The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

Interest Rates by Credit Score: What Rate Can You Get?

Understanding Interest Rates by Credit Score

Understanding interest rates by credit score can be complex, but it is essential for securing favorable loan terms. Your credit score significantly influences the interest rates you qualify for; generally, higher scores lead to lower rates. For example, individuals with excellent credit scores above 750 may secure rates as low as 3 percent, while those with scores below 600 could face rates over 10 percent. This difference can greatly affect your monthly payments and the overall cost of borrowing.

When comparing bank loan rates to online loan rates, several factors come into play. Online lenders often cater to a wider range of credit scores and may offer more competitive rates, especially for those with less-than-perfect credit. Here are some advantages of considering online loan rates:

- Faster Approval: Online lenders typically have streamlined processes for quicker approvals.

- Flexible Options: Many online lenders offer various loan types, making it easier to find one that suits your needs.

- Transparent Terms: Online platforms usually provide clear terms and conditions, aiding informed decision-making.

Ultimately, understanding how your credit score affects interest rates can help you make better financial choices. By comparing bank and online loan rates, you can find the best deal for your situation. Improving your credit score can lead to more favorable rates, making it worthwhile to invest time in managing your credit health.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

Your credit score is crucial in determining the interest rate for your loan. Generally, a higher credit score results in a lower interest rate, as lenders perceive these borrowers as less risky. For example, a borrower with a credit score of 750 may secure a loan at 3.5 percent, while someone with a score of 600 could face rates around 7 percent. This variance can greatly affect monthly payments and the total cost of the loan over time. It’s also important to understand the differences between bank loan rates and online loan rates.

Traditional banks often provide competitive rates for those with excellent credit, while online lenders may offer more flexible options and faster approvals, though sometimes at slightly higher rates. Here are some key considerations when comparing these options:

- Speed of Approval: Online lenders usually process applications more quickly than banks, which can be crucial in urgent situations.

- Flexibility: Online lenders may accommodate a broader range of credit scores, including those with less-than-perfect credit.

- Fees and Terms: Always check for hidden fees in online loans that could impact the overall cost.

- Customer Service: Consider the support you may need; banks often have a solid reputation for customer service.

Understanding how your credit score affects loan interest rates can help you make informed financial decisions. By comparing lenders, you can find a rate that fits your needs.

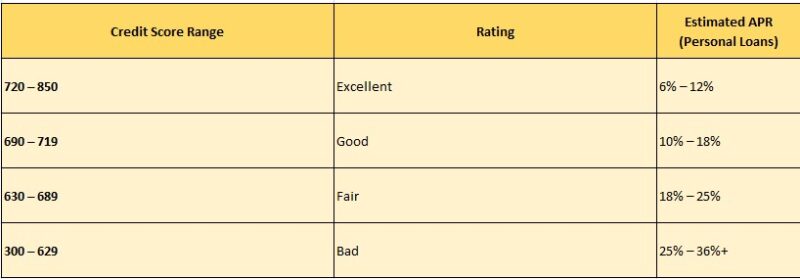

Average Interest Rates for Different Credit Score Ranges

Your credit score is crucial in determining the interest rates lenders offer you. Generally, a higher credit score results in lower interest rates. For example, individuals with excellent credit scores (750 and above) may secure mortgage rates as low as 3 percent, while those with poor credit scores (below 580) could face rates exceeding 10 percent. This significant disparity underscores the importance of maintaining a good credit score. Here’s a breakdown of average interest rates based on credit score ranges:

- Excellent (750 and above): 3 to 4 percent

- Good (700 to 749): 4 to 5 percent

- Fair (650 to 699): 5 to 7 percent

- Poor (600 to 649): 7 to 10 percent

- Very Poor (below 600): 10 percent and above

These rates can vary by loan type and lender, but they serve as a useful guideline. It’s also important to consider the differences between bank loan rates and online loan rates. Traditional banks often impose stricter lending criteria, leading to higher rates for lower credit scores. Conversely, online lenders may provide more competitive rates, particularly for those with good credit. This flexibility allows borrowers to find loans that better suit their financial needs, making it essential to understand how your credit score impacts your interest rate when seeking financing.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

Tips to Improve Your Credit Score for Better Rates

Your credit score is crucial when securing a loan, as it directly influences the interest rates by credit score available to you. Generally, a higher credit score means lower interest rates. For example, individuals with scores above 750 may secure rates as low as 3 percent, while those with scores below 600 could face rates over 10 percent. This significant difference underscores the need to maintain a healthy credit score, particularly when comparing bank loan rates to online loan rates, which can vary based on creditworthiness. To enhance your credit score and potentially lower your interest rates, consider these practical tips:

- Pay Your Bills on Time: Late payments can harm your score, so set reminders or automate payments.

- Reduce Your Credit Utilization: Keep your usage below 30 percent of your available credit to show lenders you are not overly reliant on credit.

- Check Your Credit Report: Regularly review for errors and dispute inaccuracies to boost your score.

- Limit New Credit Applications: Each application can slightly lower your score, so be strategic about applying for new credit.

By implementing these strategies, you can gradually improve your credit score, leading to better loan interest rates. Whether opting for traditional bank loans or online alternatives, a higher credit score opens doors to more favorable terms. Take control of your credit health today and see the positive impact on your financial future.

Read Also: Bank Loan Rates vs. Online Loan Rates: Which Is Cheaper?

Comparing Interest Rates by Credit Score Across Lenders

Understanding interest rates is crucial, and your credit score plays a significant role in this process. Lenders assess your creditworthiness based on your score, which directly affects the rates they offer. Typically, a higher credit score results in lower interest rates. For example, borrowers with scores above 750 may secure mortgage rates around 3.5 percent, while those with scores below 600 could face rates exceeding 6 percent. This stark contrast underscores the importance of maintaining a healthy credit score. Interest rates can vary significantly between traditional banks and online lenders. While both evaluate your credit score, online lenders often provide more competitive rates due to lower operational costs. Here are some key advantages of online lenders:

- Speed of Approval: They usually offer faster approval times, sometimes within hours.

- Flexibility: Many online lenders accommodate a broader range of credit scores, making it easier for those with less-than-perfect credit to find favorable rates.

- Transparency: Online platforms often provide clear breakdowns of rates and fees, helping borrowers make informed choices.

In conclusion, comparing interest rates by credit score across lenders is vital for securing the best deal. Whether opting for a bank or an online lender, understanding how your credit score influences your interest rate can lead to significant savings. Always shop around and consider multiple offers to find the best rate that suits your financial needs. A little research can ensure you get the most favorable terms possible.

The Impact of Credit Score on Mortgage Interest Rates

Your credit score is crucial when securing a mortgage, as it directly influences the interest rate you will receive. Typically, a higher credit score results in a lower interest rate because lenders perceive these borrowers as less risky. For example, a borrower with a credit score of 760 or above may qualify for rates as low as 3.5 percent, while someone with a score below 620 could face rates exceeding 5 percent. This disparity can greatly affect your monthly payments and the total cost of your mortgage.

It’s also important to understand the differences between bank loan rates and online loan rates. Traditional banks often impose stricter lending criteria, which can lead to higher rates for borrowers with lower credit scores. Conversely, online lenders frequently offer more competitive rates, particularly for those with good credit. Here are some key considerations when comparing these options:

- Flexibility: Online lenders typically provide more flexible terms and faster approval processes.

- Rate Variability: Rates can differ significantly between banks and online lenders, making it essential to shop around.

- Fees: Be cautious of hidden fees that may accompany lower rates, as they can increase your overall costs.

- Customer Service: Evaluate the level of support you might need during the loan process.

Understanding how your credit score impacts your mortgage interest rate can help you make informed decisions, potentially saving you thousands over the life of your loan.

Exploring Personal Loan Interest Rates by Credit Score

Understanding how your credit score affects personal loan interest rates can be a game changer when you’re looking to borrow money. Generally, the higher your credit score, the lower the interest rate you can expect. This is because lenders view individuals with higher scores as less risky. For instance, if you have a credit score above 750, you might secure rates as low as 5 percent, while those with scores below 600 could face rates exceeding 15 percent.

When comparing bank loan rates to online loan rates, it’s essential to note that online lenders often provide more competitive rates, especially for those with good credit. Traditional banks may have higher overhead costs, which can lead to steeper interest rates. Here are some key points to consider:

- Flexibility: Online lenders often offer a wider range of loan products.

- Speed: The application process is usually quicker with online lenders.

- Accessibility: Online platforms may cater to borrowers with lower credit scores, providing options that banks might not.

In summary, knowing your credit score can help you navigate the landscape of personal loans more effectively. By shopping around and comparing rates from both banks and online lenders, you can find a loan that fits your financial needs without breaking the bank.

Frequently Asked Questions About Interest Rates and Credit Scores

-

How does my credit score affect my loan interest rate?

A higher credit score usually qualifies you for lower interest rates, while a lower score may result in higher rates or loan rejection. -

What interest rate can I expect with an excellent credit score (750+)?

Borrowers with a credit score of 750+ often receive the lowest interest rates, typically ranging from 6% to 10% for personal loans. -

What is the typical interest rate for a fair credit score (600-749)?

If your credit score is between 600-749, you may be offered interest rates between 11% and 20%, depending on the lender. -

Can I get a loan with a low credit score (below 600)?

Yes, but the interest rates may be very high (20% or more), or you may need to provide collateral or a guarantor. -

How can I improve my credit score to get better loan rates?

Pay bills on time, reduce credit card balances, avoid multiple loan applications, and maintain a long credit history to improve your score.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.