The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

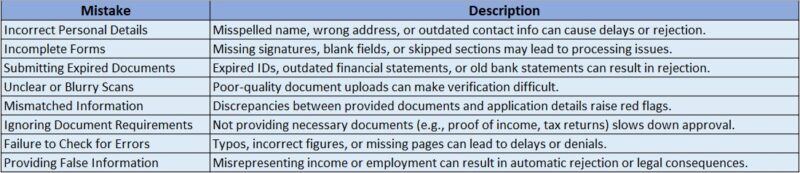

What Document Errors Can Delay Loan Approval?

When applying for a loan, document errors can lead to frustrating delays. Understanding common document mistakes in loan applications is essential to avoid unnecessary back-and-forth with your lender. Simple oversights, like missing signatures or incorrect dates, can significantly slow down the approval process, so it is vital to double-check your paperwork before submission. Here are some common document errors that can delay your loan approval:

- Incomplete Applications: Missing required fields can result in immediate rejection.

- Incorrect Personal Information: Typos in your name, address, or Social Security number can raise concerns.

- Missing Documentation: Not providing essential documents like pay stubs or tax returns can halt the process.

- Outdated Financial Statements: Submitting old bank statements can confuse your current financial status.

To ensure a smooth loan approval process, carefully review your personal loan documentation requirements. Create a checklist of all necessary documents and confirm that each one is complete and accurate. These steps can help you avoid common pitfalls and keep your loan application on track.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

How Incomplete Applications Can Delay Loan Approval

When applying for a loan, delays due to incomplete applications can be frustrating. Many borrowers overlook the importance of submitting all required documents, which can lead to hold-ups. For example, forgetting to include recent pay stubs or tax returns may prompt lenders to request clarification, extending the approval process. This can be especially stressful if you have a tight timeline for a home purchase or major expense. Common document mistakes include missing signatures, incorrect Social Security numbers, and outdated financial statements. To avoid these issues, it is essential to double-check your application before submission. Here are key documents to ensure are complete and accurate:

- Proof of income, such as pay stubs or tax returns

- Recent bank statements

- Identification documents like a driver’s license or passport

- Employment verification letters

By gathering and verifying these documents ahead of time, you can significantly reduce the chances of delays and keep your loan approval process on track. A little preparation can go a long way in ensuring a smooth experience.

The Impact of Incorrect Income Documentation on Loan Processing

When applying for a loan, accurate income documentation is crucial. Incorrect documentation can cause significant delays in processing, frustrating borrowers eager for financing. For example, if pay stubs do not match tax returns, lenders may request additional verification, extending the approval timeline and leaving borrowers in limbo. Common mistakes include discrepancies in reported income, missing tax documents, or outdated bank statements. To avoid these issues, double-check your paperwork before submission. Here are some helpful tips:

- Ensure all income sources are documented accurately.

- Use the most recent tax returns and pay stubs.

- Provide complete bank statements for the required period.

Taking these steps can streamline the loan approval process and prevent unnecessary delays. Understanding personal loan documentation requirements is also essential. Lenders typically need proof of income, employment verification, and credit history. By preparing these documents in advance and ensuring their accuracy, you can enhance your chances of a smooth approval process. Remember, attention to detail can expedite your loan application and help you secure the funds you need without unnecessary hold-ups.

Why Missing Signatures Can Halt Your Loan Approval

When applying for a loan, every detail is crucial, and one common error that can delay approval is missing signatures. Even if your financial documents are in order, overlooking a signature on a key form can send your application back, causing frustrating delays. It is vital to ensure that every required document is complete and properly signed before submission. Here are some common document mistakes that can lead to loan approval delays:

- Unsigned documents: Ensure every form requiring a signature is signed, as a missing signature can halt the process.

- Incomplete information: Providing incomplete or inaccurate details can raise concerns for lenders, leading to further inquiries and delays.

- Outdated documents: Keep all your documents current, as lenders often need the latest versions of financial statements and tax returns.

To avoid these issues, thoroughly review your application and create a checklist of required documents and signatures. By being meticulous, you can streamline your loan approval process and move closer to achieving your financial goals.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

The Role of Credit Reports in Loan Application Delays

When applying for a loan, your credit report is a crucial document that lenders examine to assess your eligibility. Errors in this report, such as incorrect account details or wrongly reported late payments, can cause delays in approval. Therefore, it is vital to review your credit report thoroughly before submitting your application to identify any discrepancies that could hinder your progress. Common mistakes in loan applications often arise from missing or incorrect information. For example, not providing proof of income or failing to include necessary identification can lead to unnecessary delays. To streamline your application process, consider these tips:

- Double-check all personal information for accuracy.

- Ensure all required documents, like pay stubs and tax returns, are included.

- Keep your credit report updated and promptly dispute any inaccuracies.

Personal loan documentation requirements can differ by lender, but typically include proof of identity, income verification, and financial history details. Understanding these requirements in advance can help you gather the necessary documents and avoid last-minute issues. A well-prepared application not only speeds up the approval process but also enhances your chances of securing the loan you need.

Addressing Name Discrepancies in Loan Documents

When applying for a loan, name discrepancies in your documents can be a significant hurdle. While it may seem minor, lenders view these inconsistencies seriously. For example, if your driver’s license states John A. Smith but your Social Security card shows John Smith, this could trigger concerns during the approval process. Ensuring that all your documents match is crucial to avoid delays. Here are some essential tips to navigate this issue:

- Check All Documents: Review your identification and financial documents for consistency in your name before submitting your loan application.

- Update Records: If you’ve changed your name due to marriage or divorce, ensure all relevant documents, like bank statements and tax returns, are updated accordingly.

- Communicate with Your Lender: If you spot any discrepancies, contact your lender right away. They can assist you in correcting these issues before they escalate.

By addressing these common document mistakes early, you can streamline your loan application process and enhance your chances of approval. Remember, clarity and consistency are vital in personal loan documentation.

How Outdated Financial Statements Affect Loan Approval

When applying for a loan, keeping your financial documents up to date is crucial. Outdated financial statements can delay loan approval, as lenders depend on current data to evaluate your creditworthiness. For example, submitting bank statements that are months old may raise concerns about your financial stability and repayment ability, leading to unnecessary delays in the approval process. Common document mistakes often arise from a lack of attention to detail. Here are some pitfalls to avoid:

- Submitting bank statements that do not reflect your latest transactions.

- Providing outdated tax returns that misrepresent your income.

- Failing to include all necessary documentation, such as proof of employment or additional income sources.

By ensuring your documents are current and complete, you can streamline the approval process and enhance your chances of securing the loan you need. In summary, maintaining updated financial statements is vital for a smooth loan approval process. By avoiding common document mistakes and ensuring all paperwork is in order, you can assist lenders in making informed decisions quickly, paving the way for a successful loan application.

The Importance of Accurate Employment Verification

When applying for a loan, employment verification is crucial. Lenders need to confirm that you have a stable income to support your repayments. Inaccuracies in your employment documents can cause significant delays in the approval process. For example, if your pay stubs do not align with the information in your application, it raises concerns about your financial stability. Common mistakes include submitting outdated pay stubs, omitting tax returns, or failing to provide a verification letter from your employer. These errors can prolong the verification process and create unnecessary stress. To avoid these issues, double-check your documents before submission. Here are some essential tips:

- Use the most recent pay stubs and tax returns.

- Include a verification letter from your employer that details your position and salary.

- Ensure consistency in names and addresses across all documents.

By following these steps, you can streamline your loan application process and secure the funding you need without delays.

Common Mistakes in Asset Documentation That Cause Delays

When applying for a loan, the documentation you provide is essential. Many applicants make common mistakes that can lead to frustrating delays in approval. For example, failing to include recent bank statements or submitting outdated tax returns can raise concerns for lenders, who need to assess your current financial situation accurately. Here are some common document errors that can slow down your loan approval process:

- Missing Documents: Not submitting all required paperwork can halt your application. Always double-check the lender’s list of necessary documents.

- Inconsistent Information: If your income details differ between your loan application and tax returns, it can cause confusion. Ensure that the information matches across all documents.

- Incomplete Forms: Leaving sections blank or failing to sign where required can lead to delays. Take your time to fill out each form completely and accurately.

By being aware of these common mistakes in asset documentation, you can streamline your loan application process and enhance your chances of approval. Lenders value thoroughness and clarity, so presenting your information correctly is crucial.

Tips for Avoiding Document Errors in Your Loan Application

When applying for a loan, document errors can lead to frustrating delays and jeopardize your chances of securing funds. To navigate this crucial step effectively, it’s essential to be aware of common pitfalls and how to avoid them. One frequent issue is submitting incomplete documentation. Lenders typically require specific personal loan documentation, including proof of income, tax returns, and bank statements. Missing even one document can cause unnecessary hold-ups. To ensure you have everything in order, consider these helpful tips:

- Double-check your application: Review all sections to confirm that every required document is included.

- Organize your paperwork: Use folders or digital tools to keep your documents sorted and easily accessible.

- Ask for help: If you’re unsure about what’s needed, reach out to your lender for clarification.

- Keep copies: Always maintain copies of submitted documents for your records.

By following these steps, you can significantly reduce the risk of document errors and streamline your loan approval process.

FAQs

-

What are the most common document mistakes in loan applications?

Errors include missing documents, incorrect personal information, unreadable scans, outdated financial records, and unsigned forms. -

How can I avoid mistakes when submitting loan documents?

Double-check all details, ensure documents are up-to-date, use clear scans or photos, and confirm lender requirements before submission. -

Will a minor document error delay my loan approval?

Yes, even small mistakes can cause delays or require resubmission, potentially affecting approval time. -

What should I do if I submitted incorrect documents?

Contact your lender immediately and provide the correct documents as soon as possible to avoid processing delays. -

Can missing documents lead to loan rejection?

Yes, incomplete applications may be denied, so always review the document checklist carefully before submission.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.