The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

Loan Rate Comparison Tools: Best Options for Borrowers

Understanding Loan Rate Comparison Tools

Understanding loan rate comparison tools can greatly simplify the borrowing process. These tools enable you to compare loan rates from various lenders, helping you find the best deal suited to your financial needs. Whether you are looking at bank loan rates or online loan rates, having a clear overview of your options can save you time and money. For example, you might discover that an online lender offers a more competitive interest rate than a traditional bank, making it a preferable choice. Here are some key benefits of using loan rate comparison tools:

- Time Efficiency: View multiple offers quickly in one place.

- Cost Savings: Spot lower rates that can decrease your overall loan expenses.

- Transparency: Gain insights into the differences in terms and conditions among lenders.

- Informed Decisions: Base your choices on comprehensive data rather than assumptions.

By utilizing these tools, you can confidently navigate the complex loan landscape.

To start using a loan rate comparison tool, follow these steps:

- Gather Your Information: Prepare your financial details, including your credit score and desired loan amount.

- Choose a Comparison Tool: Pick a reputable online platform that aggregates loan offers.

- Input Your Details: Enter your information to receive tailored loan options.

- Review and Compare: Examine rates, terms, and fees side by side.

- Apply: Once you find a suitable loan, proceed with the application.

These steps will help you make informed decisions that align with your financial goals.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

Using a loan rate comparison tool can significantly enhance your ability to secure the best loan rates. These tools simplify the process of comparing various loan options and empower you to make informed financial decisions. Here are some essential features to look for in a reliable loan rate comparison tool.

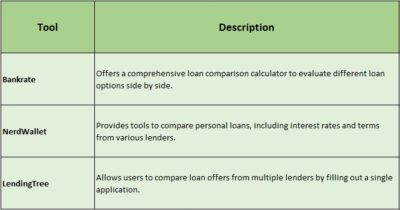

User-Friendly Interface: A straightforward design is crucial. You want a tool that allows you to input your information easily and quickly view your options. Tools like Bankrate and NerdWallet exemplify clean layouts that facilitate easy navigation.

Comprehensive Data: Choose tools that cover a wide range of loan types, including personal loans, mortgages, and auto loans. This ensures effective comparisons between bank loan rates and online loan rates.

Real-Time Updates: Access to real-time data is essential, as the financial landscape changes rapidly. Tools that frequently update their rates can help you secure the best deals before they change.

Customizable Filters: Look for tools that allow you to filter results based on your specific needs, such as loan amount, term length, and credit score. This feature can save you time and help you find the most relevant options.

In summary, a good loan rate comparison tool should be user-friendly, provide comprehensive and real-time data, and offer customizable filters, enabling you to navigate the loan landscape confidently.

How Loan Rate Comparison Tools Save You Money

Navigating the world of loan rates can be daunting for borrowers, but loan rate comparison tools simplify the process. These tools allow users to compare bank loan rates with online loan rates, helping them find the best deal tailored to their financial needs. With the ability to view multiple offers side by side, borrowers can make informed decisions without the hassle of visiting various lenders. Using loan rate comparison tools offers several significant advantages:

- Time Efficiency: Access information from multiple lenders in one convenient location.

- Cost Savings: Discover lower interest rates that can save you hundreds or even thousands over the life of the loan.

- Transparency: Understand the terms and conditions associated with each loan option more clearly.

- Customization: Adjust your search based on your unique financial situation, such as credit score or loan amount.

For instance, a borrower seeking a personal loan of ten thousand dollars might find that a local bank offers a rate of seven percent, while an online lender provides a rate of five percent. By opting for the online lender, the borrower not only lowers their monthly payments but also decreases the total interest paid over the loan’s term. This simple comparison can lead to significant financial benefits, making loan rate comparison tools invaluable for borrowers.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

The Best Loan Rate Comparison Tools for Homebuyers

Securing a mortgage requires a clear understanding of your options, and loan rate comparison tools are essential for homebuyers navigating the complex interest rate landscape. These tools enable you to compare various loan offers from different lenders, helping you find the best deal suited to your financial needs. Whether you are looking at traditional bank loan rates or online loan rates, these resources simplify your decision-making process. Here are some top loan rate comparison tools to consider:

- Bankrate: Offers comprehensive comparisons of mortgage rates from various lenders and includes calculators for estimating monthly payments.

- Zillow: Provides a mortgage comparison tool alongside property listings, allowing you to view rates from local lenders.

- LendingTree: Connects you with multiple lenders, presenting a range of offers based on your credit profile.

- NerdWallet: Known for financial advice, it also features a mortgage comparison tool to help you find competitive rates and understand loan terms.

Using these tools is easy. Enter your desired loan amount, credit score, and location to receive a list of current rates. This not only saves time but also empowers you to make informed decisions. Comparing bank loan rates with online loan rates can uncover significant differences, leading to substantial savings over the life of your mortgage. Take advantage of these resources to secure the best loan for your new home.

Read Also: Bank Loan Rates vs. Online Loan Rates: Which Is Cheaper?

Comparing Personal Loan Rates with Online Tools

Securing a personal loan requires a solid understanding of loan rates, and comparing these rates using online tools can be a game changer. These tools enable you to view various loan offers side by side, making it easier to find the best rates that fit your financial needs. Whether you are looking at bank loan rates or online lenders, these comparison tools provide valuable insights into what to expect. Here are some key benefits of using loan rate comparison tools:

- Convenience: Access multiple lenders in one place without visiting each bank.

- Transparency: Get a clear view of interest rates, fees, and terms to make informed choices.

- Time-saving: Quickly narrow down options based on your credit score and loan amount. To use these tools effectively, follow these steps:

- Enter your desired loan amount and term.

- Provide your credit score range for accurate results.

- Review the offers and note the terms that best suit you.

By comparing bank loan rates with those from online lenders, you can often discover more competitive options. Online lenders typically have lower overhead costs, which can lead to better rates for borrowers. Whether you need a small personal loan or a larger sum for a major purchase, utilizing these online tools can result in significant savings.

User Reviews: What Borrowers Say About Loan Rate Comparison Tools

Borrowers seeking the best loan rates frequently utilize loan rate comparison tools, which allow them to compare bank loan rates with online loan rates. These tools simplify the process of finding favorable loan terms. Insights from users reveal several key benefits of these platforms:

- Time-Saving: Users appreciate the speed at which they can access information from multiple lenders without visiting each site individually.

- Transparency: Borrowers feel empowered by the clear breakdowns of rates and terms provided by these tools.

- User-Friendly: Many comparison platforms are designed for ease of use, catering to individuals regardless of their technical skills.

- Real-Time Updates: Users value the fact that these tools often display the latest rates, enabling timely decision-making.

For example, one borrower recounted saving hundreds of dollars by using a comparison tool to secure a lower interest rate than their bank’s initial offer. This illustrates the significant savings and advantages of effectively utilizing these tools. Overall, borrowers consistently find loan rate comparison tools to be essential in their search for the best loan rates, highlighting their importance in the lending landscape.

How to Use Loan Rate Comparison Tools Effectively

Securing a loan requires a clear understanding of your options, and loan rate comparison tools can be invaluable in this process. These tools enable you to compare various loan rates from different lenders, making it easier to make informed decisions. Whether you are exploring bank loan rates or online loan rates, these tools streamline the process and save you valuable time. By simply entering your financial details, you can quickly identify which lenders offer the best rates tailored to your needs.

To effectively use loan rate comparison tools, follow these steps:

- Gather your financial information, including your credit score, income, and desired loan amount.

- Select a reliable comparison tool that features a broad range of lenders.

- Input your information and review the results.

- Note the interest rates, terms, and any associated fees.

- Narrow down your options and consider contacting lenders for further details.

This method not only helps you find competitive rates but also ensures you grasp the total cost of borrowing.

The advantages of using loan rate comparison tools are significant. They offer:

- A comprehensive overview of available rates, making it easier to identify the best deals.

- Access to both traditional bank loan rates and potentially lower online loan rates.

- The ability to filter results based on your specific criteria, such as loan type or repayment term.

By utilizing these tools, you can confidently navigate the loan landscape and secure the best terms for your financial future.

Common Mistakes to Avoid When Using Loan Rate Comparison Tools

Using loan rate comparison tools can be exciting, but it’s crucial to avoid common mistakes that may lead to poor decisions. One major pitfall is focusing solely on the interest rate while neglecting other important factors such as fees, loan terms, and customer service.

For example, a loan with a slightly higher interest rate but lower fees might be more cost-effective in the long run than a seemingly cheaper option. Another mistake is failing to compare similar loan types. Bank loan rates can differ significantly from online loan rates, leading to confusion.

For instance, a traditional bank may offer a fixed-rate mortgage, while an online lender might provide an adjustable-rate option. Ensuring you compare similar products is essential for making informed choices. Additionally, relying on a single comparison tool can limit your options since different tools feature various lenders and rates. Exploring multiple platforms can give you a broader view of available options. To avoid these pitfalls, keep these tips in mind:

- Read the fine print: Check for hidden fees or terms that could impact your loan.

- Use multiple tools: Explore various comparison sites for the best rates.

- Consider your financial situation: Reflect on how long you plan to keep the loan and your monthly budget.

By being aware of these common mistakes, you can effectively use loan rate comparison tools to secure the best deal for your needs.

FAQs

-

What are loan rate comparison tools?

These are online tools that help borrowers compare interest rates, APRs, fees, and terms from multiple lenders in one place. -

How do loan comparison tools work?

Users enter basic details like loan amount, credit score, and loan type, and the tool provides rate estimates from various lenders. -

Are loan comparison tools accurate?

They provide general estimates, but actual loan offers depend on a lender’s full review of your financial profile. -

Do loan comparison tools affect my credit score?

No, most tools perform a soft credit check, which doesn’t impact your credit score, unlike a full loan application. -

Are loan rate comparison tools free to use?

Yes, most are free, but some may promote sponsored lenders, so always verify offers directly with the lender.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.