The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

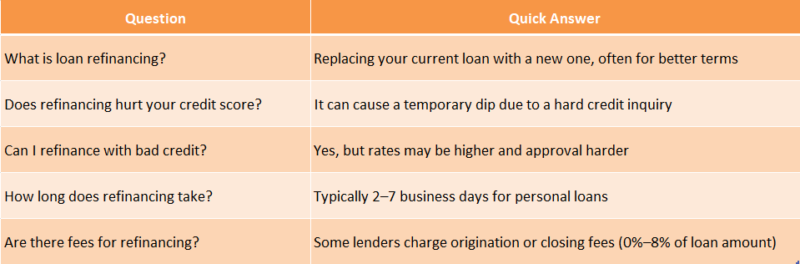

FAQs About Loan Refinancing: Common Questions Answered

When unexpected expenses arise, many people in Illinois turn to payday loans online for quick financial relief. Understanding how these loans work and where to apply can make a significant difference in your financial journey. Let’s dive into the essentials of payday loans online in Illinois and what you need to know before applying.

What Are Payday Loans Online?

Payday loans online are short-term loans designed to help you cover urgent expenses until your next paycheck. They are typically easy to apply for and can provide funds quickly. However, it’s essential to understand the terms and conditions before committing to one.

Where to Apply for Online Payday Loans

Finding a reliable lender is crucial. Here are some tips to consider:

- Research Lenders: Look for reputable companies with positive reviews.

- Check Rates: Compare interest rates and fees to find the best deal.

- Read the Fine Print: Always understand the repayment terms before signing anything.

By following these steps, you can confidently navigate the world of payday loans online in Illinois.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

How to Apply for Payday Loans Online in Illinois: A Step-by-Step Guide

Applying for payday loans online in Illinois can be a straightforward process, especially when you know where to start. These loans can provide quick cash for unexpected expenses, making them a popular choice for many. Understanding how to apply is crucial for a smooth experience.

Step-by-Step Guide to Applying for Online Payday Loans

- Research Lenders: Start by looking for reputable lenders that offer payday loans online in Illinois. Check reviews and ratings to ensure they are trustworthy.

- Gather Necessary Documents: You’ll typically need to provide proof of income, identification, and a bank account. Having these ready can speed up the process.

- Fill Out the Application: Visit the lender’s website and complete the online application form. Be honest and accurate with your information.

- Review Terms: Before submitting, carefully read the loan terms, including interest rates and repayment schedules. Make sure you understand what you’re agreeing to.

- Submit Your Application: Once everything looks good, hit submit! You should receive a response quickly, often within minutes.

Benefits of Online Payday Loans

- Convenience: Apply from the comfort of your home.

- Speed: Get funds deposited into your account quickly.

- Accessibility: Available even if you have less-than-perfect credit.

The Benefits of Choosing Payday Loans Online in Illinois

When unexpected expenses arise, many people in Illinois find themselves in need of quick cash. This is where payday loans online in Illinois come into play. Understanding where to apply for these loans can make a significant difference in your financial situation. Let’s explore the benefits of choosing online payday loans.

Quick Access to Funds

One of the biggest advantages of online payday loans is the speed at which you can access funds. Unlike traditional loans that may take days or weeks, online payday loans can often be approved within hours. This means you can tackle urgent bills or emergencies without delay.

Convenience and Flexibility

Applying for payday loans online in Illinois is incredibly convenient. You can complete the entire process from the comfort of your home, using your computer or smartphone. Plus, many lenders offer flexible repayment options, allowing you to choose a plan that fits your budget. This flexibility can ease the stress of repayment.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

What Are the Eligibility Requirements for Payday Loans in Illinois?

When you’re in a financial pinch, understanding the eligibility requirements for payday loans online in Illinois can make all the difference. These loans can provide quick cash to help you cover unexpected expenses, but knowing if you qualify is key to getting the help you need.

Basic Eligibility Criteria

To apply for payday loans online in Illinois, you generally need to meet a few basic requirements:

- Age: You must be at least 18 years old.

- Income: A steady source of income is essential, whether from a job or other means.

- Bank Account: Having an active checking account is necessary for loan disbursement and repayment.

Additional Considerations

While the above criteria are standard, lenders may also consider:

- Credit History: Some lenders may check your credit, but many offer loans regardless of your score.

- Residency: You must be a resident of Illinois to apply for payday loans online in Illinois.

Understanding these requirements helps you prepare for the application process and increases your chances of approval.

Also Read: Personal Loan Refinance Options: Best Ways to Lower Your Payments

Comparing Online Lenders: Which Payday Loan Provider is Right for You?

When you’re in a tight spot financially, knowing where to find payday loans online in Illinois can be a game changer. With so many options available, it’s essential to compare lenders to find the right fit for your needs. This guide will help you navigate the world of online payday loans and make an informed choice.

Key Factors to Consider

- Interest Rates: Different lenders offer varying rates. Always check the APR to avoid surprises.

- Loan Amounts: Some lenders may only offer small amounts, while others provide larger loans. Know what you need before applying.

- Repayment Terms: Understand how long you have to repay the loan. Shorter terms can mean higher payments, so choose wisely!

Tips for Choosing the Right Lender

- Read Reviews: Look for feedback from other borrowers to gauge reliability.

- Check for Licensing: Ensure the lender is licensed to operate in Illinois.

- Customer Service: Good support can make a difference if you have questions or issues.

By considering these factors, you can confidently choose a payday loan provider that meets your needs and helps you get back on track.

Common Myths About Payday Loans Online in Illinois Debunked

When it comes to managing finances, many people in Illinois turn to payday loans online. However, there are several myths surrounding these loans that can lead to confusion. Understanding the truth about payday loans online in Illinois is essential for making informed decisions. Let’s debunk some of these common misconceptions!

Myth 1: Payday Loans Are Always Bad

Many believe that payday loans are a trap. While they can be risky, they can also provide quick cash in emergencies. Used wisely, online payday loans can help bridge financial gaps without long-term consequences.

Myth 2: You Need Perfect Credit

Another myth is that only those with excellent credit can qualify for payday loans online in Illinois. In reality, many lenders consider other factors, making these loans accessible to a broader range of borrowers.

Myth 3: They’re All the Same

Not all payday loans are created equal! Different lenders offer varying terms and fees. It’s crucial to shop around and compare options before applying. This way, you can find the best deal that suits your needs.

How to Use Payday Loans Responsibly: Tips for Borrowers

When considering payday loans online in Illinois, it’s crucial to use them responsibly. While these loans can provide quick cash in emergencies, they also carry risks that can impact your financial health. Here are some tips for responsible borrowing:

Tips for Responsible Borrowing

- Only Borrow What You Need: Stick to borrowing only what is necessary to keep repayments manageable.

- Read the Fine Print: Understand the terms and fees of online payday loans; knowledge is essential!

Create a Repayment Plan

- Set a Budget: Plan your repayment strategy before applying to avoid falling into debt.

- Consider Alternatives: Look into personal loans or credit unions for potentially better rates.

Stay Informed

- Know Your Rights: Understand Illinois laws on payday loans to protect yourself from unfair practices.

Avoid Repeated Borrowing

- Limit Your Loans: Repeated borrowing can lead to a difficult cycle of debt.

Seek Financial Advice

- Talk to Experts: If uncertain, consult a financial advisor for tailored guidance.

Exploring Alternatives to Payday Loans Online in Illinois

When facing unexpected expenses, many people in Illinois consider payday loans online. However, it’s essential to explore alternatives that might be more beneficial. Understanding where to apply for payday loans online in Illinois can help, but knowing your options is equally important.

- Credit Unions: Many local credit unions offer small personal loans with lower interest rates. They often have flexible repayment terms, making them a great alternative.

- Payment Plans: Some businesses allow you to set up payment plans for larger purchases. This can help you avoid high-interest loans altogether.

- Borrowing from Friends or Family: If you can, consider asking someone close to you for a loan. This can save you from high fees and interest rates.

Exploring these alternatives can lead to better financial decisions. Remember, while payday loans online in Illinois may seem convenient, other options can provide relief without the stress of high repayment costs.

How LendersCashLoan.com Can Help You Find the Best Payday Loans Online in Illinois

Finding the right payday loans online in Illinois can feel overwhelming. With so many options available, it’s crucial to know where to apply and how to choose the best loan for your needs. That’s where LendersCashLoan.com comes in, making your search easier and more efficient.

Why Choose LendersCashLoan.com?

At LendersCashLoan.com, we understand the importance of quick access to funds. Our platform connects you with reputable lenders offering online payday loans tailored to your situation. Here’s how we can help:

- Easy Comparisons: We provide a side-by-side comparison of different lenders, so you can see rates and terms at a glance.

- User-Friendly Interface: Our website is designed to be simple and straightforward, making it easy for anyone to navigate.

- Expert Guidance: We offer tips and advice on how to choose the right payday loan, ensuring you make informed decisions.

With LendersCashLoan.com, finding payday loans online in Illinois is just a few clicks away. Let us help you secure the funds you need, quickly and safely.

FAQs

-

What is loan refinancing?

Loan refinancing means replacing your existing loan with a new one—often to get a lower interest rate, better terms, or reduced monthly payments. -

When should I consider refinancing my loan?

Refinance when interest rates drop, your credit score improves, or if you need to adjust your repayment schedule to fit your budget. -

Does refinancing hurt my credit score?

It may cause a temporary dip due to a hard credit inquiry, but in the long run, on-time payments on the new loan can help your score. -

Are there fees involved in refinancing?

Yes, lenders may charge processing fees, prepayment penalties, or origination fees, so always check the total cost before refinancing. -

Can I refinance with bad credit?

Yes, but you may face higher interest rates or limited options. Improving your credit first can help you qualify for better refinance deals.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.