The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

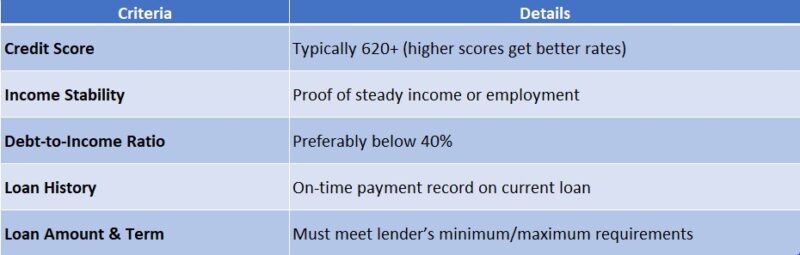

Loan Refinance Eligibility Criteria: Do You Qualify?

Understanding the Loan Refinance Eligibility Criteria is crucial for anyone considering refinancing their loan. It’s like checking if you can ride a roller coaster before you hop on. Knowing if you qualify can save you time and help you make better financial decisions.

Key Factors to Consider

When it comes to Loan Refinance Eligibility Criteria, there are a few key factors lenders look at. These include your credit score, income, and the amount of equity in your home. Let’s break these down further:

Credit Score

A higher credit score can open doors to better refinancing options. Lenders typically prefer scores above 620. If your score is lower, don’t worry! There are still Personal Loan Refinance Options available, but they may come with higher interest rates.

Income Stability

Lenders want to see that you have a steady income. This shows them you can handle monthly payments. If you’ve recently changed jobs, it might affect your eligibility, so keep that in mind!

Home Equity

If you own a home, the equity you have built up can play a big role. Generally, having at least 20% equity can help you qualify for better rates. If you’re unsure, it’s worth checking your home’s current value!

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

Are You Ready to Refinance? Key Factors to Consider

Refinancing your loan can be a smart financial move, but first, you need to understand the Loan Refinance Eligibility Criteria. Knowing whether you qualify can save you time and help you make informed decisions. So, are you ready to refinance? Let’s explore the key factors that can impact your eligibility.

Key Factors to Consider

- Credit Score: Lenders often look for a good credit score. A score above 620 is generally favorable.

- Debt-to-Income Ratio: This ratio shows how much of your income goes toward debt. A lower ratio (ideally below 43%) can improve your chances.

- Employment History: Stable employment can boost your credibility as a borrower. Lenders prefer applicants with a steady job history.

- Current Loan Terms: The type of loan you have and its terms can affect your refinancing options.

Understanding these criteria helps you assess your readiness for refinancing. If you meet these requirements, you can explore various Personal Loan Refinance Options that might suit your financial goals. Remember, refinancing can lead to lower monthly payments or better loan terms, making it a worthwhile consideration!

Credit Score Requirements for Loan Refinance: Do You Meet Them?

When considering a loan refinance, understanding the Loan Refinance Eligibility Criteria is crucial. It can help you save money and lower your monthly payments. But do you qualify? One of the most important factors is your credit score. Let’s dive into what you need to know!

Your credit score is like a report card for your financial behavior. Lenders use it to decide if you’re a good candidate for refinancing. Generally, a score of 620 or higher is preferred. Here’s a quick breakdown:

- Excellent (740 and above): You’ll likely get the best rates.

- Good (700-739): You’re in a solid position for favorable terms.

- Fair (640-699): You may still qualify, but rates could be higher.

- Poor (below 640): Refinancing might be challenging, but not impossible!

Remember, your credit score isn’t the only factor. Lenders also look at your income, debt-to-income ratio, and employment history. So, even if your score isn’t perfect, you might still have some personal loan refinance options available. Always check with your lender to see what they require!

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

Income Stability and Employment History: How They Affect Your Eligibility

When considering a loan refinance, understanding the Loan Refinance Eligibility Criteria is crucial. Your eligibility can significantly affect your financial future, so knowing what lenders look for can help you prepare and improve your chances of approval.

Why Income Matters

Lenders want to see that you have a steady income. This shows them you can repay the loan. If you’ve been at your job for a while, that’s even better! It gives lenders confidence in your financial stability.

Key Factors to Consider

- Consistent Income: A reliable paycheck helps demonstrate your ability to manage monthly payments.

- Employment Duration: Staying in the same job for at least two years can boost your chances.

- Job Type: Stable jobs in reputable companies are often viewed more favorably.

By focusing on these aspects, you can enhance your chances of qualifying for personal loan refinance options. Remember, lenders want to see that you’re a low-risk borrower!

Also Read: Personal Loan Refinance Options: Best Ways to Lower Your Payments

Debt-to-Income Ratio: What It Means for Your Refinance Application

When considering a loan refinance, understanding the Loan Refinance Eligibility Criteria is crucial. One key factor that lenders look at is your debt-to-income ratio (DTI). This ratio helps them assess how much of your income goes toward paying debts. If your DTI is too high, it may affect your chances of qualifying for better rates or terms.

Your DTI is calculated by dividing your monthly debt payments by your gross monthly income. For example, if you earn $5,000 a month and pay $2,000 in debts, your DTI would be 40%. Generally, lenders prefer a DTI below 43%, but some may allow higher ratios depending on other factors.

Why DTI Matters

- Lender Confidence: A lower DTI shows lenders you manage your finances well.

- Better Rates: Qualifying for a lower DTI can lead to better interest rates on your personal loan refinance options.

- Financial Health: Keeping your DTI low can help you maintain a healthy financial profile, making future borrowing easier.

Understanding your DTI can empower you to make informed decisions about refinancing and improve your chances of qualifying for the best loan options.

Property Value Assessment: Is Your Home Worth Refinancing?

When considering refinancing your home, understanding the Loan Refinance Eligibility Criteria is crucial. It helps you determine if your home’s value supports a refinance, which can lead to lower monthly payments or cash for other needs. So, is your home worth refinancing? Let’s find out!

Understanding Your Home’s Value

First, you need to assess your home’s current market value. This can be done through a professional appraisal or by checking recent sales of similar homes in your area. Knowing this helps you understand if refinancing is a smart move.

Key Factors to Consider

- Current Mortgage Balance: Make sure your home’s value exceeds what you owe.

- Market Trends: Is your neighborhood growing? Rising values can boost your refinancing options.

- Loan-to-Value Ratio (LTV): Lenders prefer an LTV of 80% or lower for better rates.

By evaluating these factors, you can see if you qualify for personal loan refinance options. Remember, a higher home value can open doors to better refinancing deals, making it a worthwhile journey to explore!

The Role of Lenders in Determining Refinance Eligibility

Understanding the Loan Refinance Eligibility Criteria is crucial for anyone considering refinancing their loan. It’s not just about wanting a lower interest rate; it’s about knowing if you qualify. Lenders play a significant role in this process, and their requirements can vary widely. Let’s dive into how they determine your eligibility!

Lenders assess several factors to decide if you qualify for refinancing. Here are some key points they consider:

- Credit Score: A higher score often leads to better rates.

- Income Stability: Lenders want to see that you can repay the loan.

- Debt-to-Income Ratio: This shows how much of your income goes to debt payments.

- Loan-to-Value Ratio: This compares your loan amount to the value of your home.

These factors help lenders gauge your financial health and risk level. If you meet their criteria, you might unlock better personal loan refinance options!

Why It Matters

Knowing the eligibility criteria helps you prepare. If you understand what lenders look for, you can improve your chances of getting approved. Plus, it can save you money in the long run by securing a lower interest rate. So, take the time to check your financial situation before applying!

How ExpressCash Can Help You Navigate Loan Refinance Eligibility Criteria

When considering a loan refinance, understanding the Loan Refinance Eligibility Criteria is crucial. This knowledge can empower you to make informed decisions about your financial future. Refinancing can lower your monthly payments or help you pay off your loan faster, but first, you need to know if you qualify.

At ExpressCash, we simplify the process of determining your eligibility for refinancing. Here are some key factors we consider:

- Credit Score: A higher score often leads to better rates.

- Income Stability: Steady income reassures lenders.

- Debt-to-Income Ratio: Lower ratios improve your chances.

- Loan Type: Different loans have different criteria.

Understanding these elements can help you assess your options effectively. We also provide insights into various Personal Loan Refinance Options tailored to your needs. Navigating the world of loan refinancing can feel overwhelming, but you don’t have to do it alone. With ExpressCash, you gain access to expert guidance and resources that make the process smoother. We’re here to help you explore your options and find the best refinancing solution for your situation.

FAQs

-

What are the basic eligibility requirements for refinancing a loan?

Most lenders require a stable income, a good credit score, a low debt-to-income ratio, and a consistent repayment history on your current loan. -

What credit score do I need to refinance a personal loan?

A credit score of 670 or above is typically preferred, but some lenders offer refinancing options for borrowers with fair or even poor credit, often at higher rates. -

Can I refinance a loan if I have bad credit?

Yes, but your options may be limited. You may need to show strong income, have a co-signer, or accept higher interest rates to qualify. -

Do I need to be employed to qualify for refinancing?

Generally, yes. Lenders usually want to see proof of steady employment or self-employment income to ensure you can repay the new loan. -

Can I refinance if I’ve missed payments on my current loan?

It may be difficult. Late or missed payments can hurt your chances, but some lenders may still consider your application if your recent repayment behavior has improved.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.