The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

Loan Prepayment Calculator: Save on Interest with Early Payments

Managing loans effectively requires understanding how to save money, and a Loan Prepayment Calculator is an essential tool in this process. This calculator shows how making extra payments can significantly reduce the total interest paid over time, making it feel like a magic wand for your finances!

What is a Loan Prepayment Calculator?

A Loan Prepayment Calculator helps you determine potential savings from paying off your loan early. It considers your loan amount, interest rate, and any extra payments you plan to make, allowing you to visualize your savings and make informed choices.

Benefits of Using a Personal Loan Repayment Calculator

- Understand Your Savings: Discover how much interest you can save.

- Plan Your Budget: Identify how much extra you can afford to pay.

- Stay Motivated: Tracking your savings can keep you focused!

Regularly using the Loan Prepayment Calculator allows you to adjust your payment strategy, helping you take control of your finances and potentially pay off your loan faster. Start today and see how much you can save!

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

How Does a Loan Prepayment Calculator Work?

A Loan Prepayment Calculator is a useful tool that helps you see how making extra payments on your loan can save you money. By paying off your loan early, you can significantly reduce the total interest paid over time, which is crucial for personal loans where interest accumulates quickly!

How Does It Work?

Using the calculator is easy. Simply enter your loan amount, interest rate, and remaining term. Then, add how much extra you plan to pay each month. The calculator will provide:

- Total interest saved

- New payoff date

- Monthly payment adjustments

This allows you to visualize the benefits of making extra payments!

Benefits of Using a Personal Loan Repayment Calculator

- Clear Savings Insight: It reveals your potential savings.

- Flexible Options: Experiment with different payment scenarios.

- Motivation to Pay Early: Seeing possible savings can inspire you to pay more.

Overall, a Loan Prepayment Calculator can transform your financial strategy!

The Benefits of Making Early Loan Payments

When considering loans, many focus on monthly payments and interest rates. However, using a Loan Prepayment Calculator can significantly save you money. By making early payments, you can lower the total interest paid over time, highlighting the importance of understanding early loan payment benefits!

Why Make Early Payments?

Early payments can lead to substantial savings. Key benefits include:

- Lower Interest Costs: Paying off your loan early reduces the principal, leading to less interest.

- Improved Credit Score: Timely payments can enhance your credit score, easing future borrowing.

- Financial Freedom: Early debt repayment offers peace of mind and allows for more discretionary spending!

Using a Personal Loan Repayment Calculator

To discover your potential savings, utilize a Personal Loan Repayment Calculator. Simply enter your loan details to see how early payments affect your total cost. This tool helps visualize savings and encourages faster loan repayment!

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

Is It Worth It? Evaluating the Cost of Prepayment

When considering a loan, many borrowers ponder the advantages of early repayment. A Loan Prepayment Calculator is a valuable tool that helps you determine how much interest you could save by making extra payments, aiding in reducing your financial burden and achieving debt freedom sooner.

Understanding the Benefits

Paying off your loan early can lead to significant savings, including:

- Interest Savings: The sooner you pay off your loan, the less interest you’ll pay overall.

- Debt-Free Sooner: Early payments can help you become debt-free faster, providing peace of mind.

Using a Personal Loan Repayment Calculator

A Personal Loan Repayment Calculator allows you to see how different payment amounts impact your loan. By entering your loan details, you can discover:

- The interest savings from extra payments.

- The revised timeline for loan payoff.

In summary, evaluating the cost of prepayment is essential. With the right tools, you can make informed decisions that lead to financial freedom.

Also Read: Personal Loan Repayment Calculator: Estimate Your Payments

Maximizing Your Savings: Tips for Using a Loan Prepayment Calculator

Using a Loan Prepayment Calculator can be a game-changer for anyone looking to save money on their loans. By making extra payments, you can reduce the total interest you pay over time. This means more money in your pocket for things you really enjoy!

Understand Your Loan Terms

Before diving into calculations, know your loan terms. Some loans have prepayment penalties, which could affect your savings. Always check if your lender allows extra payments without fees. This knowledge helps you make informed decisions!

Use the Calculator Effectively

- Input Your Loan Details: Start with your loan amount, interest rate, and term.

- Add Extra Payments: Experiment with different amounts to see how they impact your total interest.

- Compare Scenarios: Use a Personal Loan Repayment Calculator to visualize how early payments can change your repayment timeline.

By following these steps, you can maximize your savings and pay off your loan faster!

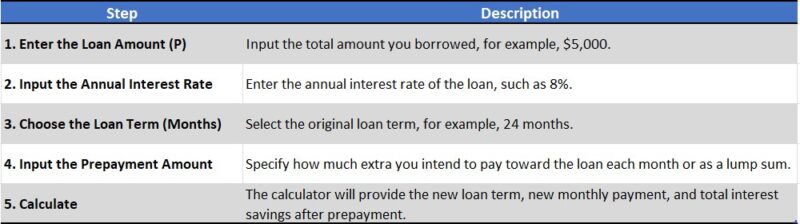

How to Use the Loan Prepayment Calculator

Common Misconceptions About Loan Prepayment

When it comes to loans, many people have questions about prepayment. A Loan Prepayment Calculator can help you understand how paying off your loan early can save you money on interest. However, there are some common misconceptions that can lead to confusion.

Misconception 1: Prepaying Always Saves Money

Some believe that prepaying their loan will always result in savings. While it often does, it’s essential to check if your loan has prepayment penalties. These fees can offset your savings, so using a Personal Loan Repayment Calculator can clarify your situation.

Misconception 2: All Loans Allow Prepayment

Not all loans allow for prepayment without penalties. For instance, some mortgages might have strict terms. Always read your loan agreement carefully to avoid surprises. Knowing the rules can help you make informed decisions about your finances.

How to Use the Loan Prepayment Calculator Effectively

Using a Loan Prepayment Calculator can be a game-changer for anyone with a loan. It helps you see how making extra payments can save you money on interest. By understanding this tool, you can take control of your finances and pay off your loans faster, which is a win-win!

To get started, simply input your loan amount, interest rate, and loan term. Then, add any extra payment you plan to make. The calculator will show you how much interest you can save and how much sooner you can pay off your loan. It’s like having a financial crystal ball!

Key Benefits of Using the Calculator

- Understand Your Savings: See how much interest you can save with early payments.

- Plan Your Budget: Adjust your monthly budget to include extra payments.

- Stay Motivated: Watching your loan balance drop faster can keep you motivated to pay off your debt!

Real-Life Scenarios: When Prepaying Makes Sense

When it comes to loans, many people wonder if paying off their debt early is a smart move. This is where a Loan Prepayment Calculator comes in handy. It helps you see how much interest you can save by making extra payments. Understanding this can lead to significant savings over time!

Example 1: The New Car Purchase

Imagine you took out a personal loan to buy a new car. If you use a Personal Loan Repayment Calculator, you might find that making an extra payment each month could save you hundreds in interest. This means you can pay off your car sooner and enjoy it without the weight of debt!

Example 2: Home Renovations

Let’s say you borrowed money for home renovations. If you have some extra cash, consider prepaying your loan. By doing so, you can reduce your overall interest payments. Plus, you’ll finish paying off that loan faster, giving you peace of mind and more financial freedom!

How ExpressCash Can Help You Navigate Loan Prepayment

When it comes to managing loans, understanding how to save on interest is crucial. That’s where a Loan Prepayment Calculator comes into play. By making early payments on your loan, you can significantly reduce the total interest you pay over time. This tool helps you visualize the impact of those extra payments, making it easier to plan your finances.

At ExpressCash, we offer a user-friendly Loan Prepayment Calculator that simplifies the process. With just a few clicks, you can see how much you can save by paying off your loan early. It’s like having a financial advisor right at your fingertips!

Key Benefits of Using Our Calculator

- Easy to Use: Our Personal Loan Repayment Calculator is designed for everyone, even if you’re not a math whiz.

- Instant Results: Get immediate feedback on how much interest you can save.

- Plan Ahead: Make informed decisions about your financial future with clear projections.

Frequently Asked Questions About Loan Prepayment Calculators

-

What is a loan prepayment calculator?

A loan prepayment calculator helps borrowers estimate how much they can save on interest by making early or extra payments towards their loan principal. -

How does prepaying a loan affect my total interest?

Prepaying reduces the outstanding principal, which lowers the interest accrued over time, leading to faster loan repayment and significant interest savings. -

Can I use a prepayment calculator for any type of loan?

Yes, it can be used for personal loans, home loans, auto loans, or any term-based loan where interest is charged over time. However, check if your lender charges prepayment penalties. -

What factors does the prepayment calculator consider?

The calculator takes into account loan amount, interest rate, loan tenure, EMI amount, and prepayment amount to show how much interest and time you can save. -

Does making a lump sum payment always reduce my EMI?

Not necessarily. Some lenders allow you to reduce either the EMI or the loan tenure. Choosing to shorten the tenure maximizes interest savings, while reducing EMI lowers monthly payment burden.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.