The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

How to Keep Your Loan Documents Secure and Private?

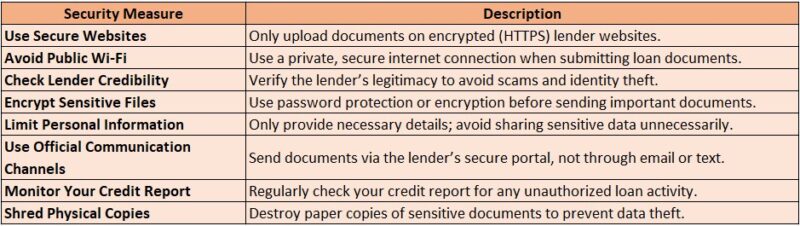

Understanding document security and privacy for loans is crucial, as applying for a loan involves sharing sensitive information that can attract identity thieves. Your personal loan documentation contains details like your Social Security number, income, and bank account information. If these documents are compromised, the repercussions can be severe. So, how can you ensure your loan documents remain secure and private? Here are some practical steps to enhance your document security:

- Use a locked filing cabinet: Keep all physical copies of your loan documents in a secure location. A locked cabinet provides an extra layer of protection against unauthorized access.

- Shred old documents: When you no longer need certain paperwork, avoid simply throwing it away. Shredding ensures that sensitive information cannot be reconstructed.

- Limit digital access: For documents stored online, use strong passwords and enable two-factor authentication to make it more difficult for hackers to access your files.

Additionally, regularly reviewing your credit report is essential to identify any unauthorized activity early. By implementing these precautions, you can have peace of mind knowing your personal loan documentation is secure and your privacy is protected. Staying proactive about document security is vital for safeguarding your financial future.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

Best Practices for Storing Loan Documents Safely

When it comes to managing your loan documents, keeping them secure and private is crucial. After all, these documents contain sensitive information that could lead to identity theft or financial fraud if they fall into the wrong hands. So, how can you ensure that your personal loan documentation remains safe? Here are some best practices to consider. First and foremost, consider going digital. Storing your loan documents in a secure cloud service can provide both convenience and security. Look for services that offer encryption and two-factor authentication. This way, even if someone gains access to your account, they won’t be able to read your documents without the second layer of protection.

Additionally, make sure to regularly update your passwords and avoid using easily guessable ones. Here are some other key tips to keep your loan documents secure:

- Use a fireproof safe: For physical documents, a fireproof safe can protect against disasters. This is especially important for original copies of important documents.

- Shred old documents: Once you no longer need certain paperwork, shred it instead of tossing it in the trash. This prevents others from accessing your information.

- Limit sharing: Only share your loan documents with trusted individuals or institutions. Be cautious about sharing sensitive information over email or unsecured platforms.

How to Use Encryption for Loan Document Protection

Encryption is essential for securing your loan documents, as it converts sensitive information into a code that only authorized individuals can decipher. This means that even if your documents are compromised, they remain unreadable. Many banks and financial institutions utilize encryption to safeguard personal loan documentation, ensuring your financial data remains private throughout the loan process. To effectively use encryption for your loan documents, follow these steps:

- Choose the Right Software: Select reputable encryption software that meets industry standards.

- Encrypt Before Sending: Always encrypt documents before emailing or uploading them to cloud services.

- Use Strong Passwords: Protect your encrypted files with strong, unique passwords.

- Regularly Update Your Software: Keep your encryption software updated to guard against vulnerabilities.

- Educate Yourself: Stay informed about the latest encryption technologies and best practices.

The benefits of encryption are significant. It not only provides peace of mind by securing your information but also helps you comply with privacy regulations. Encrypted documents can prevent identity theft and fraud, which are major concerns today. By implementing these steps, you can ensure your loan documents remain confidential and protected, allowing you to focus on securing the best loan for your needs.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

The Role of Passwords in Securing Loan Files

When it comes to securing your loan documents, passwords play a crucial role. Think of your password as the first line of defense against unauthorized access. A strong password not only protects your sensitive information but also gives you peace of mind. So, what makes a password strong? Ideally, it should be a mix of uppercase and lowercase letters, numbers, and special characters. For example, instead of using a simple password like ‘Loan123’, consider something more complex like ‘L0an$ecure2023’. Here are some benefits of using strong passwords for your loan files:

- Enhanced Security: A strong password significantly reduces the risk of unauthorized access.

- Peace of Mind: Knowing your documents are secure allows you to focus on other important aspects of your loan process.

- Protection Against Identity Theft: With robust passwords, you can safeguard your personal information from cybercriminals.

To further enhance the security of your loan documents, consider these steps:

- Use Unique Passwords: Avoid reusing passwords across different accounts. Each loan document should have its own unique password.

- Enable Two-Factor Authentication: This adds an extra layer of security by requiring a second form of verification, such as a text message or email confirmation.

- Regularly Update Your Passwords: Change your passwords every few months to minimize the risk of breaches.

Physical Security Measures for Loan Document Safety

Securing your loan documents is essential, as they contain sensitive information that can lead to identity theft or financial fraud if mishandled. To enhance your privacy and security, consider implementing practical strategies. First, invest in a quality safe or lockbox to store your important loan documents, including personal loan documentation requirements. Choose a fireproof and waterproof safe to protect against unforeseen disasters, and place it in a discreet location to avoid attracting attention. Here are some benefits of using a safe:

- Protection from theft: A secure safe deters potential intruders from accessing your sensitive information.

- Disaster preparedness: Fireproof and waterproof safes safeguard your documents from natural disasters.

- Peace of mind: Knowing your documents are secure allows you to focus on other financial matters without worry.

Another effective measure is to limit access to your loan documents. Share them only with trusted individuals, such as your financial advisor or family members who need to know, reducing the risk of unauthorized access. Additionally, use a shredder for any documents you no longer need. Tossing them in the trash can expose you to identity theft, while shredding ensures that sensitive information is completely destroyed and unreadable.

Digital Tools for Managing Loan Document Privacy

In today’s digital landscape, securing your loan documents is essential due to the sensitive information involved. Utilizing digital tools that emphasize security and privacy is crucial. From cloud storage to encrypted communication platforms, various options can help keep your personal loan documentation safe. Let’s delve into effective strategies for maintaining confidentiality and protection. Start by using reputable cloud storage services with strong encryption, such as Google Drive and Dropbox. These platforms allow you to set permissions and share documents securely. Here are some key benefits:

- Accessibility: Access your documents from anywhere, anytime.

- Collaboration: Share documents with lenders or financial advisors while controlling who can view or edit them.

- Backup: Protect your documents from loss due to hardware failure by storing them in the cloud.

Additionally, consider using password managers to securely track your login credentials, allowing easy access to your loan documents without the risk of forgetting passwords. Always be cautious about the information you share online. When communicating with lenders, opt for encrypted email services or secure messaging apps for added protection. Remember, securing your loan documents involves using the right tools and being vigilant about your online activities. By implementing these strategies, you can effectively manage your loan documentation while ensuring your privacy.

Regularly Updating Security Protocols for Loan Documents

Keeping your loan documents secure and private requires regularly updating your security protocols. Just as you wouldn’t leave your front door unlocked, it’s vital to protect your sensitive financial information. Staying informed about the latest security measures is crucial. For example, using encrypted cloud storage can prevent unauthorized access, while regularly changing your passwords enhances protection. Here are some key steps to consider when updating your security protocols for loan documents:

- Use Strong Passwords: Ensure your passwords are complex and unique for each account.

- Enable Two-Factor Authentication: This adds an extra layer of security for accessing your documents.

- Regularly Review Access Permissions: Limit access to authorized individuals only.

- Stay Updated on Software: Keep your antivirus and security software current to defend against new threats.

- Educate Yourself: Stay aware of the latest scams and phishing attempts targeting personal financial information.

By implementing these practices, you enhance the security of your loan documents and promote a culture of privacy. Many individuals have faced identity theft due to inadequate security measures. By taking proactive steps, you can avoid becoming a victim. Remember, your financial information is valuable, and treating it with respect is essential in today’s digital landscape. Regularly updating your security protocols is not just advisable; it is a necessity for anyone managing personal loan documentation.

What to Do in Case of a Loan Document Breach

Securing your loan documents is crucial, as a breach can lead to identity theft and financial loss. If you find yourself in this situation, the first step is to stay calm and notify your lender immediately. They can help you assess the breach and guide you on what to do next. Additionally, consider placing a fraud alert on your credit report to protect against potential misuse of your information. Next, review your personal loan documentation requirements by checking your credit report for unauthorized accounts or inquiries. If you notice anything suspicious, report it to the credit bureaus, who can assist in disputing fraudulent activity. Here are some essential steps to take in case of a breach:

- Contact your lender right away

- Place a fraud alert on your credit report

- Review your credit report for unauthorized activity

- Report any fraud to the authorities

- Consider identity theft protection services for extra security.

Finally, maintaining document security and privacy is vital even after a breach. Use secure storage solutions for your loan documents, whether digital or physical, and regularly update your passwords. Be cautious about sharing sensitive information. By following these steps, you can protect your financial future and ensure your loan documents remain secure and private. Stay vigilant and informed to defend against potential threats.

FAQs

-

How do lenders protect my personal documents?

Reputable lenders use encryption, secure servers, and strict access controls to protect your sensitive information. -

Is it safe to upload loan documents online?

Yes, as long as you use the lender’s official secure portal. Avoid sending documents via email or unsecured websites. -

What personal information should I never share with lenders?

Never share login credentials, Social Security numbers, or banking details with unverified lenders or through unsecured channels. -

How can I verify if a lender’s document submission process is secure?

Check for HTTPS in the website URL, read the lender’s privacy policy, and ensure they comply with data protection regulations. -

What should I do if I suspect a data breach with my loan documents?

Contact the lender immediately, monitor your credit report for suspicious activity, and consider freezing your credit if needed.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.