.

- Consider Loan Terms: Shorter loan terms generally offer lower interest rates. Although monthly payments may be higher, the total cost of the loan can be reduced significantly, especially with mortgages, where a 15-year term can save you thousands compared to a 30-year term.

The Role of Down Payments in Securing Lower Loan Rates

Securing lower loan rates hinges significantly on the size of your down payment. A larger down payment reduces the amount you need to borrow and signals to lenders that you are financially responsible, which can lead to better loan terms and lower interest rates. For example, when buying a home, a 20 percent down payment can greatly impact your monthly payments compared to just 5 percent. Here are some key benefits of making a larger down payment:

- Lower Interest Rates: Lenders typically offer lower interest rates to borrowers with substantial down payments, as it lowers their risk.

- Avoiding Private Mortgage Insurance (PMI): A down payment of less than 20 percent often requires PMI, increasing your monthly costs. A larger down payment can help you sidestep this expense.

- Stronger Negotiating Power: A solid down payment gives you leverage when negotiating terms with lenders, whether they are traditional banks or online loan providers.

To qualify for lower loan rates, prioritize saving for a larger down payment. This strategy not only boosts your chances of approval but also strengthens your financial stability. Whether opting for bank loan rates or online loan rates, remember that your down payment size is crucial in determining the interest you will pay. Start planning and saving now to secure the best loan terms for your future.

Negotiating Loan Terms for Optimal Rates and Conditions

Securing a loan with lower rates can significantly impact your financial journey. To negotiate effectively, it’s essential to be informed and prepared. Start by researching current market rates and understanding the differences between bank loan rates and online loan rates. Online lenders often provide more competitive rates due to lower overhead costs, while traditional banks may offer personalized service. Knowing these differences can enhance your negotiation skills. Here are some tips to help you secure optimal rates and conditions:

- Improve Your Credit Score: A higher credit score can lead to lower interest rates. Focus on paying down debts and making timely payments.

- Increase Your Down Payment: A larger down payment reduces the lender’s risk, potentially leading to better loan terms.

- Shop Around: Compare rates from various lenders, including banks and online options, to find the best deal.

- Consider Loan Types: Fixed-rate loans offer stability, while adjustable-rate loans may provide lower initial rates.

Choose what fits your financial situation best. When approaching lenders, be ready to negotiate. Present your research and clearly state your needs. Informed borrowers are often more successful in securing favorable terms. By following these steps, you can improve your chances of qualifying for lower loan rates and obtaining loan conditions that align with your financial goals.

FAQs

-

What factors determine my loan interest rate?

Lenders consider your credit score, income stability, debt-to-income ratio, loan amount, and repayment history when determining your interest rate. -

How can I improve my credit score to get lower loan rates?

Pay bills on time, reduce outstanding debt, avoid multiple loan applications, and maintain a good credit mix to improve your credit score. -

Does a higher income help in securing a lower loan rate?

Yes, a stable and high income reduces risk for lenders, making you eligible for lower interest rates and better loan terms. -

Can I negotiate my loan interest rate with lenders?

Yes, you can negotiate a lower rate if you have a strong credit score, a good repayment history, or an existing relationship with the lender. -

Do secured loans offer lower interest rates than unsecured loans?

Yes, secured loans backed by collateral (e.g., home or car loans) generally have lower interest rates than unsecured personal loans.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.