The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

Loan Rates for Self-Employed Borrowers: Eligibility & Offers

Understanding Loan Rates for Self-Employed Borrowers

Understanding loan rates for self-employed borrowers can be challenging. Unlike traditional employees, self-employed individuals face unique hurdles when applying for loans, as lenders scrutinize their income more closely, often resulting in higher loan rates. However, with proper preparation, self-employed borrowers can find competitive offers that align with their financial needs.

When comparing bank loan rates to online loan rates, it’s crucial to recognize the differences. Banks typically have stricter requirements and may offer slightly lower rates due to their established reputation. In contrast, online lenders often provide more flexible criteria, which can be advantageous for self-employed individuals. Here are some key insights to keep in mind:

- Documentation: Expect to provide two years of tax returns and profit and loss statements.

- Credit Score: A higher credit score can significantly influence the loan rate you receive.

- Debt-to-Income Ratio: Lenders will evaluate your debt-to-income ratio to assess repayment ability.

The best strategy for self-employed borrowers is to shop around. By comparing offers from banks and online lenders, you can discover a loan rate that fits your financial situation. Preparation is essential; gather your financial documents, check your credit score, and be ready to explain your income sources. With the right approach, you can navigate the loan landscape effectively.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

Securing a loan as a self-employed borrower can be challenging due to fluctuating incomes, which complicate the approval process. However, understanding the eligibility criteria can significantly improve your chances of obtaining favorable loan rates for self-employed borrowers. Lenders typically seek a consistent income stream, demonstrated through tax returns, profit and loss statements, and bank statements, which establish your financial stability and repayment ability. Key eligibility criteria for self-employed loan applicants include:

- Income Verification: Two years of tax returns are usually required.

- Credit Score: Aim for a score above 700 to access better loan rates.

- Debt-to-Income Ratio: Keeping this ratio below 43 percent enhances your chances.

- Business Longevity: Lenders prefer businesses operational for at least two years.

In addition to meeting these criteria, it is crucial to shop around for the best loan offers. While bank loan rates may be stable, online lenders often provide competitive rates and quicker processing times. By comparing options, you can find a loan that meets your needs and offers favorable terms. With the right preparation and knowledge, being self-employed does not have to hinder your ability to secure a loan.

How Income Verification Affects Loan Rates for Self-Employed

Securing a loan as a self-employed borrower presents unique challenges, especially regarding income verification. Unlike traditional employees with steady paychecks, self-employed individuals often have fluctuating incomes, which can make lenders cautious. This variability can significantly impact loan rates. Generally, the more stable and verifiable your income appears, the better your chances of obtaining favorable loan rates.

For example, providing two years of tax returns and a profit and loss statement can help lenders view you as a lower risk, potentially leading to lower interest rates. It’s essential to understand the differences between bank loan rates and online loan rates. Banks usually have stricter requirements and may offer lower rates but can be less flexible with income verification. Conversely, online lenders often cater to self-employed borrowers, offering quicker approvals and more lenient documentation requirements, though sometimes at higher rates. Here are some benefits of online lenders:

- Faster application processes

- More flexible income verification

- Potentially higher loan amounts

- Tailored loan products for self-employed individuals

In conclusion, navigating loan rates as a self-employed borrower can be challenging. By preparing thorough documentation and exploring both bank and online loan rates, you can find a loan that meets your financial needs. Presenting your income effectively can lead to better loan terms.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

Comparing Loan Offers for Self-Employed Individuals

Securing a loan can be particularly challenging for self-employed individuals due to their fluctuating incomes, which may impact loan eligibility. Therefore, comparing loan offers is essential. Understanding the differences between bank loan rates and online loan rates can guide you in making an informed decision that fits your financial needs.

Bank Loan Rates vs. Online Loan Rates: Here are some important factors to consider:

- Stability: Bank loan rates are generally more stable and predictable, providing peace of mind for long-term planning.

- Flexibility: Online lenders often offer more flexible terms and faster approval processes, which can be advantageous if you need funds quickly.

- Interest Rates: While online lenders may present competitive rates, it is crucial to read the fine print for any hidden fees or conditions.

- Documentation: Banks typically require extensive documentation, whereas online lenders may have a more streamlined process, making it easier for self-employed borrowers to qualify.

Ultimately, the best loan offer will depend on your unique financial situation. Collect quotes from various lenders, both traditional and online, to find a loan that meets your immediate needs and supports your long-term goals. The right loan can empower your business and help you achieve your aspirations.

Read Also: Bank Loan Rates vs. Online Loan Rates: Which Is Cheaper?

Tips for Improving Loan Rates as a Self-Employed Borrower

Securing a loan as a self-employed borrower can be challenging, particularly when it comes to loan rates. Unlike traditional employees, self-employed individuals may lack a steady paycheck, making lenders more cautious. However, there are effective strategies to improve your loan rates and strengthen your application. Start by organizing your financial documents, including tax returns, profit and loss statements, and bank statements, to showcase your income stability.

It’s also important to understand the differences between bank loan rates and online loan rates. Banks typically offer lower rates but have stricter eligibility criteria, while online lenders may provide more flexible options, albeit often at higher rates. Therefore, it’s crucial to shop around and compare offers from both types of lenders. Here are some tips to secure better loan rates as a self-employed borrower:

- Maintain a strong credit score by paying bills on time and reducing debt.

- Keep your business finances separate from personal finances for clarity.

- Save for a larger down payment to lower your loan-to-value ratio.

- Consider getting pre-approved to gauge what you can afford and demonstrate seriousness to lenders.

By following these steps, you can significantly enhance your chances of obtaining favorable loan rates suited to your self-employed situation.

Common Challenges Faced by Self-Employed Borrowers

Self-employed borrowers encounter distinct challenges in securing loan rates due to their fluctuating incomes. Unlike traditional employees with steady paychecks, self-employed individuals may struggle to demonstrate financial stability, leading to higher loan rates or even disqualification from certain products. For example, a freelance graphic designer might experience a profitable year followed by a lean one, complicating their income verification for banks. When comparing bank loan rates to online loan rates, self-employed borrowers often find online lenders provide more flexible options. These lenders typically use alternative data to assess creditworthiness, which can benefit those with non-traditional income streams. Here are some key considerations:

- Documentation Requirements: Online lenders may require less paperwork, expediting the process.

- Interest Rates: Although bank rates can be lower, online lenders often offer competitive rates tailored for self-employed individuals.

- Approval Speed: Online lenders frequently have faster approval times, which is crucial for urgent financial needs.

To overcome these challenges, self-employed borrowers should maintain detailed financial records, such as tax returns and profit and loss statements, to demonstrate income stability. Additionally, shopping around for loan rates and understanding the differences between bank and online lenders can empower borrowers to make informed decisions. By being proactive, self-employed individuals can find suitable loan options.

The Impact of Credit Scores on Loan Rates for Self-Employed

Securing a loan can be particularly challenging for self-employed borrowers, especially when it comes to loan rates. A key factor influencing these rates is the borrower’s credit score. Generally, a higher credit score leads to lower loan rates, making it essential for self-employed individuals to maintain a strong credit history. For example, a self-employed person with a credit score of 750 may enjoy better loan terms than someone with a score of 620, even if their incomes are similar.

Additionally, understanding the differences between bank loan rates and online loan rates is crucial for making informed decisions. Banks typically offer competitive rates but often have stricter eligibility requirements. In contrast, online lenders may provide more flexible options, though these can come with higher rates. Here are some important considerations when comparing these options:

- Flexibility: Online lenders may have more lenient documentation requirements, benefiting self-employed borrowers without traditional income verification.

- Speed: Online applications are usually processed more quickly, providing faster access to funds.

- Rate Variability: Bank rates tend to be more stable, while online rates can vary based on market conditions.

By grasping these factors, self-employed borrowers can effectively navigate their options and secure favorable loan rates.

Exploring Different Types of Loans for Self-Employed Borrowers

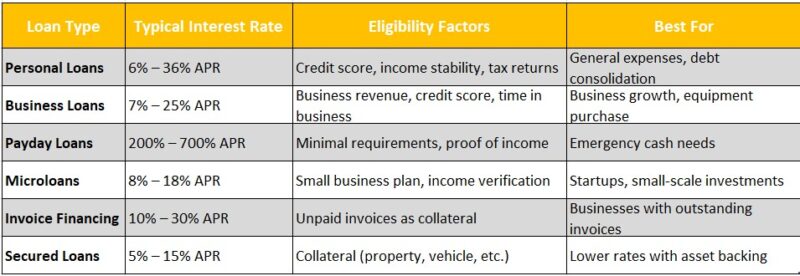

Securing a loan as a self-employed borrower can be challenging due to fluctuating incomes that complicate eligibility. However, understanding the various loan types available can ease this process. Many lenders offer specific products for self-employed individuals, including personal loans, business loans, and mortgages, which assess overall financial health rather than just monthly income.

A crucial aspect to consider is the difference between bank loan rates and online loan rates. Bank loan rates are typically more stable and may offer lower interest rates, but they often come with stricter eligibility criteria. In contrast, online lenders may provide more flexible options, though sometimes at higher rates. Here are some benefits of each:

- Bank Loan Rates: Lower interest rates, established credibility, and potentially better customer service.

- Online Loan Rates: Faster application processes, more lenient credit requirements, and a wider variety of loan products.

To enhance your chances of securing a favorable loan rate, consider these steps:

- Maintain accurate financial records to show income stability.

- Shop around and compare offers from different lenders.

- Be ready to provide additional documentation like tax returns and profit and loss statements.

By following these steps, self-employed borrowers can find suitable loan rates to meet their financial goals.

Navigating the Loan Application Process for Self-Employed

Navigating the loan application process as a self-employed borrower can be challenging, but understanding loan rates can simplify it. Self-employed individuals often face unique hurdles, such as fluctuating incomes and extensive documentation requirements. However, with the right strategy, you can secure favorable loan rates. Many lenders consider your average income over the past two years, so consistent earnings can help when negotiating rates.

When comparing bank loan rates to online loan rates, it’s crucial to weigh the pros and cons. Banks typically offer stability and personalized service, but their rates may be higher and approval slower. Conversely, online lenders often provide quicker approvals and competitive rates, making them appealing for self-employed borrowers. Here are some key points to consider:

- Documentation: Online lenders may require less paperwork.

- Flexibility: Online platforms often have more lenient eligibility criteria.

- Speed: Expect faster processing times with online applications.

To improve your chances of securing a favorable loan rate, consider these steps:

- Prepare Your Documentation: Gather tax returns and bank statements.

- Check Your Credit Score: A higher score can lead to better rates.

- Shop Around: Compare offers from banks and online lenders.

By following these steps, you can navigate the loan application process confidently and find the right loan rates for your self-employed status.

FAQs

-

What interest rates do self-employed borrowers typically get?

Interest rates for self-employed individuals range from 10% to 24%, depending on the lender, credit score, and income stability. -

Why are loan interest rates higher for self-employed people?

Lenders consider self-employed borrowers riskier due to irregular income, making interest rates slightly higher than those for salaried individuals. -

How can a self-employed borrower qualify for lower loan rates?

Maintaining a high credit score, providing consistent income proof (ITRs), and having a good banking relationship can help secure lower interest rates. -

Do self-employed borrowers need collateral for a loan?

Many personal loans for self-employed individuals are unsecured, but secured loans (backed by assets) may offer lower interest rates. -

What documents are required for self-employed loan approval?

Typically, lenders require income tax returns (ITRs), bank statements, business proof, and identity/address verification.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.