The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

Loan Repayment History Tips to Boost Credit Score

Understanding your loan repayment history is essential for managing your finances effectively. This history not only shows your ability to repay borrowed money but also significantly impacts your credit score. By implementing some straightforward Loan Repayment History Tips, you can enhance your credit score and increase your chances of obtaining a personal loan in the future.

Why It Matters

Your loan repayment history is a major factor in your credit score. Lenders assess this history to determine your reliability. Consistently making on-time payments demonstrates financial responsibility, which can lead to more favorable loan terms.

Key Tips to Improve Your Credit Score

- Pay on Time: Always pay your loans by the due date to avoid late fees and score damage.

- Keep Balances Low: Aim to pay more than the minimum due to reduce debt and improve your score.

- Check Your Credit Report: Regularly review your credit report for errors, as disputing inaccuracies can help enhance your score.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

How Late Payments Affect Your Credit Score

Understanding late payments’ impact on your credit score is essential for improving financial health. Your loan repayment history plays a crucial role in determining your score. Missing payments can create lasting issues, making it harder to secure loans in the future.

The Impact of Late Payments

Late payments can significantly lower your credit score:

- 30 Days Late: Hurts your score.

- 60 Days Late: Causes even more damage.

- 90 Days Late: Your score may plummet, complicating personal loan approvals.

Tips to Avoid Late Payments

To maintain a healthy credit score, consider these Loan Repayment History Tips:

- Set Up Reminders: Use your phone or calendar for due date alerts.

- Automate Payments: Set up automatic payments to avoid missing deadlines.

- Communicate with Lenders: If you’re struggling, contact your lender for assistance.

By following these strategies, you can improve your credit score for a personal loan and secure a brighter financial future.

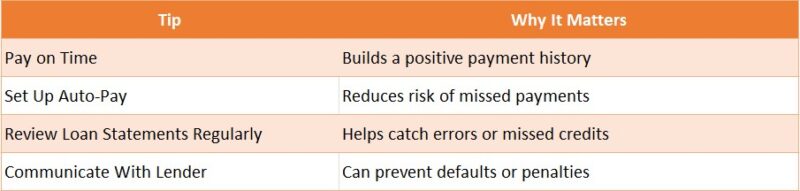

Top Loan Repayment History Tips for Improving Your Score

Improving your credit score heavily relies on your loan repayment history. Lenders assess how well you’ve managed past loans to determine your trustworthiness for new credit. Here are some effective Loan Repayment History Tips to help boost your score!

Pay on Time Every Time

Making timely payments is one of the most effective ways to enhance your credit score for a personal loan. Late payments can significantly damage your score, so consider setting reminders or automating payments to ensure you stay on track.

Keep Your Balances Low

Keeping your loan balances low is another smart strategy. Aim to pay more than the minimum payment each month. This not only accelerates your loan payoff but also demonstrates financial responsibility to lenders.

Review Your Credit Report Regularly

Lastly, regularly checking your credit report is essential. Errors can occur, and spotting them early allows you to dispute inaccuracies. Monitoring your report helps you understand your credit standing and identify areas for improvement.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

Can Regular Payments Really Boost Your Credit Rating?

Your loan repayment history is vital for your credit score, acting as a report card on your debt management. To improve your credit score for a personal loan, focus on your repayment habits with these Loan Repayment History Tips!

Understand the Importance of Timely Payments

Timely payments are crucial; late payments can significantly harm your score. Set reminders or automate payments to avoid missing due dates. Consistency is essential!

Keep Track of Your Loans

Organize your loans by keeping a list of them. This helps you monitor due dates and amounts, making budgeting easier. Remember, every on-time payment contributes to your credit history!

Consider Paying More Than the Minimum

If possible, pay more than the minimum due. This approach reduces your debt faster and demonstrates to lenders that you’re serious about your finances. Additionally, it can save you money on interest over time!

The Role of Credit Utilization in Loan Repayment

Understanding your loan repayment history is crucial for boosting your credit score. When you make timely payments, it shows lenders that you are responsible. This is especially important if you’re looking to improve your credit score for a personal loan. A good score can save you money in the long run!

What is Credit Utilization?

Credit utilization refers to the amount of credit you use compared to your total available credit. Keeping this ratio low is key to maintaining a healthy credit score. Aim for a utilization rate below 30%.

Tips to Manage Credit Utilization

- Pay on Time: Always make your loan payments on time to avoid penalties.

- Keep Balances Low: Try not to max out your credit cards. Lower balances help improve your score.

- Increase Credit Limits: If possible, ask for a credit limit increase. This can lower your utilization ratio without changing your spending habits.

Strategies to Stay on Track with Loan Payments

Improving your credit score heavily relies on your loan repayment history. By following effective Loan Repayment History Tips, you can significantly boost your score, which helps in securing loans and obtaining better interest rates. Here are some strategies to keep your payments on track!

Set Up Automatic Payments

Setting up automatic payments is a simple way to ensure you never miss a payment. This method automatically deducts your loan payments from your bank account, acting like a personal assistant. Just remember to keep enough funds in your account to avoid overdraft fees.

Create a Payment Calendar

Creating a payment calendar is another useful tip. Mark your loan due dates and set reminders a few days in advance. This visual tool helps you stay organized and makes it satisfying to check off each payment as you complete it!

Communicate with Your Lender

If you find yourself struggling, don’t hesitate to reach out to your lender. They might offer options like deferment or modified payment plans. It’s always better to ask for help than to miss a payment and negatively impact your credit score.

How to Handle Missed Payments Effectively

When it comes to improving your credit score, your loan repayment history plays a crucial role. Missing payments can hurt your score, but knowing how to handle them can turn things around. Here are some effective Loan Repayment History Tips to help you bounce back and improve your credit score for a personal loan.

Acknowledge the Missed Payment

First things first, don’t ignore the missed payment. Acknowledging it is the first step toward recovery. Reach out to your lender and explain your situation. They might offer options to help you catch up without further penalties.

Create a Repayment Plan

Next, create a repayment plan. This could involve setting up automatic payments or budgeting to ensure you never miss another due date. Consistency is key! By sticking to your plan, you’ll not only pay off your debt but also show lenders that you’re responsible.

The Impact of Loan Types on Your Credit History

Understanding how various loan types impact your credit history is essential. Your loan repayment history significantly influences your credit score. By applying some effective Loan Repayment History Tips, you can enhance your credit score for a personal loan, leading to improved financial opportunities.

Types of Loans and Their Impact

- Personal Loans: Timely repayments can elevate your credit score, demonstrating your ability to manage debt responsibly.

- Credit Cards: High balances may negatively affect your score, so aim to keep credit utilization low.

- Mortgages: Regular mortgage payments can positively influence your credit history over time.

Key Takeaways

- Timely payments are crucial to avoid negative marks on your credit report.

- Diversifying your loans can enhance your score, provided they are well-managed.

- Regularly monitor your credit to identify any errors that could impact your score. By grasping these loan types, you can make informed choices that strengthen your credit profile. A robust credit score not only opens up better loan options but also secures lower interest rates, facilitating your financial goals.

Why Monitoring Your Credit Report Matters

Monitoring your credit report is essential, much like checking your report card. It reflects your performance with loans and payments, and understanding your loan repayment history is key to improving your credit score for a personal loan. This history indicates to lenders your financial responsibility, which can lead to better loan terms.

Why It Matters

Regularly checking your credit report helps you identify mistakes or unpaid debts that could negatively impact your score. Here are some Loan Repayment History Tips:

- Check for Errors: Mistakes can occur, and correcting them can enhance your score.

- Track Your Payments: Timely payments are crucial; late payments can significantly lower your score.

- Know Your Limits: Understanding credit utilization aids in better debt management.

Benefits of Monitoring

Monitoring your credit report offers numerous advantages:

- Better Loan Offers: A higher score often results in lower interest rates.

- Increased Confidence: Being aware of your score provides security when applying for loans.

- Financial Awareness: It keeps you informed about your financial health, simplifying future planning.

How ExpressCash Can Help You Manage Your Loan Repayment

Managing your loan repayment is crucial for maintaining a healthy credit score. Your loan repayment history plays a significant role in determining your creditworthiness. By following some simple Loan Repayment History Tips, you can improve your credit score for a personal loan, making it easier to secure future financing.

At ExpressCash, we understand that keeping track of your loans can be overwhelming. Here are some ways we can assist you:

- Set Up Reminders: We offer tools to help you remember payment due dates, so you never miss a payment.

- Budgeting Tools: Our budgeting features can help you allocate funds for your loan repayments effectively.

- Credit Score Monitoring: Stay informed about your credit score changes and understand how your repayment history affects it.

By utilizing these resources, you can stay on top of your loan repayments. Remember, timely payments not only boost your credit score but also build trust with lenders. Let ExpressCash guide you on your journey to financial health!

FAQs

-

Why is loan repayment history important?

It makes up the largest portion of your credit score (about 35%) and shows lenders your reliability in repaying debts. -

How can I maintain a good loan repayment history?

Always pay on time, set up automatic payments, or use reminders to avoid missing due dates. -

Will one missed payment hurt my credit score?

Yes, even a single missed payment can negatively impact your score, especially if it’s 30 days or more overdue. -

Can I improve my repayment history after a late payment?

Yes, by consistently making on-time payments going forward, you can gradually rebuild a strong payment history. -

Do lenders report repayment history to all credit bureaus?

Most do, but not all. It’s important to check your credit report from all three major bureaus to verify accurate reporting.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.