The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

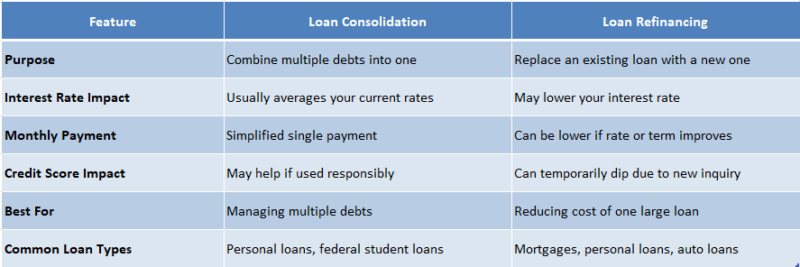

Loan Consolidation vs. Refinancing: Which Option Is Better?

When it comes to managing debt, understanding the difference between loan consolidation and refinancing is crucial. Both options can help simplify your finances, but they serve different purposes. Knowing which one is right for you can save you money and reduce stress. Let’s dive into the details!

What is Loan Consolidation?

Loan consolidation combines multiple loans into one single loan. This means you make just one monthly payment instead of juggling several. It can be a great option if you have various debts, like student loans or credit cards. The main benefit? It often lowers your monthly payment and makes budgeting easier!

What is Refinancing?

Refinancing, on the other hand, involves replacing your existing loan with a new one, usually with better terms. This could mean a lower interest rate or a different repayment period. Personal loan refinance options can help you save money over time, especially if your credit score has improved since you first took out the loan.

In summary, while both options can ease your financial burden, the choice between loan consolidation vs. refinancing depends on your specific situation. Consider your debts and financial goals to make the best decision!

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

The Benefits of Loan Consolidation: Is It Right for You?

When it comes to managing debt, understanding the differences between Loan Consolidation vs. Refinancing is crucial. Both options can help simplify your finances, but they serve different purposes. So, how do you know which one is better for you? Let’s dive into the benefits of loan consolidation and see if it’s the right choice for your situation.

Loan consolidation combines multiple debts into a single loan, making it easier to manage. Here are some key benefits:

- Simplified Payments: Instead of juggling several payments, you’ll have just one monthly payment to keep track of.

- Lower Interest Rates: Consolidation can often lead to lower interest rates, saving you money over time.

- Improved Credit Score: By reducing the number of open accounts, you may see an improvement in your credit score.

If you’re feeling overwhelmed by multiple loans, consider exploring personal loan refinance options. They can provide a fresh start and help you regain control of your finances. Remember, the right choice depends on your unique financial situation, so weigh your options carefully!

Refinancing Explained: How It Can Save You Money

When it comes to managing debt, understanding the difference between loan consolidation and refinancing is crucial. Both options can help you save money, but they work in different ways. So, which one is better for you? Let’s dive into refinancing and see how it can be a smart choice for your finances.

Refinancing means replacing your existing loan with a new one, often at a lower interest rate. This can lead to lower monthly payments and significant savings over time. Imagine paying less each month and having extra cash for things you enjoy!

Benefits of Refinancing

- Lower Interest Rates: A new loan can offer a better rate.

- Reduced Monthly Payments: Save money each month.

- Flexible Terms: Choose a repayment plan that fits your budget.

By exploring personal loan refinance options, you can find a plan that suits your needs. Remember, refinancing can be a powerful tool to help you take control of your finances and reduce your debt burden.

Loan Consolidation vs. Refinancing: Which Option Offers Better Rates?

When it comes to managing debt, understanding the difference between loan consolidation and refinancing is crucial. Both options can help simplify your finances, but they serve different purposes. So, which one offers better rates? Let’s dive into Loan Consolidation vs. Refinancing and find out!

What is Loan Consolidation?

Loan consolidation combines multiple debts into a single loan. This means you’ll have just one monthly payment, which can make budgeting easier. Often, consolidation loans come with lower interest rates, especially if you have high-interest debts. It’s a great way to simplify your payments!

What is Refinancing?

Refinancing, on the other hand, involves replacing your existing loan with a new one, usually at a lower interest rate. This can save you money over time. Personal loan refinance options can be beneficial if your credit score has improved since you took out your original loan.

Which is Better?

- Loan Consolidation: Great for managing multiple debts.

- Refinancing: Ideal for lowering interest rates on existing loans.

Ultimately, the best choice depends on your financial situation and goals. Consider your debts and what you hope to achieve before deciding!

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

Key Considerations When Choosing Between Consolidation and Refinancing

When it comes to managing debt, understanding the difference between loan consolidation and refinancing is crucial. Both options can help simplify your finances, but they serve different purposes. Knowing which one is right for you can save you money and stress in the long run.

Understanding Your Needs

- Loan Consolidation combines multiple loans into one, making it easier to manage payments. This is ideal if you have several debts with varying interest rates.

- Refinancing involves taking out a new loan to pay off an existing one, often at a lower interest rate. This is great if you want to reduce monthly payments or shorten your loan term.

Evaluating Costs and Benefits

- Interest Rates: Compare rates for both options. Lower rates can lead to significant savings.

- Fees: Look out for any fees associated with refinancing or consolidation. Sometimes, these can offset potential savings.

- Credit Score Impact: Both options can affect your credit score differently. Refinancing might lower your score temporarily, while consolidation can help improve it over time.

Also Read: Personal Loan Refinance Options: Best Ways to Lower Your Payments

How Your Credit Score Affects Loan Consolidation vs. Refinancing

When considering Loan Consolidation vs. Refinancing, understanding how your credit score plays a role is crucial. Your credit score can significantly impact the interest rates and terms you receive, making it essential to know where you stand before making a decision.

How Your Credit Score Influences Your Options

A higher credit score often leads to better personal loan refinance options. Lenders view you as less risky, which can mean lower interest rates. This can save you money over time, whether you choose to consolidate or refinance your loans.

Key Points to Consider

- Credit Score Impact: A score above 700 can open doors to favorable terms.

- Loan Consolidation: May be easier to qualify for, especially if your score is lower.

- Refinancing: Typically requires a better score for the best rates.

In summary, knowing your credit score helps you navigate the Loan Consolidation vs. Refinancing debate. It’s not just about which option is better; it’s about which one fits your financial situation best.

Real-Life Scenarios: When to Choose Loan Consolidation or Refinancing

Understanding the difference between Loan Consolidation vs. Refinancing is essential for managing debt effectively. Both options can simplify your finances but serve distinct purposes, making it important to choose the right one for your situation to save money and reduce stress.

Loan Consolidation: A Simplified Approach

If you have multiple student loans with varying interest rates and due dates, loan consolidation allows you to combine them into a single payment. This not only simplifies your finances but can also lower your monthly payment, making it ideal for those feeling overwhelmed.

Refinancing: Lowering Your Interest Rate

On the other hand, if you have a personal loan with a high interest rate, exploring personal loan refinance options can help you secure a lower rate. This can decrease your monthly payments and save you money over time, especially for those with good credit. In conclusion, choose loan consolidation for simplicity or refinancing to save on interest. Always evaluate your financial situation before making a decision!

Expert Insights: How ExpressCash.com Can Help You Decide

When it comes to managing debt, understanding the difference between loan consolidation and refinancing is crucial. Both options can help you regain control over your finances, but they serve different purposes. So, which one is better for you? Let’s dive into the details!

Understanding Loan Consolidation vs. Refinancing

Loan consolidation combines multiple debts into one single loan, often with a lower interest rate. On the other hand, refinancing involves replacing your existing loan with a new one, usually to secure better terms. Knowing these differences can guide your decision.

Key Considerations

- Loan Consolidation: Simplifies payments and may lower monthly costs.

- Refinancing: Can lower interest rates and change loan terms.

At ExpressCash.com, we provide personalized advice on personal loan refinance options, helping you choose the best path for your financial situation. Our experts are here to guide you every step of the way!

Final Thoughts: Making the Best Choice for Your Financial Future

When it comes to managing debt, understanding the difference between loan consolidation and refinancing is crucial. Both options can help ease your financial burden, but choosing the right one can significantly impact your future. So, let’s dive into Loan Consolidation vs. Refinancing: Which Option Is Better?

Key Differences to Consider

- Loan Consolidation combines multiple debts into one, often with a lower interest rate.

- Refinancing involves replacing an existing loan with a new one, usually to secure better terms.

Both methods can simplify payments, but they serve different purposes. Knowing what you need is essential!

Making Your Decision

To decide between these options, consider your financial goals. If you want to lower monthly payments, loan consolidation might be the way to go. However, if you’re looking to save on interest over time, explore personal loan refinance options. Ultimately, the best choice depends on your unique situation.

FAQs

🔄 What’s the difference between loan consolidation and refinancing?

Loan consolidation combines multiple debts into one loan, often simplifying payments. Refinancing replaces an existing loan with a new one—usually to get a better interest rate or repayment terms.

📊 Which option lowers my interest rate?

Refinancing is typically the better option if your goal is to reduce your interest rate. Consolidation may not lower rates but can make repayment more manageable.

🧾 Can I consolidate and refinance at the same time?

Yes! You can consolidate multiple loans and then refinance the new loan into one with better terms, especially if your credit has improved.

💸 Which is better for managing multiple debts?

Loan consolidation is ideal for simplifying multiple bills into a single monthly payment. It’s a helpful tool for people juggling credit cards, payday loans, or personal loans.

⚠️ Are there risks to either option?

Yes—consolidation might extend your repayment period, meaning you could pay more in interest over time. With refinancing, you might lose borrower benefits (like deferment options), especially on federal student loans.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.